What is service design and why should a banking service be designed?

The life cycle of a service can be divided into 5 parts according to the methodology of the ITIL (Information Technology Infrastructure Library):

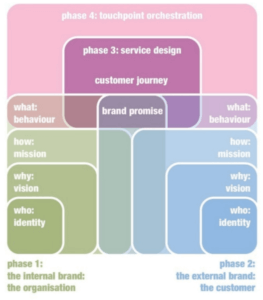

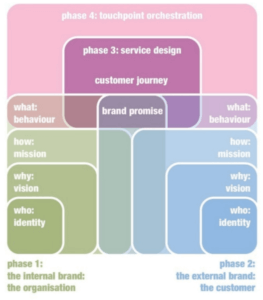

Basically, service design focuses on the overall service experience and the design of the service delivery process and strategy. It focuses on crucial points of contact with customers such as initial contact, engagement phase, and feedback on post-consumption experiences. The planning phase must focus on mapping all the key points where the client using the service meets the company. User motivation and feelings at touch points should be analyzed first in order to design a service that complements the current processes with the results of the analysis, and supports the interaction between the user and the service providers.

Even in the case of a bank, the entire banking process is part of the service, from the moment the customer walks in the bank, takes a number, waits in line, gets information and talks to a bank employee or pays money into his account until he leaves the bank. The customer’s experience at different points of the whole process basically determines what they would think of that particular bank. While planning a banking service experience, you also need to find a balance between user needs, the business processes of bank employees, and the particulars of each location. Service design diagram

Service design diagram

Many predicted the end of traditional banks years ago when new fintech and banking trends emerged, bringing a better user experience to everyday banking through new products and channels. At the same time, banks seem to be slowly beginning to incorporate market innovations into their services. In the eyes of most users, a bank still remains a reliable institution with a basic function of keeping their funds safe. The market is changing due to customer expectations, market regulation requirements, technology and the different effects of new competitors. Banks have to make a choice: either react to these changes as market leaders or take a defensive stance.

In order for banks to meet the ever-changing needs of the market, they need to focus on the next 6 points

The pace technology has been evolving in recent years is quite fast. Today, smart phones, cloud computing, and high bandwidth have become the norm. The current focus is on optimizing products and services. The next future trend is digital data collection, resulting in a more targeted, personalized customer offering and munch improved, tailored service. Banks and their partners can map the needs of their customers by creating a more sophisticated customer profile. Developing banks will become customer-centric information and risk-bearing businesses. Proportion of bank branches per million people. Source: McKensey & Company: World Banking Intelligence Databas

Proportion of bank branches per million people. Source: McKensey & Company: World Banking Intelligence Databas

Advancing in cyber security makes it possible to sell banking services online. At the same time, technology makes it easier for customers to switch banks. Customers are much more mobile so they will choose the bank where they will be offered a more personalized service. As a worldwide trend, the use of cash and the number of bank branches is declining due to technological advances and customer demand, so traditional banks are increasingly in need of redesigning their current services and sales channels.

Trust, empathy and commitment are some of the characteristics that modern customers seek when chosing their financial service provider. This means developing banking processes that allow customers to be open, honest, and encourage them to voice their problems freely, build trust with their clients. Fintech companies which are based on a thorough understanding of customer needs, are constantly developing their services and offers, and offer solutions to problems.

According to a survey by PwC on the state of the banking sector in 2020, bank directors named 3 main trends for the next period:

According to the PwC research, 61% of banks say the customer-centric model is “very important,” but only 17% are ready implement it. Significant changes in these areas are expected over the next 5 years based on the PwC survey

Significant changes in these areas are expected over the next 5 years based on the PwC survey

The effects of COVID-19 are felt in almost every segment of the global economy. The financial sector is also affected in several ways. Banks have reduced their opening hours due to government regulations and can only receive a few customers at a time due to social distancing, thus placing a greater burden on mobile and online banking channels.

At the same time, an increased number of customers, both private and corporate, contact their bank for their financial statements to get infor on their investments, loans, mortgages and financial opportunities, as many have lost their revenue streams either fully or partly.

