Spanish Fintech - A bridge to bigger goals

Look, I know it’s not a good thing to resort to easy stereotypes when speaking of different nationalities. Generally I would steer very well clear of, ‘All Swedes are…’ or, ‘Greeks are usually distinguished by…’ However, in the case of the three interviewees who are my guides to Fintech in Spain, I’m tempted to characterize them with the same quality: they all speak, and apparently operate, with passion. Or more correctly, with pasión. They share a force, a certainty in their words which is backed by the undeniable success they have achieved with their Fintech offerings. It’s more than that though, because each of them demonstrates ‘big picture’ thinking which extends beyond their own endeavors in business. Rodrigo García de la Cruz

Rodrigo García de la Cruz

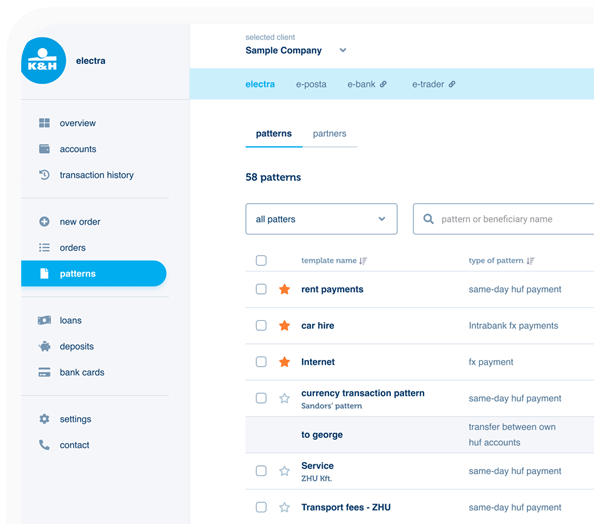

Let’s start with Rodrigo García de la Cruz, a genial graduate from 20 years of assorted technical and finance experience with Renault, Citibank and Barclays, before he branched off into education and created ‘probably one of the first Fintech master programs’ in 2013. He gathered students and professors to help create a federal system of knowledge, which has continued to grow and bear fruit. However within 2 years of this initiative, the potential of Fintechs was becoming ever clearer to Rodrigo, and he started an investment fund specifically for the sector, with the first investments being in 12 emerging Spanish Fintechs. In doing so he realized that there was no central repository of information that investors in Fintech could turn to, so also began the process of identifying businesses, their models, and their founders. The result of all this was his company Finnovating, with the goal of identifying and evaluating companies for investment, and creating ecosystems. The mapping of connections, and the organizing of many events and conferences meant that it rapidly became obvious to Rodrigo that those ecosystems he was interested in extended beyond Spain and - initially at least - into the wider Spanish-speaking world, including Mexico, Colombia, Peru and Chile. That led to the Iberoamerican Fintech Alliance, of which Rodrigo was the first President, representing some 15 associations in 20 countries. Finnovating

Finnovating

But before that, as Rodrigo notes, “When you put together the right people in the right place, things happen.” So 2016 had seen the inauguration of AEFI, the Spanish Fintech Association, of which Rodrigo was also the first President, and indeed remains so. With the rollout of Fintech associations from Spain to Latin America developing at pace, he also set his sights on the rest of Europe, which turned out to be, “A little more complicated”, in part because of the wide mix of languages. Nevertheless, “We started attending all the different European events to connect with the right people in France, Italy, Portugal, and Holland, where the first Fintech Association in Europe was created. One result of this expanding network was the creation in 2019 of EDFA - the European Digital Finance Association.

For the last decade, Rodrigo García de la Cruz has been pushing and pulling at the emerging Fintech industry to create viable and supportive ecosystems across two continents: always connecting, connecting, connecting.

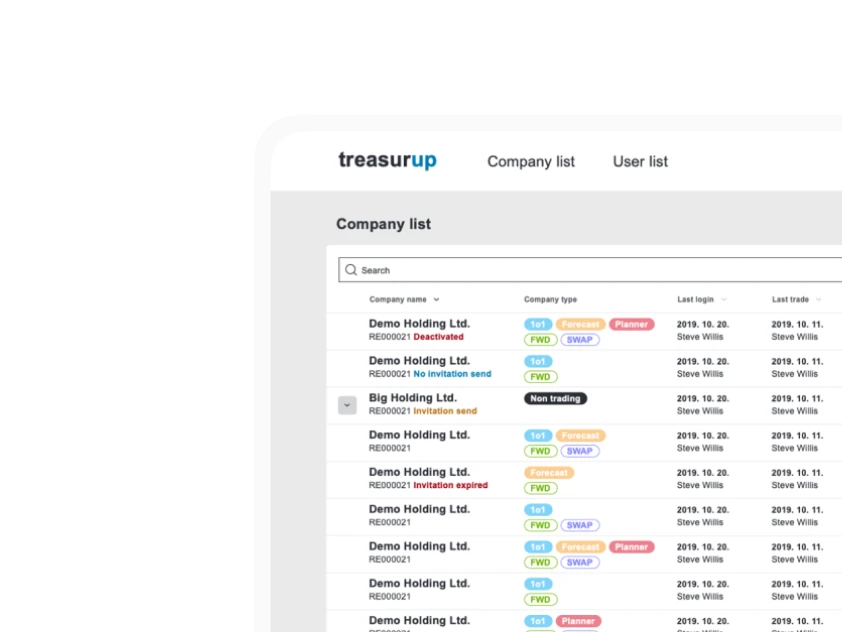

Then in 2020, he had another lightbulb moment: “I saw that our work in Finnovating, in terms of connecting people from Europe to Latin America, and from Latin America to Europe, was scalable, but the pandemic was making it very difficult to travel, and attend international events. So we decided to create a digital global platform that people can connect to, like LinkedIn, to do business. And when I say people, I mean Fintechs, Insuretechs, any kind of corporations, regulators, associations, and investors.”

For a year Rodrigo and his colleagues set about mapping all the Fintechs in the world, creating the largest database of Fintechs and prospects, and putting it all on the Finnovating platform. But he adds, it was important that this is not a private database, but one which is accessible to companies to activate their profiles and start doing mutual business. “This is innovative, and we have identified 50,000 startups and scale-ups in the world in terms of Fintech, insurtech, and projects, and more than 10,000 investors that are very interested in investing in these kinds of companies. We are creating a transactional platform that people can connect with and do business on.” Is it any surprise that Rodrigo has been frequently cited as a top Fintech influencer, worldwide?

Let’s go visit Iván Nabalón, Founder and CEO of Electronic IDentification, headquartered in Madrid, but also looking to the world, and now present in 42 countries with over 250 clients. An overnight Fintech success story? Not quite: Iván began his journey as a hacker, before being attracted to management roles, where he worked for many years, mainly in telecoms, and with a strong connection to technology. He was feeling increasingly dissatisfied with his comfortable job however, and started to think about a Digital Identity system, ‘To change the democracy paradigm through citizenship participation… the most important step forward since the creation of the internet.’ OK, so no small task then.

Despite the warnings of colleagues, who cautioned against quitting a secure job when he already had a family to support, Iván went ahead, encouraged by 150,000 followers on social media channels. He then shook the ‘Triple F’ tree: Family, Friends and Fools, to raise startup funding, and in 2013 Electronic IDentification was born…...And almost crashed.

“It was too early for the democracy project. I realized that we had to pivot, because we were working with banks, and so when we started to sell the technology to them, it became a very good time.” Banking partners then introduced Electronic IDentification to Spanish financial supervisors and regulators. Spain was, and is, a leader in worldwide retail banking: innovative solutions were being actively looked for, and Electronic IDentification could enable remote creation of bank accounts. From that point on the company started to attract Angel Investors to get commercial operations up and running, followed by VC support. After which Electronic IDentification grew quickly, with significant milestones along the way. A notable 2020 win was for the biggest ever French government citizenship contract to provide the new Social Security card to 44 million people. - This against stiff competition from Gemalto, Idemia, and Thales. Iván NabalónWith a strong growth record, it became clear that Electronic IDentification had to expand across Europe, and Iván started to look for further funding to accelerate expansion. Meanwhile the pandemic was creating ever greater demand for the Electronic IDentification offering, at which point in stepped Norwegian ID giant Signicat with its, ‘Identity solutions for a trusted digital world: One point of integration for all your digital identity needs across borders – on every step of the customer journey from onboarding, to secure authentication, to electronic signing.’ In other words a similar offering to Electronic IDentification.

