The Austrian Fintech scene - Greener grass?

From my earliest days of living in Hungary I was conscious that Austria played a big part in the history of my adoptive homeland. Austria was partner in a once-great empire, and a byword for high culture across the whole region. Later, during the dark days of Communism, Austria was the golden gateway to the West with the promise of freedom and all things new. These days the country is a byword for high wages and high standards of living. So when starting my Fintech journey with our neighbor, I expected that - as with many examples of Austro-Hungarian relations - the grass would of course be greener on the other side of the border. Would that prove true?

If Bernard Reiterer is a drinker of calming herb teas, they’re not working. He speaks in an apparently highly-caffeinated manner, pouring out his ideas in an enthusiastic stream. With an MBA from the University of Minnesota where he no doubt sharpened his English, Bernard - ‘call me Bernie’ - takes some keeping up with. “Let me give a little bit of background about myself: I'm coming from the payments industry, which is also Fintech. For me the last ten years was either startup Fintech, whether it was in consulting or building new, innovative services - especially mobile payments - or new remittance services all around the world. That's what I was doing before, and the company I'm running now is SignD.”

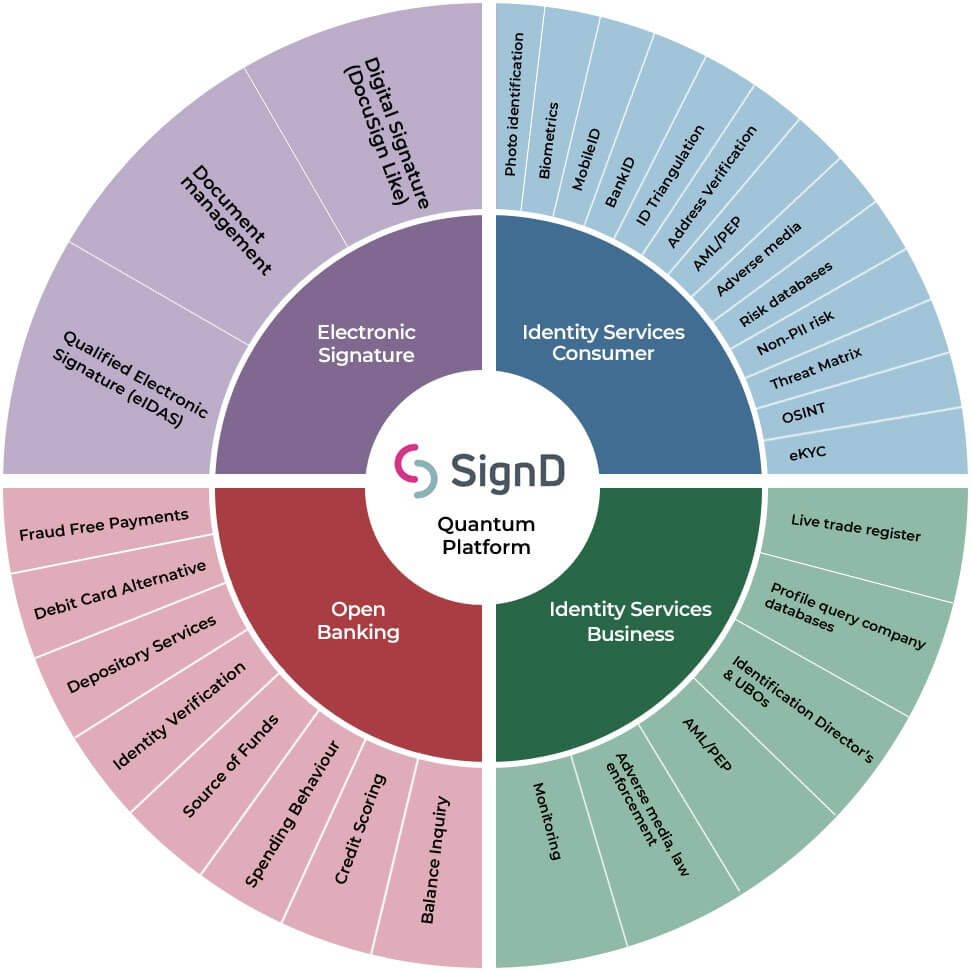

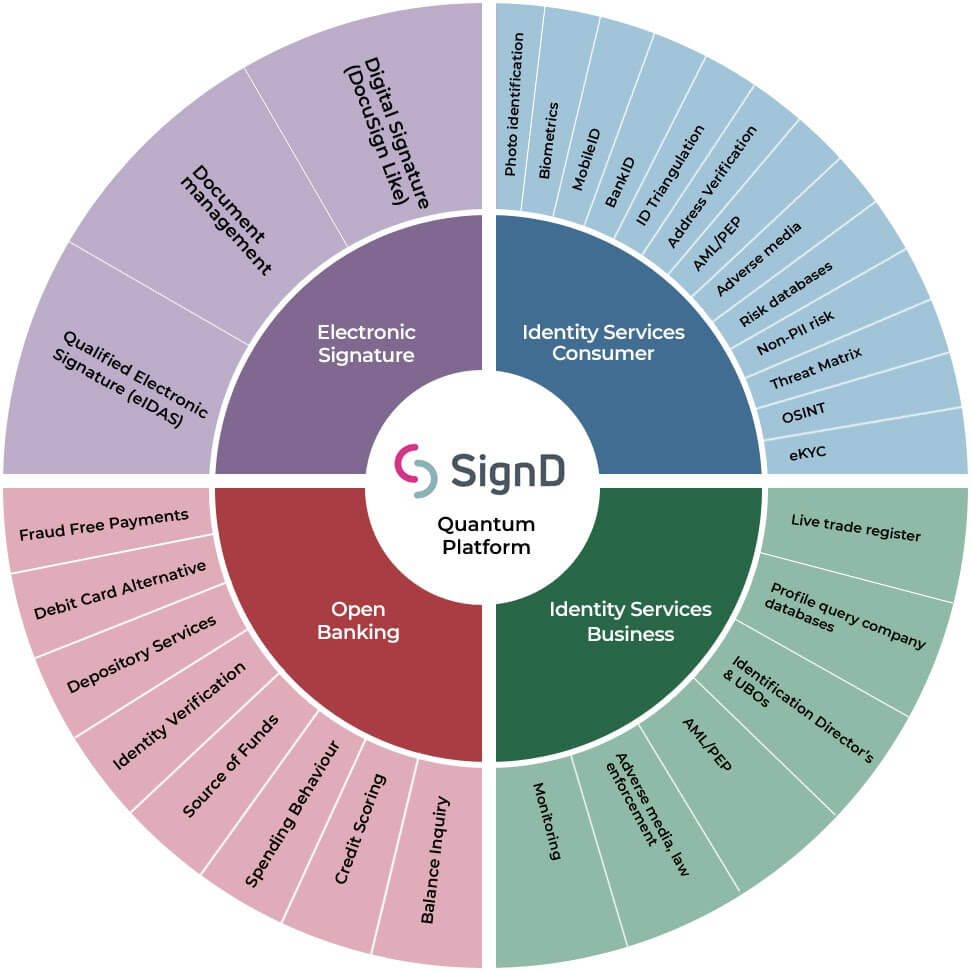

His enterprise is described as a white label turnkey solution for customer onboarding, encompassing identity verification, risk assessment, digital signatures and payments. SignD’s framework orchestrates leading providers of biometric identification, forensic analysis, PSD2, database services and open source intelligence: ‘With only one integration we offer the fastest and easiest onboarding journey for our clients' new customers. Get better data with SignD - in a simple, fast, compliant and fraud resilient way.’

OK, clear. So what’s the Fintech scene in Austria like? Bernie Reiterer

Bernie Reiterer

