Croatia - In the process of waking up

Timing is everything in the fast moving world of Fintech, banking and crypto, and sometimes time is against us. The interviews with leading players in the Croatian market started long before the publication of this article, so some of the information is a little dated. For example Croatia is now in the eurozone, and some participants have changed their jobs or responsibilities. Despite unavoidable delays in making this piece public, it nevertheless provides a snapshot of a small and vibrant country that is rapidly finding its place in the bigger European Fintech picture. As such we believe it’s a good primer to get a sense of what was happening recently in Croatia, and where that process may be heading. After exploring the Ukranian situation read our latest blogpost about the ever changing Fintech scene in Croatia.

The two Croatias

“I think we are in the process of waking up,” I was told by someone involved at the time in Customer Experience for a Croatian bank. He was referring to Fintech and banking in general, and pointed out that in some ways there are two Croatias emerging from sleep, with definite regional discrepancies. There’s the ‘continental’ part, bordering Slovenia and Hungary (and geographically pretty close to Austria), then there are the rocky folds of over 1,750 kilometers of coastal areas, with an additional 4,000 kilometers in the shape of the country’s 1,246 islands. On the coast, people are less willing to put money into something they don’t understand, like Fintech. Typically a 50-60 year old person with money to invest will buy an apartment and rent it out to tourists rather than getting into something they see as risky.

Meanwhile the metropolitan-minded citizens of the capital city Zagreb (population a shade over 800,000) seem more open to new initiatives. And yes, that’s right, the capital’s population is less than one million people, from a total of four million across Hrvatska – the name that Croatians call their homeland. Yes, it’s a small country and a small market, but with lots of skilled, experienced and talented people in the financial sector. However, many of these talented people are attracted to work for German and Austrian companies, providing nearshored services at a reduced cost. Until very recently funding has been hard to raise, with the result that homegrown Fintech startups were relatively few and far between.

The new watchword

For the last 5-10 years in banking words like digitalization have been important and everyone wanted to go digital, go online, and do everything that is cool and innovative. But banks are of course big companies, with big systems, so even though they have been generators of change in Croatia, at the same time the incumbents haven’t exactly rushed to embrace innovation. Then came the pandemic and suddenly every bank across the country had to start working on being smarter. Now customer experience became the watchword, whether through online channels, call centers, or within branches. It’s an old saying, but true that it is five times less expensive to keep an existing client than to acquire a new one. So, giving the best possible solutions for bank clients became increasingly important.

Time passes

When I began looking into the Fintech scene in Croatia, the country’s adoption of the euro was still on the horizon. Meanwhile, a relative flood of Croatian Fintechers (if three people can be said to constitute a flood) appeared, giving me a better take on things. Let’s start with a man who sketched his life ambition, in eighth grade.

In it for the tech

“I drew a nuclear scientist,” says Nikola Škorić. “Well, it was not exactly a nuclear engineer, but it was close enough.” Next thing, Nikola was running a nuclear power station. Well OK, there were a few intervening years between making the drawing and getting his ‘dream job’, but I have the sense that what Nikola decides to do, gets done. This is combined at the same time with a very relaxed attitude.

He studied computer science and graduated in cryptography, starting in the nuclear plants as a computer science engineer, before he was advised that becoming a reactor operator would suit his skillset better. Meanwhile he had many hobbies, one of which was cryptography, from his university days. “And that’s how I stumbled upon cryptocurrencies – bitcoin to be specific. I was interested in its technical side… I mean, you’re aware of solving a really, really hard problem of coordinating a number of nodes that do not trust each other. And this allowed us, for the first time ever, to create decentralized and distributed money. And it was done in a fascinating way from a technology perspective.”

He describes himself as ‘in it for the tech’ rather than the possibility of getting rich quick, and that he never came at crypto from an investment perspective. However after a year or two he began playing with the system, buying his first fraction of bitcoin to see how it all worked in practice. At which point it became apparent that in Croatia it was really hard to buy crypto, and the process was cumbersome and really expensive, with margins standing at around 20%.

