Making Fintech ‘Invisible’ - The Singapore Fintech Association’s approach to growth and vitality

Towards the end of fast-paced and wide-ranging conversation, Shadab Taiyabi expresses an interesting take on the future of Fintech, given that he is President of the Singapore FinTech Association. When I ask about the direction of Fintech there, he points out that it doesn’t have to be just in the city state where he is based, or even the ASEAN region, but for the whole world of Fintech.

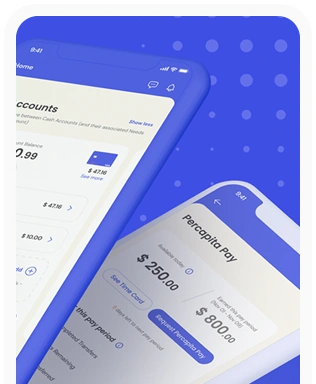

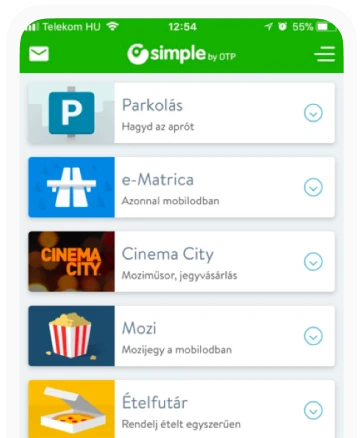

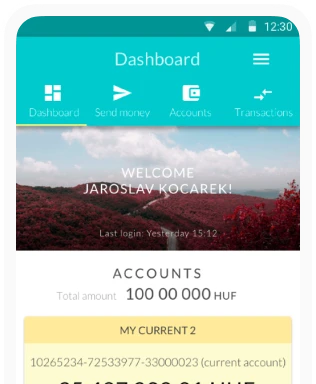

“The simple answer is that Fintech will become more invisible,” Shadab says, somewhat counter-intuitively. Meaning what exactly? “I would say the litmus test for the real availability of Fintech would be that you literally don't have to think about whether it's Fintech or not, it's just so embedded in your day to day work. So embedded finance, as an example, right? If you're using the same app for your ride hailing, or for your food delivery; If you're able to get your financial services through that - because a Fintech has enabled embedded finance in it - that’s exactly the kind of invisibility I’m talking about. You won't have to go to a separate app.” So as users, we won’t be thinking, ‘I am now going to go to a Fintech for this next service?’ Shadab confirms this view: “You could just ask Google, ‘What would be the best portfolio recommendation for me to invest in for my child’s education in the next 10 years?’ You should be able to get that on the go rather than having to log in somewhere. So that would be the ultimate objective, although that’s for the future. For now, the biggest benefit that Fintech puts on the table is to make it easy for financial services and products to be deployed to a much larger customer base, as much as possible, across jurisdictions, and across geographies.”

Shadab Taiyabi, President, Singapore FinTech Association

Shadab Taiyabi, President, Singapore FinTech Association The place of AI in Fintech

