Percapita

Launched in 2023, Percapita delivers financial services in a way that is meaningful and useful, and making you confident about how you manage your day-to-day finances.

The Case

Percapita is a new kid on the block of the United States financial scene, designed to specifically address issues for hourly workers and the people in their lives, many of whom are underserved by traditional financial institutions, and to provide them with new products and financial services, at a reasonable price. Or, as the company website states, 'Percapita is a digital company changing how people access financial products and services by making them more affordable and accessible to everyone.' As Vice President, Financial Services Marketing, Kelly Holmes is keen to clarify, Percapita is not a Fintech as such, and definitely not a bank. The company's deposit accounts are backed by the well-established Sutton Bank which claims 'Old-fashioned innovation' as its strapline. In some respects Percapita is analogous to neobanks, but with the vital difference that it is predicated on social inclusion. While other financial companies may acknowledge the need to assist unbanked and underbanked people, this is the whole founding basis of what Percapita is doing. As Kelly explains, in the USA there are vast numbers of people who are in work, and yet who may live 'from paycheck to paycheck', often falling short before the next monthly wage payment. In order to stay afloat, they may go to check cashing institutions that advance money against earnings, but which charge a high premium for the privilege. Meanwhile many banks simply decline loans, or if given, charge an untenably high premium.

Kelly Holmes

Kelly HolmesFrom banks to basketball courts

It was against this background that Percapita's CEO, Alex Ehrlich began the process which would lead to the founding of the company, and which at the close of 2023 is moving into operational mode. According to Mr. Ehrlich's bio, he states, "Talent is equally distributed, but opportunity is not. I founded Percapita with the aim of creating an equitable financial services firm that can play a role in addressing America's unsustainable income inequality. Percapita is the product of lessons learned in banks, restaurant kitchens, basketball courts, shelters, and every place where people work to build better lives for their families." Around him, Alex gathered a similarly altruistic, but highly experienced team of experts in financial companies and products, and began to formulate a plan to help 'Close the gap between financial services and financial wellness.'

Alex Ehrlich

Alex EhrlichThe financial wellness platform

This concept of financial wellness is fundamental to the new digital company. It's not 'just' a stopgap to tide people over to their next paycheck. There is a strong educational theme, which underscores the ethos of Percapita, encouraging the idea of financial health. Taking a look at the company website reveals a comprehensive approach to services which help teach users about how to manage their finances more effectively, even including gamification to engage and educate customers. This can contain modules about add-on services such as insurance issues, and in the future these will likely expand as third party providers come onboard. Kelly Holmes explains, "We're showing people how using certain products and services that we offer can help them budget and help them save. It's about actually integrating our products into the financial wellness platform. That way, people have the right tools to help them build. So our proposition is a little bit different than others, because it's not just education. It's how you can actually put that into place in the real world, in your everyday life."

B2B2C model

B2B2C modelMeaningful and useful financial services

Melissa Fox, Head of Deposit Products and Payment Solutions at Percapita, came on board in March 2021 following her initial engagement as a consultant to the fledgling company, when the idea was - at first - to launch a credit card product. "But as we dug deeper into customer needs, we realized that the start had to be more basic, with tools for saving, spending, and then getting to borrowing." So the approach was to center on customers who were not financially literate? Melissa disagrees strongly with that, "Many of our customers are actually very financially savvy because they have to manage their money and their options quite carefully. Some of them are indeed new to banking, so, there is an education component for some people, but I wouldn't say our customer base is unsophisticated." She says that banking terminology and jargon can be inaccessible, which is why Percapita's mission is to use everyday language to explain things in an intuitive way that might not otherwise be clear. Diversity and inclusion are also key Percapita principles which are not always present in the mass market. Banks and financial companies are typically focussed on affluent segments of the population, and Melissa points out that potential Percapita customers have needs that may therefore get 'glossed over'. "We want to center on their needs and experiences and build products specifically aimed at addressing those needs and pain points. Whether that's from a cost perspective, or a tools and planning perspective, from an education perspective, or a trust perspective. We deliver financial services in a way that is meaningful and useful."

Melissa Fox

Melissa FoxBreaking the debt cycle

So there's a clear need for end-users to receive financial wellness education, and much better management of their income, which Percapita believes can best be done by working with employers. A key offering is Early Wage Access, or EWA, which allows an advance on earnings based on actual wage and time system data provided by employers. Businesses can sign up to the Percapita platform, or even have their employees request company membership. The result will be fewer employees forced to go to payday lenders, and - as the word spreads - more and more employer partners signing up. As Melissa explains, with a typical payday loan, if it is repaid within the timeframe, it's an expensive loan but still OK if you do pay it off. The problem is that if the loan is not repaid on time then there are penalty fees on the back end that make the loan balloon, and "It can absolutely suffocate people and trap them in a debt cycle."