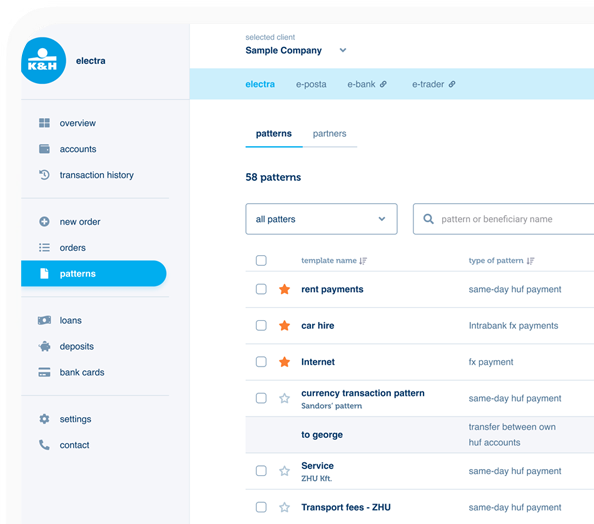

“I figured I could do it faster and cheaper,” says Nikola. “So I did, just for fun, and to see how it ended up.” The volumes began to expand, so the next step was to start a company in his free time, while still running a nuclear reactor in his day job. Today that company is Electrocoin, with around 30 employees and rapid growth. “I quit my job sometime in the bull run of 2017 when Electrocoin already had seven employees, and I realized that I could no longer sit on two chairs, as my hobby had to become my main source of income. I’m a full-on crypto guy now.” Which means what exactly? Nikola explains that Electrocoin does three things:

“We are a cryptocurrency brokerage – let’s say we are a much simpler version of coinbase.com. The whole point of our service is simplicity. If you want all the features that Coinbase offers, go there. If you want to just buy and sell crypto as fast as possible – then go to our brokerage service bitcoin-mjenjacnica.hr and get it done in seconds.

We are a crypto service provider for currency exchangers – brick and mortar currency exchangers that exchange your paper EUR to paper GBP and can use our service to sell crypto for cash to their clients. So we are a crypto payment processor – a much better version than some of the other players in the market!”

Doing it for ourselves

Almost from the start Nikola had a partner, Marin Maržić, “One of the best security guys in the country” who mutual acquaintances promised was ‘a miracle’. Between the co-founders there was huge technical expertise, however they weren’t starting from a profit motive, but as hobbyists. The initial stake was 2,500€ from Nikola’s savings. “We didn’t do it with customers in mind, but with ourselves in mind. And every morning, I get up, and I still cannot believe that we’ve kept the top spot, having done it all upside down. You know, we did something that didn’t exist in Croatia. I mean, our services feel quite unique even at the EU level because we give much more slack to our customers. I don’t know if there’s another service in the European Union where you can start a trade without paying and have the price locked in for you, for whatever period it takes for the money to arrive. We just figured that the service we’d like to use had to be clean and simple. Let’s make it really user friendly.”

Homemade UX

At this point I check in about UX. So the emerging Electrocoin obviously hired a top agency to design their processes and interfaces, and do all the user testing, right? But no, Marin drove UX development, because, “He’s a really stripped-down guy” says Nikola. “Our first few years were basically Google 2004. Just the blank, blank page. And I decided to roll with it – let’s see how it works out. If it had been real money at stake, I would probably have pressured Marin into making it all much more mainstream. But it turns out that we hit it on this one.” So homemade, hobbyist UX… that actually works. “We were always understaffed in our development departments because we wanted to work only with the top guys. We didn’t want to hire developers by the shovelful. That’s why we basically decided – up until now – to go with our own logic, completely disregarding customer feedback.”

Apart from the fact that this is UX heresy, note Nikola’s use of ‘until now’, because there are changes coming, with Electrocoin in the middle of rebranding, and designing a new platform. This time around, it’s relatively mainstream, and at first glance won’t be all that different from Coinbase or various other brokerages. The unique, original UX flows won’t be buried exactly, but perhaps one click away. And there’ll be testing too, of sorts, offering users the ‘bit weird UX’ of the original, versus the new mainstream UX on the same platform. “Now we’ll have metrics to go into detail. Up until this year, we were just doing this the way we thought it should be done. And if customers come, they’ll come and they always came, so we had this explosive growth. Growth hacking was really not needed because we were growing so fast, without growth hacking, without analytics, without feedback loops. And we decided we don’t want to go 10x in a year. We want to keep a really tight company culture. We want to really do our own thing. Originally we decided to go our own way…” There’s a pause worthy of a comedian’s well timed joke, “Which I really would not recommend!”