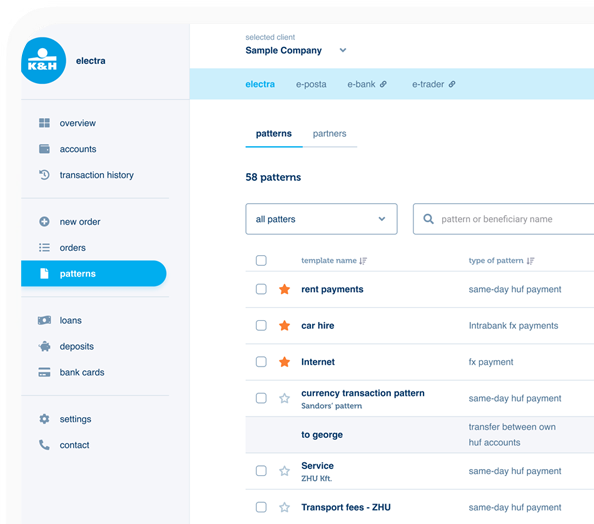

Ease of use has clearly been a hugely important factor in the growth of Fintech around the world, so how does Shadab evaluate the importance of UX design in making this concept of ‘invisible’ Fintech accessible. “It’s a hygiene factor,” he responds. “There is no way you can have bad UX and survive nowadays. So you really need to have it. But the issue is more of what else do you bring to the table? How's the UX? How am I really able to relate to the UX? Is it personalized for me? Does it really understand me? This is where Gen Z is looking towards the delivery of products and services to them, and that’s where Fintechs will have to evolve.” The connecting thought here is to wonder if Artificial Intelligence is also impacting UX design, and Fintech offerings. Shadab is cautious about how fundamental the shift to AI-powered solutions might be, given that there are elements of AI already in use across Fintechs, even though many retail customers are not fully aware of it. He sees AI currently as more of ‘a flavor element’ than as the main attraction. “So if there is an availability of ease of usage that Fintechs are able to bring to the end customers, that’s where AI will have its biggest impact.

It’s all about a much better UX, a much more personalized product and service that will attract consumers more, and that probably will affect the business models of Fintech companies as well. There is a huge element of how generative AI is going to transform the delivery, and also the production of financial products and services. Fintechs are playing a very important role in using the latest emerging tech to provide more personalized solutions, for example in the insurance space, and the wealth space.” He cautions however, “The bigger question mark on the advent of AI is how to keep it ethical, how to protect it from the challenges and issues. So, there is definitely a framework that is being worked on, and MAS (The Monetary Authority of Singapore) is leading Project MindForge, which is looking at the ethical use of AI and developing the governance frameworks around it. These will not just be applicable to Fintechs, but also financial services institutions as well.”

Sopnendu Mohanty, Chief Fintech Officer at MAS, has said, “As the financial industry continues to explore the potential of Generative AI technology, it is crucial that we develop a clear and concise framework for its responsible application.

MindForge aims to address common challenges and catalyse AI-powered innovation in the financial industry, while ensuring that this technology is used in a responsible and sustainable manner.” For regular readers of our Blogs, Mr Mohanty’s name may be familiar, as a partner in Elevandi Japan - organizer of the Japan Fintech Festival - along with partners Takeshi Kito, and Pieter Franken. So is this type of cross fertilization and interconnectedness important in the region?

