Hungarian Fintech – Bankers and the orange crop - part 2

‘It’s not what you know, it’s who you know,’ is an old saying that seems to apply particularly well to my enquiries into Hungarian Fintech, where in the home country of Ergomania, doors are significantly easier to open. So much so that it’s necessary to divide this country review into two articles, split between Bankers, and Fintechers themselves. In this part I chat with representatives from two major banks – OTP and K&H – as well as from Magyar Nemzeti Bank (MNB), the Central Bank of Hungary.

Massive change in 30 years

I begin with one of my stupid questions when I ask the Head of Innovation for OTP Bank what the flavor of Fintech in Hungary is.

“Strawberry!” answers András Fischer immediately. “Or is it orange?” chips in Ergomania’s András Rung, also on the call. From this, the two begin educating me about an old Hungarian movie, A Tanú (The Witness), which features a subplot about orange farming in the country. This isn’t possible because of the climate, but nevertheless must be achieved to satisfy Communist ideologies. The film is of course a satire, but it does vividly demonstrate how far Hungary has come. Within the lifetime of András and András, Communism collapsed, and from the ashes grew a Westwards-looking modern country. Thirty years after the beginning of that enormous change, we’re talking to András Fischer as he sits in the enormous atrium at the headquarters of OTP Bank in Budapest. My stupid question has opened up a whole vista of what it means to be in business so relatively recently after ‘Regime Change’. I have the feeling I’ll be returning to the orange crop later.

Finding the pain points

For starters though I remark that ‘Head of Innovation’ sounds like a cool job title, and András agrees because, “I came up with that myself.” So, is his door always being knocked on by the next big thing?

“Yes, to some extent Fintechs do knock on the door on an almost daily basis, but we actually plan this in a more structured way. We collect the business cases, the challenges and topics that the entire bank, or even the banking group, can benefit from. These are lending, savings, back office, whatever. We are an internal service department, and our customers are 99% our own colleagues. So, we talk with them, find out what their pain points are, what they are planning, and what shortcomings they have in their business line. We then help them formulate this into a problem statement that could be solved by a Fintech, although I think ‘Fintech’ is actually too narrow a term. So we work with all sorts of startups and scaleups. We began from startup incubation, and are currently running scaleup acceleration.”

The first OTP Lab startup program was performed with the help of an external consulting company. The following year it was organized without any external support, but still only in Hungary, and focusing on more mature companies. In the third year, the program was opened up to OTP international subsidiaries, originally for six countries.

The OTP footprint covers eleven countries across the Central and Eastern Europe region, and the OTP Innovation Lab is concerned with creating a ‘chemistry’ with chosen Fintechs. This usually follows a three-month pilot period where the creation and assessment of business cases is developed. If this looks positive, then companies are invited to engage in an additional six months of rollout. During this time, András points out, “We don’t let their hands slip, and continue to support them.” So, what kinds of companies are partnering with OTP?

Surprise us!

“They come from every angle of the business. So there are companies that work with HR, or for example, EDUardo which provides a learning solution. Then there’s a company that works with a Serbian subsidiary, developing solutions for SME Customer Relationship Management that runs on mobile. We group these topics into five-plus-one categories: Advanced data analytics; Customer experience and customer servicing; Internal efficiency; Product innovations in retail banking; and Product innovations in SME and corporate banking.”

And that ‘plus-one’ category? It’s a wild card of ‘Surprise us’! András explains that the Lab is looking to develop “Not only the core banking part that you might think of first, like lending or saving, because there are a lot of companies also addressing the needs of so-called supporting functions like compliance, cyber security, IT, back office, and contact centers.” He’s keen to add that he’s not labeling these as ‘non-critical’, because they are in fact crucial areas. But when it comes to the business, they are typically not at the top of the priority list. Now, as a result of the Innovation Lab’s involvement, departments are extremely happy when they get the chance to work with technologically savvy, state-of-the-art startups and scaleups.