People are looking for even safer investments than ever before in these financially uncertain times. In general, the decline in household spending and the complete disappearance of certain expenditures (e.g. private and business trips, hospitality) have a negative impact on fintech companies in certain business sectors. This greatly influences fintech companies and their venture capital financing. Due to the decline in demand for financial services provided by some fintech companies, they may have to look for cooperation and investment partners from the traditional banking sector. Some start-up fintech companies may need to close.

According to Forbes, the use of fintech applications increased by 72% as a direct result of the COVID-19 pandemic. Customer demands for digital banking have increased, putting pressure on the traditional banking sector to move quickly into the field of digitization. Government regulations can have a positive effect on the situation of fintech companies, as they have eased regulations in fintech companies in several countries, thus helping the economy to start back up faster. In addition, the World Health Organization (WHO) supports contactless payment.

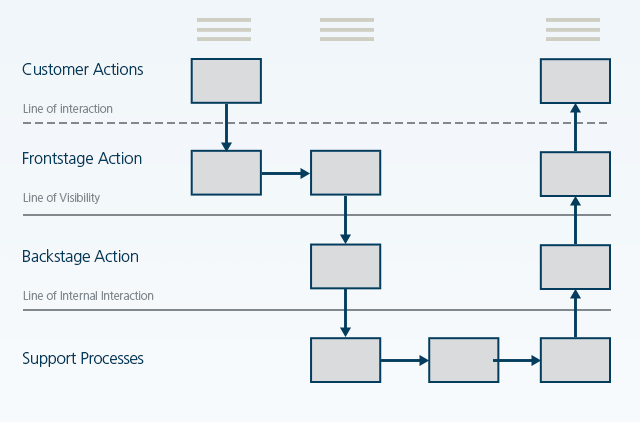

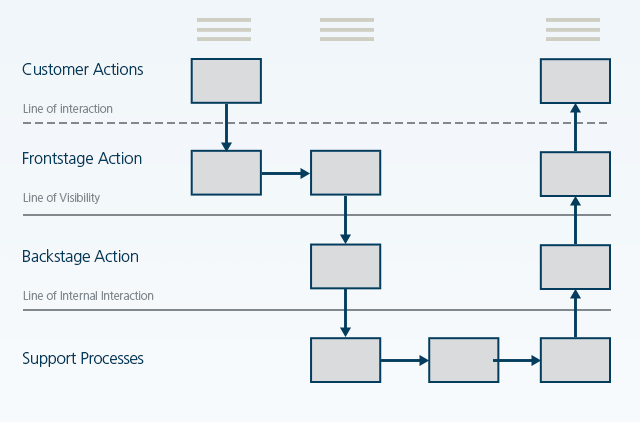

The primary tool used in the planning of the service is the so-called service blueprint. This is a diagram that allows the designer to see beyond the product and to have a clear picture of the entire system that brings the customer experience to life. Compared to customer journey mapping, which primarily examines customers' first banking relationship experience, service planning also explores the bank’s background. The behind-the-scenes analysis will be combined with the mapping of the first bank contact, and this will provide a 360-degree overview of the entire service. Thus, the purpose of the service plan is to explore how the structures supporting customer journey work, what are the responsibilities, and what are the rules that determine what can and cannot be implemented.

In order to connect Customer Actions and banking internal workflows, there are at least 3 points to consider to build the plan. Service plan

Service plan

Efforts to show the design of retail banking services are already being observed internationally. The Q110- the Deutche bankof Future retail bank in Berlin is a good example: this is a bank where there are no boundaries. The customers are called guests and are greeted with particularly friendly atmosphere and ushered into comfortable meeting rooms built in the bank branches. AA Q110- Deutche Bank of Future branch

AA Q110- Deutche Bank of Future branch

Planning begins with a new approach to the interior design of bank branches. Bank branches are not designed in the typical way. The Q110 bank branches were designed by the same professional responsible for Tom Tailor and Tommy Hilfiger retail stores. Banking products are given to customers in specially designed aluminum boxes. The new bank "guest" starter pack and account opening is presented to customers in a well-thought out manner. It is also remarkable how Q110 uses new technology to complement communication with customers. For an outstanding customer experience, Microsoft Surface system has been installed in the branches so the guest and their advisor can jointly navigate complex financial matters on a table-sized touchscreen. With the introduction of these services, Q110 has doubled its figures in retirement benefit sales. Microsoft Surface in action in a Q110 branch