Iván NabalónWith a strong growth record, it became clear that Electronic IDentification had to expand across Europe, and Iván started to look for further funding to accelerate expansion. Meanwhile the pandemic was creating ever greater demand for the Electronic IDentification offering, at which point in stepped Norwegian ID giant Signicat with its, ‘Identity solutions for a trusted digital world: One point of integration for all your digital identity needs across borders – on every step of the customer journey from onboarding, to secure authentication, to electronic signing.’ In other words a similar offering to Electronic IDentification.

Iván says, “Their path is about raising money, a lot of money. We like their team, and we like their growth strategy.” He admits that it was difficult to consider doing an exit, but feels that the acquisition of his company will consolidate the market and result in Signicat becoming one of the leading electronic identity vendors, worldwide. And in the meantime, he and his team at Electronic IDentification retain full autonomy for two years.

I want to dive deeper into what Electronic IDentification actually means in terms of e-democracy, and what has driven Iván to pursue this relentlessly for the last decade, but first let’s pop across town to call in on Arturo González Mac Dowell, founder of Eurobits Technologies - which also now has a notable Scandinavian connection in the form of acquisition by Tink. “I thought it was better that we choose a dancing partner now than choosing when there's no-one left on the dance floor!” Arturo gives a colorful explanation of the sale of his company, founded in 2004 and a leader in PSD2 and financial aggregation services. Eurobits

Eurobits

“Tink was a competitor but with a completely different growth strategy, and after they raised €100 million, then Visa offered $2,500 million for Plaid (since revoked), I thought that it was time to get out, as a lone player. It was our decision to look for a partner and we chose Tink, which is not as old as Eurobits, being founded in 2012, initially as a b2c Personal Financial Management Company, but it had proved a tough game to grow in the space. Then they received an offer from a Dutch Bank to buy their software, after which they shifted their game completely to a full-blown b2b company that basically sells the ‘Rails and Brains’ of Open Banking. Rails is also what we do at Eurobits - it’s a plumbing exercise, so to speak.”

Eurobits was founded in 2003 by two Spanish banks, Bankinter and Caja Madrid, and Arturo was head-hunted to launch the new company, the first dedicated account aggregation operation in Europe. He points out that this was long before anyone started even thinking about PSD2. The beginnings were tough, mainly because the market wasn’t ready, and in the early 2000s few people were willing to access their financial data through a third party. It took the breakthroughs of widespread social network adoption to create an environment where the fear of accessing sensitive data over the internet began to lessen. As Arturo notes, “If you’re sharing those embarrassing pictures on Facebook that could even lose you your job, then why wouldn’t you want to access your financial data through a reliable third party?”

So the time became right for PSD2, in which Arturo and Eurobits played a significant part, helping to create the ETTPA trade body - the European Third Party Providers Association.

“With PSD2 come the connections between banks where customers hold their accounts, and the company that's willing to pool that data in order to add some value on top. That value might be very simple, such as just having all the information together in one place, and that simple value is very compelling for an SME, a professional needing to hold accounts in several places, or someone who wants to integrate the information with their accounting software.

It can also be much more complex, like a Personal Finance Management solution with tools for budgeting to aid you in making wise financial decisions, or portfolio management software, or whatever.

That's the Rails, and the Brains is the part that uses the data: So it’s being able to say (for example) that this particular transaction is grocery shopping, and it was performed at Tesco.” Arturo goes on, in full flow at what has been achieved since Eurobits’ start back in 2003, “Now the sky's the limit. I think we'll see many things down the road that we can't envisage today: from the extraction of market signals for hedge funds to make wise investment decisions, to whatever can be done with financial information. Actually, I think financial information or payment information alone is extremely relevant information. Then in combination with other information such as the geolocation data provided by telcos, it becomes really powerful.” Arturo González Mac Dowell

Arturo González Mac Dowell

Let’s get back specifically to the Eurobits story, and where the company stands today. In March 2011 Savings Bank Caja Madrid merged with six other savings banks, to create Bankia. Shortly after, Bankia bailed out, and the subsequent rescue forced a sell-off of companies which were not considered strategic. Arturo stepped in with a successful Management Buyout Offer for Eurobits and became the largest shareholder. - A great example of perfect timing with PSD2 just around the corner. But also because soon after PSD2 roll-out Tink was there planning a shopping spree. Shortly after buying Eurobits, Tink was bought by Visa for, “An astounding and mind-blowing €1,800 million, which gives an idea of how relevant the space of open banking is becoming.” Arturo looks relaxed as he ponders a slightly uncertain, but for sure secure future.

“Visa bought Tink for what Tink is. Meaning that Tink will retain its brand and current management team, and its headquarters will remain in Stockholm. So in principle, nothing changes. Of course, the only permanent thing is change. So down the road, we don't know what will happen. But in principle, everything is going to continue as normal. Of course, the only permanent thing is change.” Arturo claims - perhaps modestly - that he’s not a big enough part of the puzzle to have been involved in detailed discussions of the deal, and is in ‘wait and see mode’, but says he’s nevertheless content.

So a life of rest and luxury from now on? - Unlikely!

Since the Tink deal started going through, Arturo has increased his role in lobbying and institutional activity, and is now a member of the ERPB, the European Retail Payments Board, a high level body of the European Central Bank, with a balanced representation of the supply and demand side of retail payments across Europe. All three banking representative bodies are part of the European Credit Sectoral Associations, and the three non credit sector representative bodies, including EPIF, the European Payment Institutions Federation, EMA, the E Money Association, and ETTPA, the European Third Party Providers Association, representing the interests of bank-independent TPPs. This does not sound like a man planning on hanging up his entrepreneurial running shoes any time soon. “And then I'm also a board member of EPC - the European Payments Council, plus a vice president of AEFI, the Spanish Fintech Association. So I spend a significant part of my time trying to make things better for the Fintech community, particularly in the space of payments. I also have the feeling that this role of representing interests in Europe is not very common in Spain - it's more an Anglo Saxon culture thing - so I'm thankful for how things have gone. And I feel I need to give back to the community.” Meeting in Eurobits

Meeting in Eurobits

Giving back to the community? As in charity for instance? “No, I'm not in a place to do a Foundation - that would be stupid. But there's some things I can do to help the Fintech community, particularly in Spain, such as getting certain laws changed that make doing business in Spain significantly more difficult and less attractive than in other places.” Arturo gives as an example his recent experience with the Tink acquisition of Eurobits, where there were 8 months between signing and closing, because he says that in Spain there is no specific law about the requirements to own and manage a payment institution. Instead the regulators reverted to the law for credit institutions, which as Arturo observes, “Makes absolutely no sense. The criteria to own a company like Eurobits is the same as the criteria to own a company like BBVA? We don't hold customer funds, and there's no fraud risk. So it makes no sense. These are the sort of things I want to spend a significant amount of my time on to make Spain, and also Europe, a better place to do business.” Spanish Fintech Association

Spanish Fintech Association

The Spanish Fintech Association is strong, with around 180 members, and has good liaison with all the Spanish regulators and the Treasury, so AEFI has the capacity to exert influence. But, says Arturo, there are many things that still have to change in Spain: “We don't have the best entrepreneurship culture in the world. So there's a lot of work to be done. We're pushing hard, but we're still a long way from where we think we should be.”

Arturo’s colleague and co-conspirator (if we can label them as such!) in the Spanish Fintech Association, Rodrigo García de la Cruz, points to a significant win for AEFI’s influence - the creation of a Fintech sandbox. It’s an ambitious initiative, to some extent modelled on the much-admired UK sandbox, and one which Rodrigo is slightly amazed to recount that 100% of Spanish politicians voted ‘Yes’ to. In fact it was the first time in Spanish history that a law was passed without any dissent, and was to enable the digital transformation of the finance sector. That’s testimony to the muscle, and yes, pasión, of Spanish Fintechers.

