The Netherlands Fintech Scene

With over half its landmass standing no more than a meter above sea level, and a quarter below sea level, the Netherlands (meaning ‘lower countries’) deserves its name. The country is also known as Holland, and the adjective used to describe the country and the language is Dutch. The Netherlands is home to over 17 million people, making it the second most densely populated country in Europe, with the twelfth highest population in the world. In Rotterdam, the Netherlands has the busiest seaport in Europe, and hosts the world’s ‘legal capital’ in the Hague. The Dutch are renowned for their skills as linguists – particularly in speaking English – and are on average the tallest of all Europeans. And of course we all know that Dutch people wear clogs, obsessively grow tulips, and ride bicycles everywhere.

Aside from such stereotypes, what’s more important to us here is the subject of Fintech services in the Netherlands, which as of 2019 had the highest rate of digital adoption by consumers in Europe, at 73%. Companies identifying as Fintech number around 700 in the Netherlands, with the average age of firms being 7 years, and just under half (at 48%) having 1 to 10 employees. The main centers of Fintech are Amsterdam, Rotterdam, The Hague, and Utrecht – in other words the four largest cities.

By activity sector, the majority – 14% – are involved in financial software, with 9% doing analytics and big data, and 9% concentrating on payments and remittances. Which leaves a large percentage of ‘others’ engaging in ‘something else’.

A diverse landscape

In short, the Fintech landscape in the Netherlands is very diverse with increasing numbers of companies offering new and innovative solutions, ranging from disrupters such as software company CapSearch based in Amsterdam, to multinationals such Ingenico, the ‘global digital payments champion’ with over 7,500 employees worldwide. Mollie is another payments platform which received a turbo boost of €90 million investment in September 2020 to enable the company to, ‘Build world-class products that simplify complex financial services.’

There are also many companies in the Dutch Fintech ecosystem which service other Fintechs and provide B2B services, which are less well known. Adyen is one example, providing payment tools for businesses such as Uber and Airbnb. Buckaroo also offers a range of aggregated payment solutions across 40 national and international payment methods, making it easier for businesses to sell, and consumers to buy. Mollie also occupies a similar space in providing merchant payment services.

The general openness to digital solutions among the population at large has meant rapid uptake of many Fintech offerings, particularly across the payment landscape with systems which are cheap, easy to use and widely adopted. Apps such as Tikkie, which were ground-breaking only a few years ago are now regarded as normal everyday tools. All of this makes the climate for Fintech in the Netherlands very fertile. But let’s dive a little deeper by asking some of the people in the thick of it how they see the situation.

Holland Fintech

Don Ginsel is founder and CEO of Holland Fintech, and is well placed to provide an overview. “It’s a very vivid, entrepreneurial ecosystem,” he says. And he should know, having started many enterprises, and being a mentor and encourager of startups. “The financial instruments to facilitate trade have evolved, and there’s a strong algo-trading and crypto trading community. There are also many companies recently relocating from the UK after Brexit, and we’re already seeing that the Netherlands will profit a lot from that.” (Brexit was one of the reasons why several companies chose the Netherlands to house their European financial services licenses, such as Azimo and Vitesse PSP, together with global business leader Bloomberg and credit rating agency AM Best).

Don continues, “We also have strong B2B activity, supplying the tech infrastructure behind financial services. Then there’s the very high level of digital adoption from consumers, encouraged even more by the pandemic and the need for distance transactions. The digital economy is booming, and most Fintechs are thriving.”

OK, so can we conclude this report on the Netherlands with that? Well, not quite.

Over-regulation?

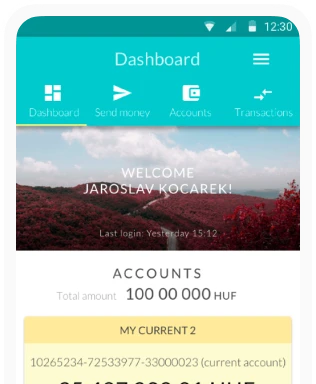

Remco Veenenberg is a Dutch expat who currently divides his time between lockdown Holland and the Hungarian Core Banking provider Perfinal, despite having started his professional life in Neuro-Science. With Fintech so new to the world, many participants have a whole other set of experiences that enrich them, and Remco’s story of a dramatic career change is a familiar one. His interest in Fintech was sparked when he attended a Revolut meetup, and found that many of his problems with traditional banking models were answered by the platform. He quickly started to find out all he could about Neo and Challenger banks, and by 2018 was organizing large-scale Fintech conferences, which included attendance by both the newer banks, and Legacy banks.

