The Romanian Fintech scene - Trusting your feet

What is a bank for? Why are there bankers? Where is this coming from?

I am plunged straight into philosophy by the Co-Founder and CEO of Finqware, one of Romanian Fintech’s brightest offerings. Perhaps it’s not entirely surprising, since Cosmin Cosma started out studying Heidegger Phenomenology at university, and says that through this he began to understand ‘the real meaning of things’.

From philosophy to banking is something of a leap, but Cosmin made it effortlessly in 2005 when he pitched for a franchise of an ING Bank branch, mainly on the basis of, ‘Well, why not?’ ING was opening branches around Romania, and Cosmin suggested that as he had no family at the time, no commitments, and was willing to locate anywhere, he was probably worth trying.

And so a local branch bank manager with a philosophy degree and zero banking knowledge started work, and made a success of his business, selling it on again after only two years. He’d rapidly become a respected member of the local community and had learned a lot about financial ecosystems, but realized that being a big fish in a small pond was not really his scene. “If I want to play football, I don't want to play in the local schoolyard, but in the world championship,” he laughs. Cosmin Cosma

Cosmin Cosma

Following Cosmin’s subsequent journey would require a chapter of its own, but involves engagement with corporates, banks, gaining a double MBA ‘on my own money,’ as well as becoming a go-to conference speaker, after helping clean up the mess left by the 2008 financial crisis. Throughout, his fascination with banking grew and those philosophical questions demanded answers. He questioned the fundamentals, such as what a bank branch is. “Philosophically, a branch is a place a customer goes to get or give some papers. So it's paper-moving related. But we started to see from 2010 onwards that paper-moving will stop.” He likens it to restrictions on diesel cars, “We all agree diesel motors should stop, and paper-moving should stop too.”

He saw the inertia in the financial ecosystem, and imagined the next thing: for example, that branches would become coffee shops, encouraging better banking interaction. And if their core purpose was to deposit and receive paper, what would happen once the paper was no longer there? He started to think how technology could make this happen, decreasing the bureaucracy within banking institutions, and in the banking system itself.

Further factors pushing Cosmin to find new solutions were the stories he had witnessed while he was responsible for distressed assets and debt collection for GE Capital, Garanti Bank, and Volksbank Romania. “I saw guys with a PhD in computer science losing their house, because some foolish uneducated banker had persuaded them to take out a big loan in Swiss francs.”

An issue he observed at first hand was that the banking system depends on information asymmetry between the customer and the bank, “The banks know something which the customers don't know, and most of their profits are from the asymmetrical balance of knowledge. This information asymmetry can create awful situations.” Such as people losing their homes? “Exactly.”

The stage was set for a Fintech that would declutter bureaucracy in the banking system and help provide for more open and responsible banking. 2018 – Local Elevator Lab Challenge – FINQ won 2nd place and ‘Local Hero’ prize

2018 – Local Elevator Lab Challenge – FINQ won 2nd place and ‘Local Hero’ prize

But aren’t Fintechs the opposition, especially when an operation like Finqware seems so focused on upending the way banking business has been done for so long? Andreea disagrees, and points out that Fintechs and banks are – or should be – allies, “At Raiffeisen we believe in partnerships.”

Fintechs can contribute innovative solutions and foster more rapid implementation of solutions, whereas, “A bank is like an elephant – a big organization with a lot of people and processes, which are well organized or have a predefined setting. Fintechs are more agile, due to having smaller teams.” Often, Andreea says, Fintechs do not have to work like a bank, where there are separate attributions such as legal teams, compliance teams, and security teams.

Raiffeisen’s Fintech support program began in Romania in 2018, with a Challenge competition focused on solutions for companies. The following year came the first Fintech Bootcamp, where wannabes were helped in their understanding of what developing and growing a Fintech startup actually means. This included how to build the startup, all the legal implications, creating a unique selling proposition, branding, marketing plans, and also when it is suitable to accept VC funding, and how to pitch in front of a VC. In other words, everything that a wise mentor can impart in the way of experience and useful knowledge.

Then came the competitions, which the Raiffeisen team calls ‘Tracks’, each year featuring a different theme. For instance, 2020’s competition was specific to data, with data analytics and loyalty solutions for companies. This was co-organized with Raiffeisen Bulgaria colleagues and was open to Fintechs from all over the world. More than 80 companies applied, of which 40% were from Romania. As Andreea says, “That proved we have a very good Fintech market here in Romania.”

And it’s growing? Not so much in numbers, she replies, but for sure in maturity. “Their solutions are interesting for the market. Startups sometimes do not last very long. If they do not have good solutions, they usually die after one year.” Most of the companies that Raiffeisen Romania have mentored or partnered with are more mature.

Despite this encouraging climate for Fintechs, there are restrictions to growth, which must be overcome. Most Fintechs are looking beyond Romania and have offices outside of the country, Finqware being an example. That’s partly because of their expansion plans, but Andreea says a factor is also that the national bank and regulator have been slower in implementing PSD2 compared to other countries. As a result some Fintechs weren't able to develop their products as quickly as they wanted to, and have had to seek the necessary certification and accreditation from outside (a point confirmed by Cosmin Cosma).

Fortunately the newly created Romanian Fintech Association is also now engaged with these issues.

As Executive Director at RoFin Tech – the Romanian Fintech Association – Magda Sandulescu is well placed to offer a view on regulatory matters. She has a long history as a banker herself and has an understanding of the system, from the inside out.

Founded in 2020, RoFin is a professional entrepreneurial organization focused on helping Fintech startups and scaleups expand internationally, and bringing more people into the space of Fintech. RoFin is a founding member of the European Digital Finance Association (EDFA), the representative body for digital finance and Fintech firms across Europe. Current activities are concentrated on developing the regulatory frameworks on Fintechs, by participation in working groups made at European level by EDFA, and with Romanian regulatory bodies. Developing international relations and running monthly networking meetup events designed for the Fintech community are also part of the RoFin remit.

Magda says that the regulators are open to discussion, but points out the paradox that the Romanian banking market has historically been a very stable one, in part due to the merits of the National Bank of Romania, which has consistently worked to make the environment very steady and predictive. This is something that Cosmin Cosma also observed – that the financial crisis which hit Romania around 2010-2011 was actually the first to affect the Romanian banking sector, while other countries had suffered earlier, and for longer. Magda Sandulescu

Magda Sandulescu

Magda adds, however, that the prized stability also came with aspects of very conservative legislation. That was a healthy enough approach for both consumers and most players in the market, but Fintechs needed different treatment. This is because Fintechs in general are only enablers of certain parts of the services offered in the banking market, and are not players themselves. So rules need to be adapted, with different types of risk tests applied to Fintech players, including having a sandbox in place.

“Currently, there are efforts on both sides. The regulators are aware that the market is evolving, and technology is everywhere. Everyone has technology in their pocket now, available from the first moment of every day. Naturally the regulators know this, and we are in permanent dialogue with them. We hope that very soon there will be some progress to announce.”

