Sweden - Accelerating innovation and saving trees - part 2

As the Swedish Fintech scene is apparently ‘booming like crazy’, to re-quote Anders Norlin of Coach & Capital, let’s hang out a little longer in Stockholm, and check in with two more practitioners of the fine art of Fintech. One working within the framework of an august Swedish bank, the other in a pioneering green enterprise founded to reduce paper usage, and provide secure digital storage for citizen’s official documents. Michael SparringMichael Sparring is the Chief Partnership Officer at SEBx, a Fintech startup launched by SEB, one of the largest financial groups in the Nordics. SEBx is built on the idea of combining the benefits of an established bank, blended with some of the advantages of a startup. Michael explains: “It enables us to borrow strength, experience, resources and support from the core business, while starting afresh with new technology and new ways of working.” Since its inception in 2018, SEBx has built a new cloud-based banking platform, launched its first consumer product, and is now looking to establish itself in the growing Banking as a Service space.

Michael SparringMichael Sparring is the Chief Partnership Officer at SEBx, a Fintech startup launched by SEB, one of the largest financial groups in the Nordics. SEBx is built on the idea of combining the benefits of an established bank, blended with some of the advantages of a startup. Michael explains: “It enables us to borrow strength, experience, resources and support from the core business, while starting afresh with new technology and new ways of working.” Since its inception in 2018, SEBx has built a new cloud-based banking platform, launched its first consumer product, and is now looking to establish itself in the growing Banking as a Service space.

SEBx has a dual mission, Michael says. “Firstly, we are building a banking platform to meet our own long-term needs within the group. The industry is going through a period of rapid evolution. Advancements in technology, changes in regulations and the introduction of new business models have accelerated the pace of innovation. Finding alternative avenues to increase the speed of experimentation and execution is becoming increasingly important in this environment. Our new banking platform provides us with strategic optionality for the future when building the next generation of products and services.”