However in contrast to Don Ginsel’s sense of enthusiasm about Netherlands Fintech, Remco is a little less impressed by his native country, where he is once again residing. “Fintech in the Netherlands suffers from over-regulation and the discouraging attitude of Regulators,” he says. “They make it costly and hard to comply, and the Dutch National Bank isn’t cooperative either.” He points to the situation in Lithuania which he is familiar with, and sees that as far more encouraging to Fintech, especially startups. “In Vilnius the community is concentrated, and the Regulators are always visiting and keeping in touch with businesses. Although that concentration is somewhat similar in Amsterdam, overall in the Netherlands there is a distance between the Regulators and the Fintech companies.”

He also points to his knowledge and experience with Challenger banks, from the many conference contacts he forged with the likes of Monzo and Revolut. In the UK for example, these organizations are getting a lot of uptake, but Remco says, “In the Netherlands I don’t know a single relative with a Challenger bank account. Part of the reason for that is that trust in the Legacy banks in Holland is high – for example with ABN Amro and its Tikkie app. For most functions the banks make things pretty easy for consumers.” Besides the legacy banks being ‘pretty OK’, the Netherlands mostly runs on the Maestro card network, to the extent that Revolut, for example, is hardly used.

Remco’s thoughts about regulation are echoed in an EY census of Fintech in the Netherlands from 2019 in which it’s stated, ‘At the moment a lot of time and money is spent, according to the Fintech companies, on complying with laws and regulations, putting innovation in the shadow of regulation … The Dutch regulators are relatively strict in interpreting the laws and regulations in comparison to regulators in other European countries.’

Despite this slightly discouraging picture of the Fintech scene – at least in terms of the lack of regulatory flexibility – Remco does like the Dutch way of doing business. In Amsterdam, with a population of less than 1 million, getting on your bike, and cycling over for a coffee with a client or investor makes for a relaxed and friendly way of doing business. “It’s collaborative,” Remco says. “And if banks can learn to work better with Fintechs, we can then start to really compete with other countries, rather than being stuck in our own ecosystem.”

The key? Getting regulatory structures more responsive.

Attending entrepreneurial bootcamp

This view of apparent lack of responsiveness is not completely shared by Niels van Daatselaar, whose initial entrance into the Fintech world involved winning a bunch of flowers! As an employee of the Rabobank Group, he and three other young colleagues won a 163-entry field in the bank’s internal ‘Moonshot’ incubator program, with their Easytrade hedging platform. No cash prize, just the flowers, but then the foursome were ordered to immediately leave their current work and attend a 3-month entrepreneurial bootcamp – something which set them in very good stead for everything which was to follow.

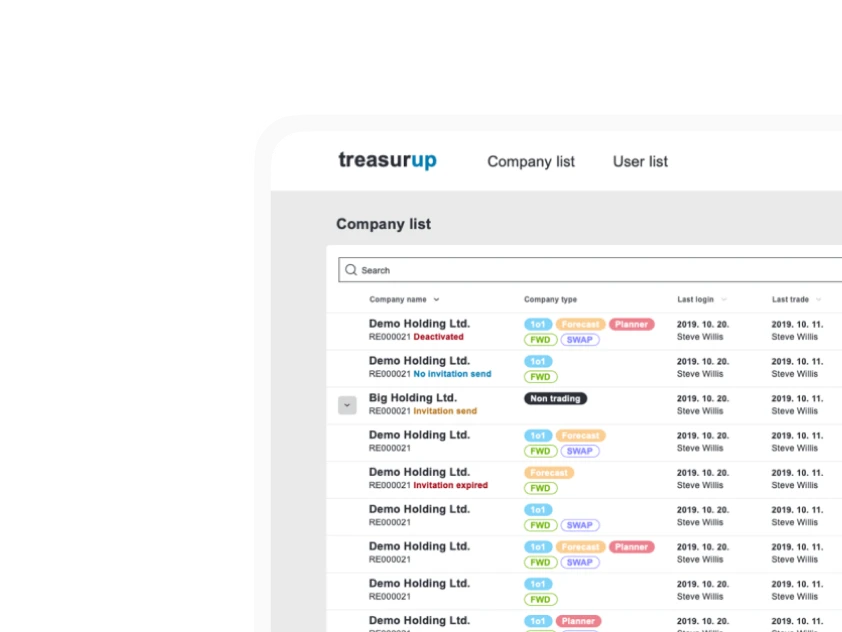

Over time Easytrade then morphed from a hedging app into the Treasury services platform TreasurUp, which at the beginning of 2021 is set-up for a possible spin-off – a four-year ‘roller coaster’ of constant development.