Magda is wary of saying more about deals yet to be done, but says that initiatives are concentrated in enabling technology access in financial services, both in insurance and banking. “Based on the experience of our members, we are putting various proposals to the National Bank, as well as the Financial Supervision Authority. This is for the insurance, reinsurance, and capital markets. We are trying to initiate modifications to both primary legislation and secondary legislation in order to allow Fintechs to bring the benefits of technology to end users.” What the Fintechs bring to the potential regulatory changes is a practical working knowledge of European regulations – including PSD2 – because they are already engaged beyond Romanian borders. So, in this sense, the regulator can appraise the experience of Fintechs in different countries across Europe.

Andreea-Luminita Porojan’s comment about Romanian Fintechs becoming more mature, but not necessarily more numerous, is expanded on by Magda Sandulescu. She says that currently RoFin’s 18 members are the result of being limited by a filtering process based on two criteria: First, having a licensed product from which they are already obtaining revenue. Second, at least one founding member must be Romanian. “Our members are representative of different verticals: Lending and crowdfunding, personal finance verticals and payments and wallets. We are also involved in investment and wealth management, and have one member active in insurtech. Currently there’s no blockchain.”

And the objectives of the new association? As we’ve already heard, a crucial point is actively working on changing legislation to support and better enable Romanian Fintechs.

A second goal is to develop international relations and expand the Romanian Fintech universe. 2021 saw the signing of MOUs with The Lhoft – The Luxembourg House of Financial Technology – and the Fintech Association of Japan. RoFin will maintain the effort to open contacts across different markets of interest for its members.

Ongoing education programs are the third goal of the Romanian Fintech Association and – Covid allowing – with conferences and other live events. Magda considers that the first year of the association went reasonably well, considering the disruption caused by the pandemic, and the challenges of only being able to meet virtually. RoFin has also cooperated closely with Raiffeisen Bank on their elevator program, and the Fintech competitions. So in a difficult time for everyone, the headline goals are being met.

But let’s visit that insurtech member who was helped on the way by The Luxembourg House of Financial Technology. What’s the story there?

That seems clear enough, but what about the Luxembourg connection? “Well, we should have deployed in July 2021,” says Dan. “But then we were accepted onto this LHoft accelerator program in Luxembourg and so we focused all our efforts there. It was such a great experience, like boot camp, even though it was online. There were up to eight hours daily where we had VCs, professionals from Deloitte and KPMG, as well as Banking and Insurance regulator representatives speaking with us. We had the financial authorities from Luxembourg to talk about what you need to do to register in Luxembourg, and that was very helpful. So we postponed the launch, dependent on discussions with the Luxembourg authorities, and the decision of whether we’ll start in Luxembourg or Romania.” Dan Alexandru Cobeanu

Dan Alexandru Cobeanu

So this seems like an example of a forward-looking Romanian Fintech that is limited by the current somewhat restrictive regulatory framework in the home country. It seems that it’s easier or more encouraging to look outside, “We're thinking of incorporating in Luxembourg, as part of the program.” Dan acknowledges. Whereas in Romania, “We were seeing that people are afraid of licensing. However, now we see that licensing actually gives you power. If you're doing it in the right country, then licensing is not a hassle. It gives you due diligence and you can show that to any company:- ‘I’m OK, I’m licensed in this country.’ Otherwise, if you are not licensed at all, potential partners will have a lot of questions, starting with, ‘Where are your servers?’ and so on.”

While Dan admits that licensing consumes a lot of human and financial resources, ultimately it can be a huge win, and if he does move the business from Romania to Luxembourg it means the company is already ‘in Europe’ – that is, in a second country in Europe. “It’s way easier when you’re in the local market for people to have trust in you. But as soon as you step outside your own country, licensing, and everything else related to licensing is very important,” he says. So a Romanian Fintech and RoFin member could soon become a Luxembourg company – a potential loss to the local ecosystem, or just a natural product of outgrowth? When you have ambition, it has to be expressed wherever the opportunity arises.

PayPact is not Dan’s first enterprise. He previously ran road toll company Scala, offering drivers in Romania the Roviniete payment system. “I exited at the end of 2018, but we built that business from scratch and it was – more or less – what we’re now doing with PayPact, if you look at the big picture. We’re taking an offline service and transforming it into a digital experience.”

Before Dan became involved with road tolls, drivers had to stop at a gas station to buy a pass, and long lines would form, with drivers required to present the registration papers for the cashier to manually insert details such as the vehicle chassis number. “This is what I like to do,” Dan says: “Solve a real problem, because then you get satisfaction. Clients write to say, ‘Thank you so much. You helped me with a hassle that was always a problem before.’ Then it’s not a problem any more.”

He gives another example, of being co-founder of an SMS ticketing company, before apps, cards and touchless payments were a trend. To travel on a public bus, it was necessary to buy a physical ticket, “Remember, you actually got a ticket?” Dan laughs.

His SMS ticketing solution helped people solve a pain point and is still an active company, present in Bucharest, Cluj Napoca and other cities where, “People love to pay with SMS. If you're doing a solution that’s very intuitive, then it will be used for a long period, no matter what new trends come along.”

Dan also successfully exited that company, but the knowledge and experience gained stood him in good stead to set up PayPact. So what’s the new operation all about? PayPact

PayPact

“PayPact is a solution. It’s a progressive web app, if you’re familiar with the term. It can be accessed from the web, and it digitalizes the claim process for the client, starting from the notification of the loss, and ending with the payment of the claim.” We’re talking here of car insurance, but the service will also be developed for households. If there is no contest about the nature of the accident, the customer then receives settlement payment within 48 hours. This strikes me as remarkably speedy, having been on the wrong end of insurance claims lasting months.

PayPact can’t be a ‘one size fits all’ solution, and has to be adapted to different markets. There are issues around car and household insurance in Luxembourg for example, which differ from the situation in Romania. “In Luxembourg the insurance market doesn’t have a payment problem. But it has a digitizing problem, which is a minus. So it needs improvement on that side.”

Dan poses the rhetorical question, “What do guys that are now 15-17 want? – They want instant gratification, because this is something that the online market has taught them. You want to buy something – you can buy it in installments. You want to watch a movie – you pay with your card or your wallet, and that’s it, you have Netflix.”

Compare and contrast to making an insurance claim, at least before PayPact: A relatively minor car crash occurs. No-one is hurt, but the vehicles are damaged. There are now a whole heap of things that have to be done to register the crash with the insurance company and have the damage assessed by a repairer. There are driver details to be sent, vehicle details such as that 17-character chassis number, and often much of this may have to be done at the site of an accident. How capable are any of us in navigating apps or call center ‘helplines’ 10 minutes after crashing our vehicle? The answer is, Not very.

The PayPact solution uses Robotic Process Automation – RPA – to help fill out the required data on the insurance company’s website, and to confirm the claim with the client. In the past the customer would then need to have their wrecked car taken to a repair shop, and get an estimate for the cost of fixing it. Now with the information sent, including photographs, an evaluation is made through the app for minor claims, or medium claims that have only external damage. The aim is to quickly arrive at a fair price for both insurer and insured. For example in some European countries it’s quite common for repairers to offer second hand parts, and this can be factored in by PayPact ‘splitting the difference’ between the cost of new parts, and used parts.

“The important thing is how you manage the claim,” Dan explains, with enthusiasm. “Because this is the moment when the client has a problem. When you’re buying your insurance, you can do it online and it takes five minutes. But this is not what is being sold. The sale is about, in the case of an accident occurring, that the customer will be reimbursed. So they’re being sold a promise, and the promise needs to be fulfilled. We achieve that at speed by digitizing all the processes.”