Looking back on the negotiations with the National Bank, Rodrigo comments that he doesn’t see Spain as an exception in the difficult road which must be travelled. “It’s a real problem for a lot of countries, that their regulators and supervisors are not used to managing this kind of innovation. They can’t meet the pace, and this is why there have to be associations, supporting the ecosystem and giving the vision and the understanding of how important this industry is for the future of the financial sector.”

Currently he sees two separate European trends: “There are the regulators that say you can do whatever you want, but you have to do it right. And if you have problems then they are going to regulate. And there are the more Latin countries, where everything is regulated and under control. So it's very complicated having to adapt the innovation to the regulator, because everything is regulated.”

In this second case, instead of adapting to what is happening in the market, the regulation gets ever more complicated. Unless, Rodrigo says, countries can follow the lead of the UK and other progressive countries, where there may not even be the need for sandboxes, because there is a culture of being constantly open to new ideas. As something of a fan of the UK Fintech scene, he points out that there is no strong Fintech Association there. Why? Because, “In the UK things are now so advanced and open that Associations aren’t needed.” Meanwhile Rodrigo continues to push the envelope, and foresees the day when there could be a Worldwide Fintech Association.

“In terms of Fintech we need to create something global that connects all the potential of companies. I think now is the moment of the banks, that is your clients, connecting with the startups and with innovation. Now is the time to cooperate, because if you are not able to work with others you're not going to get very far. In Europe there are more than 7,000 banks. All of them need to reinvent themselves and they are not going to be able to do that alone. So this is why we need to help them, and companies like Finnovating are here for that. We want to create bridges between them, and all of us.

But how am I going to reach someone? LinkedIn is not for companies but for people-to-people. So this is why there is the need for platforms for corporations, platforms for Fintechs, for banks. Banks over the last 50 years weren’t able to do financial inclusion. But now there’s the technology, and Fintechs will change things forever. Anyone with a mobile phone can have access to finance for any kind of service. That means democratizing: through Fintechs, insurance, real estate services... for any person in the world.”

I said this was Big Picture stuff, and there’s that mention again of democracy - the idea which first fired up Iván Nablón to create Electronic IDentification. He fills in some background: “Identity - the analog version - was very important in building the democracies and welfare states we have today. In the near future, with digital identity there will be a multiplier effect on GDP. Identity is essential for social trust and the way we build relationships with public administration, with banks, and with how we travel. Everything is based on trust, and the internet was born naturally with a lot of trust, but it's not embedded in the internet itself: we’re having to put this in later. Digital identity is the backbone of all democracies, and is the key to face the future. Digital Identity has huge social impact.”

OK, so I’m getting it, sort of. But why can’t we all just continue to muddle along with hybrid forms of identity? A paper passport here, a driving licence there… in other words a wallet full of cardboard and plastic, and a phone full of passwords? Iván is looking much further than this, of course. “Digital identity has the power to release a very high impact socially, and in regulated businesses. When you see commerce or non-regulated businesses, they are all digital today, and have made very good progress. But when you look at regulated industries, such as health, government, the financial sector, cross border travel and so on, there is nothing there… nothing. They are at the very beginning of digitalization.”

He makes it sound as if we’re still grubbing along in the Stone Age, but surely there are rapid changes taking place? Iván agrees, but only to some extent: “The Spanish financial regulator creating the conditions to allow the banks to open accounts and add high levels of security was a big step forward, but if you want to make something global, you need to scale. You need to move on to create that for the whole of the European Union. Strong electronic identities are becoming the standard worldwide because they allow interoperability principles with regulatory solutions. So strong digital identity is going to be key to going digital, for any regulated or non-regulated industry anywhere in the world.”

Clearly, with his lobbying of the Spanish and now European regulators, Iván and his colleagues, both in Electronic IDentification and the Spanish Fintech Association are aiming towards global standards, but surely they’re also up against some stiff competition from the already well-established Big Tech giants with their billions of users and followers? True, Iván says, Google, Facebook and Apple have the muscle, but they are all also equally challenged to create a digital identity program, although with a different goal from the democratic perspective. What Big Tech wants is to give users a strong digital identity in order to operate in any business in any country. “They have their smartphones, or they have other technologies, but they have no idea about the system of digital identity. Digital identity is being created in the European space. That means the Anglo Saxon regulatory mindset has nothing to do with the European one. They have the technology - for instance the technology Apple is trying to use for digital identities is already in their smartphones to secure wallets and credit cards. But they need to move to the European model, probably by buying or building new technology. The company that solves the issues of a decentralized global digital identity will be huge.”

So there’s a push-pull going on in the whole area of Digital Identity, on the one hand from the commercial needs of the Tech giants, and on the other side from the steady ‘democratization’ of governmental and regulated organizations which have an urgent need to leverage the vast amount of data that is potentially available. No wonder Iván shows considerable enthusiasm when he says, “This is all really challenging, and we are seeing fantastic momentum for these technologies.”

Having heard about the ‘Anglo Saxon’ mindset, and the relative merits of the UK openness to Fintech, I’m interested in Arturo González Mac Dowell’s angle here. He sees the adoption of Fintech in that country being less about innovation, and more about the inability of the banking sector to get up to speed, at least originally: “The UK was the perfect breeding ground for Fintech because it had all the elements of a very backward banking industry that was extremely inefficient. I can give you an example, it took me well over a month to open an account in Santander UK even with the help of the central systems of Santander in Spain. I wanted to open an account for a project, and it took me a month. I can walk down Main Street in any Spanish town and have 10 accounts open in different banks in one hour!

In the UK, you had to make an appointment two weeks in advance. So in the beginning, Fintechs were exploiting inefficiencies of the banking system. And one of the places where there were more inefficiencies was the UK.”

Despite this somewhat damning assessment, Arturo points out that on the other hand, the UK has one of the most forward looking authorities in the world, and instead of reflexively protecting the banking industry, it recognized opportunities. He notes, “Look, I can make any number of negative comments about the details of open banking in the UK, but the concept itself is brilliant. It's pushed not by the banking authorities, but by the competition authorities. And they make the largest nine banks in the UK pay for the exercise.

No wonder you have companies like Revolut that now are worth as much as some of the incumbent banks. You have so many huge Fintech companies in the UK due to the open mindedness of the authorities, which is lacking in some EU member states, and most notably in what we commonly call PIGS: Portugal, Italy, Greece and Spain.” Eurobits discussion

Eurobits discussion

Arturo reflects on the Spanish situation when he says that the country has been extremely protective of the incumbent banks, despite having possibly the most advanced retail banking industry worldwide. He suggests the reason for the protectiveness is that law enforcement was so bad that banks had to fill in the gaps left by poor regulation with better technology. For example, by the 1970s in Spain the majority of employees were already receiving their wages by direct debit. In addition, every bank had internet banking by the mid 90s. So the retail banking industry in Spain became extremely well developed. However now, “With this culture of protectiveness, which has always been there, I fear that we will not allow the Fintech industry to grow significantly. And at the same time, we will give a false sense of protection to banks, which will reach a point where that protection is no longer useful, and we will be left with no Fintechs. And no banks. Leaving financial services dominated by foreign companies.

That's the worst scenario. The good scenario is the one I'm fighting for: that the Spanish authorities see this risk, and eliminate the barriers to the Fintech industry, just like the UK has done. And that would make the banking sector more competitive, and the Fintech sector more competitive as well. I think it's a win-win proposition in the long term: 50/50…” He pauses for a moment and considers this possibility, before adding, “But perhaps I'm being optimistic!”