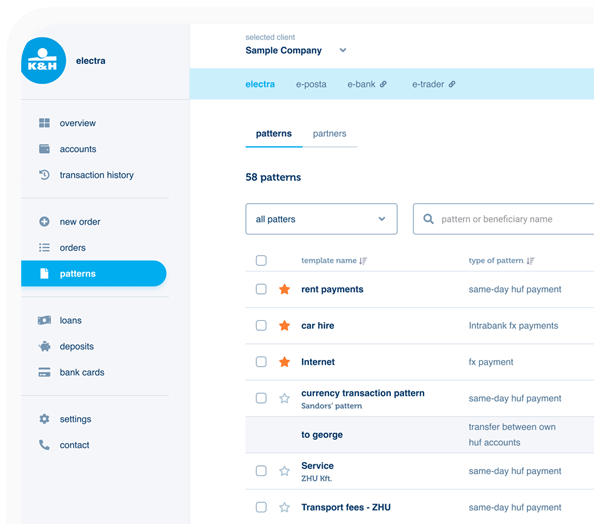

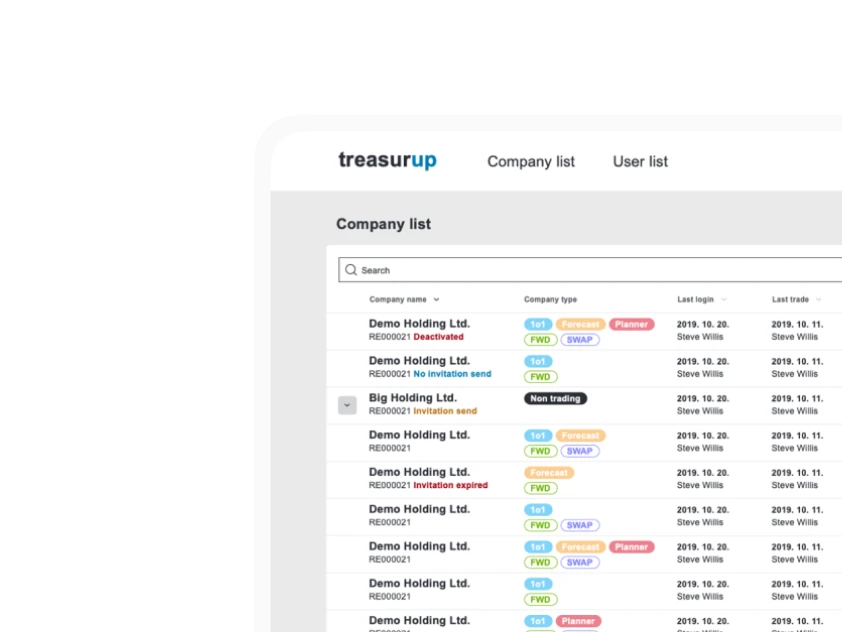

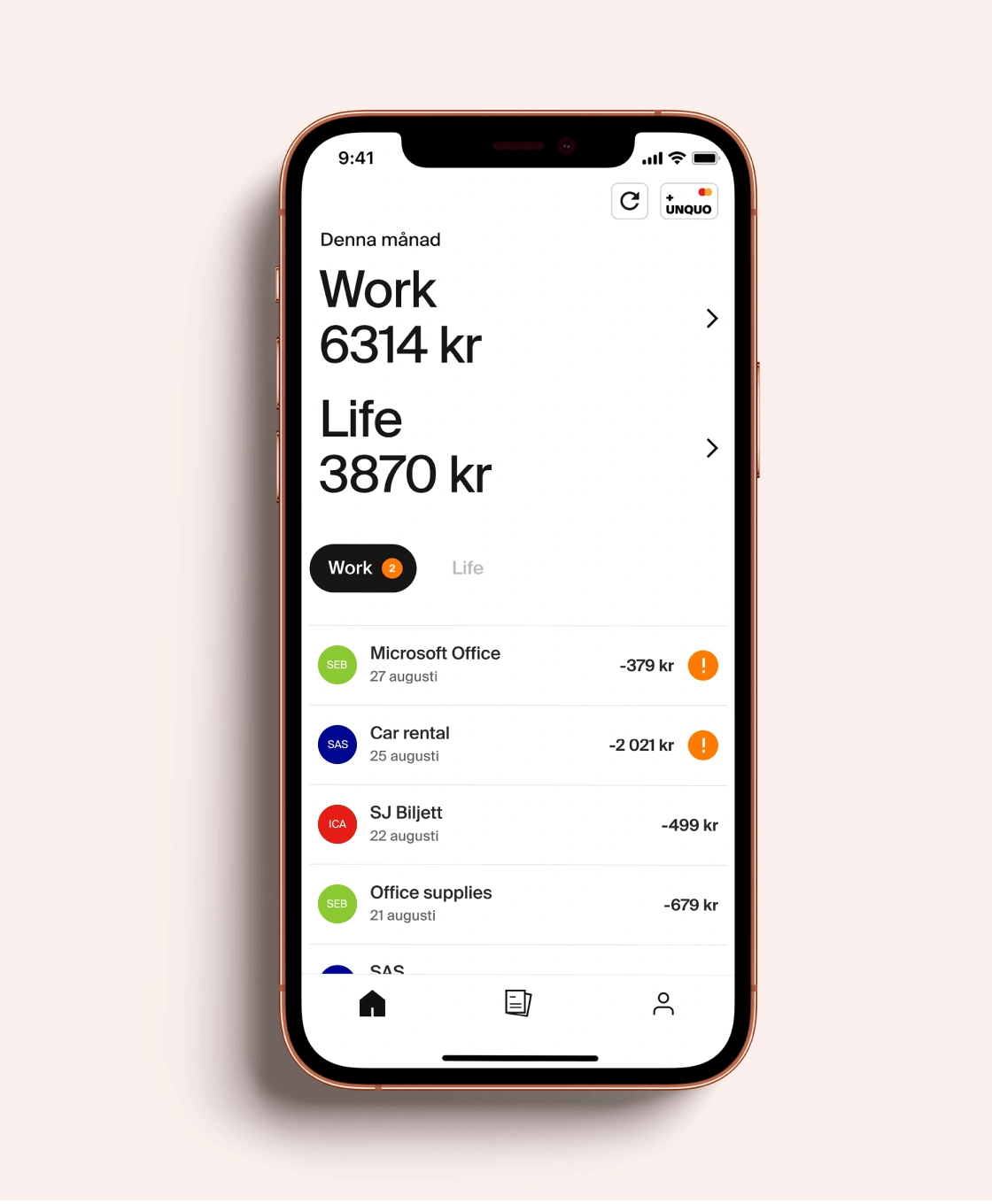

Secondly, SEBx are releasing new products and brands. The first product is called UNQUO and targets the rapidly growing gig economy. The self-employed community already makes up the majority of companies in Sweden. “With the ongoing changes in the global workforce, we should expect this community to continue to grow. We’ve released the first version of the product and are looking forward to continuing this journey with our users.” UNQUO screen

UNQUO screen

But there is another dimension to the idea behind the new banking platform, as Michael explains. “We wanted to build a platform that can support our own needs, but also make it available for external partners. Through our platform, we can help partners to build new products, embed financial services in their customer journeys, and monetize financial services without becoming banks themselves.” The team is currently preparing to bring its first external customer to the platform. “We are working with a large retail brand to bring financial services into their customer experience. It’s fascinating to see that by reinventing ourselves and the way we conduct our business, we are able to create new opportunities for our customers. This is at the core of our ambition to become a leading participant in the Banking as a Service space – to create a greater surface area of opportunities and help customers find new ways to create and capture value.”

I ask Michael why SEBx is building a new platform from the ground up instead of using the existing infrastructure. He explains, and delivers a killer metaphor. “We are experimenting with different ways to accelerate innovation across the group. We have innovation labs, developer portals, investments in fintechs, explorations of blockchains technologies and so forth. Innovation will realistically come from many different initiatives and places across the organization. When it comes to SEBx, we add another dimension to this innovation mix. Making substantial changes close to the existing core infrastructure is a challenge for any incumbent bank. You usually have a history of different technologies that have accumulated to the existing infrastructure, and you have a lot – sometimes millions – of customers depending on your services. It’s really important to be mindful when introducing significant changes. A way to conceptually think about it is to make changes to the engines of an aircraft, while in flight. Introducing improvements and having continuous upgrades is really important and necessary, but there are limitations to how much and how fast changes can be introduced. You don’t want to take unnecessary risks while in flight. Innovating close to the core is naturally not the area where we should expect a lot of rapid experimentation. That is one of the reasons why we are standing up this new bank on the side of the regular bank so that we can find additional avenues for accelerating innovation.”

SEBx is set up as an autonomous startup-like entity and operates independently from other divisions in SEB. The team is in close collaboration with the bank and draws from the experience of the group. As an example, the existing banking IT infrastructure allows SEBx to learn from the past, which is a key input to the architectural design and technology decisions for the new banking platform. It also allows SEBx to attract new types of talent. “Many people want to work with the latest technology and we are trying to take full advantage of the technological progress that has been made in recent years, especially within cloud technology.”

A win-win then? Michael says that there are benefits of being part of a large financial group, especially when building a Banking as a Service offering. He shares an observation that incumbents are often exploring ways to replicate the speed and agility of Fintechs, but Fintechs are also trying to find ways to replicate the strengths and abilities of incumbents. He adds, “Startups have a lot of benefits of starting small and from a clean slate, but they also lack some of the assets and abilities of established banks. We believe that having close ties to the bank to leverage licenses, finances, experience and network is a key competitive advantage for us. To blend that with new technology, processes and ways of working is what we are all about. We try to combine this in a startup format where we have full ownership of our value chain, from customer relations and product development to technology and compliance. That is an important aspect because we need to be able to move fast to compress feedback loops, learn from decisions, and make adjustments when we have to – just like a startup.” The SEBx Company Logo

The SEBx Company Logo

SEBx started in 2018 with a small team and has a current roster of 90 staff, and the number of open positions indicates that the team will continue to grow. “We have an ambitious agenda and we’re looking to attract more talented people to join us,” says Michael. Glancing at the types of roles, it’s clear that SEBx is in the market for software engineers. “Building a platform and consumer product at the same time requires heavy lifting in many areas, especially in software development.”

In the beginning everyone worked in the same team, building both the platform and product at the same time. “It was a learning experience for everyone. Our dual mission means that we need to strike a balance between building a highly performant banking platform able to support the needs of a large bank, while also building the first versions of the new product. As we are building a Fintech startup, we face similar challenges to regular startups. So we talked to a lot of entrepreneurs and company builders early on to learn from them, and one recurring theme was that staying focused was really important. Today we have dedicated teams that work on either building out the Banking as a Service offering, or on the consumer product. In that sense, you can view UNQUO as the first customer on the banking platform.”