By far the biggest volume of cases in car insurance is in small claims, with a huge amount of paper generated and time consumed. And this is for an average payment claim of around €2,000 in the CEE region, which compared to the cost and hassle-factor for everyone involved is not actually a big sum. In fact it’s so relatively small, says Dan, that issues of fraud are almost non-existent, thereby removing another layer of traditional insurance company investigation. “People who have these kinds of claims want them solved fast. We have a KYC module implemented. Right now we’re working on instant payment to your bank card through Visa or MasterCard. We have the Optical Character Recognition part to get the data out of the documents. And we have RPA to upload all the data to the insurance company’s website. We're also using AI claim assessing – something that we’re working on right now to compare with human claim assessing. All of this is aggregated into one product, because there are a lot of great technologies involved, like blockchain as a part of our database.” (Blockchain because it must be shown that the data was not altered at any point, so that insurers know that everything reported is absolutely unaltered.)

This all adds up to, “A great service for clients.” And who could disagree with that?

With PayPact a rising star of the Romanian Fintech scene (unless the company becomes Luxembourg-based!), I ask Magda Sandelescu to suggest other Fintechs that the wider world should know about. In her position as Executive Director of the Fintech Association, she doesn’t want to seem like she’s favoring any particular company, but is willing to be drawn a little on the subject, citing PayByFace as an interesting biometrics-based app which enables ‘payment by selfie’. It definitely sounds like something whose time has come, and the company, headed up by Founder and CEO Mihai Draghici, is already expanding outside of Romania.

Then there are iFactor and SeedBlink. iFactor is ‘An innovative online solution that brings together small to medium-sized companies interested in selling their individual outstanding invoices for immediate cash, and investors and banks looking to diversify their asset portofolio with a low-risk investment.’

So that’s factoring services, and seed funding outfit SeedBlink ‘Democratizes investments with access to pre-vetted tech start-ups.’ The company says it is ‘backing visionaries’ and has to date made over 2,000 individual investments, across 15 countries. For an outfit only founded in 2019, SeedBlink is gaining very rapid traction and is ‘The fastest growing investing platform specialized in sourcing, vetting, financing, and scaling European tech start-ups.’

Oh, and then there’s Finqware of course, says Magda, with the company’s CEO also being President of RoFin.

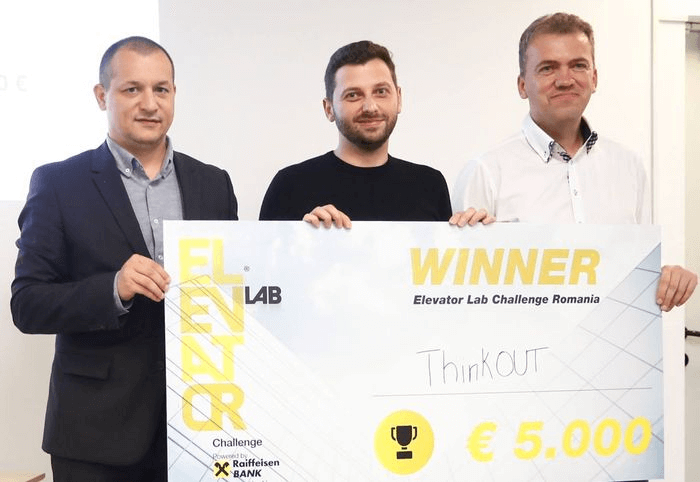

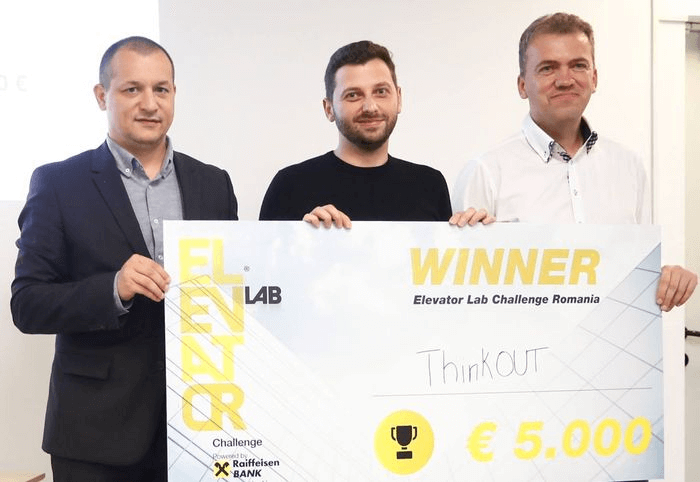

Finqware is also very much on the radar of Andreea-Luminita Porojan at Raiffeisen Bank, but she mentions some other notable Fintechs too. ThinkOut cash flow analysis was the winner of the Raiffeisen 2018 competition, with ‘Clear, real time overview, easy to understand data, and a better way to plan business.’ ThinkOut Co-Founder Cristi Bârladeanu says, ‘We know exactly the burdens small businesses face day by day.

Therefore we decided to create a dedicated platform for SME managers in order to make informed business decisions. ThinkOut is the result of the work of a team of young people motivated to build a product of their own, developing a solution for entrepreneurs which can help them grow their businesses.’

There’s also Druid, a company specialized in automating work with AI chatbots and UiPath RPA. It should also be noted that UiPath is one of the superstars of the Romanian scene, founded in 2005 in Bucharest by Daniel Dines and Marius Tîrca, and now headquartered in New York. It’s another operation that had to leave home to gain international recognition.

Druid was started in 2018 by Liviu Dragan, together with a team of experienced software engineers and business consultants, and has proved to be one of the most successful AI-focused startups in CEE, winning over 50 enterprise customers in just six months, for its chatbot and conversational AI solutions.TypingDNA recognizes people by the way they type at a keyboard – something I seem to remember the CIA pioneering many years ago. Now that is Fintech territory and the techniques are used for authentication and fraud prevention. From as few as four words typed, the platform can recognize every individual on its database. With a $7M Series A in January 2020 led by Gradient VC, Google’s AI venture fund, TypingDNA is tipped as the next Romanian unicorn, after UiPath. Andreea says, “We will see about that, but they certainly have a very interesting solution.”

Andreea also points to the invaluable CEE Fintech Atlas created by Raiffeisen Bank International and its Elevator Lab, which includes data on Romania. An interesting point that all four interviewees refer to is the excellent internet infrastructure in the country, which has helped Fintechs power ahead, and has 85% penetration of the general population. Indeed, the speed and reliability of the internet has been a contributing factor in attracting companies from abroad.

Magda confirms that great internet infrastructure also means there is not necessarily a single center for Fintechs, because they can operate anywhere. Ia?i in eastern Romania, has become a hotbed for tech talents, due to the establishment of the biggest Amazon operation in CEE some seven years ago. She adds that regionalization is not big in Romania, and is often only about where founders have been offered resources to get started. Having said this, she reflects that actually around 90% of Fintechs are Bucharest-based. So perhaps it’s the lure of the capital city buzz that attracts the entrepreneurs. A 2019 Raiffeisen Local Bootcamp

A 2019 Raiffeisen Local Bootcamp

We left Cosmin Cosma explaining his mission towards ‘decluttering’ the banking system. And then what happened?