Changing sides

If Nikola Škorić projects a somewhat swashbuckling image of an entrepreneur, I suspect that Filip Šaravanja is less likely to be casual in his approach to all things Fintech. For a start I join him in his last week as Fintech Co-ordinator at HANFA, the Croatian Financial Services Supervisory Agency, where he has served around ten years. From being embedded in a regulatory entity, he’s off to new pastures with Aircash, the biggest e-money institution in Croatia, with a rising presence in nearby countries, including Slovenia, Austria, Romania, and Germany. The company reckons on 500,000 users and counting, and its mobile wallet is licensed across the whole of the EU and EEA. Filip will be dealing with new products relating to investment services and the blockchain, not related to Aircash’s core offering of e-money.

Having worked as the Fintech coordinator in HANFA for more than three years, Filip is well placed to comment on how he sees Fintech in Croatia. “We started the Innovation Hub in the Spring of 2019, and I coordinated the work on that. So I believe Croatia can be really, really great. That’s from my anecdotal perspective, not statistically. We have a really great IT scene, with technical firms creating solutions for the financial industry, not just in Croatia but worldwide. They’re working from the Machine Learning, AI perspective, or crypto assets, and blockchain telemetrics. And in the insurance sector, compared to the size of the country, we do really well.”

What constitutes Fintech?

That all sounds good news, but Filip cautions against too rosy a picture. “What we don’t have as a small market is good access to capital and most of the regulated financial intermediaries, such as banks and insurance companies, are owned by large foreign institutions.” (Aircash being one of the rare examples of a homegrown major success story). “We don’t have vertically integrated Fintech services, offering the whole value chain, so what companies are really offering is the Fintech product on the market and using new technologies in developing that product. Most Fintechs here are IT companies, some of them dealing exclusively with financial institutions. But a large portion of them are also dealing with many industries. For example, one of our best deep learning algorithm developers is working not just in the financial industry worldwide, but they’re servicing every industry. If you ask, ‘Are you a Fintech company?’ they will say, No, we are not.”It’s not for the first time that I have heard this sort of observation – everything is Fintech …and nothing is Fintech.

Filip mentions that a few days previously he was asked to a meeting in a private college to discuss starting a new MBA course related to Fintech. But how could the term even be defined? He suggested that ‘Digital Finance’ might be a better description of the diploma offering, “Because lots of stuff we call Fintech isn’t Fintech any more, it’s just applications. It’s nothing new, it’s not new technology implemented in financial services.” He agrees that perhaps ten years ago that definition may have applied, but now he reckons the emphasis should be on new cutting edge technologies, implemented in the financial industry. If that definition can’t be applied, then it isn’t Fintech. “Maybe that’s not the book definition,” Filip says. “But that’s what I see.”

Regulation vs cutting edge

On his own terms, most of the projects submitted to the HANFA Innovation Hub did indeed qualify as Fintechs, however the biggest problem was that startups were rarely fully aware of the regulatory framework they had to fit into. It’s one thing to develop a financial product, but what does it mean to offer that on the market? It sounds like a frustrating situation, to be both the encourager for startups, and the gatekeeper for an institution. “When you want to develop a fully regulated business, sometimes even the regulation itself puts you in the position not to use so much cutting edge technology. It’s really hard to present that, and to prove that you are regulatory compliant, using something regulators and maybe your partners from the legacy business side – banks, credit institutions, the insurance sector – could say, ‘OK we did a deep assessment of your project and this is really compliant…’ Usually, from my experience, they say things like, ‘OK, you’re using permissionless public and open blockchain networks, so this is not really compliant to GDPR’. That’s the reason why many good ideas go in the direction that they eventually don’t develop regulated projects with cutting edge technology, but very often pivot to something more common to existing market products.” And was Filip dispirited by this? – I imagine that the greater freedom of working for a well-established Fintech will come as something of a relief for him.