The name UNQUO is a word play on ‘undo the status quo’, and emphasizes the reality of being a solopreneur. “Most solopreneurs shoulder many responsibilities, from sales and marketing to bookkeeping and taxes,” so trying to do things in a new way is important to the SEBx team, and UNQUO has some features that are unique. As a self-employed person myself, I appreciate one feature that makes it possible to have life and work purchases on the same card. As Michael explains, “UNQUO is an app that allows you to connect all your banking to one place. It’s possible to make both personal and business purchases on the same card. You can see all your expenses – regardless which bank you have – in the same app, and can swipe transactions to keep everything in order. Users can also save their receipts and get help to prepare their bookkeeping.” And yep, I can think of many times – usually just before end of year accounting – when I’ve sat down with a mountain of disorganized receipts and tried to recall whether that train journey was a legitimate business expense or a fun trip somewhere. I could have used UNQUO then.

And thinking about user-friendliness, let’s turn next to Kivra, and CEO Anna Bäck. It’s one of the joys of writing about European Fintech that one person leads on to another, and Michael suggests that Kivra’s is an essential story to cover, not least because over half the population of Sweden use the app.

Like, really?That’s massive market penetration, so let’s check in with Anna. Anna Bäck

Anna Bäck

So what does Kivra do? Speaking from her Stockholm base, Anna outlines the offering, which is neatly encapsulated in the company name, an anagram of ‘Arkiv’ – Swedish for archive. The company’s core offering is about securely storing information that would originally have been kept on paper – all the various deeds and forms that everyone needs to interface with government departments, legal matters and a host of other official documentation. Then there’s paperwork generated by credit checking legislation, which came into being in 2013, where copies had to be created for all parties involved. Put together, that’s a huge amount of physical paper, which equates to many trees being felled. Kivra was founded in 2011 specifically to address the ecological issues of paper use, waste, and transportation of forms and letters to the houses of citizens.

