Fintech conquers Belgium - What are parties and WhatsApp doing in a mobile banking app? - Part 3

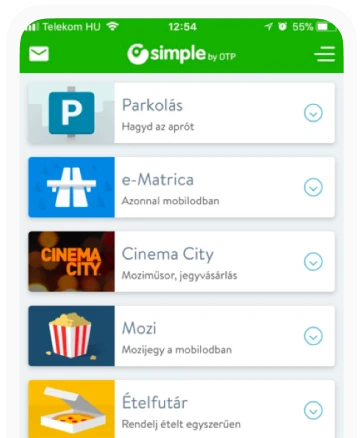

The majority of young people do not want to bother with banking apps; however, they are keen on using novel or on the contrary, familiar interfaces if those match their lifestyle. Splitting the cost of a dinner together or communication with the bank similar to a chat app? We need solutions to questions like this!

The low-budget, and therefore often uncharted age group is not yet experienced in using financial apps but can be won over by functions that are used daily. Fintech player who is able to engage the young generation obtains an advantage compared to banks that target only the well-known, more well-off, middle-aged customers.

Payconiq

Founded in 2015, Payconiq International, which operates a platform centred around payment processing and is engaged in mobile payment activities, took its first steps under the aegis of ING bank, later also joined by several other Belgian financial institutions, such as KBC Bank. Bancontact Payconiq Company was created as a result of the 2018 merger between the Belgian business unit of Payconiq, which transformed from a mobile payment app into a comprehensive platform, and the also Belgian payment system, Bancontact. Its five main shareholders, Belfius, BNP Paribas Fortis, ING, KBC, and AXA, provided it with a nearly EUR 18 million capital injection, followed by the unification of the two existing payment applications under the name ‘Payconiq by Bancontact’. It is supported by several local banks; it has been integrated into the mobile applications of KBC and ING Belgium among others, but the service is available as a separate app as well.

No more arguments about splitting the cost of parties

The API-based Payconiq platform connects banks, retailers, payment providers, and consumers in order to make online or in-store invoiced or peer-to-peer (that is without the involvement of a third party) payments. After customers have connected in three steps their bank accounts, held with practically any of the leading Belgian financial institutions, with the application, they are able to pay retailers and acquaintances who have also joined by scanning a QR code. The latter is possible via an email address or mobile telephone number as well, meaning that the portion of the cost of yesterday’s night out can be repaid or a family member supported at the end of the month by the user with the simplicity of a telephone call.

In the stores of retailers that have entered into a contract with Payconiq, items can be paid for even while you are still standing in line, and train tickets can also be purchased directly through the app. Adding our funds together for birthdays of friends or employee farewell parties is similarly easy and donations can also be made in the most simple way possible.

The extreme weather at the end of July 2021 gave a large boost to the latter. In connection with the rain and flooding, which severely affected not only Germany but Belgium as well, several support campaigns were launched to help the victims in the affected regions. The funds offered for donation through Payconiq (via the Donations option in the Services menu of the application) were forwarded to the appropriate entities with the coordination of the Belgian Red Cross.

Payconiq recommends its Joyn mobile application to users with a love for collecting things. Customers not only get a digital loyalty card for their mobile phone by installing the app but can also receive rewards if they actively use the app. Thanks to the widespread adoption of the app, it can be used in several thousand stores in Belgium; so far more than 2 million people have taken advantage of the option to scan QR codes and collect points in the Benelux state. Naturally, the programme is connected to the Payconiq by Bancontact application, thus providing simple mobile payment services in addition to reinforcing and maintaining customer loyalty.

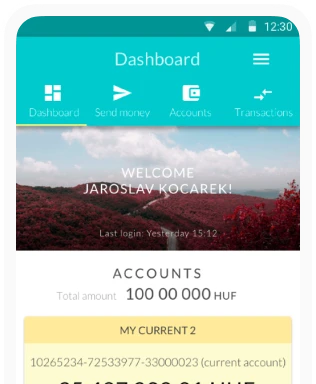

UX: simple steps on a clear interface

The strength of Payconiq is in its simplicity. This is what customers and consumers want: an easy-to-use and cheap digital payment method with an interface that is transparent and easy as apple-pie.

Installing the application already takes a short time only, and its use is logical and simple, while the payment process is quick and comfortable.

It can be used in stores, for paying bills, and we can even order and pay for something from our homes and collect the ordered product from the retailer later by showing them the order number. For this, the application needs to be connected to our account, which is possible with the Belgian ING and Paribas banks.

Argenta

The Belgian Argenta bank was founded in 1956 with a capital that would be worth only a total of EUR 25 thousand today; however, it has expanded its operations to the entirety of the Benelux Region. The group focuses on financial activities provided to families and private customers, such as savings, credit, investments, and insurance. Argenta manages a total of more than EUR 52 billion in customer funds, generates a profit of EUR 219 million, achieves a return on equity of 7.6% and a cost-to-income ratio of 59%, and produces excellent capital adequacy indicator and liquidity buffer figures, as evidenced by the 2020 report of the financial institution.