Microsoft Surface in action in a Q110 branch

The future of banking industry depends entirely on a new generation of bankers reshaping their way of thinking according to the needs of the digital age. Some already use the Design Thinking method to provide services that meet customer expectations. Digital banks focus on their customers instead of numbers. Get the banks ready: Transforming into experience takes the place of digitization.

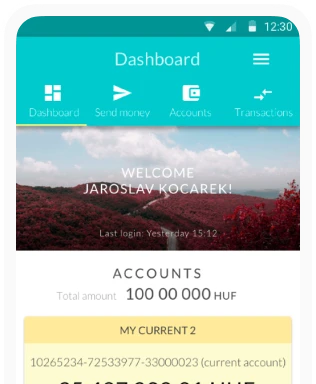

Digitalization development is no longer enough to survive. Making mobile banking available is no longer enough to make customers satisfied. What happens if the bank’s application is not customer-friendly and difficult to use? What happens when you need to call customer service and across the line the bank worker is not kind but arrogant? The digital transformation makes no sense without banks providing an outstanding user experience. Service planning is what gives the experience. Customer first!Service design and design thinking are methodologies allowing UX or CX to tailor the right services and products exactly to customer needs. This customer-centric approach should affect each and every department of the bank. This must be the way forward. Design smart. The best financial products are designed the other way around.

By this we mean an unusual top to down design that begins by determining the final value for the customer and ends with the development plan. This is the opposite approach to when the development of a product begins with coding based on business needs. Watch what the fintech giants are doing!

We are witnessing the integration of active financial solutions into the ecosystem. From Apple's credit card, via Google's credit account, Facebook Messenger microtransactions, to crypto and Libra for Facebook: these services cannot and should not be ignored by traditional banks, even though they do not resemble traditional banking at all. The customer retention method needs to be changed.

Experienced leaders understand that digitization is not just about creating the most modern online and mobile experience, and that satisfaction is determined by customer experience across different platforms. Customer experience should be seamless, especially in cases that are likely to take place through multiple channels, such as the opening of a new account, getting financial advice or solving problems.

Banks need to look at how they can encourage their own employees to shift focus from selling goods to long-term cooperation with the customer in order to be profitable. Data should be converted into real-time offers and personalized products

The amount of customer data available has increased exponentially in recent years. The challenge is how to turn data into personalized offers that the bank can deliver to their customers at the right moment. A good example to follow is what credit card companies are doing, who have long provided discounts to their customers by release category. Nowadays, they improve customer loyalty and spending distribution by offering site-specific direct offers to their customers when, for example, a customer goes into an electronics store or cinema.

In this digital age, it is a big challenge for traditional banks to retain and attract customers unless they find new market opportunities and transform the current customer experience. Inadequate business processes can result in customer frustration or churn. Service planning can be used to assess the critical points in the bank’s internal processes, such as the customer experience, and by developing them, banks can regain their competitive advantage.

- Service strategy

- Service design

- Service implementation (implementation and conversion)

- Service operation

- Service development, optimization

Basically, service design focuses on the overall service experience and the design of the service delivery process and strategy. It focuses on crucial points of contact with customers such as initial contact, engagement phase, and feedback on post-consumption experiences. The planning phase must focus on mapping all the key points where the client using the service meets the company. User motivation and feelings at touch points should be analyzed first in order to design a service that complements the current processes with the results of the analysis, and supports the interaction between the user and the service providers.

Even in the case of a bank, the entire banking process is part of the service, from the moment the customer walks in the bank, takes a number, waits in line, gets information and talks to a bank employee or pays money into his account until he leaves the bank. The customer’s experience at different points of the whole process basically determines what they would think of that particular bank. While planning a banking service experience, you also need to find a balance between user needs, the business processes of bank employees, and the particulars of each location.