It seems that András Fischer’s 99% internal customer base have reason to be satisfied with the work of the OTP Innovation Lab. To date there have been over 1,300 startups evaluated for collaboration, more than 45 completed pilot schemes, and a 45% ratio of post-pilot collaborations, with 105+ participating OTP business units. As Dr. Tina Ruseva, CEO of Mentessa remarks, ‘The OTP Startup Partner Program has been essential in understanding the unique ecosystem of OTP Bank, connecting us with champions from within the organization, and providing all the resources necessary for the first step into a successful collaboration. I strongly recommend it to all startups.’

Note that while we’re talking about a bank that is headquartered in Hungary, with the Innovation Lab in Budapest, Mentessa is a German enterprise – so the scope of András Fischer and his team is wide.

Finding effective partners

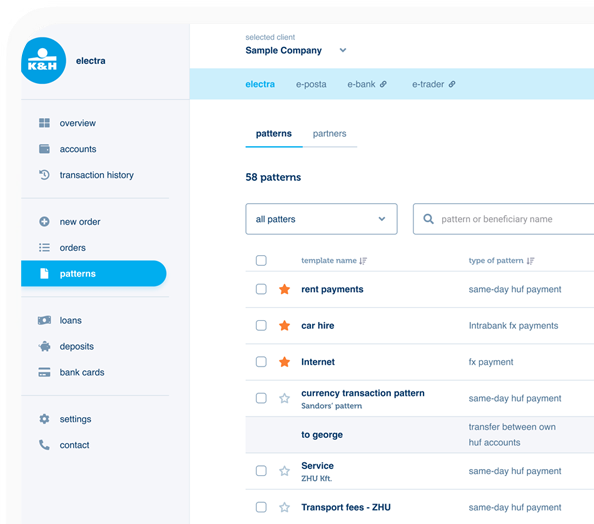

Over at K&H Bank, Head of Products, Imre Fónai also has a wide remit, “I’m responsible for the product owners of the digital product, who are escorting the development process, and later on when it gets into the live environment. I’m also responsible for the UX process.” Imre points out that while not everything is digital yet, more and more processes and products will be digitized – not just in banking, but across many industries.

The Belgian KBC Bank, owner of K&H, is in the process of implementing a huge digital roadmap across the group. “In the future, digital products will dominate almost all aspects of banking,” Imre reflects. But for the time being there are still some processes that are not yet digital, like the more complex products such as investments and mortgages. However, he says that ways will be found to make them more simplified and ready for digitalization.

As with András Fischer’s Innovation Lab, Imre points out that a structured process is paramount in focused scouting for potential solutions, although – with the exception of some big players – it’s seldom the case that a bank in Hungary has a specific department to figure out how Fintechs can be integrated into its portfolio.

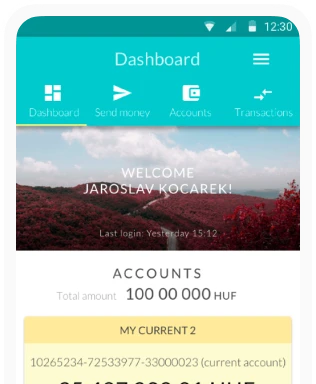

The K&H digital onboarding process is a recent win where everything from the first touch until the very last moment of onboarding can be achieved via smartphone. It’s very simple for the customer, but of course is complex in the background, with many systems and interfaces working together. Imre explains that there were some of these components which K&H was not able to build, or for which building them would have taken too long and “Didn’t make any sense. For example, KYC identification components where you have to show your ID card, record a video of yourself, and be compliant with Central Bank regulations. So we went out to the market and found a Hungarian company that built an application called FaceKom, a software base which is also being used by more and more companies.”