WhatsApp-like chat experience

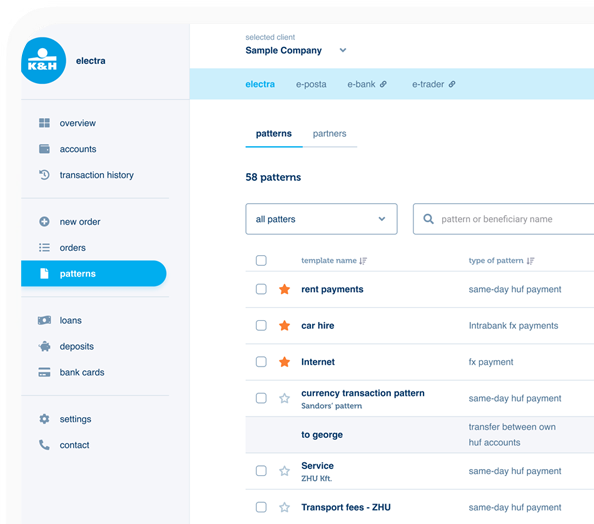

In 2019, the bank published a thoroughly updated version of its mobile application, a big feature of which was the so-called ‘conversational banking experience’. Hootsuite, the developer of the Sparkcentral messaging and customer service platform, and Smooch, a messaging-specialist startup (which has since been acquired by Zendesk, the developer of a customer support and ticker handling system) cooperated to create this intuitive service, through which customers are able to have conversations with the customer support employees of the financial institution via an interface similar to that of WhatsApp.

Instead of reaching for an automatic chatbot, a tool that is also gaining ever greater popularity, Argenta explicitly chose to use a solution in its app that favours human interaction. After a connection is established between the customer and the financial expert, live support can be provided on a variety of topics. Pay-ins and withdrawals, fees, savings and investment advice, information about the latest products, etc. – customers are able to consult the experts on these topics without leaving the mobile application.

Emphasis on human interaction instead of chatbots

Thanks to the design of the messaging interface, which continuously tracks conversations and allows users to view all previous messages if required, customers never feel like they have been left alone with their problems. However, they can suspend or continue the conversation at any time, which Argenta believes provides a better experience for the participants of the conversation compared to traditional live messaging solutions.

Geert Van Hove, technical director at Argenta, pointed out the WhatsApp-like message streams represent the interface that people generally use for keeping in touch with their acquaintances, friends, and family members; however, the business world has so far failed to fully take advantage of the opportunities they provide. Still, their simplicity and easy accessibility have been recognised by more and more over the past two years when it comes to B2C communication as well but Argenta still holds the title of the first adopter, at least in the world of finance.

By doing so, the financial institution has replaced its ‘mobile first’ concept with ‘messaging first’. It was driven not only by the desire to stand out (since all banks and Fintech companies have a smartphone application today) but its intention to provide a better customer experience and increase customer loyalty towards the organisation to a higher level also played the role of motivator during the development process. Now it can be said that the concept worked: Argenta’s mobile application now handles more customer transactions than all other channels, including transactions initiated online or in branches. This statement applies in particular to the customers of the financial institution that belong to the younger generations.

Comprehensive UX audit in 60 days

The score of the app, which is available via both Google Play and the Apple App Store, was 4.5 when a comprehensive UX audit was ordered. Within the framework of this, a detailed 6-year survey was conducted with the help of an external agency. During the audit, the existing interface was evaluated in-house and with the help of customers as well, the full analytics were reviewed, the strengths and the areas requiring development were identified, and user tests, as well as competition analyses, were also performed.

After this, the top 10 prio UX-development proposals were formulated, in addition to which mock-ups and detailed development recommendations were also created.

As a result of the comprehensive audit, the Belgian Argenta bankieren (https://www.argenta.be/) app provides a variety of services in addition to the traditional ones today. These include the preparation of a retirement savings plan and opening a retirement savings account (as mentioned earlier as something learned from the research performed for Paribas Fortis, this is a service that can be attractive to customers), managing paper-based transaction orders by scanning them with the help of a mobile device, and making instantaneous and free transfers.

Crelan

The roots of the bank created through the merger of the financial institutions Landbouwkrediet / Crédit Agricole and Centea are in the financing of agriculture. It became a truly significant player, the fifth largest, in the country in 2019, after the acquisition of the Belgian business unit of AXA. As part of the transaction, the company handed over its insurance business unit to the AXA Group; however, this only marginally affected the number of customers served and the amount of capital managed.

Following the acquisition, Crelan had a deposit portfolio of EUR 37.7 billion, 1.8 million customers, nearly 1600 employees, and 1140 branches. The financial institution intends to reduce the latter figure, which is the highest customer to branch ratio in Belgium to nearly 900 by the end of this year, in the spirit of large-scale digitalisation. The reported financial result of the company was EUR 125 million in 2019.