Service design diagram

Service design diagramChanging customer needs and the influence of technology

Many predicted the end of traditional banks years ago when new fintech and banking trends emerged, bringing a better user experience to everyday banking through new products and channels. At the same time, banks seem to be slowly beginning to incorporate market innovations into their services. In the eyes of most users, a bank still remains a reliable institution with a basic function of keeping their funds safe. The market is changing due to customer expectations, market regulation requirements, technology and the different effects of new competitors. Banks have to make a choice: either react to these changes as market leaders or take a defensive stance.

In order for banks to meet the ever-changing needs of the market, they need to focus on the next 6 points

- Building a customer-centric business model

- Optimizing resource allocation

- Simplification of business and operating models

- Acquiring customer information advantage

- Stimulating internal innovation

- Risk management

The pace technology has been evolving in recent years is quite fast. Today, smart phones, cloud computing, and high bandwidth have become the norm. The current focus is on optimizing products and services. The next future trend is digital data collection, resulting in a more targeted, personalized customer offering and munch improved, tailored service. Banks and their partners can map the needs of their customers by creating a more sophisticated customer profile. Developing banks will become customer-centric information and risk-bearing businesses.

Proportion of bank branches per million people. Source: McKensey & Company: World Banking Intelligence Databas

Proportion of bank branches per million people. Source: McKensey & Company: World Banking Intelligence DatabasAdvancing in cyber security makes it possible to sell banking services online. At the same time, technology makes it easier for customers to switch banks. Customers are much more mobile so they will choose the bank where they will be offered a more personalized service. As a worldwide trend, the use of cash and the number of bank branches is declining due to technological advances and customer demand, so traditional banks are increasingly in need of redesigning their current services and sales channels.

Trust, empathy and commitment are some of the characteristics that modern customers seek when chosing their financial service provider. This means developing banking processes that allow customers to be open, honest, and encourage them to voice their problems freely, build trust with their clients. Fintech companies which are based on a thorough understanding of customer needs, are constantly developing their services and offers, and offer solutions to problems.

2020 banking trend forecast

According to a survey by PwC on the state of the banking sector in 2020, bank directors named 3 main trends for the next period:

- Develop customer-centric perspective and create a frictionless user journey

- Real-time intelligent data integration through artificial intelligence and cognitive computing

- Open banking solutions

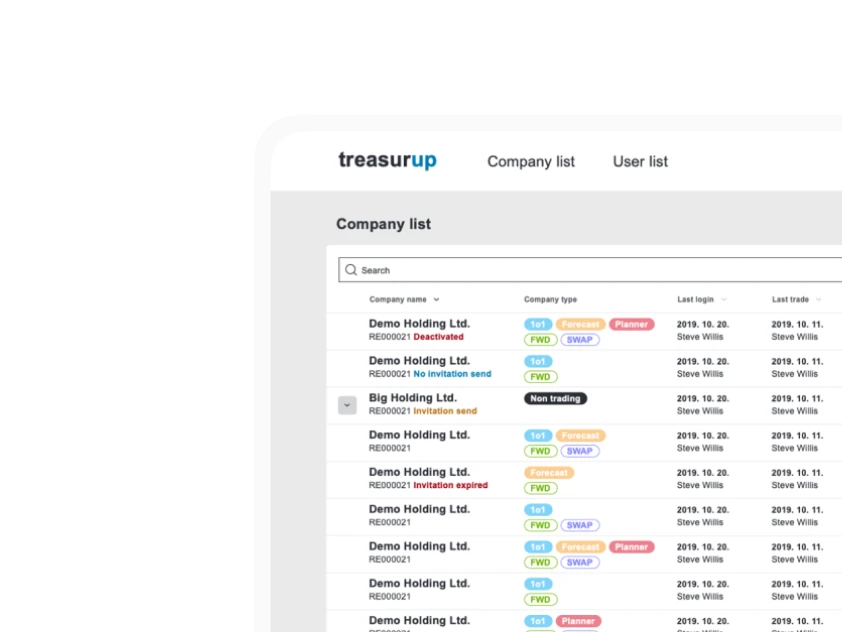

According to the PwC research, 61% of banks say the customer-centric model is “very important,” but only 17% are ready implement it.