Singapore Fintech Association

Singapore Fintech Association Cooperation is key

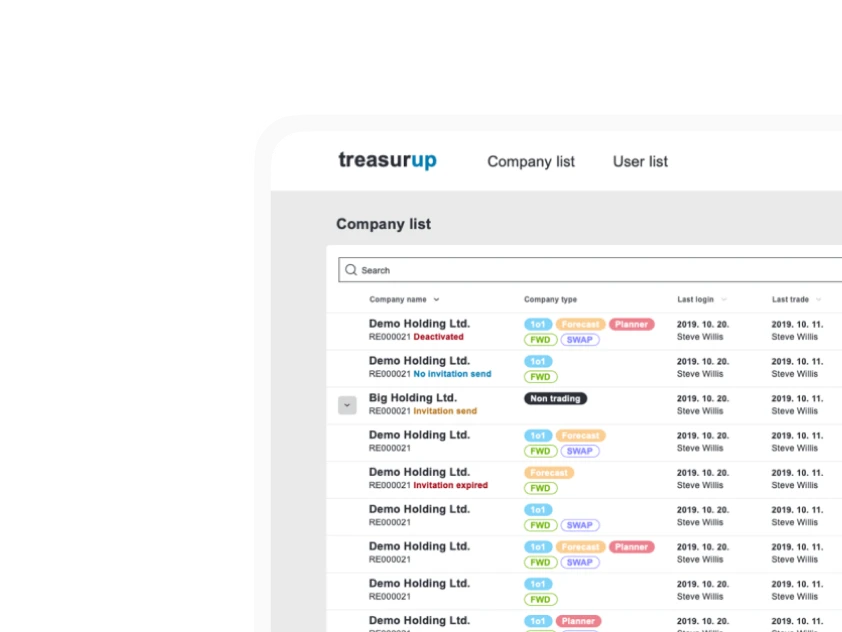

Shadab describes collaboration between the Singapore Association and other Fintech associations, including a Memorandum of Understanding signed with regional ASEAN organizations in 2022, and the formation of the Asia FinTech Alliance in November ‘23. The AFA was, ‘Jointly initiated and launched by prominent FinTech associations from ten countries and regions, including Hong Kong, Indonesia, Japan, Malaysia, Mongolia, Philippines, Singapore, South Korea, Taiwan, and Thailand. The AFA aims to foster further financial innovations with new technologies, enhance growth of the FinTech ecosystem, and facilitate the development of a supportive regulatory environment in Asia and beyond.’ That’s what the AFA’s website says, but Shadab adds, “The idea is for us to share information on the latest companies as well as the regulatory landscape. So it’s easier for one country’s companies to actually expand into other markets as well. We also do Mission Trips every year. Last year, we did five, and in 2024 we are planning another five, to different countries.

We want to bring our companies, our members, to meet with regulators, with policymakers, with other Fintech companies, banks, and FSIs... to see if there is potential for client engagement. So that kind of connectivity within the various jurisdictions, and within the associations is definitely going to help push the growth of Fintech in the region. And of course, globally, as well.” And just in case you think that Singapore and AFA in general is only focussed on immediate neighbours, Shadab mentions a mission he led to the UK in 2023, and a planned March ‘24 trip to Japan.

SFA and AFA meeting

SFA and AFA meeting Growth and guardrails

The cooperation between the Monetary Authority of Singapore and the Fintech Association suggests a different landscape to many other countries, where Fintech was initially - at the very least - treated with suspicion, and often hostility by regulators. It seems that from the start there was greater openness in Singapore, a point that Shadab agrees with. He describes how the regulator was interested in supporting the fledgling Fintech organization, rather than putting up barriers to the growth of Fintech. He adds that of course MAS had to strike a balance between the interests of the Financial Services Institutions and the ‘new kids on the block’, as well as ensuring protections from the broader consumer protection angle. As he describes it, there had to be a balance between, “Growth versus guardrails.” However Shadab reports that, “At no point in time, was there a situation of a lack of trust.

There has been very strong trust, support, and collaboration with the regulator all through these years with the Fintech community. MAS has done a good job of balancing that, while keeping the interests and benefits of all the stakeholders involved.”

Brand Singapore

I wonder about parallels between Switzerland and Singapore, in the sense that there is a very strong ‘Brand Swiss’ which is highly regarded around the world. Stick a Swiss flag on a product or service, and it immediately conveys ideas of stability, reliability, security and quality. Is there something similar going on with ‘Brand Singapore’? Shadab concurs that there is huge value in how Singapore is perceived in other countries, and cites international participation in the Singapore Fintech Festival year-on-year.

It’s billed as the largest Fintech Festival in the world, and the figures bear this out, with over 66,000 attendees in 2023, from 150 countries, listening to 970-plus speakers, along with representatives of 530 Central Banks, Regulators and other Government Organizations. So how has ‘Brand Singapore’ contributed to the growth of the Festival? “You can see from the attendee numbers and participation in the festival that people definitely see the value of Singapore,” Shadab says. “Singapore Fintech as a term was coined somewhere back in 2015 with the establishment of the FinTech Innovation Group, at MAS, followed by the formation of the Singapore FinTech Association in 2016. There were already companies in the Fintech space, but at the time it was less than 100, with about $20 million of investment in them.

Fast forward to 2022, and it was $4 billion of equity investments into Fintechs. Now, that did not happen by chance: there was a lot of effort, from the regulator, the policymakers, the government agencies, working hand in hand with the innovation community, the founders, and the entrepreneurs in terms of developing the right level of guardrails, while evolving the regulatory landscape.”