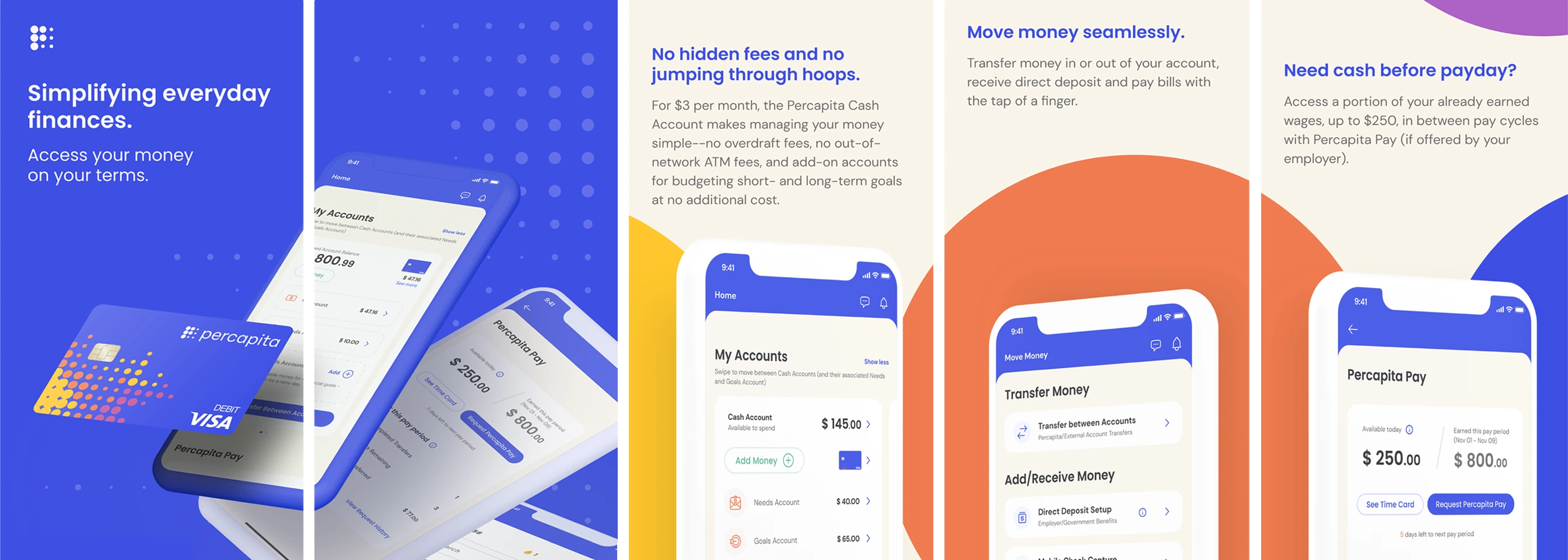

The Percapita Pay service is available through their partnership with a third-party provider, Immediate Solutions, Inc. There is no cost to employers, and employees simply pay a $3 fee per EWA request. So Percapita is a purely philanthropic institution? While it may look like that at first sight, Percapita is not a non-profit organization. The company's goal is to provide affordable financial services with clear and transparent pricing so customers can make informed decisions about their options. The company makes money through a $3 monthly fee on their Cash Account offering, which replaces out-of-network ATM fees, overdraft fees, and other hidden "gotcha" fees that bank customers are often not aware they've incurred until after they've incurred them. Percapita also earns interchange income from debit card purchases through the VISA network and a revenue share on some transaction fees, which are disclosed up-front at the time of the transaction.

The business seems to be ultimately about scale, however Melissa Fox is cautious about any suggestion of explosive growth. "Our goal is not to open up millions of accounts. We are not at this point a direct-to-consumer model. Our model is actually a B2B2C model where we are partnering with channel partners and offering the Percapita platform as an employee benefit. So a lot of our marketing is through those channels. From a business development perspective, we have to sign up the employers, and then work on getting the product into the hands of their employees."

Cohesive and intuitive

Percapita is starting to roll out its offer, although there are still a number of small 'kinks' that need straightening, which is why it's a soft launch, and not one done with all trumpets blaring. The expectation is that sometime around Spring 2024 things will be humming along, and the company will be scaling up. Melissa says, "My focus is on completing the build of the initial product set. We still have some additional functions and enhancements that we're working on to complete with the design team, and then we'll start to look at the next features and products that we're going to add to the platform. We will deliver that entire experience in a way that feels cohesive, easy to navigate and intuitive - when it's not just one product, but multiple options that people can choose. I'm excited about the challenge of building that out, not just as an app but as a platform experience."

