Clas Beese - curating change and growth

Imagine this: You’re outside a beautiful walled garden. You can see inside through the gates, and there’s lots of new growth, delicious looking fruit, and even some quite mature trees. You want to enter, but the garden gates are locked, and although you can see the many gardeners at work inside, they are all too busy to respond to your requests for entry.

This was the feeling I had when writing The Flavor of Fintech, a book of interviews with movers and shakers in European Fintech. The walled garden was the German Fintech scene, and it seemed sealed against intruders like me. I tried startups, I tried medium sized businesses, I contacted some of the big success stories, to no avail. It seemed that things in the German Fintech garden were growing nicely, but without the need of external reporting, thank you very much.

And then the first edition of the book was published by Ergomania Digital Design, and I started getting new contact requests on LinkedIn from around the European Fintech scene. One of those was from an entrepreneur called Clas Beese, in Hamburg. He had read the book, including my introduction about having wished for German input. As it turned out, Clas could have helped me there. That old saying, “It’s not what you know, it’s who you know,” was being proven once again.

Clas’ story

So, to Clas. Although his initial offer was to help me prise open the gates of that walled garden, I wanted to hear more about his own story, and how he came to be in a position of knowing so many Fintechs across Germany. In doing so I decided that my analogy of the garden was further validated by his description of being a curator – tending to ideas and helping them grow. But to explain why he’s a curator, we have to step back into his personal history.

Clas was always attracted to entrepreneurship, and did business studies before becoming a startup consultant in a Hamburg enterprise center. This was ‘startup’ in a slightly different way to how we use the term now. Mainly the center assisted freelancers and self-employed people, and the most frequent problem they faced was obtaining finance to simply get going, and then continue for long enough to begin earning money. Needs were often quite modest – ‘in the couple of thousands of euro’ range – but most banks would decline loan requests because their cost structure made it unfeasible. This frustrating situation was to some extent eased by Clas and his colleagues at the Hamburg center, who began to set up micro loans, acting in place of the banks – but that was difficult to sustain. At which point, a friend and colleague, Christoph who had written his PhD on the subject of micro loans, moved to Washington to work for the World Bank. This was around 2010, and Clas soon started receiving emails about an exciting new solution to the problem, called Peer to Peer Lending, as exemplified by Prosper.com.

Although the idea was new to Clas, when he started researching the subject he discovered that there were already two Peer to Peer Lending operations active in Germany, Smava and Auxmoney for consumer oriented loans. So it clearly could be done, and within a year Clas had quit his job and was working full time on developing what was to become Finmar, a Peer to Peer Lending platform. “Back in those days we called it a startup. These days it would be called a Fintech, but the term hardly existed then.”

Finmar went live in 2013. And was it an instant success?

“We went offline in 2015,” Clas recalls. “So no, we failed. I can explain that story extensively nowadays, and tell you a lot about entrepreneurial failure, and how that feels, and what I learned.” Like many battle-hardened entrepreneurs, Clas gained some of his lessons the tough way. And also, in keeping with the entrepreneurial template, he bounced back.

Following the closure of Finmar, Clas recalls, “I was saying to my partner Caro how I noticed there was no German Fintech media outlet at that time.” Clas’ proposal to start a Fintech website was met with the response, ‘Are you crazy? We’ll have to be writing all the time, and that’s a lot of work!’

Enter the curators

Caro’s alternative idea was to start a curated newsletter, a digest of the news of the week, headed up by a few sentences, and then linked to the original source. The result was Finletter, the first in its field, and still a popular and relevant platform, since joined by several others. While Finletter remains at the core of Clas’ activities, the concept has expanded to include possibly the largest Fintech event in Germany, the annual Fintech Week in Hamburg. And like Finletter, Fintech Week is curated. Which means?

“Each event is run by independent hosts, invited by us,” Clas explains. “It’s quite colorful, and really diverse in terms of topics.” When we speak – in July 22 – the upcoming event is still being formulated and the team are at work on a longlist of invitees. Even so, Clas predicts that Sustainability will be one of the big topics. “I believe that sustainability is coming to the financial industry from three sides. First, and probably the major one, is on the demand side from customers, especially when it comes to investment products.” He sees sustainable products ‘popping up’ everywhere, with the numbers rising all the time because “People are voting with their money.”

There is also an increased interest in sustainable issues at a Federal level, where the penetration of the Green Party into Parliament and Government in the 2021 election is pushing sustainability into further prominence. “So there’s also this pressure on the financial industry from the government side, which is true for the whole of the EU too.”