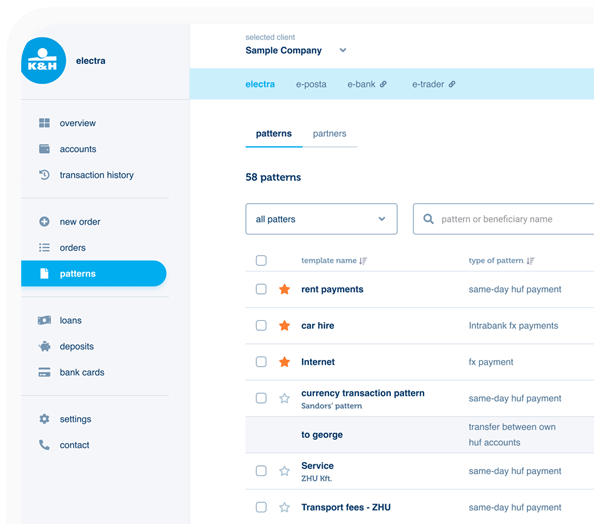

“I thought: look at this PSD2 implementation in Europe, this API interconnectivity between the data of the banks. It is the seed for a transformation that might make the financial life of people wiser, simpler and better. So I put together this idea for Finqware and said to my partners: ‘We are here to put Open Banking to work. This is our mantra and we are here to make things better in the financial ecosystem, putting these pieces of technology together in order to create that.’ So, what we are right now is a technical service provider for banks to consume the data from other banks, democratizing the ecosystem and pushing banks to be open.”

He echoes Magda Sandulescu’s comments about Fintechs being enablers of the banking system. “Banca Transilvania is the biggest bank in Romania and many people and businesses consume data from the other banks. The banks are willing to make that data available, because it’s Banca Transilvania, not Finqware. So we have the right team, and powerful scope. But we also have something of a struggle, being from Central and Eastern Europe. It was a disadvantage at first, but will become a strength in the medium to long term.” Cosmin says that the nearest comparison for Finqware is UiPath, which has reached escape velocity from Central and Eastern Europe.

So when technological innovation comes to market, everything goes well? Not exactly, Cosmin says. Regulators should sustain innovation, as it moves from lab to market, but too often they don’t dare to do so. For example, Romania has only two active e-money licenses. He compares this to how many e-money licenses there are in the UK, guessing that it’s probably three digits versus the Romanian two. (Correct: As of 28 September 2020 there were 198 authorized e-money Institutions, and 32 Small e-money Institutions in the UK. This was the highest number among all jurisdictions in the EAA.)

Cosmin observes that PSD2 is a struggle in Romania. In getting the paperwork together for a Third Party Provider license and PSD2 license, he comments, “The initial file we had to submit was 1,100 pages. Of paper! And then we were asked for clarifications and the second submission was an additional 1,600 pages. It’s not like the regulators don’t want to do it, but they are not used to it, and tend to make things more and more complicated. So, there are a lot of bureaucratic disadvantages. We are in the childhood of everything Fintech-related.” He also mentions the joint conference with Japan Fintech, which was capable of fielding up to 250 companies, compared to Romania’s less than 20 attendees. OK, that’s not exactly comparing like for like, with populations of the two countries being 125 million for Japan, and 20 million for Romania. Nevertheless I take Cosmin’s point – Romania with 16% of Japan’s population only managed 8% of companies at the conference, so there’s still a way to go.

On the upside, “We have a big market, and we have good potential. If the National Bank of Romania gives you authorization, then it is very nice because there is a market, which is like a sponge for technical innovation. You can use it as a sandbox and then export the technology to other countries.” Some of the Finqware team

Some of the Finqware team

Cosmin is on a roll. “Our mantra right now is raising an Open Banking line for Central and Eastern Europe. Among others we are working with Erste Bank, OTP, and Alpha Bank. We have a European seal of excellence from the European Commission. We are supported by both Google and Microsoft because we are doing cloud services, and the banks are buying cloud services. Usually the banks are very reluctant to use the cloud but they love us because they can showcase with us.”

“We have a vision on Open Banking, and we are in the early stages, but the real thing which will start this year is from data to information. That is the point at which data becomes valuable in a business setup, which sets the stage for the connected data system.”

He draws breath, but only for a moment because there’s so much to tell in so little time!

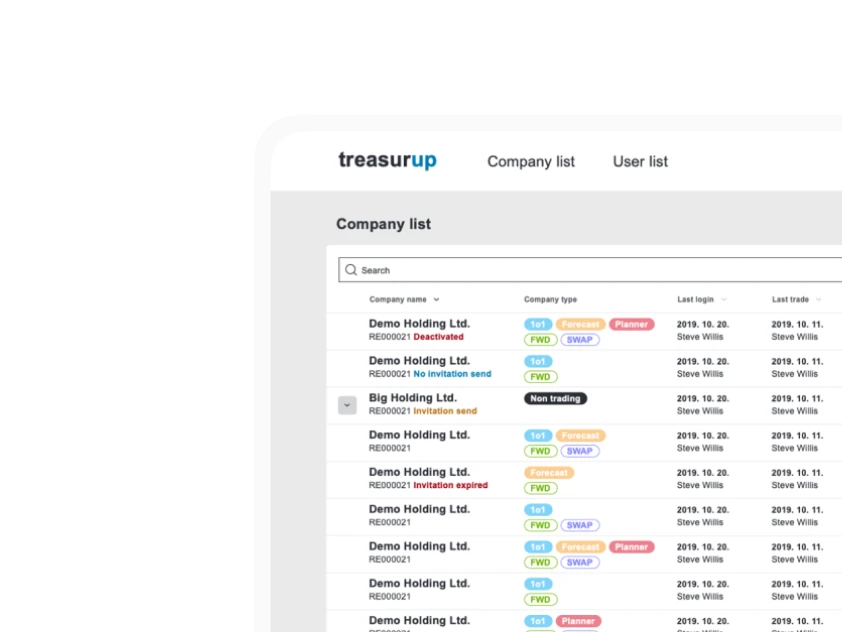

“We are also preparing to launch a product which is under the hood right now. But it will create the opportunity for automating the financial operations of enterprises, called Finqware API. It’s like the aggregation ecosystem solution for CEE Open Banking. Then the next stage is to go for the data driven optimization game with Finq Treasury, which is currently in development. We want to become the preferred provider of financial data for mid market companies at the global scale.”

Wow, OK! I have a feeling we’ll all be hearing much more from Finqware, certainly if Cosmin Cosma has anything to do with it. For a man described by a colleague as ‘The Lizard King’, (after Jim Morrison, singer with The Doors), Cosmin has developed a reputation as a do-anything entrepreneur. So I’m a little surprised that rather than having the ambition to rule the world, his personal motivation is more … Well, let’s just say more philosophical. “I’m doing all of this to prove to my kids – I have two kids – that it is possible to do whatever you want. You don’t need to be a 9-to-5, cradle-to-grave employee. It is possible to have an understanding of the world, and do something with it.”