Allies, not competitors

Imre applauds Fintechs that are creating valuable solutions for the banks, and says that for sure they will survive and thrive. But he is wary of many small Fintechs that don’t really create anything, either for customers or the banks. “It’s just an idea on the drawing board, or two garage guys dreaming of a very big future where they are very rich.”

He charts the rise of Fintechs, but also the change of emphasis since the term began to appear. At first there was the prediction – or perhaps suspicion – that these new arrivals would become ‘intermediate banks’ with all the front-end contact with customers, pushing the established banks into merely providing the solution of back-end processes and products. That’s not the way things have turned out in Hungary, because with the exception of a few, Fintechs haven’t gained the level of investment required, or indeed the branding. Perhaps the biggest challenge for them has been to reach product market fit, which seldom happens. The incumbent banks with their hundreds of thousands of customers have a base that no Fintech could hope to emulate any time soon, so Imre says the Hungarian scene has developed in a different way. No Revolut, no N26, no Monzo, and he feels that’s unlikely in the near to mid term. Instead there’s been steady cooperation for mutual benefit. That means searching for ways to integrate the solutions of Fintechs into the solution landscape of the banks. Those Fintechs not dreaming in their garages are not ‘the opposition’, but have become vital players in the ecosystem.

“It’s the big question nowadays,” Imre says – how can banks and Fintechs cooperate and integrate? For example, he points to the big legacy systems that most banks are saddled with – built in the ’90s, often running on technology from the ’70s. The K&H legacy system story is typical, where there is currently a massive change process underway, but parallel to the huge back-end transformation, the pace of digitization must also be maintained. “Otherwise we would be lagging behind the other Hungarian banks, then sooner or later we would become obsolete.” Clearly that’s not something that the Head of Digital Products is going to let happen on his watch.

“Right now, we are very much concentrating on having a result with both big initiatives: the big back-end change, and further increasing the digital capability of K&H. And this is the point where Fintechs can really help banks. Because if you want to move forward fast, if you want to build your solution on something which is already proven, like a solution from a Fintech, then you should reach out to those guys and try to integrate their solutions into your IT landscape.”

So it seems that both Imre Fónai at K&H, and András Fischer at OTP have similar approaches. They are looking for solutions from reliable, cooperative Fintechs, and have the muscle to help incubate or accelerate some of the newer offerings. Win-win then?

Becoming stable and shock resilient

Over to MNB – Magyar Nemzeti Bank – to get another piece of the picture from Digitalization Director Péter Fáykiss. For him the story began back in 2014. “At that time, our team was responsible for macroprudential policy and this team built practically the whole macroprudential policy toolkit that you can see now. We recognized then that digitalization could be a huge challenge from financial stability perspectives as well as if Fintechs or Bigtechs stepped into the market. But of course the digital transformation of the banks themselves and the insurance companies is also essential in order to provide a stable and shock-resilient, efficient financial sector.”

Now at this point I have to admit that I’m expecting a story of an ultra-conservative approach to unfold. After all, Central Banks aren’t normally leading the innovation charge, but apparently MNB is made of different stuff. Placing the twin issues of digitalization and Fintech at the root of considerations, working along with the supervisory arm of the central bank, Péter’s team started a consultation process, producing a white paper in 2017. This included a comprehensive survey of banks, Fintechs, VCs, other foreign regulators, business angels, and consumers.

Out of that consultation came some suggestions, including a regulatory sandbox, and an MNB Innovation Hub, launched in March 2018. Péter smiles at this, “MNB’s Innovation Hub was more than one year earlier than the Bank of International Settlement’s own innovation hub.”

After that came the implementation of the regulatory sandbox, which provides a specific framework for testing innovative technologies, and having the ability to grant temporary exemptions from regulatory provisions. “The bottom line is that, currently, we are only able to give waivers from Central Bank decrees; a new Regulatory Sandbox legislative framework at the level of an Act would provide testing opportunities for a wider range of market participants, which would be a forward-looking move in terms of the competitiveness of the Hungarian financial system.”