Bernie takes a breath, has a think: “There are good people here, good ideas, but the environment is not so friendly.” He cites N26 as an example: a famous Austrian startup which had to go to Germany to achieve success as the largest challenger bank in Europe. “The Austrian regulator has some strange ideas, is extremely unresponsive and is pretty weak. At SignD we're dealing with regulators across the globe, so the Austrian regulator is something we always knew was bad. It’s extremely hard to start a regulated Fintech business here in Austria.”

It’s a theme which is picked up by Martin Schachinger, Co-owner and Managing Director of Finnoconsult.

Although his company is Austrian, I find Martin during lockdown in a hotel he acquired in south-central Hungary, and which he is at the time using as an office. “The Austrian market is very small,” he says. “Finnoconsult’s main business is in Switzerland and Germany. Austrian banking management is the worst in making decisions. They just refuse to take meaningful decisions! And customers are a nuisance to them too.” Martin Schachinger

Martin Schachinger

Wow, that’s pretty damning. And do the regulators get any better praise from Martin? - They do not: The regulators are very strict, he says, and the Austrian FMA is highly bureaucratic - dating back to 1816 when the National Bank performed regulatory duties. “It hasn’t evolved much since the days of the monarchy, it’s very old family.”

Like Bernie Reiterer, Martin gives N26 as an example of an Austrian startup which had to go to Germany to achieve its considerable success. After all, why bother developing an idea for the 8.8 million population of Austria, when right next door there’s a market of 83 million, speaking a common language?

As Martin describes it, there’s also still low general trust in consumer Fintech solutions in Austria, and on a recent visit to Vienna, he was amazed to find a shop which would only accept cash payment. I remark that this doesn’t sound like the sleek, well-functioning system that Hungarians believe exists just across the border. Martin raises his eyes to heaven - he knows the Hungarian, German, Swiss and Austrian systems well, and doesn’t seem too impressed by his native country. So does the Austrian banking system have to change, and can it change? “Banks will become redundant,” Martin replies. Right now they are, “Not flexible enough. Everything takes a long time, and people in banking don’t support new ideas. SWIFT payments can cost €30 per transfer, compared to Paypal or Revolut at just a few euro. Only old people still use banks!”