Dan Cobeanu is a dedicated and enthusiastic traveler, so the pandemic hasn’t been kind to him from that point of view. While he was once inclined to beach holidays, he picked up from his wife a curiosity about the traditions and cultures of places they visit (now with their 7-year-old son too). “If you are open enough, you see so many things that are very interesting.” Of particular fascination to Dan is how people pay in different countries and what systems are used, which he says are also culture-related. “When I'm traveling somewhere, I want to know, what’s the history and the culture? How are people positioned there? It’s a business study.” He’s the man on the beach, apparently sunbathing, but actually always searching for a better angle to improve payment systems.

At the start of my meeting with Magda Sandulescu, I noticed that on a bookshelf behind her was a movie clapper board. That’s the thing used by filmmakers to mark ‘Scene 3 take 5’, and so on. Was it just for decoration?

Magda says that one small satisfaction of going through the pandemic is that it enabled her to watch a movie every day, but she’s not merely a fan. With a long background in theater, movies, and other cultural activities, she’s also looking to Produce and Direct her own feature film, and is part of the production house run by the renowned Producer Ada Solomon, 2021 Golden Bear winner at Berlinale Film Festival.

And Andreea-Luminita Porojan? She’s sporty, and loves skiing (along with her family, including boys 13 and 9), as well as swimming and biking. We get to exchanging a little about our experience of running, and I tell her of my very late arrival to the joys of half-marathons. Will I be ready for the next Budapest run after a twisted ankle? “You must trust your feet,” Andreea advises, who pre-Covid ran at least two half-marathons each year in Bucharest. When she’s skiing, running, and all the rest, she says “I have to trust my feet, and then I overcome my fears.”

It seems to be a suitable summary of my brief visit to Romania, where each of the contributors in their different ways demonstrate a belief in and commitment to the advancement of Fintechs. As Andreea observed, Fintech is growing, “Not so much in numbers, but for sure in maturity.”

I am plunged straight into philosophy by the Co-Founder and CEO of Finqware, one of Romanian Fintech’s brightest offerings. Perhaps it’s not entirely surprising, since Cosmin Cosma started out studying Heidegger Phenomenology at university, and says that through this he began to understand ‘the real meaning of things’.

From philosophy to banking is something of a leap, but Cosmin made it effortlessly in 2005 when he pitched for a franchise of an ING Bank branch, mainly on the basis of, ‘Well, why not?’ ING was opening branches around Romania, and Cosmin suggested that as he had no family at the time, no commitments, and was willing to locate anywhere, he was probably worth trying.

And so a local branch bank manager with a philosophy degree and zero banking knowledge started work, and made a success of his business, selling it on again after only two years. He’d rapidly become a respected member of the local community and had learned a lot about financial ecosystems, but realized that being a big fish in a small pond was not really his scene. “If I want to play football, I don't want to play in the local schoolyard, but in the world championship,” he laughs.

Cosmin Cosma

Cosmin CosmaThe urge to declutter

Following Cosmin’s subsequent journey would require a chapter of its own, but involves engagement with corporates, banks, gaining a double MBA ‘on my own money,’ as well as becoming a go-to conference speaker, after helping clean up the mess left by the 2008 financial crisis. Throughout, his fascination with banking grew and those philosophical questions demanded answers. He questioned the fundamentals, such as what a bank branch is. “Philosophically, a branch is a place a customer goes to get or give some papers. So it's paper-moving related. But we started to see from 2010 onwards that paper-moving will stop.” He likens it to restrictions on diesel cars, “We all agree diesel motors should stop, and paper-moving should stop too.”

He saw the inertia in the financial ecosystem, and imagined the next thing: for example, that branches would become coffee shops, encouraging better banking interaction. And if their core purpose was to deposit and receive paper, what would happen once the paper was no longer there? He started to think how technology could make this happen, decreasing the bureaucracy within banking institutions, and in the banking system itself.

Further factors pushing Cosmin to find new solutions were the stories he had witnessed while he was responsible for distressed assets and debt collection for GE Capital, Garanti Bank, and Volksbank Romania. “I saw guys with a PhD in computer science losing their house, because some foolish uneducated banker had persuaded them to take out a big loan in Swiss francs.”

An issue he observed at first hand was that the banking system depends on information asymmetry between the customer and the bank, “The banks know something which the customers don't know, and most of their profits are from the asymmetrical balance of knowledge. This information asymmetry can create awful situations.” Such as people losing their homes? “Exactly.”

The stage was set for a Fintech that would declutter bureaucracy in the banking system and help provide for more open and responsible banking.

The urge to partner

Andreea-Luminita Porojan has known Cosmin Cosma’s Fintech startup since 2018 when FINQ – the initial version of Finqware – participated in the Elevator Lab Competition organized by Raiffeisen Bank locally in Romania. Andreea is a Fintech Partnerships Manager at Raiffeisen Bank Romania, responsible for an annual Program for promising Fintechs by the RBI’s Elevator Lab Partnership Program. In 2020 Raiffeisen’s Elevator Ventures VC Fund made its first investment in a Romanian Fintech company – Finqware. CEO, Cosmin Cosma. 2018 – Local Elevator Lab Challenge – FINQ won 2nd place and ‘Local Hero’ prize

2018 – Local Elevator Lab Challenge – FINQ won 2nd place and ‘Local Hero’ prizeBut aren’t Fintechs the opposition, especially when an operation like Finqware seems so focused on upending the way banking business has been done for so long? Andreea disagrees, and points out that Fintechs and banks are – or should be – allies, “At Raiffeisen we believe in partnerships.”

Fintechs can contribute innovative solutions and foster more rapid implementation of solutions, whereas, “A bank is like an elephant – a big organization with a lot of people and processes, which are well organized or have a predefined setting. Fintechs are more agile, due to having smaller teams.” Often, Andreea says, Fintechs do not have to work like a bank, where there are separate attributions such as legal teams, compliance teams, and security teams.

Raiffeisen’s Fintech support program began in Romania in 2018, with a Challenge competition focused on solutions for companies. The following year came the first Fintech Bootcamp, where wannabes were helped in their understanding of what developing and growing a Fintech startup actually means. This included how to build the startup, all the legal implications, creating a unique selling proposition, branding, marketing plans, and also when it is suitable to accept VC funding, and how to pitch in front of a VC. In other words, everything that a wise mentor can impart in the way of experience and useful knowledge.

Getting on Tracks

Then came the competitions, which the Raiffeisen team calls ‘Tracks’, each year featuring a different theme. For instance, 2020’s competition was specific to data, with data analytics and loyalty solutions for companies. This was co-organized with Raiffeisen Bulgaria colleagues and was open to Fintechs from all over the world. More than 80 companies applied, of which 40% were from Romania. As Andreea says, “That proved we have a very good Fintech market here in Romania.”

And it’s growing? Not so much in numbers, she replies, but for sure in maturity. “Their solutions are interesting for the market. Startups sometimes do not last very long. If they do not have good solutions, they usually die after one year.” Most of the companies that Raiffeisen Romania have mentored or partnered with are more mature.

Despite this encouraging climate for Fintechs, there are restrictions to growth, which must be overcome. Most Fintechs are looking beyond Romania and have offices outside of the country, Finqware being an example. That’s partly because of their expansion plans, but Andreea says a factor is also that the national bank and regulator have been slower in implementing PSD2 compared to other countries. As a result some Fintechs weren't able to develop their products as quickly as they wanted to, and have had to seek the necessary certification and accreditation from outside (a point confirmed by Cosmin Cosma).