Then there are the banks, which are trying to analyze their portfolios to assess exactly how ‘green’ they may be – not an easy task when many investments are historic, and complex. It’s a task that Clas believes most banks can’t do alone, suggesting further opportunities for Fintechs. We’ll be speaking of the relationship between Fintechs and banks presently.

Sustainability, and more

And what of the sustainability of Fintechs themselves? Clas has the data, and it’s pretty accurate: the answer is that there are 57 sustainable-oriented Fintechs in Germany. He’s started a new magazine, Zebra specifically addressed to sustainable finance companies, and featuring a Sustainable Fintech monitor for the whole of the country. Estimates suggest roughly 1,000 Fintechs are active in Germany, so Clas believes that around 5% being green is a reasonably ‘honorable’ figure. This is set against the findings of the Swiss F10 Accelerator group which reckons there are some 400 Europe-wide sustainable Fintechs, with another figure ‘on the grapevine’ counting up to 600 Sustainable Fintechs across the world. Clas thinks there’ll be growth in that ‘honorable 57’, and that the big funding rounds, and the next population of German founders will increasingly focus on sustainability.

So if Sustainability is certain to be a hot topic during Fintech Week in the autumn, what other subjects does Clas see himself curating? “We’ll be talking about Open Banking, that’s a for-sure. And it’s pretty safe to say that we’ll be covering Identity too. Blockchain technology will be a topic, and AI is always of interest.”

Is AI a major topic? I ask, but Clas isn’t yet convinced by the case for Artificial Intelligence. “I am still missing the really AI based solutions that are making a difference, and I’m wondering if that is due to the stage of development of the AI technology itself. Or it might be that the relevant data you need to feed the AI to make it useful to the customers is still hidden in data pools within the banks. Many banks have loads of data to offer customers, but they’re not allowed to use it because they haven’t asked permission beforehand. So that’s still an issue.”

The Fintech cityscape

Let’s talk about Hamburg, home of Fintech Week, but perhaps not the first place we think of when talking of Fintech in Germany. However, as a native, Clas is ready to sing the praises of his home city, in comparison to Berlin and ‘Bankfurt.’ Firstly, with Frankfurt being the financial services capital of Germany, almost all of the country’s 1,500 banks have their headquarters there. This means that in turn the majority of Fintechs have gravitated around them. When I ask if Brexit (the UK leaving the EU) means that the financial crown has slipped from London, expecting that Frankfurt took up a lot of the slack, Clas is unconvinced. He reckons that Dublin, Paris and Luxembourg shared a larger slice of the cake, despite the high hopes in Frankfurt that banking business would be boosted there. “In Frankfurt, because of all the headquarters, digitalization of the banks is happening, so people are still moving there, and still working there. So Frankfurt is growing, but the financial services sector overall is not.”

And Berlin? That’s a different scene altogether, Clas says. It almost sounds like a different country, where people can get Fintech jobs without even knowing a word of German. It’s an international vibe with a really active startup scene and a strong funding environment. Berlin is a great place for startups, Clas says, because the ecosystem is ‘quite brilliant’. So while Frankfurt represents the establishment, Berlin is more cutting edge, and “Berliners are not at all worried about losing any banking industry, because they never had any!”

Then there are the ‘second cities’ such as Hamburg and Munich, where there is definite Fintech activity although at a lower level than Berlin and Frankfurt. Hamburg and Munich are beautiful cities, with a high quality of life, but “No-one moves here to start a Fintech, not when the ecosystem is so much better elsewhere.” So the big difference is that the second-city Fintechs typically have their Founders and teams already living there – perhaps even born there, and raising their families. “They don’t want to move,” Clas says, including himself and his own growing family. “And importantly, no-one is going to move to Hamburg or Munich just to start a Fintech.”

Catching the mood

And what about the mood among Fintechs, whether in freewheeling Berlin, the more conservative Frankfurt, or the ‘local’ centers of cities such as Munich and Hamburg? A tough question to answer, but my curator/guide has a go. “The Fintech scene has seen tremendous growth when you look at the indicators of funding rounds, and funding volume. Many job opportunities have been created and many people are working in Fintech nowadays.” Even despite the pandemic? – Well of course there were cuts in funding, and a scramble to change business models.