Significant changes in these areas are expected over the next 5 years based on the PwC survey

Significant changes in these areas are expected over the next 5 years based on the PwC surveyThe effect of COVID-19 on bank digitization

The effects of COVID-19 are felt in almost every segment of the global economy. The financial sector is also affected in several ways. Banks have reduced their opening hours due to government regulations and can only receive a few customers at a time due to social distancing, thus placing a greater burden on mobile and online banking channels.

At the same time, an increased number of customers, both private and corporate, contact their bank for their financial statements to get infor on their investments, loans, mortgages and financial opportunities, as many have lost their revenue streams either fully or partly.

Negative effects of COVID-19 on fintech companies

People are looking for even safer investments than ever before in these financially uncertain times. In general, the decline in household spending and the complete disappearance of certain expenditures (e.g. private and business trips, hospitality) have a negative impact on fintech companies in certain business sectors. This greatly influences fintech companies and their venture capital financing. Due to the decline in demand for financial services provided by some fintech companies, they may have to look for cooperation and investment partners from the traditional banking sector. Some start-up fintech companies may need to close.

Positive effects of COVID-19 on fintech companies

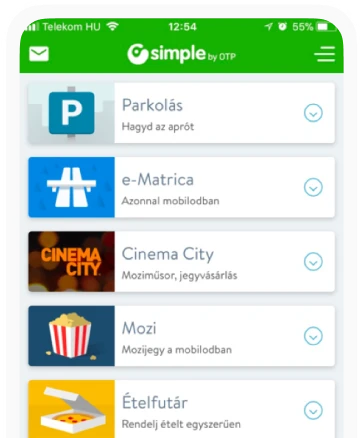

According to Forbes, the use of fintech applications increased by 72% as a direct result of the COVID-19 pandemic. Customer demands for digital banking have increased, putting pressure on the traditional banking sector to move quickly into the field of digitization. Government regulations can have a positive effect on the situation of fintech companies, as they have eased regulations in fintech companies in several countries, thus helping the economy to start back up faster. In addition, the World Health Organization (WHO) supports contactless payment.

How to design a service for the best customer experience?

The primary tool used in the planning of the service is the so-called service blueprint. This is a diagram that allows the designer to see beyond the product and to have a clear picture of the entire system that brings the customer experience to life. Compared to customer journey mapping, which primarily examines customers' first banking relationship experience, service planning also explores the bank’s background. The behind-the-scenes analysis will be combined with the mapping of the first bank contact, and this will provide a 360-degree overview of the entire service. Thus, the purpose of the service plan is to explore how the structures supporting customer journey work, what are the responsibilities, and what are the rules that determine what can and cannot be implemented.

In order to connect Customer Actions and banking internal workflows, there are at least 3 points to consider to build the plan.

- The process of interactions (Frontstage Action)

- The boundary separating the customer from the bank (Backstage Action)

- The boundaries of internal interactions (Support Processes)

Service plan

Service planA well-functioning banking customer experience can also be planned

Efforts to show the design of retail banking services are already being observed internationally. The Q110- the Deutche bankof Future retail bank in Berlin is a good example: this is a bank where there are no boundaries. The customers are called guests and are greeted with particularly friendly atmosphere and ushered into comfortable meeting rooms built in the bank branches.

AA Q110- Deutche Bank of Future branch

AA Q110- Deutche Bank of Future branchPlanning begins with a new approach to the interior design of bank branches. Bank branches are not designed in the typical way. The Q110 bank branches were designed by the same professional responsible for Tom Tailor and Tommy Hilfiger retail stores. Banking products are given to customers in specially designed aluminum boxes. The new bank "guest" starter pack and account opening is presented to customers in a well-thought out manner. It is also remarkable how Q110 uses new technology to complement communication with customers. For an outstanding customer experience, Microsoft Surface system has been installed in the branches so the guest and their advisor can jointly navigate complex financial matters on a table-sized touchscreen. With the introduction of these services, Q110 has doubled its figures in retirement benefit sales.