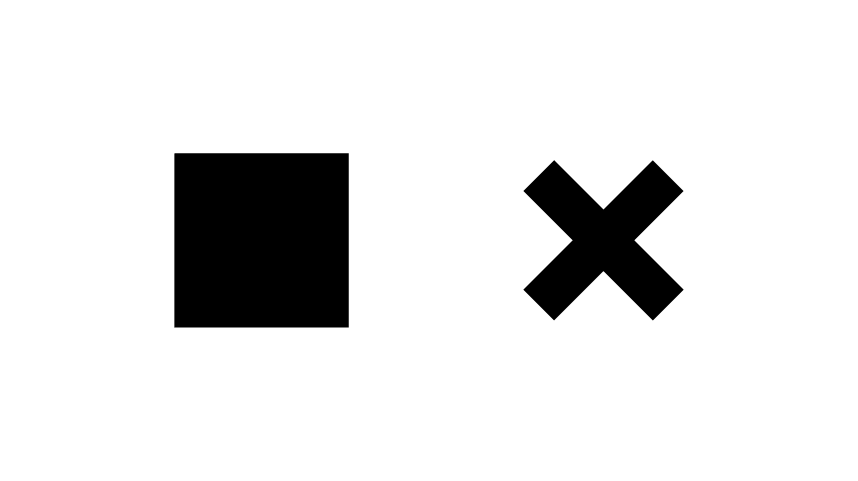

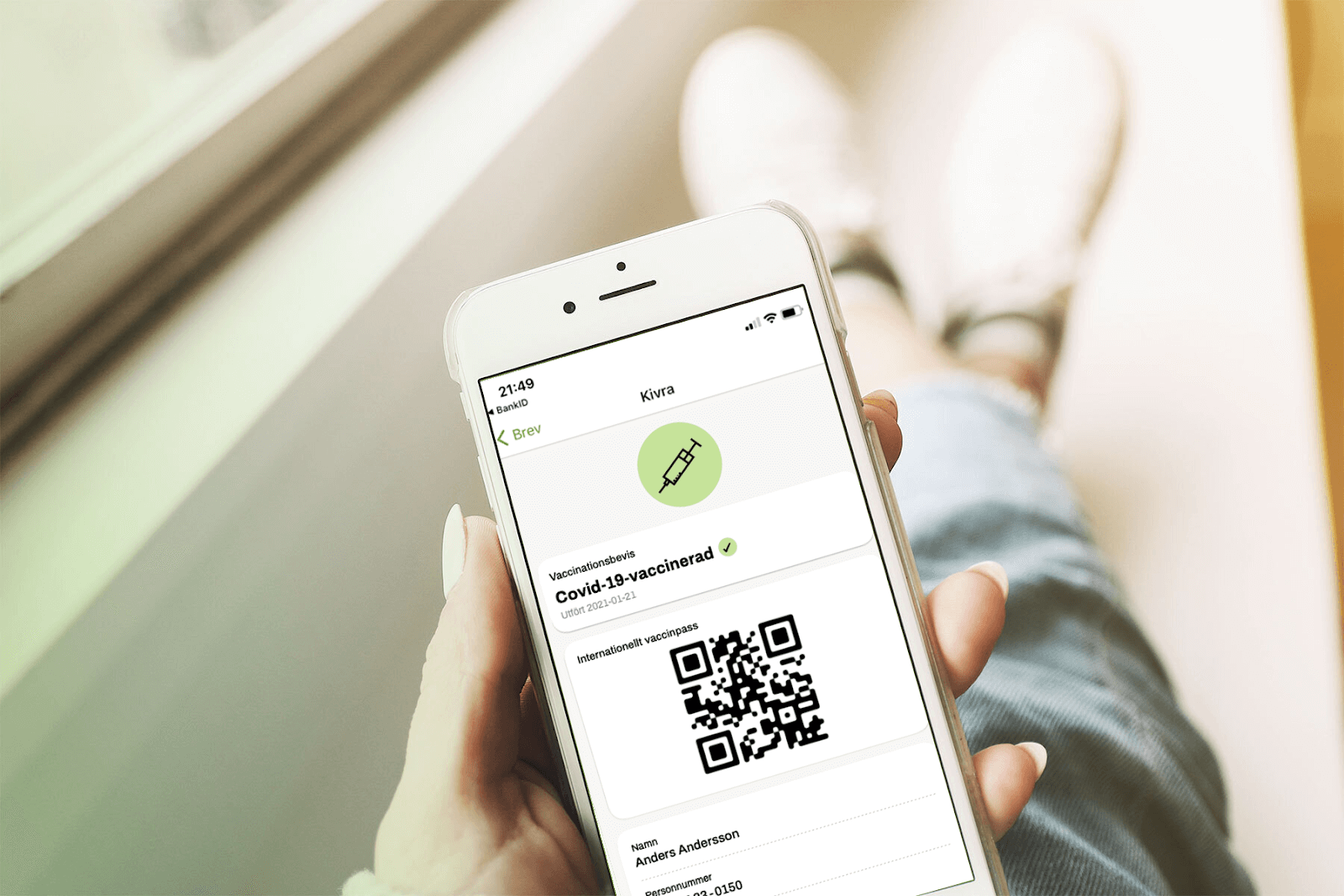

As Anna points out, the service gains its revenue from a transactional postal service model, charging a digital stamp fee, only at a much lower cost than with snail mail. The vastly reduced cost for the environment is also an essential part of the offering, and one that finds ready uptake in ecology-conscious Sweden. “The sustainability angle is very important, but then it’s also much better both for consumers and senders that they communicate much quicker,” explains Anna. “And also to keep track – that’s the archive part. People need to know that their important stuff has been received, like the insurance letter or bank statement, or whatever.”The digitization ofCovid certificateshas also been an important part of the Kivra service from March 2020 onwards, becoming a ‘proof point’, and going through the same ecosystem as other governmental communication. I ask if this means that Kivra is in some respects a digital ‘drop down’ of the government, but Anna doesn’t see it quite that way. The Agency for Digital Government coordinates digitalization within public administration, and its work is supported by partners such as Kivra. As mentioned by Anders Norlin, I hear again of the high degree of trust Swedes – and people in the Nordics in general – place in banks, and government authorities. “You can actually know who is who,” says Anna. “We use the bank ID to log in to services, so you really know who is supposed to get a letter, and that the user is truly that user.” Kivra’s Covid-19 certificateKivra’s service is evolving all the time, with the addition ofdigital receiptsand warranties from shopping, further cutting down on the generation of wasteful paper trails. Medical applications such as blood testing are also an increasingly useful area, where patient and doctor can quickly and securely exchange results.

Kivra’s Covid-19 certificateKivra’s service is evolving all the time, with the addition ofdigital receiptsand warranties from shopping, further cutting down on the generation of wasteful paper trails. Medical applications such as blood testing are also an increasingly useful area, where patient and doctor can quickly and securely exchange results.

And can I store my photographs with Kivra? Anna says that there are other apps specifically designed to do such things, but she does say that, for her, Kivra is the repository of the many codes and passwords that we all require on a daily basis. They’re not documents as such, but are vital to record and keep safely. I like Anna’s simple description: “We provide a better place for the important stuff.” Or as the Kivra website has it, ‘Collect letters, invoices, receipts and more – which you would otherwise have had in binders, pockets or in different piles of paper. Safe, accessible and good for the environment.’

OK, got it. So presumably the pandemic has been beneficial for Kivra’s business? The answer is, ‘Yes and No’.

Yes, says Anna, because getting all your important letters, wherever you are, has become much more relevant since people have been remote working from summerhouses and non-regular locations. Not being dependent on the postal service, or a worker delivering to your door who may or may not be a Covid carrier, has encouraged more widespread use of Kivra. At the same time the CEO admits that the receipt service has not yet taken off as was intended back in 2020, and may still not have caught up by the end of 2022. It’s not because of any problems with Kivra’s core offering, but rather that in retail – for example – the focus during the pandemic was on survival rather than on digitizing receipts.

On the other hand, at the height of the pandemic, Kivra was extremely busy, processing 100,000-180,000 Covid declaration forms an hour. A huge help to the government then? Well yes, but Anna pushes back a little at that: “We see it more from the citizen side than from the government side. But of course, it does help the government immensely. Just imagine having to deliver 180,000 declarations an hour physically, all over Sweden!”

From a well-established Swedish company with tens of thousands of connected organizations and public authorities, let’s return to an almost-startup, albeit one which is ‘standing up on the side of a regular bank’.

Michael Sparring says that user research has underpinned the development of SEBx and the products now becoming available from that ‘bank within a bank’. SEBx’s qualitative understanding of what consumers need and want has come from hundreds of in-depth interviews focusing on user expectations and user experience. He says, “The initial stages of user research were very much about understanding the jobs to be done, and the problems we think we are uniquely positioned to solve. We also looked at research reports and collaborated with the bank to add quantitative data. This is one of the advantages of being part of a larger organization. Once we had collected the first set of data, we prioritized the insights in terms of – for the customer – How frequent is this pain? How intense is this pain? How are they solving this problem today? What can we build in the first version? We try to group that into the first version or Minimum Viable Product.

During those stages, the team did very open user research in terms of understanding the problems, and then built prototypes to test their hypotheses. And then after that they continue to test, and then test some more. “We care deeply about what the customers think about the product – how we solve their problems – and how the product makes the user feel when interacting with our brand. The focus has changed a bit along the way, but we’re still very humble about the need to work with our users to develop great products.”

Another aspect is to get everyone in the team to participate in user testing and talking to customers. “All problems and products are not created equal, and this actually matters a lot when building a new product. If you are building something for an audience that has a problem that you don’t experience in your life, user research and collecting data becomes really important. If you are building a product where youarepart of the audience that you are solving a problem for, your own perspective and judgment matters more because you have a deep understanding of the problem. Our experience is that it is good for the full team to participate in user research to build empathy and understanding about our customers and product. We want to build Product IQ across the team,” Michael confirms. “The principle is always to stay close to the users. Even if we don’t always have new things to test, we always lean towards talking to users to get their perspective. It could be things related to the current product, or it could be focused on emerging patterns or themes that we have picked up on. It’s a balance between executing today while exploring options and paths for the future.”

With a workforce of around 150 people, and growing, Kivra handles all UX-UI design in house. One territory for growth has been in Finland, where the company launched in 2020. The Finnish website continues to fly the ecology flag which underpins the Swedish operation’s founding principles, with the statement, ‘We work to provide consumers and companies with an easy way to reduce their carbon footprint. More than 500 million paper invoices are still sent in Finland annually. Each of these invoices could be sent digitally. By no longer using paper needlessly, each one of us can reduce our carbon footprint by 0.5%.’

There’s the additional fascinating fact that because of Kivra’s 110% carbon offsetting scheme (meaning that the company offsets more carbon than it uses), the carbon footprint of the company in Finland is equivalent to that of just two Finns! Given the Nordic awareness of green issues, that’s pretty impressive. The Kivra app

The Kivra app

Another issue that I want to ask Anna Bäck about is gender balance. It’s strange that I haven’t put this question to Michael Sparring, or indeed any other men in my conversations with European Fintech people. But had I asked, ‘So what’s it like being a man in this industry?’ I’m guessing that I might have got puzzled looks in return. Men don’t question their right to be present in Fintech, or any other industry for that matter. It turns out that I certainly should have asked about Michael’s experience in SEBx, as post-interview he points out that the SEBx management team is 50/50 women/men, and this is the case across all management roles in the company. Despite this balance, Michael does however note, “There’s still a lot of work to be done in this area in general industry, both in the Nordics and Europe.”