Let’s check in with a third contributor, David Khassidov, and see if he can paint a more upbeat picture. He’s a ‘Passionate entrepreneur and matchmaker,’ and founder of startup investor Epiphanic, based in Vienna. Since 2017 he’s also been the organizer of the largest Fintech conference in Austria. He agrees that the regulatory situation really is a big challenge, but says that there is at least ‘interest’ now in regulatory bodies creating a better environment for Fintechs. But, “We’re not seeing major support from government, and we are all influenced by the attitude of the Austrian banks. There is now some curiosity from the banks, but little support.” He draws the line at being too critical of the banking system, but like Martin Schachinger says that Austrian Fintechs will always tend to look outwards. It seems the grass is also greener on the other side for Austrian entrepreneurs!

“Everyone is banked in Austria,” David comments. “It’s a saturated market. So it’s about price and service quality rather than innovation.” David Khassidov

David Khassidov

“You have so many obstacles here,” Bernie Reiterer is direct and to the point. “It's just easier to go to Estonia and start up something there, or to Germany. And also there’s better access to funds outside of Austria.”

“Everyone's going to Lithuania,” Martin Schachinger says. “It’s much easier there, but it’s still in Europe, still inside European regulations.”

Well OK, but Finnoconsult, SignD and Epiphanic are all Austrian Fintechs, and they haven’t relocated to Lithuania or Estonia, so there must be some things which make ‘staying at home’ worthwhile...

David Khassidov takes heart from the growing Fintech activities, which he has played a large part in organizing. The first Austrian Fintech conference took place in 2017, and there have been around two held each year since then. Initially there were about 50 attendees, but this has grown steadily and become increasingly international in scope, with some 200 international participants from 20 countries. Conferences are held in Vienna, but Norway has also hosted an outrider meeting. Covid of course changed everything to online for some time, as well as having a ‘dramatic impact’ on Fintechs. “Some managed to adapt, some have profited, and of course Fintechs benefit from being largely digital.”

David points to Bitpanda, one of the largest exchanges in Europe and a huge investment gateway, which has put on muscle during the pandemic. Bitpanda was founded in Vienna in 2014 by Eric Demuth, Paul Klanschek and Christian Trummer, and now has around 2.5 million customers for its ‘user-friendly, trade-everything platform,’ which ‘empowers you to invest in the stocks, cryptocurrencies and metals you want, with any amount of money.’

The Bitpanda platform ‘Without digital walls and complex barriers’ seems slightly at odds with what I’ve been hearing from my informants about the restrictive nature of regulation in Austria.

Checking in with the ICLG (International Comparative Legal Guides) website, I find an article by Austrian Attorney at Law, Bernd Fletzberger which says that:

‘Austrian financial regulators and policy makers are receptive to Fintech innovation and committed to support new entrants to regulated financial services markets. Recently the Minister of Finance announced the development of a Fintech action plan to foster development in Austria. The plan focuses on regulating trade with cryptocurrencies, providing a new digital prospectus regime for ICOs and fines for misconduct. A Fintech advisory board has been established to assist the government with specific actions. Furthermore, the FMA (Financial Market Authority) has established a Fintech contact point which handles all kinds of regulatory questions.’

Interesting: So did Bitpanda get big because of an encouraging regulatory environment, or despite it? The platform reached unicorn level in 2021 with €142 million in equity capital and a valuation of $1.2 billion. However, David Khassidov says that some apparent Fintech unicorns of the past three years or so have proved to be unsustainable: “They were focussed on raising money rather than earning it.”

So what does his own company, Epiphanic do? David’s background is originally in software and engineering: “You never quite get the engineer out of you! The engineer part of me falls in love with stuff, then another part of me always has to intervene, like looking closely at the Founders of a company. Technology is important, but the Founders and their team really decide on whether an enterprise will succeed.” Epiphanic

Epiphanic

Epiphanic supports entrepreneurs, especially Fintechs, but the chosen projects, “Must solve problems that are worth solving.” David says he is essentially ‘Tech agnostic’ and describes his interest more as ‘scouting for technology’ which can be done on behalf of client organizations. It's always about solutions. As such, Epiphanic acts as something of an Angel Investor-stroke-collaborator, seeking out promising Fintech opportunities for other investors. The firm includes partnerships with innovation architects Techhouse; the Amsterdam-based Startupbootcamp FinTech & CyberSecurity; and the multinationally active Efma, the global non-profit organisation with membership of over 3,300 brands in 130 countries. Clearly, Epiphanic is not constrained by the borders of its home country, as it ‘paves the road to the future.’