“My job in HANFA was to be a kind of translator between the startups – people wanting to develop something new – and the formal legal procedure that they can expect at a later stage of developing their project. So I was trying to translate the languages from usually two different worlds. I like to say that every issue in regulated businesses is a legal issue, but we were not dealing only with legal issues. Of course we also had IT people, people dealing with risk, with capital requirements, and so on. So every part of their business cycle, if they want to go to the full license – not just develop new products – is under scrutiny. So did I ever say ‘This idea is great?’ I was trying to avoid going into their business decisions. But yeah, speaking for myself, there were some really great projects.”

Education, education

I ask Filip about the population of Croatia, and how the country seems to pull more than its own weight in terms of skills. Surprisingly, he sees it as one of the few benefits of Communism, in that math abilities back then were heavily encouraged. Prior to the 1990s, across the region the sciences were more respected than – say – law studies. Come the collapse of Communism, lots of hardware companies ‘just fell apart’, so many educated people gravitated from engineering to IT. Now, says Filip, there needs to be a continuing commitment to education – something he is personally involved in, lecturing in universities about Fintech and crypto. But does this indicate a lack of ‘joined up thinking’ on the part of government? While he says there isn’t an as yet comprehensive approach, individual departments are doing their part, for example in educating citizens in the potential risks of crypto. Then there’s the National Bank…

Something was going on

Now, speaking of the Croatian National Bank, when I first started chatting with Fintech players across Europe, I began by imagining a stereotypical central banker, neat of hair and dressed in a buttoned-up business suit. I was somewhat wide of the mark, as is demonstrated once again when I meet with Linardo Martinčević, who looks like he may have just returned from a rock’n’roll tour. He was in fact a musician in rock and funk bands, so I’m not so wrong, and he remains a home musician and fan of traditional Croatian Klapa music, a form of acapella singing from Dalmatia. You know what, I love the random stuff I get to learn about by talking with Fintech people – a never-ending well of information and inspiration!

But down to business, and to find out what this Advisor at the Governor’s Office of the Croatian National Bank does. “Among other things, I’m head of the Innovation Hub,” says Linardo. “I’m the person that coordinates hires, and I’m also the person who coordinates all Fintech issues in our Croatian National Bank. Three years ago, we did not have a full time person dealing with Fintech, but it started from a bottom up approach. There were five of us enthusiasts there – from the supervision department, from payments, from monetary… And I was one of them. I was working at the International Relations Department, mostly dealing with the IMF, World Bank, and the BIS (Bank for International Settlements).”

So in effect Linardo and his enthusiast colleagues created their own jobs?

“We started to notice that something was going on and that we needed to raise the level of knowledge in the Croatian National Bank. That was our main goal. We wanted to know much more because we were getting so many inquiries from the public, from companies, from startups. They wanted to know if they could be licensed, they wanted to know if they could start to work in this area, could they set up a company here?”

The simple answer was that there was no-one around who could provide definitive answers, and it wasn’t just Linardo and colleagues who were exploring the ground, the Governor of the Central Bank himself was starting to be asked questions, as a public figure: ‘What is going on with Fintech in Croatia? What is going on with stable coins? What is going on with crypto? What is going on within the financial industry?’

Obviously it’s not a great look for the Governor of a Central Bank to not have comprehensive answers to hand, and so a new job was created – Fintech coordinator. “The Governor said, ‘Okay, you will be the one who will do this. We’re a small bank, not that big in EU terms, so we cannot afford many full-time people working on Fintech.’ In fact, we could just afford one person – me.”

Linardo was instructed to start pushing for an Innovation Hub, as Croatia was almost the last country in the EU to have one. “Now I coordinate all Fintech issues in the National Bank,” he says. “Once you’re in the Governor’s office, it bears a lot of responsibility but at the same time it’s much easier to contact all other areas.” For example? “Sometimes departments can get silo-ed and entrenched – you know how things can go in an institution.”

Cross department, trans Europe

That’s not a criticism from Linardo, more a fact of life, but since 2019 he has chaired a cross-department working group in Fintech in the National Bank, comprising representatives from all sectors of the bank, and a pool of experts. Initially the largest area that the working group addressed was crypto, with the conclusion, ‘Crypto is not money, it’s not a payment instrument, it’s out of our scope.’

