Innovative UX solutions from Bunq neobank Digital banking in the Netherlands - part 1

Digital and/or mobile banks are among the most user-friendly varieties of financial organizations. Their services are not based solely on the intense interest of the digital generation, so they are primarily aimed at an increasingly populous camp of those who want a good user experience and ease of use. They strive for cost efficiency: while keeping their personal and material expenses low, they gain the attention of their customers with innovative, attractive premium services that result in high profit rates.

In addition to traditional banks that are increasingly innovating in the grip of their Fintech competitors, there are also explicitly streamlined service providers that have little or no physical representation. They are characterized by the fact that their customer service is not based on personal meetings either; they primarily prefer online communication that can be effectively aided by artificial intelligence through a website and/or mobile application.

Financial management via smartphone is an attractive – literally “hands-on” – alternative for the ever growing, Fintech development-sensitive customer base. Another value is their multilingual interface, which targets the non-native speakers of the country, those who are only temporarily there.

These trends are becoming stronger in more and more parts of the world, including the Netherlands. We shall examine the offer of local innovative services and the user experience they provide via some typical players in the Dutch market. First we unveil Amsterdam-based Bunq, one of the prominent voices in Fintech development.

Bunq – green banking and travel-based community building

Bunq is one of the four largest providers threatening traditional financial institutions, alongside N26, Revolut and Monzo. Although Bunq does not disclose accurate data, it is estimated that a user base of nearly 2 million uses the services of the company, founded in 2012. According to its financial results for 2019, its customers value their strategy based on environmental protection and travel community building: from 2018 to 2019 they more than doubled the value of their customer deposit from 211 million EUR to 433 million EUR.

The Bunq SuperGreen service is unique in its kind. The Dutch financial service provider finances environmental activities in proportion to the customer’s costs: it includes the cost of planting a tree with the involvement of its cooperating partner after every 100 euros spent, thus reducing the customer’s carbon footprint. Bunq claims that with an average spending level (€ 1,000 a month) and lifestyle, the customer can make their lives carbon-free in two years simply by using the bank’s services. The example of Bunq is, of course, followed by other providers, such as Bonsai in Ghent.

Through its non-profit Eden Reforestation Project, which has existed since 2005, the Dutch financial service provider supports the reforestation of Earth on a monthly basis. With this strong environmental message it reaches the attention of consumers committed to the topic. The service is designed to urge the customer to increase the number and value of financial transactions, thereby generating extra revenue for the bank.

To strengthen the commitment of cardholders it displays the environmental impact of past spending in both graphical and numerical ways. The amount of tree planting induced by previously executed financial transactions can be tracked through the mobile application. This not only gives a positive confirmation to Bunq’s customers, but also encourages them to spend more.

His commitment to the environment is also strengthened by the material of the bank card associated with the Bunq SuperGreen service. The sheet is made of durable stainless steel, the recycling of which imposes a lower environmental load compared to the traditional plastic design.

Bunq Travel Assistant service – unlike the offerings of other banks- makes it easier to monitor travel-related expenses. Among other things, it helps to convert between different currencies through its ZeroFX service, providing a 3 percent discount compared to general banking practice. It also advises on the use of cards in a given country and provides other financially useful tips to the bank’s customers.

Bunq also builds community through Travel Assistant. Through the service, the customers of the Dutch financial institution can share their foreign financial experience, so those who have not been to the destination before can find out first-hand about the financial habits and tips and tricks in the given country. With a system of commenting and brainstorming similar to Tripadvisor’s solution in its principles, those who move with little confidence in a foreign-language environment can receive support. This option, after the development of the service, works using almost zero bank resources, as its content is generated by the community.

With push messages that can be enabled through Travel Assistant, the user receives continuous, location-based notifications. By using so-called geofencing, a.k.a. virtually designated geographic boundaries, Bunq can determine quite accurately if its user is in a financially interesting or important location. For example, it is capable of recognize when a customer is at an airport, so you can get tips for optimal solutions before you face tasks such as currency exchange. Avoiding concerns about the use of personal information and data leakage, Travel Assistant does not store the user’s location.

Bunq also offers its customers an innovative ticketing platform. It allows you to purchase tickets to museums, exhibitions, demonstrations and other attractions using the financial institution’s mobile application.

The services mentioned above are ready available from the mobile application, making them easy and quick to use, and they are always at hand.

Every innovation is worth as much as the scope it is being used in. It is essential to have an easy-to-use interface in front of the user. Recognizing this challenge, Bunq has drastically simplified the way your mobile app is used. Newly connected users thus have only two tasks: after downloading and installing the app, they have to select the desired subscription; all other settings are made by the financial institution’s algorithms in the background.

The advantage of striving for minimal user intervention has become statistically detectable. Compared to the times before the release of the renewed mobile application, the number of subscribers to the Dutch company service in a unit time has doubled.