Although that does sound almost as bureaucratic as you might expect of a Central Bank, Péter charts part of a changing attitude, which was supported with the innovative strategic mindset of the Governor György Matolcsy, and the arrival of a new Deputy Governor, Mihály Patai, who had previously been CEO of Unicredit Hungary. A new, more commercially aware approach was fostered in MNB with the appointment of Anikó Szombati, Chief Digital Officer and Executive Director responsible for Digitalization and Fintech developments.

It was at this point that Péter became Head of the Directorate responsible for digitalization. “There are two departments in our Directorate. The first is responsible for policymaking, so they are coordinating the MNB Innovation Hub, the regulatory sandbox. They’ve put together the Fintech and Digitalization report which will be published soon (also available in English). And of course there’s the Technology Team who are responsible for research, and developing tools based on AI, machine learning, neural networks, and blockchain.”

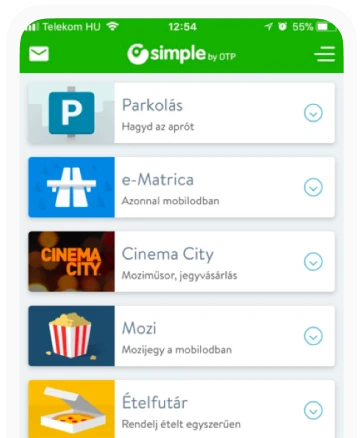

Stamping change on the next generation

From there, we leap to a surprising example of how forward-looking MNB is, or in some ways backward-looking. Péter explains that in his childhood, Savings Stamps were available for children. Kids collected books of stamps, and after a few months these could be redeemed for prized possessions such as a football. I have since checked with Hungarian friends of a certain age, who confirm with wistful smiles that they were indeed part of the scheme, more than thirty years ago. Well now MNB has revived the idea of savings stamps, with a mobile application that can be downloaded by parents, which their kids can then use for quizzes and games. If successful in doing the quizzes, children receive digital stamps of different designs, which can also be swapped with friends. There’s an internal currency called a student dollar (Diáktallér), which can be spent in a dedicated webshop, with the purchase delivered to the child’s school.

In addition, kids receive push messages on topics such as digitalization, savings, sustainability, or green issues. And of course there’s a chat feature!

At this point I’m sitting somewhat open-mouthed as I listen to concepts that sound more like the product of a cutting edge ‘out there’ design agency than a Central Bank, but Péter and his team are on a mission. “The whole logic and strategy behind this is that we see it as challenging to educate children in the financial world because it’s extremely boring for kids. With this application, we have two goals. The first one is, of course, simply solving quizzes where you receive some rewards through an educational process.” It’s still a pilot project, but the app has just reached one million solved quizzes, with several thousands of regular users.

“The other part is that it’s like a little mobile bank application. It has similar features, with a PIN code to enter, and you can transfer ‘money’ (the Diáktallér), exchange stamps, and set savings goals. So, using a gamification process, we wanted to show students that it’s useful to learn, but it’s also very challenging because children are extremely picky!”

So, MNB is promoting gamification and helping train the next generation of financially more aware citizens? Péter smiles in agreement, “Correct. In short, we are quite an innovative Central Bank.”

He also casually throws in the Money Museum mobile app, another atypical initiative aimed at elementary students, and adults because, “Money can be interesting for anyone.” The Money Museum mobile app is another way of creatively testing technology where NFTs will be available, and users will be able to register coins on MNB’s blockchain platform.

The motives of an Innovation Lab

My interest is always roused by colorful examples of activities that seem outside the expected story. While interviewing European Fintech players I’ve come across projects that support African women’s financial independence, or cleaning up oceans. Now I find that the Hungarian Central Bank has updated a leftover idea from decades ago into a contemporary app for children – another surprise.