So how has Niels experienced the regulatory system? “Regulation is an important item for TreasurUp. Our bank clients are facing an increasing amount of regulations, especially because our front-ends include foreign exchange derivative product handling. This means TreasurUp needs to learn per bank, and per country what the local or regional regulations mean for the online services that we are configuring for them. For that, part of the so-called deep-dive sessions with prospect banks, are regulatory deep-dives.”

On the one hand regulatory deep dives, but there’s another trend working in favor of Fintechs, where larger financial institutions have steered clear of offerings because of the costs and complications of getting into them, leaving the space more open for the entrepreneurs to populate. Niels reflects, “Clients and consumers want frictionless financial services, and now you can build something professionally from the ground up, with tools that enable this. In the Netherlands we are developing a great ecosystem for Fintechs to flourish. I was in Boston in 2007 and saw the future there. That’s now come to Western Europe.”

Casting the net wider

With over 400 active company members and more than 22,000 individuals involved, Holland Fintech is a major player in the Fintech ecosystem, having hosted 350 meetups and events, and sending out – so far – 314 newsletters. In short it’s a must-be place for all things Fintech in the Netherlands, and internationally. Corporate member Rabobank endorses the organization, stating that, ‘Being part of this community has provided us with relevant insights, a valuable network and access to useful workshops that benefit employees throughout the entire bank.’

Holland Fintech’s European Fintech Navigator is taking the network approach even further with a website, ‘Providing an overview of the European Fintech landscape. With an expected total of 800 companies, 17 different countries, 160 investors and 70 supervisors.’ So clearly Holland Fintech is looking beyond national borders. CEO Don Ginsel says, “There is a general understanding now that in order to embrace Digital Transformation – which for example the Dutch Government is learning to do – you also must embrace Fintech.

Holland Fintech has also hosted Amsterdam Fintech Week (XFW) since 2018, with the event moving mainly online – due to Covid – in September 2020. In keeping with Don Ginsel’s own interests in providing a helping hand for new and startup Fintechs, one of the sessions was a startup bootcamp demo day – the chance for new companies to show their wares, even if slightly constrained by the online experience. Over 6 days the offerings were varied and stimulating, with attendees clearly keen to ‘keep on keeping on’. Always looking to the future, Don now says, “We are looking forward to our next Amsterdam Fintech Week in June 2021!”

Almost free

However despite the cross-border exchange of ideas at events such as Amsterdam Fintech week, countries are still silo-ed due to differing regulations. “You can’t just travel to Germany with your Dutch credit or debit card and necessarily be able to use it,” Don points out. In the Netherlands, payments are ‘almost free’ so Dutch consumers find it hard adjusting to the often high costs in other territories. “Interchange is unknown to Dutch consumers,” says Don. However he believes that the Dutch model will gain traction, with the cost of payments across Europe falling for consumers. If so, where will Fintechs make their money? “Mainly in value added services, on top of payments,” he says. “There are many innovative consumer/small business apps being developed in that field, for example Tellow, a Rabobank initiative which focuses on helping freelancers with their accounting.”

And Don’s own role in all this? “There’s always someone else in Fintech working on similar projects, but I try to influence and facilitate people to pursue their own ideas,” he says. “When I started Holland Fintech and asked people if they were interested in creating a collective for Fintech, everyone I spoke to helped ‘put wood on the fire.’ Six and a half years later we have a very effective organization and large network.” That also applies in the current time of the pandemic, when Don says that distance working and apps are clearly the way people want to run their finances.

Remco Veenenberg agrees that the payment space is enjoying huge support currently, as “Everyone wants to pay for everything remotely.” When the pandemic is over, no-one is anticipating a return to the old ways – the changes happening now will become permanent.

Trends and ones to watch

So who are the ‘ones to watch’ in Dutch Fintech? Remco points to the large banks, such as Rabobank and ING which are active and creative in encouraging Fintechs (TreasurUp being an outstanding example with Rabobank), and running incubator programs. BNP Paribas also runs a ‘plug and play’ Fintech accelerator which could soon be active in the Netherlands. As a Challenger bank, Bunq is ‘quite successful’ and Remco predicts the further growth of open banking in 2021. He also predicts a big year for Bitcoin – already proving to be true.

NIBC commercial Bank was founded in 1945 and currently has around 650 employees, headquartered in the Hague and primarily servicing the corporate investment market. Although a legacy bank, it’s active in the Fintech arena, as well as with more general tech companies. As of January 2021, the 75 year old bank is in the process of being acquired by Flora Acquisition and pledges ‘To accelerate our strategy … continue to seek to innovate through new avenues of growth.’ So watch this space for developments.