And what’s the adoption like of Fintechs, particularly in Spain? Is the person on the street talking Fintech? Arturo reckons that a ‘significant chunk’ of the population are familiar with the concept, but not necessarily the word. He refers to what he calls, ‘a novelty application’ Bizum, for peer-to-peer instant payments, which has over 18 million active users. That’s encouraging, but Arturo says that on the downside, “It's an exercise by the banking industry that is closed within the banking industry. So I doubt this would have been allowed in the UK for example, where the competition authorities would not have given the OK to a closed system.” He laughs, dismissing this detail, “But I think if my grandmother was alive, she would be using Bizum, although she wouldn't call it Fintech.” Bizum

Bizum

And what of younger people, who are surely more in tune with all things Fintech? “People in their 30s and below use a ton of Fintech applications, but I'm not sure they call them Fintech. My son is 20 years old and he uses a number of apps, like to constantly buy and sell crypto assets. Fortunately, he has his head on his shoulders and makes wise decisions. But for most people of his age, the competitors of crypto assets are Bet365 or William Hill: it's just gambling, and they do it with absolutely no investment strategy. There are a number of companies like eToro that are making a dent in the market, along with other Spanish companies with the proposition of making investment very easy for younger people. But I’m not sure I’ve even heard my son use the word ‘Fintech’.

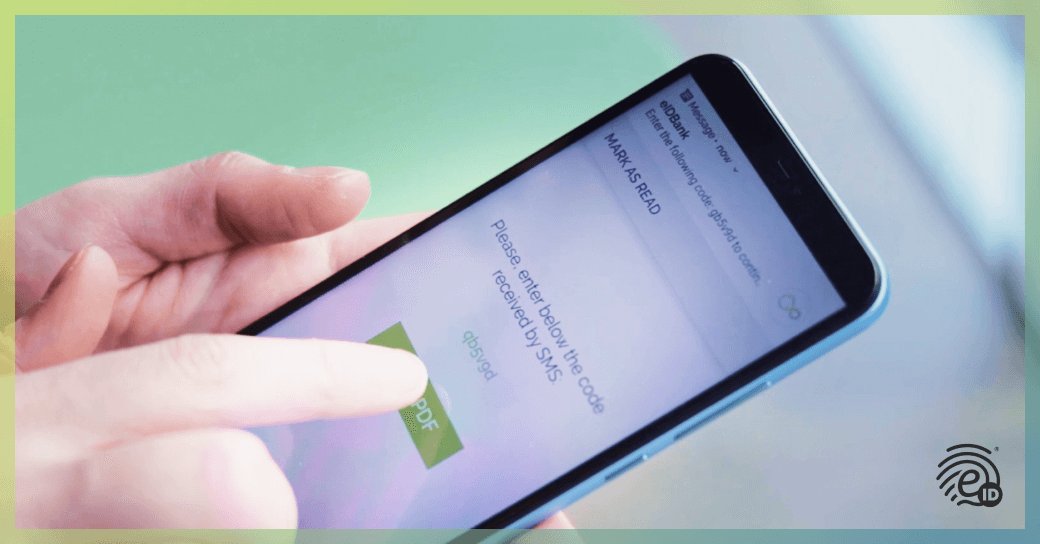

Speaking of the offspring of entrepreneurs, I’m amused to hear of Iván Nabalón’s 3 children, assisting in the testing of Electronic IDentification products (unpaid, he quickly adds). One of the cool features is the ‘Smile and Trust’ identification method where the user is required to perform the distinctly human action of smiling to the camera on their smartphone - something I can well imagine is enjoyed by the Nabalón kids who have to be encouraged with a joke or funny story to access the software - sandboxed of course. And despite their youth, Iván remarks of his in-house testing team, “I'm not sure they are 100% aware of the project, but if you ask them, they can probably tell you about the technology we are developing.” ‘Smile and Trust’ in action

‘Smile and Trust’ in action

In the absence of an available junior Nabalón to explain the nuts and bolts of Electronic IDentification, I ask Iván to guide me a little further through the offering. He says that all the building blocks of the technology are made in house, in order to guarantee control and autonomy. “It took ages to get to the combination of video identification, plus qualified electronic signature, but everything is in-house. Obviously, we trust in third parties, like the cloud providers, and we don't invent artificial intelligence. But all the IT is made at home and we are very proud that we have developed all the algorithms and technology.”

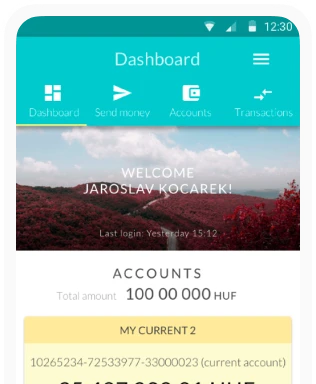

Right, so what does it all do? Iván spells it out for me, “We use biometrics to provide second factor authentication in relationship users, with the clients. To us, trying to analyze the different biometrics technologies, they have a lot of potential, but you have to look at the potential of having an omni-channel experience. For instance, we register the biometric patterns in the customer for digital onboarding. It’s seamless for the user, and we can then use those biometrics in many channels, whether you’re getting money from an ATM, or doing facial authentication on your desktop, or using an electronic signature on your mobile phone. This is part of our strategy, to introduce facial biometrics worldwide, and to be the most suitable, most seamless and most secure technology in biometrics. And that’s what Electronic IDentification is betting on.” Electronic ID

Electronic ID

Is it a bet which will pay off? Of course Iván, and now Signicat, believe that this will come to pass. He points out that even iPhone, which comes with many security measures built-in, is still not secure enough, and must be used in combination with other methods such as first factor authentication, and passwords to provide an end-to-end secure process. He says it’s the same in the area of identification. So although very good algorithms for dealing with fraud attacks have been developed, biometrics by itself is still not a fully secure technology. Electronic IDentification combines the instruments and algorithms in around 20 separate security measures to ensure the correspondence of people with their ID card. He adds, “We are even able to solve as a security measure a hologram over video streaming as part of the ID Card, which is a security measure that’s really difficult to cheat. And so we have a human factor - because the regulator needs to have a human part - and we have the electronic signature. With one process end-to-end which is very secure, we have less than 1% attempts at fraud over our systems.

It’s becoming the standard for the highest level of assurance in retail onboarding. One of the reasons is because you are recording and saving all the processes. It is more secure - and I can defend this with data - that it is more secure than in-person and face-to-face validation, because you have a lot of electronic evidence throughout the whole process. That means a lot of ways to check that the identity is the real identity.”

OK, I’m comforted to know that it’s going to be increasingly hard for fraudsters to pass themselves off as me and siphon my millions from my bank accounts, but does it end there? No, Iván says one of the notable benefits for the end-user is convenience, for example in making an appointment with a local government office, which in the very recent past would have meant a visit in person (accompanied by all the various ID proofs required, which usually seem to be different for each department).

For Electronic IDentification’s clients, using the products means widening the scope of how they acquire and manage customers. Previously in Spain, a bank would need many branch offices right across the country to service customer needs. Now a bank can access a digital single market of 500 million people, and eventually even the whole world. As Iván points out, the benefits for banks or governments is that they are able to acquire their ‘customers’ without limitation, and without borders - all at better decision costs. What’s not to like about that? Electronic IDentification in use

Electronic IDentification in use

And what’s not to like about Spanish Fintech in general? Arturo González Mac Dowell says not a lot, at least when it comes to the abilities of teams. “Spain is top notch in terms of creativity, and in terms of development power. So if you want to build a team of developers, and you want to get people with creative ideas, Spain would be one of the first places to look. But when it comes to growing a company, that’s when you get all sorts of administrative difficulties and that's what we have to change.” Fintonic

Fintonic

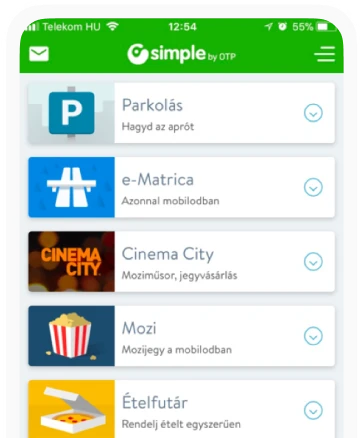

Despite this caveat, he mentions Fintonic as a ‘purely Spanish’ Fintech which is probably the largest Personal Finance Management company in Europe - and certainly in Spain - and received new funding from ING bank and other investors in 2019. Fintonic is also growing rapidly in Chile and Mexico. Then there’s BNext, which catches Arturo’s eye - also headquartered in Madrid and self-described as ‘The first supermarket for financial products.’ He also gives a nod to neobank Rebellion - as used by his son - which he says is still in the early stages, and has yet to prove itself in the way that others, such as Fintonic have. Also in the picture is Kantox, based in Barcelona and London - ‘The leader in currency management automation technology, helping companies across the globe transform how they manage currencies and overcome FX risk.’