I angle the conversation with András Fischer towards finding out if the OTP Innovation Lab has any socially-facing activities. It’s probably my second stupid question of the interview, but András gives it polite consideration. “If you look at the motives of a company, why does it do a startup program? Certain companies state that it is a CSR activity, and it’s even reflected in how they finance it, from their marketing budget, right? But that’s not the case for OTP, where it’s clearly a business-driven initiative. Our goal is twofold. On the one hand we support relatively immature companies in the market. At the same time, we want solutions to benefit the bank, so ideally, it’s a win-win.”

András swiftly corrects himself, “I mean, it has to be a win-win, otherwise we’re not going to sign the contract! OTP does have vast CSR activity, supporting sport and culture, but when it comes to collaboration with startups, we are looking for new ways of thinking, innovation, technologies, and new business models. We make this very clear from the beginning – this is not a CSR activity, this is not like a Vanity Fair – it has to bring measurable value to the bank. That value can mean revenue, cost reduction, faster time to market, customer experience, or lower churn. It can even be improving the motivation and working methods of our colleagues. But we have a business case and strict KPIs for each and every pilot project that we run.”

Wider than Fintech

We return to the question of the partners that the OTP Innovation Lab works with. András said earlier that it’s ‘Wider than Fintech,’ so how does he define the ecosystem that the Lab is nurturing? “Everything is Fintech and nothing is Fintech,” he replies, echoing the frequent comments I have heard about Fintech now being so widespread that sometimes the definition seems almost redundant. “When it comes to a chatbot, just as an example,” András considers. “Is it Fintech? I think not. A utility company or state-owned company can use a chatbot because if you’re large enough, you need customer service, and therefore will replace some manpower with bots. So it’s not only the financial industry, it’s every industry.”

And speaking of chatbots, guess what? – The seemingly ever innovative MNB is among the first of the European central banks to have a chatbot, in a pilot phase on MNB’s website, via the Innovation Hub page. Péter Fáykiss sees the use of voice as being a developing area, which at first he was skeptical about, but is beginning to appreciate use cases, such as help for blind and partially sighted people. “I won’t say voice services will come in with a big boom, but the reason behind the cautiousness of the banks in this field is that it has to work extremely well. Voice services are not like a chatbot, where in a way it’s a bit silly, but you can get some answers.”

Overall, Péter agrees that digital and financial exclusion is an important topic. For example, onboarding people in their 60s-upwards means that the process should be extremely simplified with very clear design. “We have reached almost everyone below 50, and they all use digital solutions,” he says. “But now comes the tricky part, when you have to convince people in their 70s. There are stories from the sector, that people over 70 receive their pension into their bank account. They go to the bank, withdraw the money from the ATM, count it, and then go to the cashier and put it back into their bank account! We have to convince these older people that digital solutions are safe.” That means apps that are easy to use, and that can be trusted.

Back to that question of flavor

But back to András Fischer, and my question about the flavor of Hungarian Fintech, followed by a digression into that old movie A Tanú. Having produced literally only one orange, the (fictional) Hungarian Orange Institute is preparing to present it to a visiting Soviet dignitary. That is, until a boy eats it. At the last moment the orange is replaced with a lemon and as the visitor samples it, he is told, ‘Yes, it’s a little bit small, it’s yellow and it’s bitter … but it’s ours.’

So a lemon pretending to be an orange, or a healthy crop of fruit that thirty years ago could never have been grown in Hungarian soil? András is still a little doubtful of my line of questioning, but has a go at answering anyway. “It’s really hard to say what the flavor of Hungarian Fintech is. It’s obviously not homogeneous, but there are some frontrunners that are already on the international market and have managed to raise significant funds.” He mentions Banzai Cloud, although questioning whether this is even a Fintech, rather a tech company with a massive amount of financial clients.

OTP’s VC fund, PortfoLion invested in Banzai Cloud, which claims to ‘Take care of all the detail that makes developers ecstatic, ops people a little less grumpy, and your finance guy feel like he’s a rock star.’ The company has now been acquired by Cisco.