And Anna Bäck’s take on gender balance, and ‘the glass ceiling’? She is the one and only female CEO that she is aware of, out of 50 top Swedish tech companies, although in Kivra specifically the management team is about 50/50 women/men. Vesna Lindkvist, the Chief Technology Officer is female, but not as a matter of ‘positive descrimination’, just because she’s the right person in the right job. For a while, Anna says, the majority of core positions in Kivra were occupied by women, which she liked. As to the reason for the general gender imbalance, back when she was studying tech, only 10 to 20% of students were female, resulting in today’s situation. “I don’t know why more women haven’t got interested in tech though,” Anna adds. “To me it’s a super-interesting space.” She views that space as far bigger than just Fintech, Regtech and so on, including Medtech, Musictech, and so much more. The Stockholm scene is particularly vibrant, and Anna is keen to encourage young people, especially young women. “Take my eldest daughter, who’s 16. She’s fabulous – the best in school in math, but she only thinks that she can become a doctor. There’s nothing wrong with that, but she could also go into the HealthTech scene, and do as much good for even more people with her math brain. I think it’s interesting to see the human aspect of using tech.”

Anna expands on the theme with a reflection on her time working with Korean companies, where a colleague there confided that if it was up to him, the bulk of university leavers hired as designers would be female – because they generally had the most impressive CVs. However, seven years down the road, many well-qualified women would be leaving to raise children, so it was essential to hire men – even less well-qualified men – to ensure that there would be a continuing stream of managers for the future. Sad but true, Anna reflects.

The mention of Korea sparks some background to Anna’s earlier years. She was born in Malaysia, but her parents moved back to Sweden when she was still very young. Nevertheless, Asia has inspired her throughout her life, and she studied Mandarin Chinese at school, and then at the Foreign Languages School of Beijing Foreign Studies University. After that there was consultancy and engineering work in Shanghai and Beijing, with a steady move towards the design and innovation industry. By 2016 she was working as a consultant in a company acquired by McKinsey and Co., which led to a move back to Europe in a leadership role. 2019 brings us more or less up to date, when the co-founder of Kivra – Stefan Krook – moved from his CEO position to Chairman, making way for the new CEO, Anna Bäck. The company was, “Already on a growth trajectory,” says Anna … and clearly hasn’t looked back since.

SEBx is also on a growth trajectory, and Michael Sparring’s prediction is that it’s going to be more common for financial services to be embedded in non-banking brands and places where it is contextually needed. “I believe that many companies will explore the potential of enriching their products and customer experiences with financial services. The potential to create deeper relationships, to explore new revenue streams, or to find new business opportunities is a compelling idea for many companies. Banking will likely be seamlessly integrated in the places where it makes sense for the customer. We can already see financial services playing an important role in the everyday life of businesses, especially when it comes to payments. Big tech companies like Apple have launched their own card offering, illustrating the promise and potential of embedded finance. It is still early days, but we should expect more experimentation and innovation in this space.”

Michael springs another great analogy, “A way to view our role and how we work with partners is to think about us as a provider of financial lego blocks. Our ambition is to provide access to the pieces that our partners need so that they can build a customer experience that combines the strengths of their brands, with the potential of embedded finance. I believe as more non-banking brands enter the space, new perspectives and ideas will also flow into the products that are being built. We should expect a higher degree of differentiation and personalization. Angela Strange, general partner at VC firm a16z, has said that, ‘every company will become a Fintech company’. For a venture that has set out to be an active contributor in helping companies to embed financial services under their own brands without becoming banks themselves, we can line up behind the spirit of that notion. We will continue to lean in and take part in the ongoing evolution in our industry, and press onward with building financial lego blocks to accelerate innovation for ourselves and our partners.” Kivra's office

Kivra's office

As well as developing and expanding the reach and services of Kivra, Anna Bäck is also a board member of two other organizations, both of which have strong social intent. The first is Nordnet Bank, a pan-Nordic digital platform where, ‘Through innovation, simplicity and transparency, we challenge traditional structures, and give private savers access to the same information, tools and services as professionals. With leading UX, cutting edge financial products, and automated and inspiring customer journeys, we are building the best platform for savings and investments.’ Or, as Anna says, “Nordnet is democratizing investments.”

Then there’s her involvement in what I suspect is a real heart project, Permobil, which Anna describes as her ‘inclusive design space’. She has an MSc in industrial engineering, and in Permobil, ‘The purpose is to innovate for individuals; to create advanced assistive solutions that make the lives of people living with disabilities more enriching. Our dedicated teams work tirelessly to make this happen, no matter if they are designing a new wheelchair, testing seating cushions, or supporting a therapist.’

So, a member of three boards, environmentalist, family person (‘4 kids, a dog, and a husband’), and leader of a company with half of the population of Sweden onboard. Surely Anna has her plate well and truly full? Well, there’s also ski-ing … Of course, what company leader doesn’t always go the extra distance! “For me, cross-country skiing is like my meditation yoga thing. You go out into nature, you move your whole body …”

Which brings us back to trees, and the original intention of Kivra, founded to reduce the carbon footprint of mass paper use in Sweden. How successful has the company been on this front? May 2021 saw Kivra winning the top prize at the Ecotransport 2030 event– dedicated to fossil-fuel independent vehicle fleets by 2030. Göran Erselius, chief analyst at Klimat och Miljö (Climate and Environment), stated of Kivra’s win, ‘Kivra contributes annually through their current services for digital shipments and digital receipts to ensure that we do not have 2,000 tonnes of CO2e in the atmosphere, along with 5,000 tonnes of paper that does not have to be manufactured, which in turn corresponds to saving about 40,000 trees. If we compare the paper letter with the digital letter, we realize that the paper letter creates emissions: everything from forestry and paper production, and not least transportation of the letter.’

In his analysis he also took a look at the potential if the whole world’s letters were transmitted digitally via a service like Kivra. He calculated emission savings of 4,000,000 tonnes of CO2e, which corresponds to the annual paper consumption of 200 million world citizens. So, is Kivra achieving its mission? You bet.

And are Anna Bäck and Michael Sparring working on ever newer ways of doing things? You can bet on that too. Yoga on skis, changing aircraft engines midflight, saving forests by reducing the carbon footprint, and building with financial lego blocks. What very busy people Swedes are!