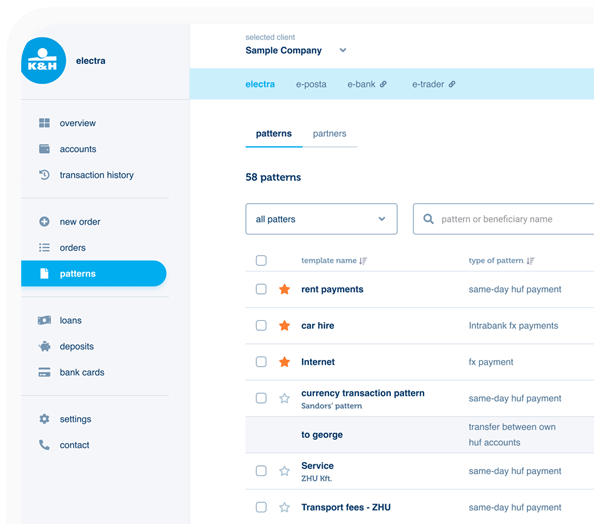

And what of Martin Schachinger’s innovation consultancy for banks and insurance companies? Along with co-owner Christian Berger, Martin founded Finnoconsult in 2015 to build digital platforms for banks and insurance companies. One of the key tools is the ‘Finnoscore’ which evaluates 200+ banks regarding their digital capabilities in 12 categories on a yearly basis. This allows the company to develop tailor-made solutions based on client needs. “Finnoscore is more than just a tool for us,” Martin adds. “We also conduct workshops with banks, where we explain what they could do better.” Finnoconsult

Finnoconsult

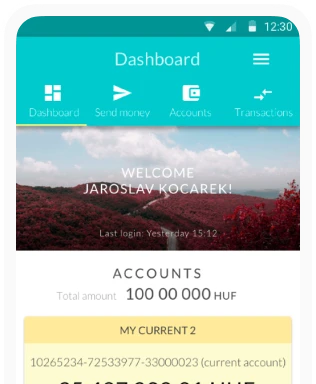

Developments have also included a multi-banking platform Teo, plus ecosystem for some of the cooperative Sparda-Banks in Germany, and the creation of Zak, which was the first smartphone banking app in Switzerland. Of this initiative, Christian Heller, former Department Head of Corporate Development at Bank Cler says, “We started at a point where we were losing customers relatively quickly. If we had had to name a date when our bank would cease to exist, it would have been in 10 years' time. We had to act fast.” Together with Finnoconsult, that’s exactly what they did, analysing the market gap with special comparison to N26 and its target group. The resulting identification of a Swiss demographic in the 15 to 32 age group, and getting Zak up and running within just 11 months turned around Christian Heller’s dire prediction.

UX-UI Design Agency Ergomania in Budapest also worked on the Sparda-Banks project and on UI design for Zak, with the team operating both remotely, and in person in Vienna.

And that name, ‘Zak’? It’s Swiss-German for ‘Hey Presto!’ - a magical and swiftly-achieved transition. Or as Gregor Eicher of Cler Bank’s Head of Marketing says, “Zak shows exactly what Bank Cler stands for as a brand: simple management of money, understanding the needs of our clients, and fresh ideas.”

However a comment from Martin Schachinger about banking ecosystems goes somewhat against the prevailing view that this is the way forward. “Ecosystems are supposed to be good for banks, but I don’t know one example that really works at the moment. Banks still have to find the perfect model that creates real benefits for them and their customers.” Banks used to get their income from the spread of interest rates, he says, but now they need different sources. They need to extend, but ecosystems can get ‘too crowded.’

He sees the big revolution in banking going back to around 2006 and the rise of mobile, with Revolut coming onstream in 2015. “Revolut didn’t care about laptops and PCs,” and mobile banking appeals much more to younger users. “Old customers die. Young customers don’t understand why you need a banking advisor. Their attention is focussed on N26, Monzo and Revolut. People used to buy investments through their traditional banks, but now they do that through their apps. That’s hurting the traditional banks, and many have no clear vision of the future.” Martin also commends Robinhood as showing the way forward with ‘democratized finance’ - Why should anyone these days pay a bank to manage their finances when it’s available directly through their mobile phone?

So it seems that as well as helping develop new and forward looking apps, service providers like Finnoconsult also provide essential hand-holding and guidance in order for the older banks to establish new aims. Some of the Finnoconsult Team in discussion

Some of the Finnoconsult Team in discussion

Which brings me back to Bernie Reiterer, who has a terrifically appropriate passtime for a Fintech CEO - he shoots for the gold bullseye as an archer, using the classic medieval longbow. “I don’t do the recurve style,” he says, of the highly-engineered modern form of the sport. And he doesn’t use gloves or other protection, with the result that he often has to hide the wounds from string-burn. “It’s a typical man thing,” he laughs.

And as to hitting business targets? “We’re two years young,” Bernie says of SignD, which now numbers 22 people in the company. Bernie himself spends around 40% of his time fundraising, 30% in sales, and the remainder making sure that the company strategy is properly supported. That time also includes interviews and raising the profile of SignD, which has obviously worked as he says, “The response has been amazing in the last four months.” SignD's services

SignD's services

So what is SignD actually doing? It offers banking clients, ‘A Unified Onboarding Platform for all your Identity, KYC, Risk, Payments and Signature needs. We map and help you deliver your entire customer journey from a simple identity check to a secured transaction.’ Not surprising that demand is picking up, including biometrics and AI-based services.

Bernie explains that to meet KYC regulations, in 80% of onboarding cases there’s a website where the customer enters their name, address, and date of birth, and then they are identified. But as he points out, “I can find all of that information about you with a Google search, and can open a bank account in your name. That's not a good thing.”

With SignD, using a phone number opens up the process in a GDPR friendly way. Bernie says, “We can identify your number and make sure that you're sitting in front of your mobile phone right now. It's extremely unobtrusive because all you do is enter the number and click the button: ‘Yes, I agree to be identified with this information.’ Nothing else necessary.