With time that stance has changed however, and now HNB – Hrvatske Narodne Banke, the Croatian National Bank – is open to embracing technologies to fit into its competence and regulatory framework. Says Linardo, “As part of my job is to cover everything related to Fintech, when the Bank of International Settlement initiated their innovation hub, as a representative of our central bank, I was there as part of the working group. Then the European Central Bank started the digital euro project, and I was also appointed as the HNB representative to that working group. We have been meeting online, at least once a month, to discuss issues on starting the digital euro. I think it’s inevitable that it will come in one form or another – that Central Bank Digital Currency will come to life.” This prediction is made at a time just before the fiat euro is to come to Croatia, but isn’t cash still king in the country? Linardo agrees, mentioning that something in the order of 79% of payments are still being made in cash, while in terms of amounts it’s about 54%. However this ‘habit’, as he describes it, is decreasing. And will the digital euro be adopted more easily on the back of Croatia joining the eurozone? “We talk a lot about the digital euro model and how it’s going to be represented to citizens, because we just can’t make mistakes. We are the central bank, the lender of last resort, we are a public institution and can’t fail the same way that a private enterprise could. They could try something, and say ‘OK, that didn’t work, let’s try something else’. But we do not have that possibility. So in terms of public communication, we must be very precise in saying that what we offer is not going to replace anything, it will be supplementary to current payment methods.”

Leveling the playing field

Which brings us back to the Adriatic sea, and its role in Croatians’ slow move away from cash transactions. Say what? Well, remember that in the somewhat more conservative coastal areas, people wishing to invest are most likely to put their money into apartments, to be rented out to tourists. That’s foreign tourists who expect to make their payments electronically. So property owners have had no choice but to start using online and mobile applications, if they wanted to do business at all. Linardo reflects, “If you take money from the public, from consumers, then you issue money-like liability, let’s call it private money, or call it whatever you want. And then on the other side of your balance sheet, you invest that money, then isn’t that a bank? Isn’t that a money market mutual fund? Isn’t that an electronic money institution? We already have this business formation which is licensed, and then if you could do the same activity, then how all of a sudden do you not need any license, and you can just you know… get away with it?”

He sees this as a need to level the playing field. As banks are heavily regulated, they have huge compliance offices and huge capital requirements. “Then suddenly you have someone else doing the same job, but without any regulation. And this is what we also hear from banks, which totally makes sense. For me, if I were a bank director or owner, I would ask, ‘How can this guy do the same activity as my company, and I need to satisfy all these requirements, while he doesn’t have to satisfy anything… He just wants to innovate?”

Bright youngsters?

Linardo admits that when he started working directly for the HNB Governor’s office, the bank was essentially quite ignorant of what Fintechs were doing, because it wasn’t the bank’s concern. Now he’s clear that the leveling of the playing field cuts both ways, and Fintechs have to understand regulatory frameworks, and work within them. He sees young developers and programmers who have great ideas and good product concepts coming to the bank’s Innovation Hub, but not appreciating the complexities of the regulatory system. He says that rather than trying to discourage startups, the mission of the bank is to help, but that might mean bringing in colleagues who are specialists in supervision, legal matters, consumer protection or anti-money laundering. None of which are probably the first thoughts that cross the minds of the bright young Fintechers in their garage office, with an idea which is set to change the world.

And is there a sandbox to allow those bright youngsters to play around in? No, says Linardo, because there is no capacity to support one, at present. “If you want to have a regulatory sandbox, it’s at a higher level of responsibility for us as an institution, because then we will let you work, and we will enable you to take people’s money. And if something goes wrong, we are the ones who are responsible. We’re just not that big of a bank but neither is there the demand from the Croatian markets to establish one.” So for now it’s the Innovation Hub, and no further.

Stepping into the boots

Meanwhile let’s pick up the story with Filip Šaravanja, who originally studied law, before joining the licensing department of HANFA, the Croatian Financial Services Supervisory Agency. He then moved on to the supervision of Capital Markets, but with Croatia being so small the volumes and turnover were ‘not so fun’ as in France, Germany or the UK. As a result he started to watch newer markets, especially the emerging one of Fintech, and between 2016 to 2018 began to get many enquiries from a new breed of entrepreneurs. In addition members of the public were asking about Initial Coin Offerings and crypto projects, and – as with Linardo Martinčević over at HNB – it was all getting very interesting as colleagues started to look for help within the organization. “All of a sudden I was the guy for all the Fintech related questions in the agency,” says Filip. “So it was my hobby, outside of my business working hours, and I was happy to step in those boots.”