An additional article on the Swedish Fintech scene is available.

Michael Sparring

Michael SparringSEBx has a dual mission, Michael says. “Firstly, we are building a banking platform to meet our own long-term needs within the group. The industry is going through a period of rapid evolution. Advancements in technology, changes in regulations and the introduction of new business models have accelerated the pace of innovation. Finding alternative avenues to increase the speed of experimentation and execution is becoming increasingly important in this environment. Our new banking platform provides us with strategic optionality for the future when building the next generation of products and services.”

Secondly, SEBx are releasing new products and brands. The first product is called UNQUO and targets the rapidly growing gig economy. The self-employed community already makes up the majority of companies in Sweden. “With the ongoing changes in the global workforce, we should expect this community to continue to grow. We’ve released the first version of the product and are looking forward to continuing this journey with our users.”

UNQUO screen

UNQUO screenBut there is another dimension to the idea behind the new banking platform, as Michael explains. “We wanted to build a platform that can support our own needs, but also make it available for external partners. Through our platform, we can help partners to build new products, embed financial services in their customer journeys, and monetize financial services without becoming banks themselves.” The team is currently preparing to bring its first external customer to the platform. “We are working with a large retail brand to bring financial services into their customer experience. It’s fascinating to see that by reinventing ourselves and the way we conduct our business, we are able to create new opportunities for our customers. This is at the core of our ambition to become a leading participant in the Banking as a Service space – to create a greater surface area of opportunities and help customers find new ways to create and capture value.”

New technology and the startup mentality

I ask Michael why SEBx is building a new platform from the ground up instead of using the existing infrastructure. He explains, and delivers a killer metaphor. “We are experimenting with different ways to accelerate innovation across the group. We have innovation labs, developer portals, investments in fintechs, explorations of blockchains technologies and so forth. Innovation will realistically come from many different initiatives and places across the organization. When it comes to SEBx, we add another dimension to this innovation mix. Making substantial changes close to the existing core infrastructure is a challenge for any incumbent bank. You usually have a history of different technologies that have accumulated to the existing infrastructure, and you have a lot – sometimes millions – of customers depending on your services. It’s really important to be mindful when introducing significant changes. A way to conceptually think about it is to make changes to the engines of an aircraft, while in flight. Introducing improvements and having continuous upgrades is really important and necessary, but there are limitations to how much and how fast changes can be introduced. You don’t want to take unnecessary risks while in flight. Innovating close to the core is naturally not the area where we should expect a lot of rapid experimentation. That is one of the reasons why we are standing up this new bank on the side of the regular bank so that we can find additional avenues for accelerating innovation.”

SEBx is set up as an autonomous startup-like entity and operates independently from other divisions in SEB. The team is in close collaboration with the bank and draws from the experience of the group. As an example, the existing banking IT infrastructure allows SEBx to learn from the past, which is a key input to the architectural design and technology decisions for the new banking platform. It also allows SEBx to attract new types of talent. “Many people want to work with the latest technology and we are trying to take full advantage of the technological progress that has been made in recent years, especially within cloud technology.”

A win-win then? Michael says that there are benefits of being part of a large financial group, especially when building a Banking as a Service offering. He shares an observation that incumbents are often exploring ways to replicate the speed and agility of Fintechs, but Fintechs are also trying to find ways to replicate the strengths and abilities of incumbents. He adds, “Startups have a lot of benefits of starting small and from a clean slate, but they also lack some of the assets and abilities of established banks. We believe that having close ties to the bank to leverage licenses, finances, experience and network is a key competitive advantage for us. To blend that with new technology, processes and ways of working is what we are all about. We try to combine this in a startup format where we have full ownership of our value chain, from customer relations and product development to technology and compliance. That is an important aspect because we need to be able to move fast to compress feedback loops, learn from decisions, and make adjustments when we have to – just like a startup.”

The SEBx Company Logo

The SEBx Company LogoBuilding a team, platform and product - at the same time

SEBx started in 2018 with a small team and has a current roster of 90 staff, and the number of open positions indicates that the team will continue to grow. “We have an ambitious agenda and we’re looking to attract more talented people to join us,” says Michael. Glancing at the types of roles, it’s clear that SEBx is in the market for software engineers. “Building a platform and consumer product at the same time requires heavy lifting in many areas, especially in software development.”

In the beginning everyone worked in the same team, building both the platform and product at the same time. “It was a learning experience for everyone. Our dual mission means that we need to strike a balance between building a highly performant banking platform able to support the needs of a large bank, while also building the first versions of the new product. As we are building a Fintech startup, we face similar challenges to regular startups. So we talked to a lot of entrepreneurs and company builders early on to learn from them, and one recurring theme was that staying focused was really important. Today we have dedicated teams that work on either building out the Banking as a Service offering, or on the consumer product. In that sense, you can view UNQUO as the first customer on the banking platform.”

The name UNQUO is a word play on ‘undo the status quo’, and emphasizes the reality of being a solopreneur. “Most solopreneurs shoulder many responsibilities, from sales and marketing to bookkeeping and taxes,” so trying to do things in a new way is important to the SEBx team, and UNQUO has some features that are unique. As a self-employed person myself, I appreciate one feature that makes it possible to have life and work purchases on the same card. As Michael explains, “UNQUO is an app that allows you to connect all your banking to one place. It’s possible to make both personal and business purchases on the same card. You can see all your expenses – regardless which bank you have – in the same app, and can swipe transactions to keep everything in order. Users can also save their receipts and get help to prepare their bookkeeping.” And yep, I can think of many times – usually just before end of year accounting – when I’ve sat down with a mountain of disorganized receipts and tried to recall whether that train journey was a legitimate business expense or a fun trip somewhere. I could have used UNQUO then.

And thinking about user-friendliness, let’s turn next to Kivra, and CEO Anna Bäck. It’s one of the joys of writing about European Fintech that one person leads on to another, and Michael suggests that Kivra’s is an essential story to cover, not least because over half the population of Sweden use the app.

Like, really?That’s massive market penetration, so let’s check in with Anna.