Fortunately the newly created Romanian Fintech Association is also now engaged with these issues.

The stable/stasis paradox

As Executive Director at RoFin Tech – the Romanian Fintech Association – Magda Sandulescu is well placed to offer a view on regulatory matters. She has a long history as a banker herself and has an understanding of the system, from the inside out.

Founded in 2020, RoFin is a professional entrepreneurial organization focused on helping Fintech startups and scaleups expand internationally, and bringing more people into the space of Fintech. RoFin is a founding member of the European Digital Finance Association (EDFA), the representative body for digital finance and Fintech firms across Europe. Current activities are concentrated on developing the regulatory frameworks on Fintechs, by participation in working groups made at European level by EDFA, and with Romanian regulatory bodies. Developing international relations and running monthly networking meetup events designed for the Fintech community are also part of the RoFin remit.

Magda says that the regulators are open to discussion, but points out the paradox that the Romanian banking market has historically been a very stable one, in part due to the merits of the National Bank of Romania, which has consistently worked to make the environment very steady and predictive. This is something that Cosmin Cosma also observed – that the financial crisis which hit Romania around 2010-2011 was actually the first to affect the Romanian banking sector, while other countries had suffered earlier, and for longer.

Magda Sandulescu

Magda SandulescuMagda adds, however, that the prized stability also came with aspects of very conservative legislation. That was a healthy enough approach for both consumers and most players in the market, but Fintechs needed different treatment. This is because Fintechs in general are only enablers of certain parts of the services offered in the banking market, and are not players themselves. So rules need to be adapted, with different types of risk tests applied to Fintech players, including having a sandbox in place.

“Currently, there are efforts on both sides. The regulators are aware that the market is evolving, and technology is everywhere. Everyone has technology in their pocket now, available from the first moment of every day. Naturally the regulators know this, and we are in permanent dialogue with them. We hope that very soon there will be some progress to announce.”

Magda is wary of saying more about deals yet to be done, but says that initiatives are concentrated in enabling technology access in financial services, both in insurance and banking. “Based on the experience of our members, we are putting various proposals to the National Bank, as well as the Financial Supervision Authority. This is for the insurance, reinsurance, and capital markets. We are trying to initiate modifications to both primary legislation and secondary legislation in order to allow Fintechs to bring the benefits of technology to end users.” What the Fintechs bring to the potential regulatory changes is a practical working knowledge of European regulations – including PSD2 – because they are already engaged beyond Romanian borders. So, in this sense, the regulator can appraise the experience of Fintechs in different countries across Europe.

The scope of RoFin

Andreea-Luminita Porojan’s comment about Romanian Fintechs becoming more mature, but not necessarily more numerous, is expanded on by Magda Sandulescu. She says that currently RoFin’s 18 members are the result of being limited by a filtering process based on two criteria: First, having a licensed product from which they are already obtaining revenue. Second, at least one founding member must be Romanian. “Our members are representative of different verticals: Lending and crowdfunding, personal finance verticals and payments and wallets. We are also involved in investment and wealth management, and have one member active in insurtech. Currently there’s no blockchain.”

And the objectives of the new association? As we’ve already heard, a crucial point is actively working on changing legislation to support and better enable Romanian Fintechs.

A second goal is to develop international relations and expand the Romanian Fintech universe. 2021 saw the signing of MOUs with The Lhoft – The Luxembourg House of Financial Technology – and the Fintech Association of Japan. RoFin will maintain the effort to open contacts across different markets of interest for its members.

Ongoing education programs are the third goal of the Romanian Fintech Association and – Covid allowing – with conferences and other live events. Magda considers that the first year of the association went reasonably well, considering the disruption caused by the pandemic, and the challenges of only being able to meet virtually. RoFin has also cooperated closely with Raiffeisen Bank on their elevator program, and the Fintech competitions. So in a difficult time for everyone, the headline goals are being met.

But let’s visit that insurtech member who was helped on the way by The Luxembourg House of Financial Technology. What’s the story there?

Looking to Luxembourg?

Dan Cobeanu is CEO and Co-Founder of PayPact, which aims to help ‘Insurance clients get compensation quickly after covered incidents. Save time by making the insurance claim via our web app and get the money for repairs directly from PayPact within 48 hours of approval by your insurer.’That seems clear enough, but what about the Luxembourg connection? “Well, we should have deployed in July 2021,” says Dan. “But then we were accepted onto this LHoft accelerator program in Luxembourg and so we focused all our efforts there. It was such a great experience, like boot camp, even though it was online. There were up to eight hours daily where we had VCs, professionals from Deloitte and KPMG, as well as Banking and Insurance regulator representatives speaking with us. We had the financial authorities from Luxembourg to talk about what you need to do to register in Luxembourg, and that was very helpful. So we postponed the launch, dependent on discussions with the Luxembourg authorities, and the decision of whether we’ll start in Luxembourg or Romania.”

Dan Alexandru Cobeanu

Dan Alexandru CobeanuSo this seems like an example of a forward-looking Romanian Fintech that is limited by the current somewhat restrictive regulatory framework in the home country. It seems that it’s easier or more encouraging to look outside, “We're thinking of incorporating in Luxembourg, as part of the program.” Dan acknowledges. Whereas in Romania, “We were seeing that people are afraid of licensing. However, now we see that licensing actually gives you power. If you're doing it in the right country, then licensing is not a hassle. It gives you due diligence and you can show that to any company:- ‘I’m OK, I’m licensed in this country.’ Otherwise, if you are not licensed at all, potential partners will have a lot of questions, starting with, ‘Where are your servers?’ and so on.”

While Dan admits that licensing consumes a lot of human and financial resources, ultimately it can be a huge win, and if he does move the business from Romania to Luxembourg it means the company is already ‘in Europe’ – that is, in a second country in Europe. “It’s way easier when you’re in the local market for people to have trust in you. But as soon as you step outside your own country, licensing, and everything else related to licensing is very important,” he says. So a Romanian Fintech and RoFin member could soon become a Luxembourg company – a potential loss to the local ecosystem, or just a natural product of outgrowth? When you have ambition, it has to be expressed wherever the opportunity arises.

Taking a toll

PayPact is not Dan’s first enterprise. He previously ran road toll company Scala, offering drivers in Romania the Roviniete payment system. “I exited at the end of 2018, but we built that business from scratch and it was – more or less – what we’re now doing with PayPact, if you look at the big picture. We’re taking an offline service and transforming it into a digital experience.”

Before Dan became involved with road tolls, drivers had to stop at a gas station to buy a pass, and long lines would form, with drivers required to present the registration papers for the cashier to manually insert details such as the vehicle chassis number. “This is what I like to do,” Dan says: “Solve a real problem, because then you get satisfaction. Clients write to say, ‘Thank you so much. You helped me with a hassle that was always a problem before.’ Then it’s not a problem any more.”