From his global viewpoint Rodrigo García de la Cruz looks beyond Spain to cite best of breed and mentions how he believes voice-based banking will soon start to grow rapidly, for example in Mexico. There 60% of a population of 130 million people are unbanked, but most have a mobile phone, and people are very used to working with apps. “So if you want to get through to these potential clients using standard forms, and everything related with traditional bank onboarding you are going to fail, and even more so because most of these people don't trust banks.” The Brazilian neobank, Nubank is one of the largest challenger banks in the world, and onboarding ‘100s of millions of clients’ in Brazil, Mexico, Colombia and Argentina. Nubank is doing this - according to Rodrigo - “By focussing on a great customer experience, and encouraging people to use their bank just like any other application.” Nubank advertising

Nubank advertising

Iván Nabalón is not so keen to be drawn on ‘one’s to watch’ in the Spanish Fintech space, possibly because some of his alliances are still under wraps. But he does say, “We're working with airlines, we're working with governments and eventually passports and analog things like plastic credit cards will disappear. We have the models that are purely digital, and totally secure.”

And what will happen for Iván when the 2 year grace period is over following the Signicat acquisition? It seems he’s not about to fade away to the golf course (although he is resuming the game, along with mountain biking, squash and gym work): “I love the Electronic IDentification project and the social impact, so as long as I can, I will stay with the Signicat projects. And plan B? - I am really looking forward to coming back to the democracy industry because we have learnt a lot in this project, and it’s the proper time to think about what's next in terms of democracy, and disruption.”

We’ve already heard from Arturo that he actually seems busier than ever with all his high level meetings to progress the cause of Spanish Fintechs, but what else is on his horizon? Well it’s more an observation than any particular project, but one thing he’d like to see is better translation facilities and apps, “Lately I have had lots of communication with my Brazilian cousins. I speak the language, but my written Portuguese is terrible. I use Google Translate and the translation is perfect, but I always have to go to Google Translate and cut and paste, and put it in WhatsApp or an email. I would love to see the translation technology embedded in the different channels or applications that I use, and banking could be one such example. I think Spain probably uses WhatsApp more than any other country, because we like to gossip a lot. And to have a button to translate what I've just written in whatever language would be extremely useful.” Let’s hope someone reads this and gets to work on that magic button.

And Rodrigo’s near-future gazing? “Blockchain is going to be one of the bridges to achieve accessibility to Fintechs, and for Fintechs. So I think blockchain is going to change a lot of things. But we need to make sure we use it in the right way, because it’s a huge technology. Artificial Intelligence is also touching on some pillars of the economy, and regulators are very worried about it. But sometimes it's more about the economy than the technology. For me, technology is going to change a lot of things. But it’s just a technology… a bridge to reach objectives. The technology is not the goal.”

After visiting Spain I’m left with a matching thought to this statement: Maybe it’s passion that really delivers results.

Rodrigo García de la Cruz

Rodrigo García de la CruzMapping connections

Let’s start with Rodrigo García de la Cruz, a genial graduate from 20 years of assorted technical and finance experience with Renault, Citibank and Barclays, before he branched off into education and created ‘probably one of the first Fintech master programs’ in 2013. He gathered students and professors to help create a federal system of knowledge, which has continued to grow and bear fruit. However within 2 years of this initiative, the potential of Fintechs was becoming ever clearer to Rodrigo, and he started an investment fund specifically for the sector, with the first investments being in 12 emerging Spanish Fintechs. In doing so he realized that there was no central repository of information that investors in Fintech could turn to, so also began the process of identifying businesses, their models, and their founders. The result of all this was his company Finnovating, with the goal of identifying and evaluating companies for investment, and creating ecosystems. The mapping of connections, and the organizing of many events and conferences meant that it rapidly became obvious to Rodrigo that those ecosystems he was interested in extended beyond Spain and - initially at least - into the wider Spanish-speaking world, including Mexico, Colombia, Peru and Chile. That led to the Iberoamerican Fintech Alliance, of which Rodrigo was the first President, representing some 15 associations in 20 countries.

Finnovating

FinnovatingBut before that, as Rodrigo notes, “When you put together the right people in the right place, things happen.” So 2016 had seen the inauguration of AEFI, the Spanish Fintech Association, of which Rodrigo was also the first President, and indeed remains so. With the rollout of Fintech associations from Spain to Latin America developing at pace, he also set his sights on the rest of Europe, which turned out to be, “A little more complicated”, in part because of the wide mix of languages. Nevertheless, “We started attending all the different European events to connect with the right people in France, Italy, Portugal, and Holland, where the first Fintech Association in Europe was created. One result of this expanding network was the creation in 2019 of EDFA - the European Digital Finance Association.

Pushing and pulling

For the last decade, Rodrigo García de la Cruz has been pushing and pulling at the emerging Fintech industry to create viable and supportive ecosystems across two continents: always connecting, connecting, connecting.

Then in 2020, he had another lightbulb moment: “I saw that our work in Finnovating, in terms of connecting people from Europe to Latin America, and from Latin America to Europe, was scalable, but the pandemic was making it very difficult to travel, and attend international events. So we decided to create a digital global platform that people can connect to, like LinkedIn, to do business. And when I say people, I mean Fintechs, Insuretechs, any kind of corporations, regulators, associations, and investors.”

For a year Rodrigo and his colleagues set about mapping all the Fintechs in the world, creating the largest database of Fintechs and prospects, and putting it all on the Finnovating platform. But he adds, it was important that this is not a private database, but one which is accessible to companies to activate their profiles and start doing mutual business. “This is innovative, and we have identified 50,000 startups and scale-ups in the world in terms of Fintech, insurtech, and projects, and more than 10,000 investors that are very interested in investing in these kinds of companies. We are creating a transactional platform that people can connect with and do business on.” Is it any surprise that Rodrigo has been frequently cited as a top Fintech influencer, worldwide?

The most important step since the internet?

Let’s go visit Iván Nabalón, Founder and CEO of Electronic IDentification, headquartered in Madrid, but also looking to the world, and now present in 42 countries with over 250 clients. An overnight Fintech success story? Not quite: Iván began his journey as a hacker, before being attracted to management roles, where he worked for many years, mainly in telecoms, and with a strong connection to technology. He was feeling increasingly dissatisfied with his comfortable job however, and started to think about a Digital Identity system, ‘To change the democracy paradigm through citizenship participation… the most important step forward since the creation of the internet.’ OK, so no small task then.

Despite the warnings of colleagues, who cautioned against quitting a secure job when he already had a family to support, Iván went ahead, encouraged by 150,000 followers on social media channels. He then shook the ‘Triple F’ tree: Family, Friends and Fools, to raise startup funding, and in 2013 Electronic IDentification was born…...And almost crashed.

“It was too early for the democracy project. I realized that we had to pivot, because we were working with banks, and so when we started to sell the technology to them, it became a very good time.” Banking partners then introduced Electronic IDentification to Spanish financial supervisors and regulators. Spain was, and is, a leader in worldwide retail banking: innovative solutions were being actively looked for, and Electronic IDentification could enable remote creation of bank accounts. From that point on the company started to attract Angel Investors to get commercial operations up and running, followed by VC support. After which Electronic IDentification grew quickly, with significant milestones along the way. A notable 2020 win was for the biggest ever French government citizenship contract to provide the new Social Security card to 44 million people. - This against stiff competition from Gemalto, Idemia, and Thales.

Iván Nabalón

Iván NabalónIván says, “Their path is about raising money, a lot of money. We like their team, and we like their growth strategy.” He admits that it was difficult to consider doing an exit, but feels that the acquisition of his company will consolidate the market and result in Signicat becoming one of the leading electronic identity vendors, worldwide. And in the meantime, he and his team at Electronic IDentification retain full autonomy for two years.