We started off with photo identification and have now built this comprehensive platform and extended it to businesses and open banking. It's all about identifying the consumer. We guide them through the process, we do all the verification metrics, and it takes 30 seconds. Or if you show me your driving license, I can scan it and validate it without you even needing to do photo identification. So that's why we're saying, ‘Alright, let's orchestrate a flow that is securitized, or go to another identification service, which is still unobtrusive, and hassle free.’ But it's also got the security that you're actually sitting in front of the screen.”

Or as the company’s website explains:

‘SignD’s Quantum Platform can be your winning recipe to achieve your goals. Speed and convenience for our clients + Outstanding user experience + Trust & future proof + Always-on compliance = Peace of mind.

That mention of User Experience - UX - prompts the question of how important it is in the scheme of things, perhaps seen from the Austrian perspective. David Khassidov is pragmatic: “UX design is a package of many things - the experience of human beings with a process. It’s a particular way of doing things and it depends on how much dedication, effort and love a company invests in delighting customers.” My attention is caught by that unusual use of ‘love’ in terms of UX-UI. How can that be quantified?

It can’t, David replies, but even if there is bad UX, “People will still use it if it solves a problem. If there are hiccups it won’t matter as long as the problem gets fixed.” But in case he appears to not care about UX, David adds the rider that he’s not an expert in the field and hasn’t invested much time in studying it. “But if it helps smooth processes, it's good.”

As a UX service provider Martin Schachinger, is more focussed on the subject. “There has been a UX revolution as everything has gone to mobile. The next area of innovation is probably speech as we move from visual to audio, based on Siri and Alexa, but why should those big tech companies in America know my account balance? That’s one reason why Google and Apple are setting up European Data Centers - to avoid potential GDPR issues.”

Looking further to the future he sees the Internet of Things as creating new challenges for UX-UI, and the drive for fewer steps to achieve a process. As an example he mentions a simple joined-up application for car parking in smart cities, where registration, location and timing of parking, access, security and billing are all within the same unified app. In fact, “The best User Interface makes itself redundant.” Contactless solutions will also continue to proliferate, especially driven forward by the pandemic, and despite the low trust levels of card use in Austria, Martin sees more widespread adoption of card payments.

So he’s optimistic about the future for Fintech?- A ‘so-so’ nod of the head from Martin. I get the sense that as optimism can’t be quantitatively measured, it’s maybe not a metric he relates strongly to.

Bernie Reiterer makes the case for simplicity in UX. “We're selling compliance and hygiene. It's all about being clever in what you put in front of the customer, and what they have to do. So UX-UI, from our perspective is not just about what you do, but also what you can avoid. So it’s about what to put into the background, but still get information about a customer for verification while avoiding asking them for stuff. Those things that they have to do need to be super lean. So most of our services have only one button on the screen. Because you cannot click a wrong button if you just have one button. And if there are two buttons, you know, they're going to click the wrong one!”

As I’m leaving David Khassidov at the end of our allotted time, he does something unusual. I’m used to being the ‘backroom guy’ who interviews people, gets a story, then says goodbye. “But I haven’t heard from you yet,” David says, and I think he means it - he really is one of those rare ‘people people’. So for another five minutes I give him my own potted CV, and in return gain one small further insight into the life of the Epiphanic CEO: from the usual high-gearing of his investment activities, he’s also developing a platform for small retailers, EBASTO.com, which will help sell their products and services - ‘Let’s buy next by!’.

It’s an encouraging and upbeat ending to a brief review of the Austrian Fintech scene, where if the grass isn’t greener, there are at least some vigorous shoots growing.

If Bernard Reiterer is a drinker of calming herb teas, they’re not working. He speaks in an apparently highly-caffeinated manner, pouring out his ideas in an enthusiastic stream. With an MBA from the University of Minnesota where he no doubt sharpened his English, Bernard - ‘call me Bernie’ - takes some keeping up with. “Let me give a little bit of background about myself: I'm coming from the payments industry, which is also Fintech. For me the last ten years was either startup Fintech, whether it was in consulting or building new, innovative services - especially mobile payments - or new remittance services all around the world. That's what I was doing before, and the company I'm running now is SignD.”

His enterprise is described as a white label turnkey solution for customer onboarding, encompassing identity verification, risk assessment, digital signatures and payments. SignD’s framework orchestrates leading providers of biometric identification, forensic analysis, PSD2, database services and open source intelligence: ‘With only one integration we offer the fastest and easiest onboarding journey for our clients' new customers. Get better data with SignD - in a simple, fast, compliant and fraud resilient way.’

OK, clear. So what’s the Fintech scene in Austria like?

Bernie Reiterer

Bernie ReitererThe environment for Fintech

Bernie takes a breath, has a think: “There are good people here, good ideas, but the environment is not so friendly.” He cites N26 as an example: a famous Austrian startup which had to go to Germany to achieve success as the largest challenger bank in Europe. “The Austrian regulator has some strange ideas, is extremely unresponsive and is pretty weak. At SignD we're dealing with regulators across the globe, so the Austrian regulator is something we always knew was bad. It’s extremely hard to start a regulated Fintech business here in Austria.”