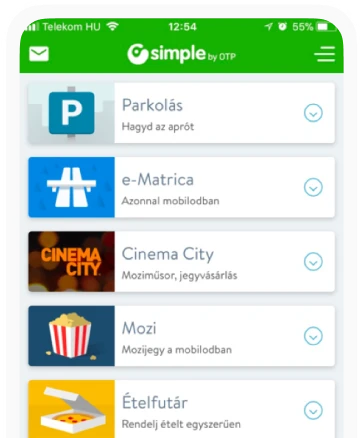

He gives another example, of being co-founder of an SMS ticketing company, before apps, cards and touchless payments were a trend. To travel on a public bus, it was necessary to buy a physical ticket, “Remember, you actually got a ticket?” Dan laughs.

His SMS ticketing solution helped people solve a pain point and is still an active company, present in Bucharest, Cluj Napoca and other cities where, “People love to pay with SMS. If you're doing a solution that’s very intuitive, then it will be used for a long period, no matter what new trends come along.”

Dan also successfully exited that company, but the knowledge and experience gained stood him in good stead to set up PayPact. So what’s the new operation all about?

PayPact

PayPactCrash, bang, mobile phone …

“PayPact is a solution. It’s a progressive web app, if you’re familiar with the term. It can be accessed from the web, and it digitalizes the claim process for the client, starting from the notification of the loss, and ending with the payment of the claim.” We’re talking here of car insurance, but the service will also be developed for households. If there is no contest about the nature of the accident, the customer then receives settlement payment within 48 hours. This strikes me as remarkably speedy, having been on the wrong end of insurance claims lasting months.

PayPact can’t be a ‘one size fits all’ solution, and has to be adapted to different markets. There are issues around car and household insurance in Luxembourg for example, which differ from the situation in Romania. “In Luxembourg the insurance market doesn’t have a payment problem. But it has a digitizing problem, which is a minus. So it needs improvement on that side.”

Dan poses the rhetorical question, “What do guys that are now 15-17 want? – They want instant gratification, because this is something that the online market has taught them. You want to buy something – you can buy it in installments. You want to watch a movie – you pay with your card or your wallet, and that’s it, you have Netflix.”

Compare and contrast to making an insurance claim, at least before PayPact: A relatively minor car crash occurs. No-one is hurt, but the vehicles are damaged. There are now a whole heap of things that have to be done to register the crash with the insurance company and have the damage assessed by a repairer. There are driver details to be sent, vehicle details such as that 17-character chassis number, and often much of this may have to be done at the site of an accident. How capable are any of us in navigating apps or call center ‘helplines’ 10 minutes after crashing our vehicle? The answer is, Not very.

Fulfilling a promise

The PayPact solution uses Robotic Process Automation – RPA – to help fill out the required data on the insurance company’s website, and to confirm the claim with the client. In the past the customer would then need to have their wrecked car taken to a repair shop, and get an estimate for the cost of fixing it. Now with the information sent, including photographs, an evaluation is made through the app for minor claims, or medium claims that have only external damage. The aim is to quickly arrive at a fair price for both insurer and insured. For example in some European countries it’s quite common for repairers to offer second hand parts, and this can be factored in by PayPact ‘splitting the difference’ between the cost of new parts, and used parts.

“The important thing is how you manage the claim,” Dan explains, with enthusiasm. “Because this is the moment when the client has a problem. When you’re buying your insurance, you can do it online and it takes five minutes. But this is not what is being sold. The sale is about, in the case of an accident occurring, that the customer will be reimbursed. So they’re being sold a promise, and the promise needs to be fulfilled. We achieve that at speed by digitizing all the processes.”

By far the biggest volume of cases in car insurance is in small claims, with a huge amount of paper generated and time consumed. And this is for an average payment claim of around €2,000 in the CEE region, which compared to the cost and hassle-factor for everyone involved is not actually a big sum. In fact it’s so relatively small, says Dan, that issues of fraud are almost non-existent, thereby removing another layer of traditional insurance company investigation. “People who have these kinds of claims want them solved fast. We have a KYC module implemented. Right now we’re working on instant payment to your bank card through Visa or MasterCard. We have the Optical Character Recognition part to get the data out of the documents. And we have RPA to upload all the data to the insurance company’s website. We're also using AI claim assessing – something that we’re working on right now to compare with human claim assessing. All of this is aggregated into one product, because there are a lot of great technologies involved, like blockchain as a part of our database.” (Blockchain because it must be shown that the data was not altered at any point, so that insurers know that everything reported is absolutely unaltered.)

This all adds up to, “A great service for clients.” And who could disagree with that?

Rising stars

With PayPact a rising star of the Romanian Fintech scene (unless the company becomes Luxembourg-based!), I ask Magda Sandelescu to suggest other Fintechs that the wider world should know about. In her position as Executive Director of the Fintech Association, she doesn’t want to seem like she’s favoring any particular company, but is willing to be drawn a little on the subject, citing PayByFace as an interesting biometrics-based app which enables ‘payment by selfie’. It definitely sounds like something whose time has come, and the company, headed up by Founder and CEO Mihai Draghici, is already expanding outside of Romania.

Then there are iFactor and SeedBlink. iFactor is ‘An innovative online solution that brings together small to medium-sized companies interested in selling their individual outstanding invoices for immediate cash, and investors and banks looking to diversify their asset portofolio with a low-risk investment.’

So that’s factoring services, and seed funding outfit SeedBlink ‘Democratizes investments with access to pre-vetted tech start-ups.’ The company says it is ‘backing visionaries’ and has to date made over 2,000 individual investments, across 15 countries. For an outfit only founded in 2019, SeedBlink is gaining very rapid traction and is ‘The fastest growing investing platform specialized in sourcing, vetting, financing, and scaling European tech start-ups.’

Oh, and then there’s Finqware of course, says Magda, with the company’s CEO also being President of RoFin.

Finqware is also very much on the radar of Andreea-Luminita Porojan at Raiffeisen Bank, but she mentions some other notable Fintechs too. ThinkOut cash flow analysis was the winner of the Raiffeisen 2018 competition, with ‘Clear, real time overview, easy to understand data, and a better way to plan business.’ ThinkOut Co-Founder Cristi Bârladeanu says, ‘We know exactly the burdens small businesses face day by day.

Therefore we decided to create a dedicated platform for SME managers in order to make informed business decisions. ThinkOut is the result of the work of a team of young people motivated to build a product of their own, developing a solution for entrepreneurs which can help them grow their businesses.’

There’s also Druid, a company specialized in automating work with AI chatbots and UiPath RPA. It should also be noted that UiPath is one of the superstars of the Romanian scene, founded in 2005 in Bucharest by Daniel Dines and Marius Tîrca, and now headquartered in New York. It’s another operation that had to leave home to gain international recognition.

Druid was started in 2018 by Liviu Dragan, together with a team of experienced software engineers and business consultants, and has proved to be one of the most successful AI-focused startups in CEE, winning over 50 enterprise customers in just six months, for its chatbot and conversational AI solutions.TypingDNA recognizes people by the way they type at a keyboard – something I seem to remember the CIA pioneering many years ago. Now that is Fintech territory and the techniques are used for authentication and fraud prevention. From as few as four words typed, the platform can recognize every individual on its database. With a $7M Series A in January 2020 led by Gradient VC, Google’s AI venture fund, TypingDNA is tipped as the next Romanian unicorn, after UiPath. Andreea says, “We will see about that, but they certainly have a very interesting solution.”