“Fintechs were extending the runways because they weren’t sure if they’d get the next funding round. At the same time many had very high burn rates, so they were losing a lot of money every month.” That was the early response during the pandemic, and the first lockdowns, but then Clas noticed that everyone was going back to a concentration on growth, and being able to grow quicker than rivals. Now he sees this as taking another hit because of the worldwide rise in interest rates, with the central banks and VCs unsure again. Should they restock their funds? Should they ‘wait and see’? As a result Fintechs are having to readjust their strategies – or more correctly their tactics – to once again extend the runway, and avoid high burn rates. “Sometimes this leads to layoffs, or not hiring. Or if funding starts to come in again, they’re re-hiring the very same people that were just layed-off! But overall, the feeling, the atmosphere, is a bit uncertain at the moment.”

Just a bit?

The case for crypto?

OK, Clas admits to a certain amount of ‘turmoil in the market’ with Celsius filing for voluntary bankruptcy, and customers of the Berlin neobank Nuri seeing a similar crash of its crypto services, resulting in the company filing for insolvency on August 9, 2022. But, perhaps a little surprisingly, Clas is a crypto-friendly curator, “A decentralized, digital crypto asset, can be safe, as long as you don’t forget your access data, your password to your wallet and stuff like that.”

He continues, “There are two motives for a German to go into crypto assets. One, if you’re really afraid that the institutions of the financial industry, but also at a public government level, are going to collapse. Then you might be interested in moving your assets into something you can carry around on a USB stick in your pocket – or just knowing the access data by heart. I believe there’s a minority who are really thinking there might be a crash in the whole governmental and financial system.”

He cites the situation in Ukraine and the Russian occupied territories where people have lost everything: access to their banks, access to their cash. In such circumstances having some crypto assets to escape to the West could be crucial. So there is good reason for having a decentralized financial system.

“And the second motive for Germans being interested in crypto is probably just greed! It’s greedy to invest in crypto assets, and okay, we’ve seen that number going up and up and up. And yes, that can be seen as a pump and dump scheme. So I believe we’re seeing a correction phase in the crypto market at the moment. But I also believe that it will be going up again, then it will be going down again! Crypto will remain a niche product, compared to the established financial systems. And the character of crypto having very high volatility will always be there.”

Digital adoption

OK, we’ve had some background on the financial industry in Germany, but now this reference to ‘Greedy Germans’ is intriguing me. What’s Clas’ take on German consumers of financial services? There are over 80 million people in Germany, who perhaps surprisingly are not adopting very quickly to digital solutions. Certainly not – in Clas’ opinion – as rapidly as consumers have responded to digitalization in the UK and the Nordics. There’s an inherent caution in the German approach, which means that startup Fintechs also have to adjust their plans, because growth paths can’t be as quick or as steep as they’d wish for.

One response has been to change offerings to white label solutions, and, “Looking back at Fintech startups who were entering the market a couple of years ago, let’s say five or ten years ago, part of their fundraising story was that they were going up against the banks… ‘We’re going to take away the banking customers.’ But that has changed with the years because many Fintech startups realize that they need to offer better usability, better digital service, better quality. Coming to a market of financial services is a disadvantage when it comes to trust, because when you’re in the money business, you’re talking about trust a lot. Who am I trusting with my money? The incumbent banks – as digitally outdated as they might be – have earned, and still enjoy the trust of their customers. And that has now been understood by Fintech startups.”

The trend is that, rather than charging head-on at Germany’s 1,500 banks and seeing them as inflexible blockers to progress, Fintechs are learning to cooperate. The Fintechs need the trust that is inbuilt with the ‘overbanked’ but loyal banking customers, while the incumbents of course need the agility and tech savviness of the Fintechs. This steady move towards alliances has been helped a great deal by both parties having a common enemy in the form of the circling sharks of Big Tech.

The tech giants eye the market

Google, Amazon, Facebook, Apple (Clas says a little less the Chinese giants) are all slowly but steadily entering the German and European market. As a result the fear in the hallowed banking halls is no longer about upstart Fintechs, but of the Big Techs that want to be both banks, and Fintechs. Now the banks are seeing Fintechs in Germany more as allies, because they can’t fight a battle on two fronts. And of course it’s clear that both the banks and the Fintechs can mutually support each other in the coming fight against Big Tech. Take for example Deutsche Bank, hamstrung by having something like 49 Legacy IT systems still up and running. Of course IT upgrading is going ahead at pace, but that means huge demands on budgets, simply to ‘keep the wheels on’, without delivering any obvious benefits to customers. Fintechs can provide the tech solutions to keep banks up and running, but beyond that, can develop new digital products that help oil the wheels of how Open Banking can function. Clas reckons that there’s an Open Banking platform now available with Deutsche Bank which actually offers more access for customers’ data than is required by law.