It’s a theme which is picked up by Martin Schachinger, Co-owner and Managing Director of Finnoconsult.

Although his company is Austrian, I find Martin during lockdown in a hotel he acquired in south-central Hungary, and which he is at the time using as an office. “The Austrian market is very small,” he says. “Finnoconsult’s main business is in Switzerland and Germany. Austrian banking management is the worst in making decisions. They just refuse to take meaningful decisions! And customers are a nuisance to them too.”

Martin Schachinger

Martin SchachingerOnly old people use banks

Wow, that’s pretty damning. And do the regulators get any better praise from Martin? - They do not: The regulators are very strict, he says, and the Austrian FMA is highly bureaucratic - dating back to 1816 when the National Bank performed regulatory duties. “It hasn’t evolved much since the days of the monarchy, it’s very old family.”

Like Bernie Reiterer, Martin gives N26 as an example of an Austrian startup which had to go to Germany to achieve its considerable success. After all, why bother developing an idea for the 8.8 million population of Austria, when right next door there’s a market of 83 million, speaking a common language?

As Martin describes it, there’s also still low general trust in consumer Fintech solutions in Austria, and on a recent visit to Vienna, he was amazed to find a shop which would only accept cash payment. I remark that this doesn’t sound like the sleek, well-functioning system that Hungarians believe exists just across the border. Martin raises his eyes to heaven - he knows the Hungarian, German, Swiss and Austrian systems well, and doesn’t seem too impressed by his native country. So does the Austrian banking system have to change, and can it change? “Banks will become redundant,” Martin replies. Right now they are, “Not flexible enough. Everything takes a long time, and people in banking don’t support new ideas. SWIFT payments can cost €30 per transfer, compared to Paypal or Revolut at just a few euro. Only old people still use banks!”

Curiosity but little support

Let’s check in with a third contributor, David Khassidov, and see if he can paint a more upbeat picture. He’s a ‘Passionate entrepreneur and matchmaker,’ and founder of startup investor Epiphanic, based in Vienna. Since 2017 he’s also been the organizer of the largest Fintech conference in Austria. He agrees that the regulatory situation really is a big challenge, but says that there is at least ‘interest’ now in regulatory bodies creating a better environment for Fintechs. But, “We’re not seeing major support from government, and we are all influenced by the attitude of the Austrian banks. There is now some curiosity from the banks, but little support.” He draws the line at being too critical of the banking system, but like Martin Schachinger says that Austrian Fintechs will always tend to look outwards. It seems the grass is also greener on the other side for Austrian entrepreneurs!

“Everyone is banked in Austria,” David comments. “It’s a saturated market. So it’s about price and service quality rather than innovation.”

David Khassidov

David Khassidov“You have so many obstacles here,” Bernie Reiterer is direct and to the point. “It's just easier to go to Estonia and start up something there, or to Germany. And also there’s better access to funds outside of Austria.”

“Everyone's going to Lithuania,” Martin Schachinger says. “It’s much easier there, but it’s still in Europe, still inside European regulations.”

Well OK, but Finnoconsult, SignD and Epiphanic are all Austrian Fintechs, and they haven’t relocated to Lithuania or Estonia, so there must be some things which make ‘staying at home’ worthwhile...

Austrian Fintech growth

David Khassidov takes heart from the growing Fintech activities, which he has played a large part in organizing. The first Austrian Fintech conference took place in 2017, and there have been around two held each year since then. Initially there were about 50 attendees, but this has grown steadily and become increasingly international in scope, with some 200 international participants from 20 countries. Conferences are held in Vienna, but Norway has also hosted an outrider meeting. Covid of course changed everything to online for some time, as well as having a ‘dramatic impact’ on Fintechs. “Some managed to adapt, some have profited, and of course Fintechs benefit from being largely digital.”

David points to Bitpanda, one of the largest exchanges in Europe and a huge investment gateway, which has put on muscle during the pandemic. Bitpanda was founded in Vienna in 2014 by Eric Demuth, Paul Klanschek and Christian Trummer, and now has around 2.5 million customers for its ‘user-friendly, trade-everything platform,’ which ‘empowers you to invest in the stocks, cryptocurrencies and metals you want, with any amount of money.’

The Bitpanda platform ‘Without digital walls and complex barriers’ seems slightly at odds with what I’ve been hearing from my informants about the restrictive nature of regulation in Austria.

Checking in with the ICLG (International Comparative Legal Guides) website, I find an article by Austrian Attorney at Law, Bernd Fletzberger which says that:

‘Austrian financial regulators and policy makers are receptive to Fintech innovation and committed to support new entrants to regulated financial services markets. Recently the Minister of Finance announced the development of a Fintech action plan to foster development in Austria. The plan focuses on regulating trade with cryptocurrencies, providing a new digital prospectus regime for ICOs and fines for misconduct. A Fintech advisory board has been established to assist the government with specific actions. Furthermore, the FMA (Financial Market Authority) has established a Fintech contact point which handles all kinds of regulatory questions.’