The everyone app

And yes indeed,Anna Bäckis quick to confirm the figures – that Kivra has 5.3 million users in Sweden, a country of 10.35 million people. Given that Kivra customers include only those over 18 years of age, the stats are even more impressive, with some 1.1 million users added in 2021. Anna Bäck

Anna BäckSo what does Kivra do? Speaking from her Stockholm base, Anna outlines the offering, which is neatly encapsulated in the company name, an anagram of ‘Arkiv’ – Swedish for archive. The company’s core offering is about securely storing information that would originally have been kept on paper – all the various deeds and forms that everyone needs to interface with government departments, legal matters and a host of other official documentation. Then there’s paperwork generated by credit checking legislation, which came into being in 2013, where copies had to be created for all parties involved. Put together, that’s a huge amount of physical paper, which equates to many trees being felled. Kivra was founded in 2011 specifically to address the ecological issues of paper use, waste, and transportation of forms and letters to the houses of citizens.

As Anna points out, the service gains its revenue from a transactional postal service model, charging a digital stamp fee, only at a much lower cost than with snail mail. The vastly reduced cost for the environment is also an essential part of the offering, and one that finds ready uptake in ecology-conscious Sweden. “The sustainability angle is very important, but then it’s also much better both for consumers and senders that they communicate much quicker,” explains Anna. “And also to keep track – that’s the archive part. People need to know that their important stuff has been received, like the insurance letter or bank statement, or whatever.”The digitization ofCovid certificateshas also been an important part of the Kivra service from March 2020 onwards, becoming a ‘proof point’, and going through the same ecosystem as other governmental communication. I ask if this means that Kivra is in some respects a digital ‘drop down’ of the government, but Anna doesn’t see it quite that way. The Agency for Digital Government coordinates digitalization within public administration, and its work is supported by partners such as Kivra. As mentioned by Anders Norlin, I hear again of the high degree of trust Swedes – and people in the Nordics in general – place in banks, and government authorities. “You can actually know who is who,” says Anna. “We use the bank ID to log in to services, so you really know who is supposed to get a letter, and that the user is truly that user.”

Kivra’s Covid-19 certificate

Kivra’s Covid-19 certificateAnd can I store my photographs with Kivra? Anna says that there are other apps specifically designed to do such things, but she does say that, for her, Kivra is the repository of the many codes and passwords that we all require on a daily basis. They’re not documents as such, but are vital to record and keep safely. I like Anna’s simple description: “We provide a better place for the important stuff.” Or as the Kivra website has it, ‘Collect letters, invoices, receipts and more – which you would otherwise have had in binders, pockets or in different piles of paper. Safe, accessible and good for the environment.’

OK, got it. So presumably the pandemic has been beneficial for Kivra’s business? The answer is, ‘Yes and No’.

Yes, says Anna, because getting all your important letters, wherever you are, has become much more relevant since people have been remote working from summerhouses and non-regular locations. Not being dependent on the postal service, or a worker delivering to your door who may or may not be a Covid carrier, has encouraged more widespread use of Kivra. At the same time the CEO admits that the receipt service has not yet taken off as was intended back in 2020, and may still not have caught up by the end of 2022. It’s not because of any problems with Kivra’s core offering, but rather that in retail – for example – the focus during the pandemic was on survival rather than on digitizing receipts.

On the other hand, at the height of the pandemic, Kivra was extremely busy, processing 100,000-180,000 Covid declaration forms an hour. A huge help to the government then? Well yes, but Anna pushes back a little at that: “We see it more from the citizen side than from the government side. But of course, it does help the government immensely. Just imagine having to deliver 180,000 declarations an hour physically, all over Sweden!”

From a well-established Swedish company with tens of thousands of connected organizations and public authorities, let’s return to an almost-startup, albeit one which is ‘standing up on the side of a regular bank’.

Build, talk, build, talk

Michael Sparring says that user research has underpinned the development of SEBx and the products now becoming available from that ‘bank within a bank’. SEBx’s qualitative understanding of what consumers need and want has come from hundreds of in-depth interviews focusing on user expectations and user experience. He says, “The initial stages of user research were very much about understanding the jobs to be done, and the problems we think we are uniquely positioned to solve. We also looked at research reports and collaborated with the bank to add quantitative data. This is one of the advantages of being part of a larger organization. Once we had collected the first set of data, we prioritized the insights in terms of – for the customer – How frequent is this pain? How intense is this pain? How are they solving this problem today? What can we build in the first version? We try to group that into the first version or Minimum Viable Product.

During those stages, the team did very open user research in terms of understanding the problems, and then built prototypes to test their hypotheses. And then after that they continue to test, and then test some more. “We care deeply about what the customers think about the product – how we solve their problems – and how the product makes the user feel when interacting with our brand. The focus has changed a bit along the way, but we’re still very humble about the need to work with our users to develop great products.”

Another aspect is to get everyone in the team to participate in user testing and talking to customers. “All problems and products are not created equal, and this actually matters a lot when building a new product. If you are building something for an audience that has a problem that you don’t experience in your life, user research and collecting data becomes really important. If you are building a product where youarepart of the audience that you are solving a problem for, your own perspective and judgment matters more because you have a deep understanding of the problem. Our experience is that it is good for the full team to participate in user research to build empathy and understanding about our customers and product. We want to build Product IQ across the team,” Michael confirms. “The principle is always to stay close to the users. Even if we don’t always have new things to test, we always lean towards talking to users to get their perspective. It could be things related to the current product, or it could be focused on emerging patterns or themes that we have picked up on. It’s a balance between executing today while exploring options and paths for the future.”

Moving outside Sweden

With a workforce of around 150 people, and growing, Kivra handles all UX-UI design in house. One territory for growth has been in Finland, where the company launched in 2020. The Finnish website continues to fly the ecology flag which underpins the Swedish operation’s founding principles, with the statement, ‘We work to provide consumers and companies with an easy way to reduce their carbon footprint. More than 500 million paper invoices are still sent in Finland annually. Each of these invoices could be sent digitally. By no longer using paper needlessly, each one of us can reduce our carbon footprint by 0.5%.’

There’s the additional fascinating fact that because of Kivra’s 110% carbon offsetting scheme (meaning that the company offsets more carbon than it uses), the carbon footprint of the company in Finland is equivalent to that of just two Finns! Given the Nordic awareness of green issues, that’s pretty impressive.

The Kivra app

The Kivra appThat glass ceiling question

Another issue that I want to ask Anna Bäck about is gender balance. It’s strange that I haven’t put this question to Michael Sparring, or indeed any other men in my conversations with European Fintech people. But had I asked, ‘So what’s it like being a man in this industry?’ I’m guessing that I might have got puzzled looks in return. Men don’t question their right to be present in Fintech, or any other industry for that matter. It turns out that I certainly should have asked about Michael’s experience in SEBx, as post-interview he points out that the SEBx management team is 50/50 women/men, and this is the case across all management roles in the company. Despite this balance, Michael does however note, “There’s still a lot of work to be done in this area in general industry, both in the Nordics and Europe.”