“Are they a platform themselves? And are those Fintech startups Service providers who are offering their products on a platform from one of the big banks? Or are the banks the providers of the services to other platforms? And then we’re speaking again about the Tech Giants. Are we offering loans on Amazon? Are we offering Buy Now Pay Later solutions? Are we integrating Apple Pay or Google Pay? That’s the sort of discussion that is going on.”

The German island

With the banks allying with Fintechs, there’s also another noticeable trend: Fintechs don’t need to look outside of Germany for their business. With 83 million people in the home market, German Fintechs aren’t ‘born globals’ and few intend to go international from the very start. In comparison, Clas says that the UK – and especially London – always saw itself as a worldwide financial hub, with the result that Fintechs ‘born’ there are far more outward looking. (Of course, I note that having English as the de facto world financial language hasn’t harmed UK Fintechs either).

So we have a big, bustling, successful Fintech scene in Germany, which nevertheless is quite self-contained and insular when it comes to engaging with the rest of the world, or even just the rest of Europe. Which takes me back to the walled garden analogy, and people working inside with care, and successfully. I thank Clas for opening a gate and look forward to getting closer to some of the people who are cultivating German Fintech. As Clas observes, “People say I’m well-connected in the German Fintech scene.”

And with that we bid each other farewell for now, with my guide about to head off to the wide blue yonder of vacation time in Sweden. He’s a mountain hiker and sailboat enthusiast, but for the time being, with two offspring – five and one and a half – curating the family holiday takes precedence!

Postscript

When I check in with Clas again, the days are getting colder and shorter, and he’s full-on busy putting the finishing touches to Fintech Week. He says that everything is going well and that “Things are moving,” but perhaps the attendance numbers will be down compared to pre-pandemic levels. The whole events industry in Germany is just getting back on its feet, which means that more people are going to more shows and meetings, of all descriptions. There are a lot of options available, so perhaps audiences have to choose more carefully what they go to. Having said that, Clas was amazed to see news footage from the previous week of people running to get into the Oktoberfest event, to drink beer at nine in the morning!

And how was that holiday in Sweden? Clas replies that it was very good. Oh, apart from his son getting ill at the start, and a massive storm ripping away part of their Recreational Vehicle. I get the sense that it would take an awful lot to truly ruffle Clas’ feathers!

The sustainability thing

When we spoke previously I’d asked about hot topics at Fintech Week, and Clas confirms that his prediction of Sustainability being of widespread interest is being borne out, “Everybody’s thinking about sustainability. If you’re a bank and you have all your efforts allocated somewhere and are then asked to evaluate your assets, and how sustainable they really are, it’s huge work to do. That’s something for specialists.” Meaning his recent venture, the magazine Zebra? “No, we’re not the right medium because we’re not into the taxonomy thing. We’re more coming from the business architecture side or financial architecture side.” He admits to being a little too busy with Fintech Week to attend to Zebra as fully as he’d like, but the site has published every day and is picking up readers. “A surprising number of readers,” in fact. Once the hullabaloo of Fintech Week is over, Clas and his partners in Zebra will be revisiting the concept, and examining how to better monetize it.

Horrible UX

Which leads us onto the subject of UX, as Clas makes a shocking admission: that some of the UX for Fintech Week is ‘horrible to use.’ This too will be revisited in the near future. “With finletter that’s fine, because it’s an email, and the signup process is really smooth, then you receive an email every day. It’s a very basic product: we write our emails, which have to work without any formatting. That’s very important because we reach a lot of readers in the established banks, and the banks filter out all the HTML formatting for security reasons. So that’s really our minimum viable product.” That’s one tick in the box for finletter, but Fintech Week involves – and here’s that word again – curating many different entities and event hosts. The resulting different interests and needs make for a user experience which is less cohesive and approachable than Clas would like, so there’s work to do there to move well beyond ‘horrible to use’.

In the case of Zebra the team holds more control over the website and how it is viewed by users, and impacts on them, whether through phones, tablets or computers.