Always a hub for something

It sounds like it was government bodies which were pushing for the growth of Fintech, but Shadab is quick to correct that impression. He says that the tenacity and ambitions of the entrepreneurs were - of course - the most crucial deciding factors in the ballooning growth of the sector. Another useful factor for growth was that of Singapore’s geographical position as a hub for trade - a position it occupied long before Fintech. As Shadab says, “Singapore has always been a hub for something.”

In recent times that began with being a global trade hub, then the country pushed forward as being an education hub, then a medical tourism hub. Each step forward has built on the previous successes of ‘Brand Singapore’. And then came Fintech in the last decade, starting from those green shoots of no more than 100 companies, and during 2022 growing by 30%, with a current workforce of 18,000.

There are around 1,500 Fintech companies based in Singapore, with payments constituting the largest segment, followed by blockchain, then insuretechs and wealthtechs. Shadab observes in something of an understatement, “Yes, Fintechs have been quite successful in getting their values and brand out there.”

The challenges of recent times

So it’s all go go go for Fintech in Singapore? Shadab reflects that 2022 wasn’t the easiest of years, but that's the experience of many people in recent times. Specifically he says that it was a difficult time from the investment perspective, with Venture Capital investment drying up globally, across all sectors. Nevertheless Singapore still stands top of the league within Southeast Asian countries, in terms of the amount of funding going to Fintechs. So, challenging, but not crushing? “Well, we expect and we hope that the funding environment gets better in 2024. There are already positive signs where the deal environment is getting better. By Q2 to Q3, it should be back to the pre COVID days, as much as possible. But that’s for all of us to see. I think one of the major factors, because of the higher interest rate environment, was, of course, more hesitation from the investor community to actually go invest in private assets.

Investors have been sitting on dry powder for a while - So more capital deployment coming up, as we go on through 2024.” SFA at work, Networking

SFA at work, Networking And will that mean business as usual for the Fintech models Shadab has already mentioned, such as payments and insurtech, or are there new models coming in too? He is in no doubt that there are new methodologies and offerings on their way, or indeed already established. He mentions a considerable segment of the Fintech community, which is focused on financial inclusion, and broadening that sector. “On the financial inclusion side, there is the usage of emerging tech such as blockchain, AI, in terms of being able to service not just the affluent, but also the mass less-affluent, and drill down to the regional customer base as well, by providing them with access to the same tools as private banking clients or affluent clients have had access to.”

Financial inclusion across the region

That includes access to alternative investments, having a lower minimum for investment into corporate bonds, private assets, and so on. But also access to relatively better advice from financial advisors with the tools to service that market. The financial inclusion element is very prevalent in the bigger regional economies of the likes of India and Indonesia. “There are definitely more financial services and products for the unbanked and the underbanked population, because the advent of Fintechs has enabled lower costs and the ability to scale. So Fintechs are playing a huge role, although less in Singapore because the majority of the population is already digitally savvy, internet connected, and has access to bank accounts.” In more mature markets like Singapore, Shadab sees developments in the availability of wealth products for a much bigger mass affluent and retail customer class.

Green and sustainable Fintech

Another growth area is in ‘Green Fintech’ where Singapore has taken a lead, with between 40 to 50 companies focused on green finance solutions, both at the origination level, and the ability to extract Environmental, social, and corporate governance (ESG) factors, which can then be used for disclosure and more efficient green financing by financial institutions. And also beyond that, is the importance of measuring the impact of green finance and its accurate measurement. Shadab mentions that of the 10 committees of his organization, one is the Green and Sustainable Fintech subcommittee, which includes banking representatives, and has made leaps forward in terms of its impact on the green and sustainable tech space.

An SFA Sustainable Businesses meeting

An SFA Sustainable Businesses meeting The Monetary Authority of Singapore has also been taking a lead on this front with the launch of Project Greenprint, ‘Using technology for efficient and trusted data flows to support Green Finance.’ This is not just Singapore-centric either, with the stated aim of, ‘Scaling Green Fintech solutions beyond Singapore.’ So, Shadab sums up, “These are good steps towards establishing Singapore as a center of green finance and transition finance, serving not just the region around us, but also broadly globally.”