Interesting: So did Bitpanda get big because of an encouraging regulatory environment, or despite it? The platform reached unicorn level in 2021 with €142 million in equity capital and a valuation of $1.2 billion. However, David Khassidov says that some apparent Fintech unicorns of the past three years or so have proved to be unsustainable: “They were focussed on raising money rather than earning it.”

The engineer falls in love with stuff

So what does his own company, Epiphanic do? David’s background is originally in software and engineering: “You never quite get the engineer out of you! The engineer part of me falls in love with stuff, then another part of me always has to intervene, like looking closely at the Founders of a company. Technology is important, but the Founders and their team really decide on whether an enterprise will succeed.”

Epiphanic

EpiphanicEpiphanic supports entrepreneurs, especially Fintechs, but the chosen projects, “Must solve problems that are worth solving.” David says he is essentially ‘Tech agnostic’ and describes his interest more as ‘scouting for technology’ which can be done on behalf of client organizations. It's always about solutions. As such, Epiphanic acts as something of an Angel Investor-stroke-collaborator, seeking out promising Fintech opportunities for other investors. The firm includes partnerships with innovation architects Techhouse; the Amsterdam-based Startupbootcamp FinTech & CyberSecurity; and the multinationally active Efma, the global non-profit organisation with membership of over 3,300 brands in 130 countries. Clearly, Epiphanic is not constrained by the borders of its home country, as it ‘paves the road to the future.’

And what of Martin Schachinger’s innovation consultancy for banks and insurance companies? Along with co-owner Christian Berger, Martin founded Finnoconsult in 2015 to build digital platforms for banks and insurance companies. One of the key tools is the ‘Finnoscore’ which evaluates 200+ banks regarding their digital capabilities in 12 categories on a yearly basis. This allows the company to develop tailor-made solutions based on client needs. “Finnoscore is more than just a tool for us,” Martin adds. “We also conduct workshops with banks, where we explain what they could do better.”

Finnoconsult

FinnoconsultDevelopments have also included a multi-banking platform Teo, plus ecosystem for some of the cooperative Sparda-Banks in Germany, and the creation of Zak, which was the first smartphone banking app in Switzerland. Of this initiative, Christian Heller, former Department Head of Corporate Development at Bank Cler says, “We started at a point where we were losing customers relatively quickly. If we had had to name a date when our bank would cease to exist, it would have been in 10 years' time. We had to act fast.” Together with Finnoconsult, that’s exactly what they did, analysing the market gap with special comparison to N26 and its target group. The resulting identification of a Swiss demographic in the 15 to 32 age group, and getting Zak up and running within just 11 months turned around Christian Heller’s dire prediction.

UX-UI Design Agency Ergomania in Budapest also worked on the Sparda-Banks project and on UI design for Zak, with the team operating both remotely, and in person in Vienna.

And that name, ‘Zak’? It’s Swiss-German for ‘Hey Presto!’ - a magical and swiftly-achieved transition. Or as Gregor Eicher of Cler Bank’s Head of Marketing says, “Zak shows exactly what Bank Cler stands for as a brand: simple management of money, understanding the needs of our clients, and fresh ideas.”

Ecosystems - swimming or drowning?

However a comment from Martin Schachinger about banking ecosystems goes somewhat against the prevailing view that this is the way forward. “Ecosystems are supposed to be good for banks, but I don’t know one example that really works at the moment. Banks still have to find the perfect model that creates real benefits for them and their customers.” Banks used to get their income from the spread of interest rates, he says, but now they need different sources. They need to extend, but ecosystems can get ‘too crowded.’

He sees the big revolution in banking going back to around 2006 and the rise of mobile, with Revolut coming onstream in 2015. “Revolut didn’t care about laptops and PCs,” and mobile banking appeals much more to younger users. “Old customers die. Young customers don’t understand why you need a banking advisor. Their attention is focussed on N26, Monzo and Revolut. People used to buy investments through their traditional banks, but now they do that through their apps. That’s hurting the traditional banks, and many have no clear vision of the future.” Martin also commends Robinhood as showing the way forward with ‘democratized finance’ - Why should anyone these days pay a bank to manage their finances when it’s available directly through their mobile phone?

So it seems that as well as helping develop new and forward looking apps, service providers like Finnoconsult also provide essential hand-holding and guidance in order for the older banks to establish new aims.

Some of the Finnoconsult Team in discussion

Some of the Finnoconsult Team in discussionTargeting business

Which brings me back to Bernie Reiterer, who has a terrifically appropriate passtime for a Fintech CEO - he shoots for the gold bullseye as an archer, using the classic medieval longbow. “I don’t do the recurve style,” he says, of the highly-engineered modern form of the sport. And he doesn’t use gloves or other protection, with the result that he often has to hide the wounds from string-burn. “It’s a typical man thing,” he laughs.

And as to hitting business targets? “We’re two years young,” Bernie says of SignD, which now numbers 22 people in the company. Bernie himself spends around 40% of his time fundraising, 30% in sales, and the remainder making sure that the company strategy is properly supported. That time also includes interviews and raising the profile of SignD, which has obviously worked as he says, “The response has been amazing in the last four months.”