The benefits of good infrastructure

Andreea also points to the invaluable CEE Fintech Atlas created by Raiffeisen Bank International and its Elevator Lab, which includes data on Romania. An interesting point that all four interviewees refer to is the excellent internet infrastructure in the country, which has helped Fintechs power ahead, and has 85% penetration of the general population. Indeed, the speed and reliability of the internet has been a contributing factor in attracting companies from abroad.

Magda confirms that great internet infrastructure also means there is not necessarily a single center for Fintechs, because they can operate anywhere. Ia?i in eastern Romania, has become a hotbed for tech talents, due to the establishment of the biggest Amazon operation in CEE some seven years ago. She adds that regionalization is not big in Romania, and is often only about where founders have been offered resources to get started. Having said this, she reflects that actually around 90% of Fintechs are Bucharest-based. So perhaps it’s the lure of the capital city buzz that attracts the entrepreneurs.

A 2019 Raiffeisen Local Bootcamp

A 2019 Raiffeisen Local BootcampWiser, simpler, better

We left Cosmin Cosma explaining his mission towards ‘decluttering’ the banking system. And then what happened?

“I thought: look at this PSD2 implementation in Europe, this API interconnectivity between the data of the banks. It is the seed for a transformation that might make the financial life of people wiser, simpler and better. So I put together this idea for Finqware and said to my partners: ‘We are here to put Open Banking to work. This is our mantra and we are here to make things better in the financial ecosystem, putting these pieces of technology together in order to create that.’ So, what we are right now is a technical service provider for banks to consume the data from other banks, democratizing the ecosystem and pushing banks to be open.”

He echoes Magda Sandulescu’s comments about Fintechs being enablers of the banking system. “Banca Transilvania is the biggest bank in Romania and many people and businesses consume data from the other banks. The banks are willing to make that data available, because it’s Banca Transilvania, not Finqware. So we have the right team, and powerful scope. But we also have something of a struggle, being from Central and Eastern Europe. It was a disadvantage at first, but will become a strength in the medium to long term.” Cosmin says that the nearest comparison for Finqware is UiPath, which has reached escape velocity from Central and Eastern Europe.

Daring to innovate

So when technological innovation comes to market, everything goes well? Not exactly, Cosmin says. Regulators should sustain innovation, as it moves from lab to market, but too often they don’t dare to do so. For example, Romania has only two active e-money licenses. He compares this to how many e-money licenses there are in the UK, guessing that it’s probably three digits versus the Romanian two. (Correct: As of 28 September 2020 there were 198 authorized e-money Institutions, and 32 Small e-money Institutions in the UK. This was the highest number among all jurisdictions in the EAA.)

Cosmin observes that PSD2 is a struggle in Romania. In getting the paperwork together for a Third Party Provider license and PSD2 license, he comments, “The initial file we had to submit was 1,100 pages. Of paper! And then we were asked for clarifications and the second submission was an additional 1,600 pages. It’s not like the regulators don’t want to do it, but they are not used to it, and tend to make things more and more complicated. So, there are a lot of bureaucratic disadvantages. We are in the childhood of everything Fintech-related.” He also mentions the joint conference with Japan Fintech, which was capable of fielding up to 250 companies, compared to Romania’s less than 20 attendees. OK, that’s not exactly comparing like for like, with populations of the two countries being 125 million for Japan, and 20 million for Romania. Nevertheless I take Cosmin’s point – Romania with 16% of Japan’s population only managed 8% of companies at the conference, so there’s still a way to go.

On the upside, “We have a big market, and we have good potential. If the National Bank of Romania gives you authorization, then it is very nice because there is a market, which is like a sponge for technical innovation. You can use it as a sandbox and then export the technology to other countries.”

Some of the Finqware team

Some of the Finqware teamRolling out the offering

Cosmin is on a roll. “Our mantra right now is raising an Open Banking line for Central and Eastern Europe. Among others we are working with Erste Bank, OTP, and Alpha Bank. We have a European seal of excellence from the European Commission. We are supported by both Google and Microsoft because we are doing cloud services, and the banks are buying cloud services. Usually the banks are very reluctant to use the cloud but they love us because they can showcase with us.”

“We have a vision on Open Banking, and we are in the early stages, but the real thing which will start this year is from data to information. That is the point at which data becomes valuable in a business setup, which sets the stage for the connected data system.”

He draws breath, but only for a moment because there’s so much to tell in so little time!

“We are also preparing to launch a product which is under the hood right now. But it will create the opportunity for automating the financial operations of enterprises, called Finqware API. It’s like the aggregation ecosystem solution for CEE Open Banking. Then the next stage is to go for the data driven optimization game with Finq Treasury, which is currently in development. We want to become the preferred provider of financial data for mid market companies at the global scale.”

Trusting your feet

Wow, OK! I have a feeling we’ll all be hearing much more from Finqware, certainly if Cosmin Cosma has anything to do with it. For a man described by a colleague as ‘The Lizard King’, (after Jim Morrison, singer with The Doors), Cosmin has developed a reputation as a do-anything entrepreneur. So I’m a little surprised that rather than having the ambition to rule the world, his personal motivation is more … Well, let’s just say more philosophical. “I’m doing all of this to prove to my kids – I have two kids – that it is possible to do whatever you want. You don’t need to be a 9-to-5, cradle-to-grave employee. It is possible to have an understanding of the world, and do something with it.”

Dan Cobeanu is a dedicated and enthusiastic traveler, so the pandemic hasn’t been kind to him from that point of view. While he was once inclined to beach holidays, he picked up from his wife a curiosity about the traditions and cultures of places they visit (now with their 7-year-old son too). “If you are open enough, you see so many things that are very interesting.” Of particular fascination to Dan is how people pay in different countries and what systems are used, which he says are also culture-related. “When I'm traveling somewhere, I want to know, what’s the history and the culture? How are people positioned there? It’s a business study.” He’s the man on the beach, apparently sunbathing, but actually always searching for a better angle to improve payment systems.

At the start of my meeting with Magda Sandulescu, I noticed that on a bookshelf behind her was a movie clapper board. That’s the thing used by filmmakers to mark ‘Scene 3 take 5’, and so on. Was it just for decoration?

Magda says that one small satisfaction of going through the pandemic is that it enabled her to watch a movie every day, but she’s not merely a fan. With a long background in theater, movies, and other cultural activities, she’s also looking to Produce and Direct her own feature film, and is part of the production house run by the renowned Producer Ada Solomon, 2021 Golden Bear winner at Berlinale Film Festival.

And Andreea-Luminita Porojan? She’s sporty, and loves skiing (along with her family, including boys 13 and 9), as well as swimming and biking. We get to exchanging a little about our experience of running, and I tell her of my very late arrival to the joys of half-marathons. Will I be ready for the next Budapest run after a twisted ankle? “You must trust your feet,” Andreea advises, who pre-Covid ran at least two half-marathons each year in Bucharest. When she’s skiing, running, and all the rest, she says “I have to trust my feet, and then I overcome my fears.”

It seems to be a suitable summary of my brief visit to Romania, where each of the contributors in their different ways demonstrate a belief in and commitment to the advancement of Fintechs. As Andreea observed, Fintech is growing, “Not so much in numbers, but for sure in maturity.”