Contacts everywhere

These days, as we’ve heard, Filip has transferred his allegiance fully to the Fintech side with Aircash, and I imagine his decade working as a regulator must be very useful to his new employer. “HANFA does not directly supervise Aircash, because electronic money businesses are under the central bank. But generally speaking, I believe that my experience with foreign regulators, and providing expertise to ESMA (the European Securities and Markets Authority) does give me some advantage when dealing with regulatory issues.”

I think that’s an example of Croatian understatement.

And presumably Filip’s address book is comprehensive? Well, just a bit: “I was the HANFA representative on a few standing committees in ESMA, and more recently the Innovation standing committee. Then, in the International Association of Insurance Supervisors I was involved in the Fintech Forum. In IOSCO (International Organization of Securities), I was in a Fintech network mostly dealing with DeFi – Decentralized Finance, and so on.” And not forgetting markets in crypto assets regulation, a DLT pilot regime… and crowdfunding before that. And – of course – while Croatia was taking the revolving Presidency of the European Council, Filip was also involved in that too. With so much networking and high-level meetings, he admits that three years of Covid lockdowns was ‘kind of depressing’. While other players may have adapted and even thrived in the new online world, Filip says you can’t beat meeting people in person, in Brussels or Paris.

Into the future

Now that the pandemic is over, and Filip also has his new job with Aircash, is he feeling optimistic? “The large players from the legacy industry will develop some cutting edge Fintech products, especially if they are part of larger financial groups across Europe. What I have positive feelings about is: Of course the company I am working for now, and about any kind of payment industry built outside of the legacy infrastructure. But we need the legacy infrastructure for cooperation, because you can’t develop anything without it. That’s how things work.

And on the other side, of course, there’s the crypto asset industry in Croatia, because they are developing new products and offering them across Europe. So regulation is coming in for that, I would say in the next two years. And those crypto companies that survive regulatory scrutiny will have the opportunity to scale across Europe. So those are the parts of the industry I’m positive about and although it’s not really my thing, the biggest potential, I think, is the insurance sector. That is the most promising part of the Fintech industry, maybe even worldwide, and definitely in Croatia.”

The expanding insurance sector

Filip says that the reason is that the credit institutions are relatively large, especially in Croatia, and have resources to develop or integrate something new. But as yet the sector – both worldwide and in Croatia – is not so willing to take such steps. So there is a gap between their potential and what they are doing currently. “But they have resources and I believe that the market will eventually push them into that direction, because they’re earning pretty good money nowadays, as far as I know. But market circumstances similar to what happened in the payment industry could easily push them soon into more competition. Then out of necessity they will have to develop something new. Ten years ago, in the payments industry no-one believed that it could change. The banks dominated and were untouchable, then all of a sudden some Fintechs showed up and disrupted their business models. I hope that the insurance industry is on the same path.”

Moving boundaries

And what’s the path, specifically for Electrocoin? Like Filip, Nikola Škorić’s interest is tweaked by the Insurance market. Electrocoin is not looking to move out of Europe anytime soon, with the current balance being roughly 50% Croatian business, and 50% EU. “We do crypto brokerage, where you can easily buy and sell crypto, and we also do payment processing. So we enable retail stores or web shops or whatever to accept payments. For the next few years, our plans are about launching the new brokerage platform, then doing some aggressive marketing in the European Union.” He mentions Bitpay and Coinbase as direct competitors, but doesn’t expect either company to penetrate the Croatian market in the near future. “So we decided, OK, let’s have some fun, let’s try pushing crypto into all spheres of the economy. Let’s see if we can get crypto everywhere.” It sounds like a typical statement from Nikola, that mixing business and pleasure is perfectly normal.

“And there’s nothing more regulated than insurance, or only banking and nuclear. And I doubt we’ll be entering those two industries! So, insurance is the last stop for us. If we manage to onboard car insurance to accept crypto payments, then we’re done, we’ll have done it all. Which is a really great selling point for the European Union.”