Choosing the right dancing partner

I want to dive deeper into what Electronic IDentification actually means in terms of e-democracy, and what has driven Iván to pursue this relentlessly for the last decade, but first let’s pop across town to call in on Arturo González Mac Dowell, founder of Eurobits Technologies - which also now has a notable Scandinavian connection in the form of acquisition by Tink. “I thought it was better that we choose a dancing partner now than choosing when there's no-one left on the dance floor!” Arturo gives a colorful explanation of the sale of his company, founded in 2004 and a leader in PSD2 and financial aggregation services.

Eurobits

Eurobits“Tink was a competitor but with a completely different growth strategy, and after they raised €100 million, then Visa offered $2,500 million for Plaid (since revoked), I thought that it was time to get out, as a lone player. It was our decision to look for a partner and we chose Tink, which is not as old as Eurobits, being founded in 2012, initially as a b2c Personal Financial Management Company, but it had proved a tough game to grow in the space. Then they received an offer from a Dutch Bank to buy their software, after which they shifted their game completely to a full-blown b2b company that basically sells the ‘Rails and Brains’ of Open Banking. Rails is also what we do at Eurobits - it’s a plumbing exercise, so to speak.”

Eurobits was founded in 2003 by two Spanish banks, Bankinter and Caja Madrid, and Arturo was head-hunted to launch the new company, the first dedicated account aggregation operation in Europe. He points out that this was long before anyone started even thinking about PSD2. The beginnings were tough, mainly because the market wasn’t ready, and in the early 2000s few people were willing to access their financial data through a third party. It took the breakthroughs of widespread social network adoption to create an environment where the fear of accessing sensitive data over the internet began to lessen. As Arturo notes, “If you’re sharing those embarrassing pictures on Facebook that could even lose you your job, then why wouldn’t you want to access your financial data through a reliable third party?”

So the time became right for PSD2, in which Arturo and Eurobits played a significant part, helping to create the ETTPA trade body - the European Third Party Providers Association.

“With PSD2 come the connections between banks where customers hold their accounts, and the company that's willing to pool that data in order to add some value on top. That value might be very simple, such as just having all the information together in one place, and that simple value is very compelling for an SME, a professional needing to hold accounts in several places, or someone who wants to integrate the information with their accounting software.

It can also be much more complex, like a Personal Finance Management solution with tools for budgeting to aid you in making wise financial decisions, or portfolio management software, or whatever.

That's the Rails, and the Brains is the part that uses the data: So it’s being able to say (for example) that this particular transaction is grocery shopping, and it was performed at Tesco.” Arturo goes on, in full flow at what has been achieved since Eurobits’ start back in 2003, “Now the sky's the limit. I think we'll see many things down the road that we can't envisage today: from the extraction of market signals for hedge funds to make wise investment decisions, to whatever can be done with financial information. Actually, I think financial information or payment information alone is extremely relevant information. Then in combination with other information such as the geolocation data provided by telcos, it becomes really powerful.”

Arturo González Mac Dowell

Arturo González Mac DowellGrowth, and more growth

Let’s get back specifically to the Eurobits story, and where the company stands today. In March 2011 Savings Bank Caja Madrid merged with six other savings banks, to create Bankia. Shortly after, Bankia bailed out, and the subsequent rescue forced a sell-off of companies which were not considered strategic. Arturo stepped in with a successful Management Buyout Offer for Eurobits and became the largest shareholder. - A great example of perfect timing with PSD2 just around the corner. But also because soon after PSD2 roll-out Tink was there planning a shopping spree. Shortly after buying Eurobits, Tink was bought by Visa for, “An astounding and mind-blowing €1,800 million, which gives an idea of how relevant the space of open banking is becoming.” Arturo looks relaxed as he ponders a slightly uncertain, but for sure secure future.

“Visa bought Tink for what Tink is. Meaning that Tink will retain its brand and current management team, and its headquarters will remain in Stockholm. So in principle, nothing changes. Of course, the only permanent thing is change. So down the road, we don't know what will happen. But in principle, everything is going to continue as normal. Of course, the only permanent thing is change.” Arturo claims - perhaps modestly - that he’s not a big enough part of the puzzle to have been involved in detailed discussions of the deal, and is in ‘wait and see mode’, but says he’s nevertheless content.

Giving back to the community

One of the reasons Arturo decided to sell Eurobits was that the growth strategy imposed by PSD2 required tons of cash. He also admits to being somewhat burned out by the long haul he’d been on, “I was still eager to push open banking, but my batteries were drained. I needed a break. When we negotiated I voluntarily said that I didn’t want to be an executive anymore, and that my key contribution would be to help smooth the transition.”So a life of rest and luxury from now on? - Unlikely!

Since the Tink deal started going through, Arturo has increased his role in lobbying and institutional activity, and is now a member of the ERPB, the European Retail Payments Board, a high level body of the European Central Bank, with a balanced representation of the supply and demand side of retail payments across Europe. All three banking representative bodies are part of the European Credit Sectoral Associations, and the three non credit sector representative bodies, including EPIF, the European Payment Institutions Federation, EMA, the E Money Association, and ETTPA, the European Third Party Providers Association, representing the interests of bank-independent TPPs. This does not sound like a man planning on hanging up his entrepreneurial running shoes any time soon. “And then I'm also a board member of EPC - the European Payments Council, plus a vice president of AEFI, the Spanish Fintech Association. So I spend a significant part of my time trying to make things better for the Fintech community, particularly in the space of payments. I also have the feeling that this role of representing interests in Europe is not very common in Spain - it's more an Anglo Saxon culture thing - so I'm thankful for how things have gone. And I feel I need to give back to the community.”

Meeting in Eurobits

Meeting in EurobitsGiving back to the community? As in charity for instance? “No, I'm not in a place to do a Foundation - that would be stupid. But there's some things I can do to help the Fintech community, particularly in Spain, such as getting certain laws changed that make doing business in Spain significantly more difficult and less attractive than in other places.” Arturo gives as an example his recent experience with the Tink acquisition of Eurobits, where there were 8 months between signing and closing, because he says that in Spain there is no specific law about the requirements to own and manage a payment institution. Instead the regulators reverted to the law for credit institutions, which as Arturo observes, “Makes absolutely no sense. The criteria to own a company like Eurobits is the same as the criteria to own a company like BBVA? We don't hold customer funds, and there's no fraud risk. So it makes no sense. These are the sort of things I want to spend a significant amount of my time on to make Spain, and also Europe, a better place to do business.”

Spanish Fintech Association

Spanish Fintech AssociationThe Spanish Fintech Association is strong, with around 180 members, and has good liaison with all the Spanish regulators and the Treasury, so AEFI has the capacity to exert influence. But, says Arturo, there are many things that still have to change in Spain: “We don't have the best entrepreneurship culture in the world. So there's a lot of work to be done. We're pushing hard, but we're still a long way from where we think we should be.”

The 100% ‘Yes’ vote

Arturo’s colleague and co-conspirator (if we can label them as such!) in the Spanish Fintech Association, Rodrigo García de la Cruz, points to a significant win for AEFI’s influence - the creation of a Fintech sandbox. It’s an ambitious initiative, to some extent modelled on the much-admired UK sandbox, and one which Rodrigo is slightly amazed to recount that 100% of Spanish politicians voted ‘Yes’ to. In fact it was the first time in Spanish history that a law was passed without any dissent, and was to enable the digital transformation of the finance sector. That’s testimony to the muscle, and yes, pasión, of Spanish Fintechers.

Looking back on the negotiations with the National Bank, Rodrigo comments that he doesn’t see Spain as an exception in the difficult road which must be travelled. “It’s a real problem for a lot of countries, that their regulators and supervisors are not used to managing this kind of innovation. They can’t meet the pace, and this is why there have to be associations, supporting the ecosystem and giving the vision and the understanding of how important this industry is for the future of the financial sector.”