Aiming for automation

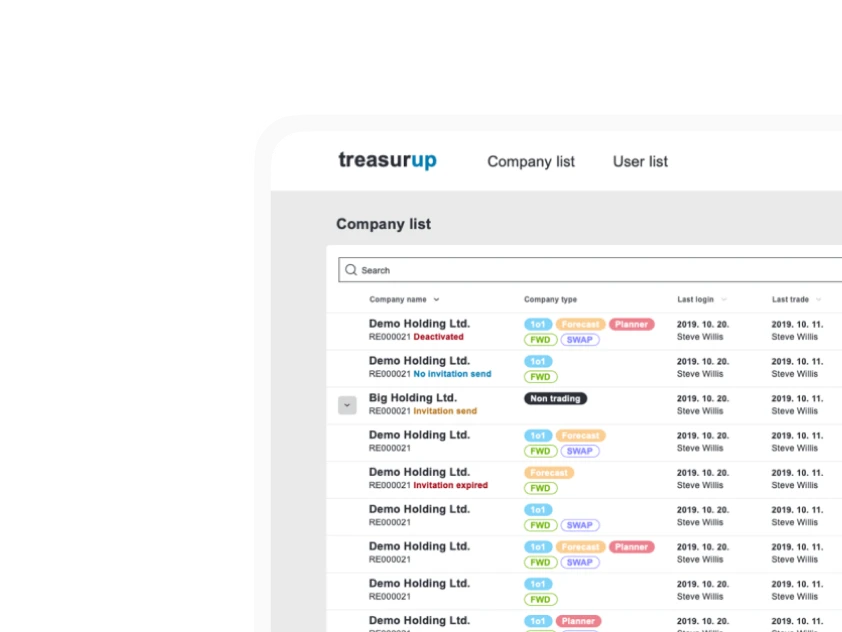

Several walks of life can become simpler, more efficient, and cheaper through the automation of repeated tasks. One of the most pronounced trends at the beginning of the 21st century is naturally not leaving the world of Fintech developments unaffected either since many financial activities can become faster and the number of errors can be reduced if these tasks are left to algorithms instead of humans. This is the field where Crelan is leaving the competition behind.

CodaBox, which operates as the subsidiary of the Belgian Isabel Group, presented its CARO service in December 2020, which allows accountants to automate the entry of digital credit card statements of their customers into their accounting software. The service can be instantly activated by opening a company account with Crelan Bank, thus replacing the monotonous process of manual entry, which also introduces the possibility of errors.

According to a statement by Vincent Van Zande, acting manager for the B2B market at Crelan, the financial institution is the first to introduce this option in Belgium. By focusing on automation, Crelan can significantly reduce the financial administrative burned on its business customers. The stress associated with observing the deadlines for quarterly VAT returns can also be reduced with the help of CARO.

Enhancing the user experience is possible not only through the (repeated) redesign of the end-user interface. Crelan intends to automate and thus improve its investment consultancy services as well and at the same time ensure the uniformity of the customer experience, stated Jean-Paul Grégoire, the commercial director of the bank, at the time of Comarch Wealth Management being introduced. The system supports the agents of the financial institution in providing comprehensive and appropriate investment consultancy services in accordance with the needs, priorities, investment preferences, and risk appetite of the customers.

Belgium and Europe on new paths

In the shadow of the huge markets of Germany and France, thanks to its multilingual nature, the Belgian financial sector is an ideal market for testing and introducing new services for both the giants of the banking world and Fintech companies. As a result of its geographical location and level of economic development, the country consisting of Flanders and Wallonia has been taking advantage of this opportunity for a long while; both the residents and the business entities can try out the latest financial developments among the first.

These include a large number of interesting novelties but two key trends are the most dominant. On the one hand, on the side of customers, access to the most streamlined services possible in the most comfortable and simplest manner, on the other hand, on the side of service providers, the implementation of automation and artificial intelligence to a degree never seen before. Their combined result is a further increase in cost-efficiency and the creation of new income opportunities through the expansion of their clientele.

This is due to the fact that the developmental ‘urge’ in Fintech creates target groups in segments outside the wealthy, middle-aged users as well, the latter of which has so far proven to be an easy field to navigate while the former has been hard to crack, including the age group of young people with low funds but open to new concepts. Naturally, today’s youth, fans of WhatsApp, cannot be expected to view their usually hectic finances with the same tempo, determination, and worldview as their parents.

Financial institutions must adapt to the new expectations of the new generation, which pressure is further increased by the innovative and quickly-developing segment of Fintech companies. This phenomenon forces the market players to seek out new paths.

In order to improve user experience, it has practically become a generally accepted practice in the highly-developed Belgian market to conduct UX research and incorporate the results into the applications. The lessons learned here may soon appear everywhere across Europe (the first signs are already visible) since the majority of the banks operating in the Low Countries have multinational roots.