András continues, “So there are a small number of very mature and advanced state-of-the-art technology companies. And then there are a lot of companies that are still trying to find the ideal product, or match the product to the market, or their service with the market.” Stabilizing the business model, and figuring out how they can actually make money out of their offering is also on the minds of many of these companies. “And there are very few companies in between. That’s my gut feeling, but I cannot underpin it with data.”

Coming back in through the window

Imre Fónai of K&H Bank interprets the idea of ‘flavor’ as being more one of style, and sees it as quite generation-dependent. “You see guys coming out of university, through to old-time very experienced guys over 50. Many of them suffer slightly with the problem of their pitching knowledge. They don’t have that experience of how to pitch, how to get close to the banks, and decision makers. If you are a guy who is pushing through his ideas, because he believes in the idea, you’ll do everything possible to get it through. You’ll not give up immediately after making a pitch.”

Bankers are busy people, Imre points out, and if they don’t take a meeting with a startup it’s often just because they’re tied up with other things, not because they see the company as competition. His advice? That bankers must be made to move on with an idea. “You have to push, push, push! And if you leave through the door, you will have to come back in through the window! So sometimes I do have the feeling that Fintechers in Hungary give up very easily, and in addition the old school guys don’t know how to do this new age business.”

“I think it’s a general Hungarian problem because Hungarians are very shy. And probably this is my overall feeling about Hungarian Fintechs. I am in a position where if the Fintech world was very pushy, and believed its own story, every second day I would get something on LinkedIn in terms of Fintech solutions offered to me. What I do get comes mainly from other countries like Czechia or the UK. But Hungarians very seldom contact me.”

So you heard it here: If you’re an up-and-coming Hungarian Fintech, push harder, and if the door doesn’t get opened, knock at the window!

András Fischer is also complimentary about the entrepreneurial drive in other countries. “I sort of envy the Czechs, I think they have so many great startups. It’s venture building as well. The Czechs are so innovative and the startups are not even startups anymore. I think many are large corporates by now, just within a couple of years. In comparison there is still a lot of leeway in Hungary and a lot of room to grow.”