Searching for and developing talent

With so much activity springing from a relatively small country, I wonder how Singapore can grow and maintain enough talent to service all this. Shadab admits that talent is always an issue, and Fintech founders frequently ask how the Association can help in attracting more talent.

The Universities and Polytechnics have been successful at creating new programs which are Fintech-focussed, and the Fintech Association is active in helping develop these with the Institutes of Higher Learning. The Association also runs its own Foundation Programs to ramp up the knowledge base for fresh graduates, but also - interestingly - is keen to harness the skills of mid-career professionals. Such people can be a valuable resource, having life experience and business and technical skills, but not necessarily in Financial Technology. Redirecting them and reskilling them brings that resource into the Fintech arena, alongside younger ‘fresh’ graduates. It’s a combo that sounds like a useful approach for other countries to look into. When we speak, the third cohort of around 40 ‘middle aged’ people is just starting the program.

Attendees at an SFA Career Fair

Attendees at an SFA Career Fair And of course, when speaking of attracting enough talent to the Singapore Fintech sector, there’s always the option of hiring skilled workers from other countries. Which may go back to that idea of ‘Brand Singapore’ and the attractions to foreigners of relocating to such a settled and affluent environment. Once again, it’s clear that government agencies in Singapore are supportive, with the Ministry of Manpower creating the Compass Visa scheme to encourage and facilitate foreign nationals to find new opportunities in the country. As Shadab explains, “It's a point based system for visa applications. So there is more visibility and more transparency in terms of companies making their resourcing plans, so they know who to hire, and where to hire them from.” He stresses however that it’s homegrown talent which should be the first consideration, and his Association, the Universities and Government are intent on developing local talent as the next generation of Fintech developers.

Weighing the gender balance

While I’m impressed by the idea of giving new opportunities in Fintech to mid-life workers, I’m also interested in how the gender balance is looking in Singapore’s Fintech scene. Not surprisingly (given that this is probably globally true), Shadab says that “It’s not the most balanced at the moment”, but the Association is aware of the imbalance, and is trying to address this. ‘Taking Stock & Looking Ahead: Gender Diversity in Southeast Asia’s FinTech Landscape’ is a report commissioned by the Singapore Fintech Association for the 2022 Fintech Festival which graphically demonstrates that there is as yet a way to go when it comes to gender balance.

There are an average 14% female lead partners on deals, at all funding stages, and around 13% female representation on boards at all funding stages. Women founders or CEOs currently pans out at an average of 9%. So, definite room for future improvement, but the awareness is there.

Looking to youth

Speaking of inclusivity, Shadab is keen to point out that the Association is not only reporting on gender balance, helping mid-lifers to reskill, and working with Institutes of Higher Learning, but is also involved in more grassroots projects, such as being organizer, judge and mentor for hackathons.

This included the grand final of the 2023 series being held at Fintech Festival - a great shop window for the students, where the winners were evaluated by Shadab and his colleagues. Then there’s also the Association’s participation in Fintech 101, an entirely free course for younger students to engage in, under the auspices of the Singapore Fintech Youth Chapter. In the future Shadab can even foresee expansion into secondary school programs, where the principle of creating a problem statement, and coming up with a solution and proof of concept can equally well be applied.

Youth event at SFA’s Robinson Road headquarters

Youth event at SFA’s Robinson Road headquarters It seems that the Association is dedicated to its stated aims of, ‘Advocate. Collaborate. Connect.’ Currently it numbers 8,000 industry professionals as members, with around 800 corporate members. There’s also a host of authoritative publications to draw on, and a rich seam of past and future events. It’s therefore hardly surprising when the man at the helm of all this varied activity checks the time and announces that he really has to be somewhere else. I’m left with the fascinating idea of ‘Invisible Fintech’, matched by the very visible and comprehensive activities of the vibrant Singapore FinTech Association.