Currently he sees two separate European trends: “There are the regulators that say you can do whatever you want, but you have to do it right. And if you have problems then they are going to regulate. And there are the more Latin countries, where everything is regulated and under control. So it's very complicated having to adapt the innovation to the regulator, because everything is regulated.”

In this second case, instead of adapting to what is happening in the market, the regulation gets ever more complicated. Unless, Rodrigo says, countries can follow the lead of the UK and other progressive countries, where there may not even be the need for sandboxes, because there is a culture of being constantly open to new ideas. As something of a fan of the UK Fintech scene, he points out that there is no strong Fintech Association there. Why? Because, “In the UK things are now so advanced and open that Associations aren’t needed.” Meanwhile Rodrigo continues to push the envelope, and foresees the day when there could be a Worldwide Fintech Association.

Going global

“In terms of Fintech we need to create something global that connects all the potential of companies. I think now is the moment of the banks, that is your clients, connecting with the startups and with innovation. Now is the time to cooperate, because if you are not able to work with others you're not going to get very far. In Europe there are more than 7,000 banks. All of them need to reinvent themselves and they are not going to be able to do that alone. So this is why we need to help them, and companies like Finnovating are here for that. We want to create bridges between them, and all of us.

But how am I going to reach someone? LinkedIn is not for companies but for people-to-people. So this is why there is the need for platforms for corporations, platforms for Fintechs, for banks. Banks over the last 50 years weren’t able to do financial inclusion. But now there’s the technology, and Fintechs will change things forever. Anyone with a mobile phone can have access to finance for any kind of service. That means democratizing: through Fintechs, insurance, real estate services... for any person in the world.”

I said this was Big Picture stuff, and there’s that mention again of democracy - the idea which first fired up Iván Nablón to create Electronic IDentification. He fills in some background: “Identity - the analog version - was very important in building the democracies and welfare states we have today. In the near future, with digital identity there will be a multiplier effect on GDP. Identity is essential for social trust and the way we build relationships with public administration, with banks, and with how we travel. Everything is based on trust, and the internet was born naturally with a lot of trust, but it's not embedded in the internet itself: we’re having to put this in later. Digital identity is the backbone of all democracies, and is the key to face the future. Digital Identity has huge social impact.”

Scaling up

OK, so I’m getting it, sort of. But why can’t we all just continue to muddle along with hybrid forms of identity? A paper passport here, a driving licence there… in other words a wallet full of cardboard and plastic, and a phone full of passwords? Iván is looking much further than this, of course. “Digital identity has the power to release a very high impact socially, and in regulated businesses. When you see commerce or non-regulated businesses, they are all digital today, and have made very good progress. But when you look at regulated industries, such as health, government, the financial sector, cross border travel and so on, there is nothing there… nothing. They are at the very beginning of digitalization.”

He makes it sound as if we’re still grubbing along in the Stone Age, but surely there are rapid changes taking place? Iván agrees, but only to some extent: “The Spanish financial regulator creating the conditions to allow the banks to open accounts and add high levels of security was a big step forward, but if you want to make something global, you need to scale. You need to move on to create that for the whole of the European Union. Strong electronic identities are becoming the standard worldwide because they allow interoperability principles with regulatory solutions. So strong digital identity is going to be key to going digital, for any regulated or non-regulated industry anywhere in the world.”

Clearly, with his lobbying of the Spanish and now European regulators, Iván and his colleagues, both in Electronic IDentification and the Spanish Fintech Association are aiming towards global standards, but surely they’re also up against some stiff competition from the already well-established Big Tech giants with their billions of users and followers? True, Iván says, Google, Facebook and Apple have the muscle, but they are all also equally challenged to create a digital identity program, although with a different goal from the democratic perspective. What Big Tech wants is to give users a strong digital identity in order to operate in any business in any country. “They have their smartphones, or they have other technologies, but they have no idea about the system of digital identity. Digital identity is being created in the European space. That means the Anglo Saxon regulatory mindset has nothing to do with the European one. They have the technology - for instance the technology Apple is trying to use for digital identities is already in their smartphones to secure wallets and credit cards. But they need to move to the European model, probably by buying or building new technology. The company that solves the issues of a decentralized global digital identity will be huge.”

So there’s a push-pull going on in the whole area of Digital Identity, on the one hand from the commercial needs of the Tech giants, and on the other side from the steady ‘democratization’ of governmental and regulated organizations which have an urgent need to leverage the vast amount of data that is potentially available. No wonder Iván shows considerable enthusiasm when he says, “This is all really challenging, and we are seeing fantastic momentum for these technologies.”

Exploiting inefficiencies

Having heard about the ‘Anglo Saxon’ mindset, and the relative merits of the UK openness to Fintech, I’m interested in Arturo González Mac Dowell’s angle here. He sees the adoption of Fintech in that country being less about innovation, and more about the inability of the banking sector to get up to speed, at least originally: “The UK was the perfect breeding ground for Fintech because it had all the elements of a very backward banking industry that was extremely inefficient. I can give you an example, it took me well over a month to open an account in Santander UK even with the help of the central systems of Santander in Spain. I wanted to open an account for a project, and it took me a month. I can walk down Main Street in any Spanish town and have 10 accounts open in different banks in one hour!

In the UK, you had to make an appointment two weeks in advance. So in the beginning, Fintechs were exploiting inefficiencies of the banking system. And one of the places where there were more inefficiencies was the UK.”

Despite this somewhat damning assessment, Arturo points out that on the other hand, the UK has one of the most forward looking authorities in the world, and instead of reflexively protecting the banking industry, it recognized opportunities. He notes, “Look, I can make any number of negative comments about the details of open banking in the UK, but the concept itself is brilliant. It's pushed not by the banking authorities, but by the competition authorities. And they make the largest nine banks in the UK pay for the exercise.

No wonder you have companies like Revolut that now are worth as much as some of the incumbent banks. You have so many huge Fintech companies in the UK due to the open mindedness of the authorities, which is lacking in some EU member states, and most notably in what we commonly call PIGS: Portugal, Italy, Greece and Spain.”

Eurobits discussion

Eurobits discussionSigns of optimism?

Arturo reflects on the Spanish situation when he says that the country has been extremely protective of the incumbent banks, despite having possibly the most advanced retail banking industry worldwide. He suggests the reason for the protectiveness is that law enforcement was so bad that banks had to fill in the gaps left by poor regulation with better technology. For example, by the 1970s in Spain the majority of employees were already receiving their wages by direct debit. In addition, every bank had internet banking by the mid 90s. So the retail banking industry in Spain became extremely well developed. However now, “With this culture of protectiveness, which has always been there, I fear that we will not allow the Fintech industry to grow significantly. And at the same time, we will give a false sense of protection to banks, which will reach a point where that protection is no longer useful, and we will be left with no Fintechs. And no banks. Leaving financial services dominated by foreign companies.

That's the worst scenario. The good scenario is the one I'm fighting for: that the Spanish authorities see this risk, and eliminate the barriers to the Fintech industry, just like the UK has done. And that would make the banking sector more competitive, and the Fintech sector more competitive as well. I think it's a win-win proposition in the long term: 50/50…” He pauses for a moment and considers this possibility, before adding, “But perhaps I'm being optimistic!”

And what’s the adoption like of Fintechs, particularly in Spain? Is the person on the street talking Fintech? Arturo reckons that a ‘significant chunk’ of the population are familiar with the concept, but not necessarily the word. He refers to what he calls, ‘a novelty application’ Bizum, for peer-to-peer instant payments, which has over 18 million active users. That’s encouraging, but Arturo says that on the downside, “It's an exercise by the banking industry that is closed within the banking industry. So I doubt this would have been allowed in the UK for example, where the competition authorities would not have given the OK to a closed system.” He laughs, dismissing this detail, “But I think if my grandmother was alive, she would be using Bizum, although she wouldn't call it Fintech.”

Bizum

BizumIs ‘Fintech’ a word on the street?