Counting growth

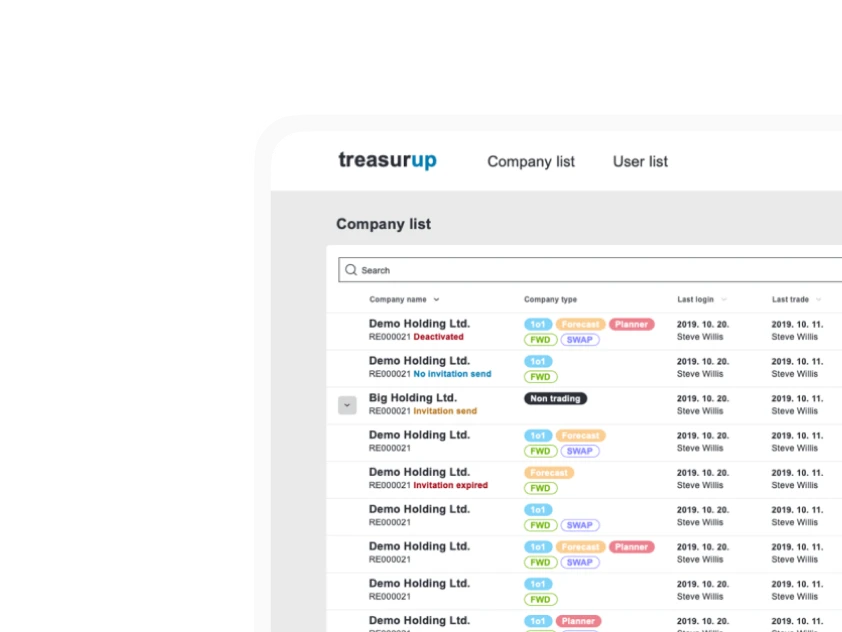

That room to grow is commented on by Péter Fáykiss at MNB, who remarks on a Deloitte analysis that counted around 3,500 active Fintechs in the EU. In Hungary, he observes that the sector is certainly growing, and an MNB survey currently counts about 150 active Hungarian Fintechs, although this was difficult to measure. Banks are obligated to report directly to the Central Bank but in the case of Fintechs, the situation is different. Some companies do have a license, such as e-money providers, AISPs (Account Information Service Providers) and PISPs (Payment Initiation Service Providers), however, a significant number of Fintechs don’t need any license from the Central Bank.

“So the first challenge for us, when we made the first Fintech digitalization report in 2020, was how to measure the number of Fintechs in Hungary. We had a list of companies, based on activity numbers (NACE). We collected all of those companies in software development or any other areas that might be related to Fintechs, and arrived at a figure of 50,000 companies.”

Knowing that this was a vast overestimation, the tech team at MNB then web-scraped company websites, and put likely companies into a ‘Fintech Bucket.’ The operation involved doing some 300,000 web scrapes, pretty much equivalent to panning for gold, considering the final list of just 130 Hungarian Fintechs. The identification process also involved expert opinions about whether the short-listed companies have real integrity, rather than just some misunderstanding in the machine learning process. The resulting data means that MNB now has a very real sense of what’s going on ‘out there’ in Hungarian Fintech.

This encompasses business worth 130 billion Hungarian Forints (roughly €360 million) income in 2019, with about 6,000 people involved in the sector. “It’s not insignificant, but there is huge room for improvement,” says Péter, “And they are very active.”

Breaking down the numbers

Most of the companies are B2B focused. So they are not on par with the neobank successes of other countries. Rather, more than 80% of Hungarian Fintechs provide services for banks, insurance companies, wealth management companies, investment companies, and are founded to help these on their digital journey. From a technical perspective, Péter rates many of the Fintechs highly, and also points out that with B2B services it’s possible to export know-how to the UK, Germany, Vietnam … or anywhere. With B2B being the main business model, many of the Hungarian Fintechs are quite profitable. Instead of just burning through VC money, roughly 50% of the micro Fintechs in the Hungarian sector are profitable, which Péter sees as quite unusual.

“I think this is a very good situation because one of our main goals at the Central Bank is how we can support the digital transformation of the financial sector itself. How we can push them, encourage them to make the digital transformation to provide better services to consumers, and make them more efficient to increase their competitiveness. In that sense, the B2B Fintechs are very good. They are supporters of the banks in that sense. They provide chatbots; RPA solutions; and blockchain solutions, to optimize internal processes. So it’s a win-win and usually the Hungarian Fintechs are not the competitors of the banks, and are mainly helping make their digital journey much better.”

Which brings us more or less exactly back to the role of the OTP Innovation Lab.

Startup Hubs

“We are far from being a true Startup Hub,” remarks András Fischer. “It’s a very complex topic, and some countries such as Israel have invested heavily in it. They changed their regulations, they set up certain institutions, they tried to attract startups from abroad. So Hungary has many options that are not utilized yet.” He acknowledges the progress made by MNB however, “I can see the efforts that the government is making. And the National Bank is very active in the Fintech space, and very determined to bring out the most of this.” Here he mentions the Information and Innovation Hub created by MNB, which startups, and even ‘one-person garage companies’, can turn to for a single point of contact. They’ll get help with regulations, and be able to use the regulatory sandbox, meaning it’s possible to join forces with a regulated company such as OTP. Startups can also jointly get waivers for a period of six months. “So MNB is very determined to drive digitalization in the financial arena. They even came up with the digitalization recommendations for the banks. But it’s a massively complex topic, how to make a country a true Fintech or Startup Hub.”

And is Hungary there yet? András wears a ‘You cannot be serious’ expression. No, Hungary has some way to go.