And Anna Bäck’s take on gender balance, and ‘the glass ceiling’? She is the one and only female CEO that she is aware of, out of 50 top Swedish tech companies, although in Kivra specifically the management team is about 50/50 women/men. Vesna Lindkvist, the Chief Technology Officer is female, but not as a matter of ‘positive descrimination’, just because she’s the right person in the right job. For a while, Anna says, the majority of core positions in Kivra were occupied by women, which she liked. As to the reason for the general gender imbalance, back when she was studying tech, only 10 to 20% of students were female, resulting in today’s situation. “I don’t know why more women haven’t got interested in tech though,” Anna adds. “To me it’s a super-interesting space.” She views that space as far bigger than just Fintech, Regtech and so on, including Medtech, Musictech, and so much more. The Stockholm scene is particularly vibrant, and Anna is keen to encourage young people, especially young women. “Take my eldest daughter, who’s 16. She’s fabulous – the best in school in math, but she only thinks that she can become a doctor. There’s nothing wrong with that, but she could also go into the HealthTech scene, and do as much good for even more people with her math brain. I think it’s interesting to see the human aspect of using tech.”

The Eastern experience

Anna expands on the theme with a reflection on her time working with Korean companies, where a colleague there confided that if it was up to him, the bulk of university leavers hired as designers would be female – because they generally had the most impressive CVs. However, seven years down the road, many well-qualified women would be leaving to raise children, so it was essential to hire men – even less well-qualified men – to ensure that there would be a continuing stream of managers for the future. Sad but true, Anna reflects.

The mention of Korea sparks some background to Anna’s earlier years. She was born in Malaysia, but her parents moved back to Sweden when she was still very young. Nevertheless, Asia has inspired her throughout her life, and she studied Mandarin Chinese at school, and then at the Foreign Languages School of Beijing Foreign Studies University. After that there was consultancy and engineering work in Shanghai and Beijing, with a steady move towards the design and innovation industry. By 2016 she was working as a consultant in a company acquired by McKinsey and Co., which led to a move back to Europe in a leadership role. 2019 brings us more or less up to date, when the co-founder of Kivra – Stefan Krook – moved from his CEO position to Chairman, making way for the new CEO, Anna Bäck. The company was, “Already on a growth trajectory,” says Anna … and clearly hasn’t looked back since.

Lego blocks and building together

SEBx is also on a growth trajectory, and Michael Sparring’s prediction is that it’s going to be more common for financial services to be embedded in non-banking brands and places where it is contextually needed. “I believe that many companies will explore the potential of enriching their products and customer experiences with financial services. The potential to create deeper relationships, to explore new revenue streams, or to find new business opportunities is a compelling idea for many companies. Banking will likely be seamlessly integrated in the places where it makes sense for the customer. We can already see financial services playing an important role in the everyday life of businesses, especially when it comes to payments. Big tech companies like Apple have launched their own card offering, illustrating the promise and potential of embedded finance. It is still early days, but we should expect more experimentation and innovation in this space.”

Michael springs another great analogy, “A way to view our role and how we work with partners is to think about us as a provider of financial lego blocks. Our ambition is to provide access to the pieces that our partners need so that they can build a customer experience that combines the strengths of their brands, with the potential of embedded finance. I believe as more non-banking brands enter the space, new perspectives and ideas will also flow into the products that are being built. We should expect a higher degree of differentiation and personalization. Angela Strange, general partner at VC firm a16z, has said that, ‘every company will become a Fintech company’. For a venture that has set out to be an active contributor in helping companies to embed financial services under their own brands without becoming banks themselves, we can line up behind the spirit of that notion. We will continue to lean in and take part in the ongoing evolution in our industry, and press onward with building financial lego blocks to accelerate innovation for ourselves and our partners.”

Kivra's office

Kivra's officeBusy, busy people

As well as developing and expanding the reach and services of Kivra, Anna Bäck is also a board member of two other organizations, both of which have strong social intent. The first is Nordnet Bank, a pan-Nordic digital platform where, ‘Through innovation, simplicity and transparency, we challenge traditional structures, and give private savers access to the same information, tools and services as professionals. With leading UX, cutting edge financial products, and automated and inspiring customer journeys, we are building the best platform for savings and investments.’ Or, as Anna says, “Nordnet is democratizing investments.”

Then there’s her involvement in what I suspect is a real heart project, Permobil, which Anna describes as her ‘inclusive design space’. She has an MSc in industrial engineering, and in Permobil, ‘The purpose is to innovate for individuals; to create advanced assistive solutions that make the lives of people living with disabilities more enriching. Our dedicated teams work tirelessly to make this happen, no matter if they are designing a new wheelchair, testing seating cushions, or supporting a therapist.’

So, a member of three boards, environmentalist, family person (‘4 kids, a dog, and a husband’), and leader of a company with half of the population of Sweden onboard. Surely Anna has her plate well and truly full? Well, there’s also ski-ing … Of course, what company leader doesn’t always go the extra distance! “For me, cross-country skiing is like my meditation yoga thing. You go out into nature, you move your whole body …”

Which brings us back to trees, and the original intention of Kivra, founded to reduce the carbon footprint of mass paper use in Sweden. How successful has the company been on this front? May 2021 saw Kivra winning the top prize at the Ecotransport 2030 event– dedicated to fossil-fuel independent vehicle fleets by 2030. Göran Erselius, chief analyst at Klimat och Miljö (Climate and Environment), stated of Kivra’s win, ‘Kivra contributes annually through their current services for digital shipments and digital receipts to ensure that we do not have 2,000 tonnes of CO2e in the atmosphere, along with 5,000 tonnes of paper that does not have to be manufactured, which in turn corresponds to saving about 40,000 trees. If we compare the paper letter with the digital letter, we realize that the paper letter creates emissions: everything from forestry and paper production, and not least transportation of the letter.’

In his analysis he also took a look at the potential if the whole world’s letters were transmitted digitally via a service like Kivra. He calculated emission savings of 4,000,000 tonnes of CO2e, which corresponds to the annual paper consumption of 200 million world citizens. So, is Kivra achieving its mission? You bet.

And are Anna Bäck and Michael Sparring working on ever newer ways of doing things? You can bet on that too. Yoga on skis, changing aircraft engines midflight, saving forests by reducing the carbon footprint, and building with financial lego blocks. What very busy people Swedes are!

An additional article on the Swedish Fintech scene is available.