Microsoft Surface in action in a Q110 branch

Microsoft Surface in action in a Q110 branchErgomania's advice for a better customer experience

Worth remembering: the current corporate attitude has an impact on the future.The future of banking industry depends entirely on a new generation of bankers reshaping their way of thinking according to the needs of the digital age. Some already use the Design Thinking method to provide services that meet customer expectations. Digital banks focus on their customers instead of numbers. Get the banks ready: Transforming into experience takes the place of digitization.

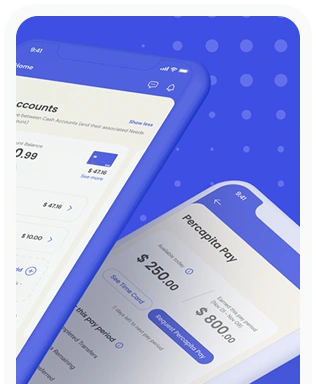

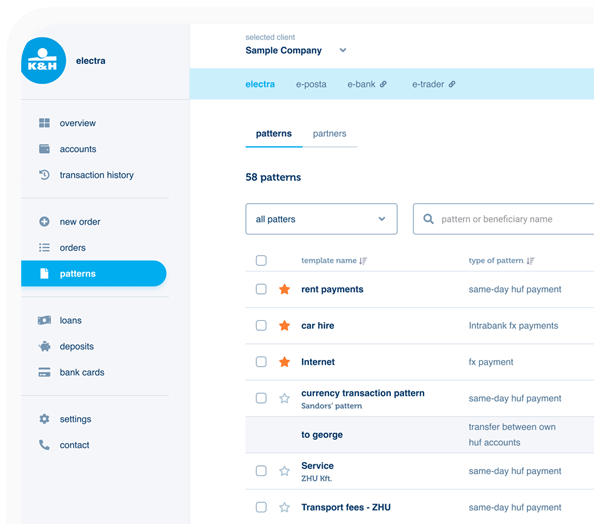

Digitalization development is no longer enough to survive. Making mobile banking available is no longer enough to make customers satisfied. What happens if the bank’s application is not customer-friendly and difficult to use? What happens when you need to call customer service and across the line the bank worker is not kind but arrogant? The digital transformation makes no sense without banks providing an outstanding user experience. Service planning is what gives the experience. Customer first!Service design and design thinking are methodologies allowing UX or CX to tailor the right services and products exactly to customer needs. This customer-centric approach should affect each and every department of the bank. This must be the way forward. Design smart. The best financial products are designed the other way around.

By this we mean an unusual top to down design that begins by determining the final value for the customer and ends with the development plan. This is the opposite approach to when the development of a product begins with coding based on business needs. Watch what the fintech giants are doing!

We are witnessing the integration of active financial solutions into the ecosystem. From Apple's credit card, via Google's credit account, Facebook Messenger microtransactions, to crypto and Libra for Facebook: these services cannot and should not be ignored by traditional banks, even though they do not resemble traditional banking at all. The customer retention method needs to be changed.

Experienced leaders understand that digitization is not just about creating the most modern online and mobile experience, and that satisfaction is determined by customer experience across different platforms. Customer experience should be seamless, especially in cases that are likely to take place through multiple channels, such as the opening of a new account, getting financial advice or solving problems.

Banks need to look at how they can encourage their own employees to shift focus from selling goods to long-term cooperation with the customer in order to be profitable. Data should be converted into real-time offers and personalized products

The amount of customer data available has increased exponentially in recent years. The challenge is how to turn data into personalized offers that the bank can deliver to their customers at the right moment. A good example to follow is what credit card companies are doing, who have long provided discounts to their customers by release category. Nowadays, they improve customer loyalty and spending distribution by offering site-specific direct offers to their customers when, for example, a customer goes into an electronics store or cinema.

Service planning is a tool for development

In this digital age, it is a big challenge for traditional banks to retain and attract customers unless they find new market opportunities and transform the current customer experience. Inadequate business processes can result in customer frustration or churn. Service planning can be used to assess the critical points in the bank’s internal processes, such as the customer experience, and by developing them, banks can regain their competitive advantage.