And what of younger people, who are surely more in tune with all things Fintech? “People in their 30s and below use a ton of Fintech applications, but I'm not sure they call them Fintech. My son is 20 years old and he uses a number of apps, like to constantly buy and sell crypto assets. Fortunately, he has his head on his shoulders and makes wise decisions. But for most people of his age, the competitors of crypto assets are Bet365 or William Hill: it's just gambling, and they do it with absolutely no investment strategy. There are a number of companies like eToro that are making a dent in the market, along with other Spanish companies with the proposition of making investment very easy for younger people. But I’m not sure I’ve even heard my son use the word ‘Fintech’.

Speaking of the offspring of entrepreneurs, I’m amused to hear of Iván Nabalón’s 3 children, assisting in the testing of Electronic IDentification products (unpaid, he quickly adds). One of the cool features is the ‘Smile and Trust’ identification method where the user is required to perform the distinctly human action of smiling to the camera on their smartphone - something I can well imagine is enjoyed by the Nabalón kids who have to be encouraged with a joke or funny story to access the software - sandboxed of course. And despite their youth, Iván remarks of his in-house testing team, “I'm not sure they are 100% aware of the project, but if you ask them, they can probably tell you about the technology we are developing.”

‘Smile and Trust’ in action

‘Smile and Trust’ in actionNuts and bolts

In the absence of an available junior Nabalón to explain the nuts and bolts of Electronic IDentification, I ask Iván to guide me a little further through the offering. He says that all the building blocks of the technology are made in house, in order to guarantee control and autonomy. “It took ages to get to the combination of video identification, plus qualified electronic signature, but everything is in-house. Obviously, we trust in third parties, like the cloud providers, and we don't invent artificial intelligence. But all the IT is made at home and we are very proud that we have developed all the algorithms and technology.”

Right, so what does it all do? Iván spells it out for me, “We use biometrics to provide second factor authentication in relationship users, with the clients. To us, trying to analyze the different biometrics technologies, they have a lot of potential, but you have to look at the potential of having an omni-channel experience. For instance, we register the biometric patterns in the customer for digital onboarding. It’s seamless for the user, and we can then use those biometrics in many channels, whether you’re getting money from an ATM, or doing facial authentication on your desktop, or using an electronic signature on your mobile phone. This is part of our strategy, to introduce facial biometrics worldwide, and to be the most suitable, most seamless and most secure technology in biometrics. And that’s what Electronic IDentification is betting on.”

Electronic ID

Electronic IDIs it a bet which will pay off? Of course Iván, and now Signicat, believe that this will come to pass. He points out that even iPhone, which comes with many security measures built-in, is still not secure enough, and must be used in combination with other methods such as first factor authentication, and passwords to provide an end-to-end secure process. He says it’s the same in the area of identification. So although very good algorithms for dealing with fraud attacks have been developed, biometrics by itself is still not a fully secure technology. Electronic IDentification combines the instruments and algorithms in around 20 separate security measures to ensure the correspondence of people with their ID card. He adds, “We are even able to solve as a security measure a hologram over video streaming as part of the ID Card, which is a security measure that’s really difficult to cheat. And so we have a human factor - because the regulator needs to have a human part - and we have the electronic signature. With one process end-to-end which is very secure, we have less than 1% attempts at fraud over our systems.

It’s becoming the standard for the highest level of assurance in retail onboarding. One of the reasons is because you are recording and saving all the processes. It is more secure - and I can defend this with data - that it is more secure than in-person and face-to-face validation, because you have a lot of electronic evidence throughout the whole process. That means a lot of ways to check that the identity is the real identity.”

OK, I’m comforted to know that it’s going to be increasingly hard for fraudsters to pass themselves off as me and siphon my millions from my bank accounts, but does it end there? No, Iván says one of the notable benefits for the end-user is convenience, for example in making an appointment with a local government office, which in the very recent past would have meant a visit in person (accompanied by all the various ID proofs required, which usually seem to be different for each department).

For Electronic IDentification’s clients, using the products means widening the scope of how they acquire and manage customers. Previously in Spain, a bank would need many branch offices right across the country to service customer needs. Now a bank can access a digital single market of 500 million people, and eventually even the whole world. As Iván points out, the benefits for banks or governments is that they are able to acquire their ‘customers’ without limitation, and without borders - all at better decision costs. What’s not to like about that?

Electronic IDentification in use

Electronic IDentification in useWhat’s not to like

And what’s not to like about Spanish Fintech in general? Arturo González Mac Dowell says not a lot, at least when it comes to the abilities of teams. “Spain is top notch in terms of creativity, and in terms of development power. So if you want to build a team of developers, and you want to get people with creative ideas, Spain would be one of the first places to look. But when it comes to growing a company, that’s when you get all sorts of administrative difficulties and that's what we have to change.”

Fintonic

FintonicDespite this caveat, he mentions Fintonic as a ‘purely Spanish’ Fintech which is probably the largest Personal Finance Management company in Europe - and certainly in Spain - and received new funding from ING bank and other investors in 2019. Fintonic is also growing rapidly in Chile and Mexico. Then there’s BNext, which catches Arturo’s eye - also headquartered in Madrid and self-described as ‘The first supermarket for financial products.’ He also gives a nod to neobank Rebellion - as used by his son - which he says is still in the early stages, and has yet to prove itself in the way that others, such as Fintonic have. Also in the picture is Kantox, based in Barcelona and London - ‘The leader in currency management automation technology, helping companies across the globe transform how they manage currencies and overcome FX risk.’

From his global viewpoint Rodrigo García de la Cruz looks beyond Spain to cite best of breed and mentions how he believes voice-based banking will soon start to grow rapidly, for example in Mexico. There 60% of a population of 130 million people are unbanked, but most have a mobile phone, and people are very used to working with apps. “So if you want to get through to these potential clients using standard forms, and everything related with traditional bank onboarding you are going to fail, and even more so because most of these people don't trust banks.” The Brazilian neobank, Nubank is one of the largest challenger banks in the world, and onboarding ‘100s of millions of clients’ in Brazil, Mexico, Colombia and Argentina. Nubank is doing this - according to Rodrigo - “By focussing on a great customer experience, and encouraging people to use their bank just like any other application.”

Nubank advertising

Nubank advertisingIván Nabalón is not so keen to be drawn on ‘one’s to watch’ in the Spanish Fintech space, possibly because some of his alliances are still under wraps. But he does say, “We're working with airlines, we're working with governments and eventually passports and analog things like plastic credit cards will disappear. We have the models that are purely digital, and totally secure.”

And what will happen for Iván when the 2 year grace period is over following the Signicat acquisition? It seems he’s not about to fade away to the golf course (although he is resuming the game, along with mountain biking, squash and gym work): “I love the Electronic IDentification project and the social impact, so as long as I can, I will stay with the Signicat projects. And plan B? - I am really looking forward to coming back to the democracy industry because we have learnt a lot in this project, and it’s the proper time to think about what's next in terms of democracy, and disruption.”

It’s just technology

We’ve already heard from Arturo that he actually seems busier than ever with all his high level meetings to progress the cause of Spanish Fintechs, but what else is on his horizon? Well it’s more an observation than any particular project, but one thing he’d like to see is better translation facilities and apps, “Lately I have had lots of communication with my Brazilian cousins. I speak the language, but my written Portuguese is terrible. I use Google Translate and the translation is perfect, but I always have to go to Google Translate and cut and paste, and put it in WhatsApp or an email. I would love to see the translation technology embedded in the different channels or applications that I use, and banking could be one such example. I think Spain probably uses WhatsApp more than any other country, because we like to gossip a lot. And to have a button to translate what I've just written in whatever language would be extremely useful.” Let’s hope someone reads this and gets to work on that magic button.

And Rodrigo’s near-future gazing? “Blockchain is going to be one of the bridges to achieve accessibility to Fintechs, and for Fintechs. So I think blockchain is going to change a lot of things. But we need to make sure we use it in the right way, because it’s a huge technology. Artificial Intelligence is also touching on some pillars of the economy, and regulators are very worried about it. But sometimes it's more about the economy than the technology. For me, technology is going to change a lot of things. But it’s just a technology… a bridge to reach objectives. The technology is not the goal.”

After visiting Spain I’m left with a matching thought to this statement: Maybe it’s passion that really delivers results.