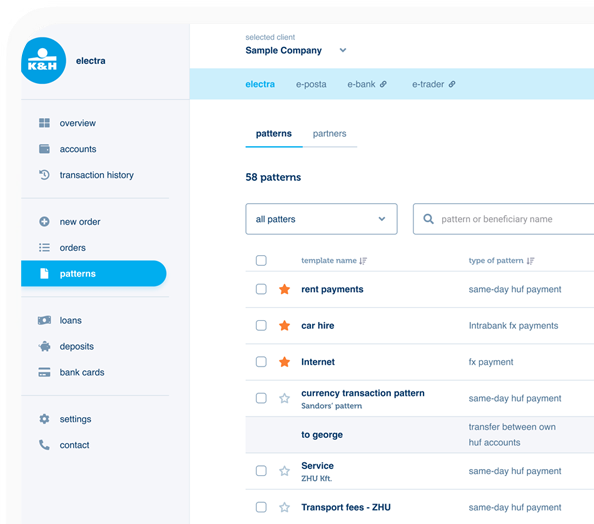

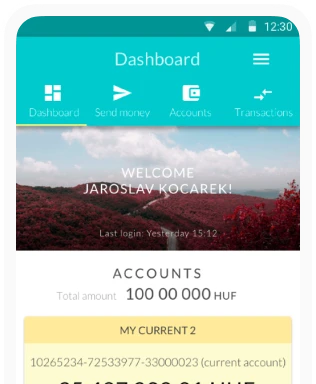

Complex portfolios

UX is a ‘bread and butter thing’ as Clas describes it, a must-have. “When you start from scratch, as FinTech startups do – and as I’ve done in the past as well – you start with the UX first. You think about the customer journey and how people are going to experience the product: In what situation? What are their problems? What are their jobs? How can I make their life easier? How can I help them do their jobs better? And then you try to improve the user experience with the customer journey. That’s where you start nowadays.”

He then remarks that now the incumbents are trying to do the same, even though they are so big, with so many products on the market that it’s difficult to chart the customer journey for every single offering, within such a complex portfolio. “So you can’t actually handle the user experience. And that still is the main advantage of Fintech startups: that they are concentrating on niches and on single target groups. So they can create better UX, just by focusing.”

The big incumbents are struggling to copy the same methods as the Fintechs, “But that’s not going to work for the banks. We are speaking about digital products, and then we hard code them into an app, or into a web interface. And we’re just not there yet – technologically speaking – where we can create an individual UX for every single customer. That will only be possible when we have really powerful AI capabilities. At the moment we have to think about a customer journey, and if it involves ten steps, then it’s just endless decision trees where the customer might be taken.”

Clas recounts a real life example of bad UX when dealing with one of his own company accounts – actually with a neobank, not even a traditional incumbent. Something had apparently gone wrong during the bank’s onboarding process, and now there was a request for signatures on tax documents. The bank however had no channels to ask for this other than a traditional email, the first they’d ever sent. Was it phishing, was it fraud? Clas decided to close the account and anticipated that the process might take months. Paradoxically, that part turned out to be easy, and after only five minutes the bank had one customer less. “So, UX really matters. Because I believe that people are changing their financial provider because they want better UX. And obviously, there is the risk that as a Fintech company or financial service, you put all your UX resources into the onboarding process. And then you leave it at that and provide really bad UX.” He suggests that perhaps the incumbents get away with this poor UX because people are lazy about changing their financial service providers.

UX into the future

What’s the solution then, and how should UX be developing? Although he may have that ‘horrible’ UX that will be changed on his own website, Clas has very clear ideas for where things might be going. “I’m really excited to see where UX will be in the future. We design UX at the moment with wireframes, on the principle that ‘if the customer does that, we’ll do this… If they click there we’ll show them something here, but it’s all hard coded UX.” In other words it’s inflexible, and he says the same applies to chatbots, which can only be programmed to answer if the question is known beforehand. However this state of affairs will not last forever and Clas predicts more tailored UX, enabling conversations and websites which are much more individual. “I’m from the generation where I don’t ask for a cup of tea, I want to see the menu of which teas are available. I don’t want to ask, ‘Do you have that very special tea?’ because the chance is really high that I’ll get a No, and I’ll be frustrated. So there will have to be a middle way to make User Experience way more customized to an individual’s situation.”

So much hard work

I ask what the timescale to all that is likely to be, but it seems it won’t be with us soon. “Ten years or even later,” says Clas. “We’re at the stage of developing AI so it can even just begin to deal with such situations. But when I think of screen design, UX design, wireframes, and how you create a financial service, or a digital interface, or a touchpoint for a financial service, then it’s all really static right now. You have to consider the channel: Is a customer using a phone, a big screen, a smart TV, a laptop, a desktop computer, a voice assistant, or stuff like that? And I hope it can be made way easier in the future with such services. We’re still waiting for platforms to create a truly omni-channel user experience, and UX right now is such hard work.”

Speaking of which, I’m aware of the clock ticking, and the need for the CEO of finletter and Fintech Week to get on with his real work… But not before Clas takes the time to inquire about my own reasons for residing here. It seems typical of his curiosity and enthusiasm that it’s always worth questioning and looking for answers.

And probably then curating them.