Crystal ball gazing

As we start to wrap up, I ask for some predictions from the Digitalization Director of MNB, Péter Fáykiss, who cites three big issues.

The first is Mindset Change, and the need for acceptance by banks that digital transformation is a must. Without it, Péter says banks will have no chance of surviving in the next ten years. “Currently, the banks are banks, providing financial services in a digital way. But in the future they will probably be tech companies providing financial services. This is the other way around, and should create a paradigm change in their mindset. But it is extremely challenging because this is a very traditional business, and it’s not an easy journey.”

The second big issue is that from a technology perspective, AI, cloud services, and the blockchain will grow massively in the coming years. In the case of AI, Péter predicts several strong use cases. The first is credit scoring where AI will be extremely helpful. Another area is in deploying more advanced chatbots. One commercial bank in Hungary already had its chatbot operational at the start of the pandemic, and without it the bank could have struggled with customer demand. During lockdown, the call center would have been overwhelmed, but the chatbot coped well with the huge additional demand for information.

Péter says the last major future issue will be fraud and cyber security, where AI will increase in importance. He mentions, “A very promising Hungarian Fintech, SEON Technologies. They are very good and have received millions of euro investment. They are already providing fraud detection solutions to Air France – Afterpay or Grab – and that is quite a typical B2B offering, which is very crucial.”

After a pause, Péter also adds another factor to his list of three, making it ‘Three plus one’. He sees a major step forwards for Hungarian Fintech being the creation of MAFISZ, the Fintech Association that was established in 2020.

A question of UX

Before leaving the three bankers, none of whom fit the stereotypical image of how banking people look and behave, I’m interested to know what the take of each is on UX-UI design. After all, this is the home turf of Ergomania, and András Rung and his company is known to each of them. So does UX matter?

Imre Fónai says that we are all now very used to having good user experiences in our day-to-day lives, and expect that in banking applications as well. There is good user experience with Apple, Revolut or Wise, so whether they like it or not, banks are forced to follow these best practices – which means focusing on UX-UI. “We have developed a good process in K&H of how to approach the UX challenge. We start by defining hypotheses: What the problem is for the customers, and then once we identify the problem, and are coming up with a possible solution, we go out again to customers to check and validate the demand. So we have many points where we validate or invalidate what we have built. Going through this process, the chances decrease of delivering something which is not useful or usable. There is a big difference between useful and usable! Sometimes people forget that, because they just want to build something. But we have to ask, ‘Okay, what are you building? Why are you building this?’ Many people are building solutions, but are not very knowledgeable about how a product should be built from a customer perspective. And that’s why so many companies and products end up having no users at all.”

Let’s chalk that up to ‘Must try harder.’

Péter Fáykiss points to the Central Bank also being proactive in the area of UX. “We’ve issued some guidance about UX, included in probably the first recommendations on banking digital transformation from among the central banks. We put a dedicated section in the publication about how banks should focus on UX design and have a use strategy. They have to increase their skills and knowledge in this area.” Next up will be further guidelines for the banks showing the principles they should follow if they want to make UX truly customer-facing.

András Fischer says that most companies now have either an internal team of UX designers, or at least some employees working with, and coordinating external consulting companies. “Five years ago every startup was saying how great their user experience was. Today if you say that, you are not saying anything new. I mean, it’s a must have. It’s like saying, ‘We have a password to our website.’ So the question is, how much UX is fully done and fully tested, and how frequently we involve customers in the testing. Because you can do too little, and at the other end of the scale you can overdo it. It’s true for all new technologies: If you are too early, then you will fail. And if you are too late, then the ship will go without you.”

A case of hitting the sweet spot, in the right place at the right time. Or a lemon pretending to be an orange? Clearly not, and somehow since Regime Change in 1989, from the unpromising and arid financial soil of Communist Hungary, a flavorsome crop has grown, tended by a new breed of Fintech-aware bankers.