Working from more within the banking system itself, Niels van Daatselaar sees trends rather than specific companies as being worth noting. He comments how when he started at Rabobank, suits, ties, and black shoes were the mark of a successful banker. Now he and his colleagues are more interested in employees ‘being themselves.’ He views it as ‘CPU usage’, where unsatisfied or unmotivated people only use a fraction of their capacity. However if people are motivated, their output ‘goes through the roof.’ He says, “Some people might be only giving 50%, but my purpose is to get 100% out of people.” Part of that comes from the excitement and challenges of the Fintech arena, where TreasurUp provides white label Treasury solutions to banks, and where suits, ties and black shoes are now merely optional. Niels observes, “These same bankers, once they are sitting on the buy side of the table, expect people from Fintech to not be like them. They expect us to inspire them through who we are, and what we can bring to the table.”

So of course inspiration plays a part, and with his finger on the pulse of the Holland Fintech scene, Don Ginsel has a wide choice of inspiring front-runners, also mentioning neobank Bunq, which he says consistently adds consumer-oriented features. Blanco is a regtech/management offering which is ‘Turning KYC legislation and client data management from a nuisance into an opportunity.’ Then there’s software-as-a-service company Mambu helping to power deregulation of the banking system. OK, it’s a Berlin headquartered operation, but making headway in the Netherlands.

Founded in 2014, Bux is another pick that Don says is worth watching, offering free neo-brokering services with the declared aim that, “We want to show users that investing is fun.”

So let’s recap this snapshot of now in the Netherlands Fintech scene:

- The Netherlands has the highest consumer adoption of digital solutions in Europe

- Many consumer-oriented apps are ‘almost free’

- The large Legacy banks have been active in promoting new services and encouraging startups

- Neo and Challenger Banks have correspondingly little traction

- There are around 700 Fintech companies currently active in the Netherlands

- 400 companies are members of Fintech Holland

- The spread of activities is wide, with the largest grouping (14%) being in financial software

- Almost half of Fintech companies have a team of between 1 to 10 people

Enhancing and expanding teams

This last point is not so surprising – after all, few startups have large teams from the get-go. Usually it’s a few friends or colleagues with a specific set of skills or interests, and a passion to develop their ideas. As the company gets up to speed, others join them, usually in support roles. But rarely are all the necessary skills on board to cover every eventuality. One of these areas which is both very necessary, and at the same time often in short supply within the core team is UX-UI design. Which is where UX-UI design agency Ergomania comes into the picture. In the Netherlands?

Well actually Ergomania is based in Budapest, Hungary, but the company has long experience of working at distance, even before the coming of the pandemic. Ergomania specializes in banking and Fintech and is active with clients across Europe. The company is a partner of Holland Fintech, and at the September 2020 virtual Amsterdam Fintech Week, Ergomania CEO András Rung was invited to give his well-received presentation ‘The 7 deadly sins in UX’.

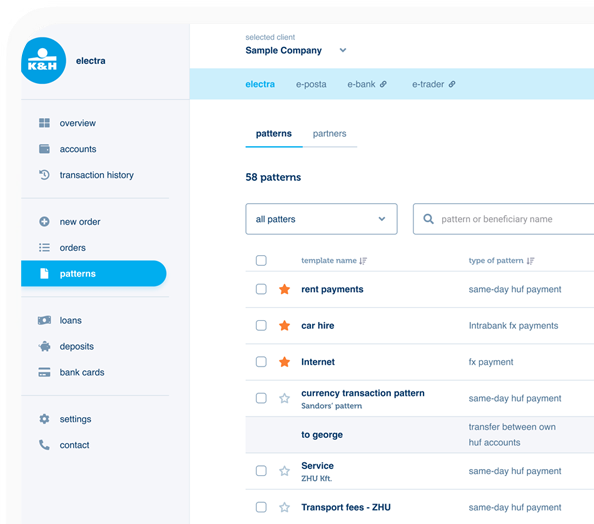

A notable Dutch engagement for Ergomania was with Niels van Daatselaar’s TreasurUp operation. Ergomania was called in to make a root and branch review of systems which had grown with the expansion of the business, but without any overall control of the process, so that ‘inconsistencies’ had crept in. With the change of business model as Easytrade became TreasurUp, the team decided that such inconsistencies must be ironed out.

“We have some great Designers,” says Eward Bartlema who was in charge of the review for TreasurUp. “But UX Designers are creative people, and they’re always thinking of new ways to do things, sometimes starting from scratch. It may make the design better and more contemporary, but there can be underlying problems.”