Boosting morale

While it’s probably good to know that (as yet) Nikola isn’t planning on building his own nuclear power station, it’s notable that Electrocoin’s expansion plans are not merely motivated by business logic. “For us, it’s really important to build something interesting. Sometimes we get feedback from our employees. ‘Oh, my mother told me, she saw on television that we did this and that’, and it’s a really great morale boost for all of us – like, we’re doing something nice, not just raking in profits. We’re also moving boundaries, and that’s really fulfilling. Now anybody that touches crypto knows about us, and our philosophy from the get-go, was let’s do this right, because I was already coming from a highly regulated industry.”

Nikola describes how, upon founding Electrocoin, he wrote to all the regulatory bodies in Croatia, informing them that he was starting something very new. Did they have any input? He received no response, but imagines that the people he wrote to merely laughed at his ambitions and possible naivety. “But we were never here to just make a quick buck and then leave. We wanted to build something with good foundations, so we always kept our fingers on the pulse of the regulator. And when they finally started paying attention we really tried to engage them.” These days that engagement is more steady, and Nikola now knows who to call in all the regulatory areas, and that his calls will be answered. “There are many worse examples in the neighborhood,” he says, referring to regulation in other EU countries. “So I cannot stress enough that we are really happy with the cooperation in Croatia. But, you know, there is always room for improvement!”

The developing CBCD story

Linardo Martinčević is very likely one of those people who can now be reached when Nikola wants to connect (and indeed Linardo independently suggested that I get in touch with Nikola, as a great example of what is being achieved in Croatia). Linardo stresses the importance of connection, and rates trust highly. People have to trust the institutions that serve them, and he says that for him it comes back to being a citizen too, first and foremost. If a citizen wants to renew their driving license, or apply for a building permit, then it’s essential that they trust the departments they are dealing with. Which leads us on to some further future-gazing, and the concept of Central Bank Digital Currencies – what’s the story there?

“It is just a different form of Fiat, that is really what we want to communicate to the public: nothing is going to change for you – you will pay with the same payment instruments, and methods as you do today, especially in the European Union, where the payment system and payment instruments are well developed. You could pay by watch, by credit card… it’s all the same thing. But at the back end, who takes the responsibility? That is going to change, so nothing is going to change for you, but for me as a central banker there will be a huge difference. It will be a direct liability, it will be on our balance sheet. But as a citizen, nothing is going to change. So really it depends on the point of view.”

The ultimate risk takers

Linardo continues, “So why are central banks thinking about this new form of public money, when today the only direct liability that exists is cash – because you have a signature of the Governor on the bank note? You can bring that to the central bank, and there is some liability there. But why is CBCD happening now? – Because there are so many private money initiatives, and not all private money is the same.” At a general level, it doesn’t matter whether the bearer is token-based or account-based, because someone issued the liability and there has to be a some entity responsible for it – regardless of how a client identifies themself when they ask the issuer to honor the commitment, such as bringing their ID or knowing their key. Bitcoin changed the paradigm in that ‘everyone is responsible, but ultimately no one is’, an unsustainable arrangement in times of crisis. So when it comes to privacy – or anonymity – not going through KYC or doing identity checks is attractive to some. However this points to the need for limits on holdings and transactions, in ways that are similar to cash.

Linardo continues, “Private money is also deposited in banks, because that’s the liability of the banks. If a bank goes bust, then you cannot come to a central bank and ask for your money, you need to sue that particular bank. And that then has a special resolution procedure, where the central bank steps in to give you your money.”

He explains that as the vast majority of new private money initiatives such as crypto, and so-called algorithmic stablecoins are not backed in any way, if they go down it’s unlikely that the money will be recoverable. So central banks are looking for a digital solution to help in such circumstances – a nominal anchor, which is public money. “We are the ultimate risk takers in the system. OK, we support innovation. But we always look just a little bit more to the risk side, because eventually we are the ones who are responsible.”

Waking up and packing a punch

I’m left wondering how a nation as small as Croatia can pack such a punch, and how potent that will be as and when it does truly ‘wake up’. I’m not talking just in the field of Fintech either. For instance, did you know that the Croatian men’s football team has beaten the English football team (with a population 14 times larger to draw on) three times since the beginning of the millennium? That’s more than any other national team. Hrvatska certainly seems to be doing a lot of things right.