Currently, the number of end users is in the hundreds, with the signed-up channel partners around five, but this could rapidly expand in the coming year. Just think of many major employers across the USA, with huge numbers of relatively low-paid wage-earners, and the benefits to both sides that can accrue from using Percapita.

Transatlantic teams

Speaking of 'kinks' to be straightened - that's with the technology of developing the website and back office processes, rather than regulatory issues? Kelly confirms that the journey to reach the present state of the Percapita offering has occasionally been a little bumpy, but she seems sanguine about this. To create a digital company out of thin air is no small feat, but perhaps surprisingly Percapita turned to European developers and UX-UI specialists to achieve this, "Probably because of the knowledge base the team has." And were there challenges to do with language, the US-European time difference, and even cultural differences? Generally, Kelly says, there were no issues at all. "The time challenge wasn't an issue. Because we say, 'Okay, here's what we want, please go off and do it.' And while we're sleeping, they're doing it, and the next day we look and say, 'Okay, there it is!' For the most part the time difference, the language, the culture… none of it has been an issue. I think everything has gone really well. And the team all works really well together."

Melissa comments on small factors in the 'Americanization' of some details when working with the European team, but nothing significant. She observes, "I don't know how much they had to learn about the US banking system, but whatever they did have to learn, they got up to speed really quickly. Conceptually, I didn't feel like I had to explain to them how banking works in the US because they came in with a working knowledge base. We weren't starting from scratch." The design process involves a weekly Cadence review, with iterative feedback, sometimes on a daily basis using Figma. "We talk about what needs to be designed and we present from a product perspective: here's what we want to do. We show some preliminary examples: here's the flow, and then they take it away and design it, and tag us for review. Comments fly back and forth in line with Agile sprints."

Home

HomeFundamental principles

Leading the design team at the European end of the pipeline is Maria Amidi Nouri, UX Architect and Partner at Ergomania Digital Product Design, based in Budapest, Hungary. As well as managing the Ergomania team, Maria integrates with other European developers, and of course works closely with the Percapita team. Maria says, "We originally were asked to put together a demo prototype when at the time there was no consideration about UX-UI, which of course is at the core of what Ergomania does. However, we knew from the start that the fundamental principle was that everything had to be super accessible. Someone who doesn't know much - or anything - about banking should be able to understand what Percapita is offering."

Percapita's website is also dual language - in English and Spanish - and may one day be also available in Mandarin, although the scope of the company is only within the borders of the USA. "The potential audience for Percapita is huge," says Maria. "It's been great working on a project that is so socially relevant, and so well thought through in how it can help the people who really need help." She draws particular attention to the financial wellness modules, and is also pleased with the way the teams have responded to the challenges of being able to smoothly onboard future channel partners. Although there have been no issues of language misunderstandings, Maria does admit to the challenges of the dual approval process with Percapita and its sponsoring bank, although she admits that's simply 'the name of the game.' So, all good from the Ergomania side of the equation, and it's a project that Maria and her team have a right to be proud of, having helped steer it to the point where the soft launch of Percapita is underway.

Of the Ergomania input, and that of the other designers and developers, Kelly Holmes says, "I think everyone has been great. They're always very responsive, and they definitely take direction wonderfully. They have great ideas and solutions to things that we're trying to solve for the first time, especially with the app. So although the app part is all new to me, they have provided guidance on best practices and better ways of doing things. We may see something one way, and they'll say, 'Well, here's a better user experience.' And it's like, 'Oh, yeh, why didn't we think of that?' But obviously, it's because that's their skill set. I feel like we've had a great working relationship with everyone. They're very responsive, and definitely put all their effort into it, like our own people would do. They're really part of the team."https://ergomaniacdn2.azureedge.net/

Do More

Do MoreYour money is your money

As for end users, Melissa Fox says, "We're still in the early stages of getting actual customer feedback, but so far the responses have been positive about the intuitiveness of the app design, and the ease of the account opening process. The positive feedback is not just about the app experience, but the whole customer experience." Melissa says that what Percapita is doing challenges many of the norms in the US market for payday loans, which she describes as something of a 'predatory area'. As she explains about the Earned Wage Access feature, "It's more like an ATM transaction. You are basically withdrawing money from your paycheck as opposed to taking out a loan. That money is directly deducted from your paycheck on payday, and there's no penalty or recourse from a repayment perspective. There's nothing magic about making people wait weeks till payday. If you were to quit today that money would be paid to you, because you've earned it. So this is a mechanism for letting people tap into that - your money is your money."

To understand and appreciate more of Percapita's offering, go to the company website and see how with this digital company, 'Financial wellness is feeling confident about how you manage your day-to-day finances. That's why whether you are looking to support your personal financial journey or help your employees, Percapita is for you!'