SignD's services

SignD's servicesSo what is SignD actually doing? It offers banking clients, ‘A Unified Onboarding Platform for all your Identity, KYC, Risk, Payments and Signature needs. We map and help you deliver your entire customer journey from a simple identity check to a secured transaction.’ Not surprising that demand is picking up, including biometrics and AI-based services.

Bernie explains that to meet KYC regulations, in 80% of onboarding cases there’s a website where the customer enters their name, address, and date of birth, and then they are identified. But as he points out, “I can find all of that information about you with a Google search, and can open a bank account in your name. That's not a good thing.”

With SignD, using a phone number opens up the process in a GDPR friendly way. Bernie says, “We can identify your number and make sure that you're sitting in front of your mobile phone right now. It's extremely unobtrusive because all you do is enter the number and click the button: ‘Yes, I agree to be identified with this information.’ Nothing else necessary.

We started off with photo identification and have now built this comprehensive platform and extended it to businesses and open banking. It's all about identifying the consumer. We guide them through the process, we do all the verification metrics, and it takes 30 seconds. Or if you show me your driving license, I can scan it and validate it without you even needing to do photo identification. So that's why we're saying, ‘Alright, let's orchestrate a flow that is securitized, or go to another identification service, which is still unobtrusive, and hassle free.’ But it's also got the security that you're actually sitting in front of the screen.”

Or as the company’s website explains:

‘SignD’s Quantum Platform can be your winning recipe to achieve your goals. Speed and convenience for our clients + Outstanding user experience + Trust & future proof + Always-on compliance = Peace of mind.

UX-UI

That mention of User Experience - UX - prompts the question of how important it is in the scheme of things, perhaps seen from the Austrian perspective. David Khassidov is pragmatic: “UX design is a package of many things - the experience of human beings with a process. It’s a particular way of doing things and it depends on how much dedication, effort and love a company invests in delighting customers.” My attention is caught by that unusual use of ‘love’ in terms of UX-UI. How can that be quantified?

It can’t, David replies, but even if there is bad UX, “People will still use it if it solves a problem. If there are hiccups it won’t matter as long as the problem gets fixed.” But in case he appears to not care about UX, David adds the rider that he’s not an expert in the field and hasn’t invested much time in studying it. “But if it helps smooth processes, it's good.”

As a UX service provider Martin Schachinger, is more focussed on the subject. “There has been a UX revolution as everything has gone to mobile. The next area of innovation is probably speech as we move from visual to audio, based on Siri and Alexa, but why should those big tech companies in America know my account balance? That’s one reason why Google and Apple are setting up European Data Centers - to avoid potential GDPR issues.”

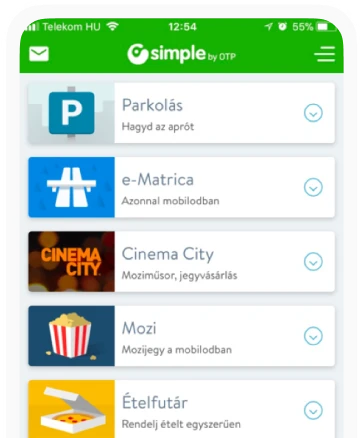

Looking further to the future he sees the Internet of Things as creating new challenges for UX-UI, and the drive for fewer steps to achieve a process. As an example he mentions a simple joined-up application for car parking in smart cities, where registration, location and timing of parking, access, security and billing are all within the same unified app. In fact, “The best User Interface makes itself redundant.” Contactless solutions will also continue to proliferate, especially driven forward by the pandemic, and despite the low trust levels of card use in Austria, Martin sees more widespread adoption of card payments.

So he’s optimistic about the future for Fintech?- A ‘so-so’ nod of the head from Martin. I get the sense that as optimism can’t be quantitatively measured, it’s maybe not a metric he relates strongly to.

One button good

Bernie Reiterer makes the case for simplicity in UX. “We're selling compliance and hygiene. It's all about being clever in what you put in front of the customer, and what they have to do. So UX-UI, from our perspective is not just about what you do, but also what you can avoid. So it’s about what to put into the background, but still get information about a customer for verification while avoiding asking them for stuff. Those things that they have to do need to be super lean. So most of our services have only one button on the screen. Because you cannot click a wrong button if you just have one button. And if there are two buttons, you know, they're going to click the wrong one!”

Green shoots

As I’m leaving David Khassidov at the end of our allotted time, he does something unusual. I’m used to being the ‘backroom guy’ who interviews people, gets a story, then says goodbye. “But I haven’t heard from you yet,” David says, and I think he means it - he really is one of those rare ‘people people’. So for another five minutes I give him my own potted CV, and in return gain one small further insight into the life of the Epiphanic CEO: from the usual high-gearing of his investment activities, he’s also developing a platform for small retailers, EBASTO.com, which will help sell their products and services - ‘Let’s buy next by!’.

It’s an encouraging and upbeat ending to a brief review of the Austrian Fintech scene, where if the grass isn’t greener, there are at least some vigorous shoots growing.