However, Bunq does not ignore individual needs either: the app for smartphones offers detailed settings in the simplest possible form, using three menus (me, us, profile).

Virtually unique among banks, Bunq has allowed anyone to improve their mobile application. The financial institution’s own API can be used to build additions to the company’s app with its own development tools. Completed applications will be available to other users after screening.

As can be seen from the examples above, community building and ease of use at all levels are important for the dutch fintech company. Utilizing the mobile app’s Common Goals option the user could create new fundraisers that are considered socially important with just a few touches. Others could support the cause by logging into their own applications. Bunq has recognized that it could easily gain new users and keep existing ones at a relatively low cost with the power of community building. In turn, they can not only increase their market share compared to other, slower-moving financial service providers, but also achieve higher profit levels.

Playful, simple, elegant: all based on light design and simple flow

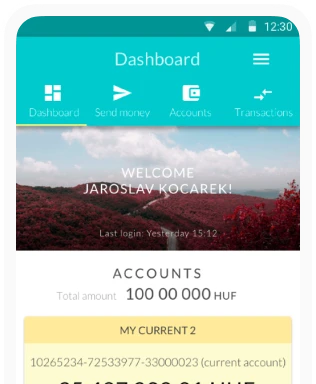

The interface of Bunq is also constantly updated and redesigned in the framework of the already mentioned community cooperation. The latest interface has once again become fresher, bolder and more playful than before. The clear goal of the designers was to keep the new design true to the original brand, meaning it would remain colorful, playful, simple and elegant. Its primary message is that the solution helps save time and money and also protects the environment. An important aspect was that when accessed through a desktop, mobile, and other media, a unified image welcomed users. Thus, it was decided that recurring visual elements would be the vibrant color, simple grotesque font set and the extremely accentuated iconography.

It can be seen that the designers of the app have paid close attention to ensuring the uniform and consistent appearance of the interface. To this end, it was necessary to introduce several elements that link all of these together. These include an extremely simple user flow, a plethora of primary and secondary colors appearing on a black background, which are still able to show a unified, cheerful and extremely trendy, vibrant world. All this shows that Bunq is not exactly a typical, boring and traditional bank.

During the design, they started from the mobile version and also paid close attention to the fact that the majority of Bunq users clearly come from mobile environment (i.e., this is the most common environment). They designed the smaller elements first, then grouped them into modules and sections. Once these modules have been put in place on the mobile interface variations on desktop, mobile, and tablet have also been designed. The arrangement of the surfaces was assisted by the strict grid system already mentioned. In order to avoid the childish effect the wide variety of colors they used might have on the unsuspecting user they came up with two solutions. On the one hand, black background and neutral font colors were used, and on the other, the colors chosen are slightly different from those used in toys and publications for children (using deeper reds and more ocher yellows for example). The icons and pictures used were also more adult-oriented.

Bunq users often praise the application for its simplicity, meaning that by opening the app, they can do everything very easily. The interface and the ease of use feel particularly fresh to them. They like the expressive colors best (in addition to the easy flow, of course). Bunq also does a lot to make its interface so good and its users love it too. They are operating a complete interface with the sole purpose for giving the users a surface to write their suggestions, problems, or to comment on the improvements they have noticed while using the app. Problems and voluntary suggestions come together here that in many cases could only be identified through lengthy user research and testing. Bunq also follows up on user requests informing them on which problems have already been solved and what the developers are working on.

And what makes Bunq really sympathetic and lovable is the fact that the company thanks these user comments publicly on Twitter, which is an excellent communication gesture to users because it shows that they are listening to their comments, and on the other hand they announce updates of the interface the same way.

They are continuously release updated versions – partly based on user comments – in January 2021. they were on 16.0 version.

Summary – Why users like Bunq?

A service can be really popular if it either solves a serious problem or creates a need for something unknown even to consumers. Bunq performs well in both areas: it makes digital banking convenient and simple, while bringing unique aspects into financial management.

By making the environment comfortable, it can also attract couch potatoes who, in theory, would like to do something to preserve the flora and fauna of our planet but just cannot be bothered to make the least effort towards it. It also facilitates adaptation to the different financial habits of non-Dutch countries, even if this benefit is only moderate in the current period of coronavirus and quarantine.

Bunq’s features are coupled with an innovative UX design, making a smartphone the sole tool to perform online banking activities. This was, in fact, a declared goal of the Dutch financial institution; specifically targets mobile platform users with its products and services. Nowadays, this is a really logical decision as we use more and more smartphones and tablets in our daily lives, as opposed to the stagnant number of desktops and laptops. Currently, the ratio is roughly half in Europe, but at the same time we get mobile devices more easily, especially on the fly.

In continuing the blog post, we wrote in detail about the large Dutch-rooted banks with an international background that are also known for their proactive, innovative solutions.