Following in-depth examination and research, Ergomania developed a ‘Single Source of Truth’ for TreasurUp by creating a Design System which can be referred to by everyone in the business, at every level. As Ergomania’s lead on the project, Partner Maria Amidi Nouri comments, “The work we have done so far with TreasurUp has resulted in making existing modules more intuitive and user friendly. But there’s also a compelling case that a Design System actually saves money. We calculate that TreasurUp’s ROI on the work came after two months.”

Nearshoring

So it’s clearly possible to work effectively in UX-UI design across national borders. In fact Ergomania has made something of a fine art of its nearshoring capabilities, bringing a full and advanced suite of tools and methodologies into play, and working very closely with clients – even when separated by some distance. The Design System which TreasurUp and Ergomania worked on together is tailored to specific Treasury applications, but at the same time is a rigorous process, with an outcome which is of benefit to any Fintech, anywhere. The sense of rigor is a hallmark of everything that Ergomania does, from the design or update of a single webpage, through to a portfolio ranging through massive design and implementation of mobile and Internet banking, to internal systems, from sales support to chatbot and voice interfaces. Or as József Nyíri, Partner at BnL Growth Partners says, “Ergomania is our go-to UX problem solver. My companies have been working with Ergomania since 2011. When we need UX design I always call them.”

Big organizations need UX-UI help, like TreasurUp unwinding all their ‘inconsistencies’ as they scaled up to service ever larger client banks, such as their recent white label Treasury work with Nordea bank. Other organizations, such as the unicorn Mollie need rapid and completely bombproof UX-UI. Fintech UX-UI design is not merely about making ‘pretty websites’ – it’s the very basis by which a company will live or die, and every step of the way will be walked under the eagle eyes of the regulators. Fintech demands proven expertise in a UX-UI Agency, and that’s what Ergomania delivers. And for the smaller Fintechs, which comprise nearly half of the Netherlands Fintech scene, an expert helping hand is equally vital. ‘Start as you mean to go on,’ is an excellent maxim, and taking time at the beginning of a business to truly interrogate all the factors which will result in it being successful is essential. The Ergomania team is accomplished in using many tools and methodologies, including the Business Model Canvas approach, and especially the Value Proposition part of that.

So whatever size of business, and whatever its maturity, UX-UI expertise is as valuable in the Netherlands as anywhere, and Ergomania already has a proven track record in the low country. Other UX-UI agencies making their presence felt in Holland include Essense Service Design, Wonderland, Momentum Design Lab, and Deuxers, each with their own approaches and specialties within the Fintech space.

As Product Designer Jessica Lascar writes in her blog contemplating Things to know when designing for Fintech, “It might seem a bit of a paradox, but there’s a fine line between the hard matter of money and the soft matter of human emotions. Finding a connection between the two will lead to designing for ‘money moments.’ When designing for those moments, we need to think about how people feel rather than just thinking about their logical behavior.” Of course that could be said to apply to all UX-UI design, but it’s worth remembering that even with the most complex Fintech offerings – and there are many specialist apps and platforms amongst the Netherlands Fintech scene – there has to be engagement with people. Firms like those recommended by András Rung, plus Ergomania of course, understand this and apply it to everything they do.

Take just two examples of customer feedback which demonstrate the vibrancy of Netherlands UX-UI engagement with customer needs: “I liked Creative Navy‘s attitude. They are right on the spot. They also have a kind of intuition; they know what a customer needs, and they seem to provide it.” – CTO, IT/Tech Startup.

“Your Majesty’s work was superb. The website has a world-class look and feel to it. From the beginning, they understood our needs and put forward a clear vision.” – VP of Digital, Media Company.

Now and into the future

So it seems all the ingredients exist for a continuing upward curve to Fintech in the Netherlands. Writing in the European Fintech Navigator in mid-2020, Don Ginsel was upbeat even though the pandemic was by then spreading rapidly: ‘In general, the year has been very positive from the angle of purpose for the financial industry. After years of talking about ethics and the societal role of financial services, we seem to have gone past a tipping point. Now, not only Fintech startups try to make the world a little better, but also incumbent asset managers, banks, pension funds and many others really make social and sustainable goals part of their business. This pushes forward even more initiatives and support for financial inclusion, financial literacy, sustainable finance and financial well-being.’

Looking to the current year, Remco Veenenberg returns to the theme of regulation, “Regulators must make it easier in terms of compliance. Costs need to drop, and then we have real potential. But the next year could be difficult: smaller, newer Fintechs may find it harder to get funding.”

And for Niels van Daatselaar? “I’m optimistic,” he says. “There will be a lot of opportunities, a lot of potential. Banks need to formulate a real digital strategy and we happen to be able to provide them with serious input for that. If you have the right tech stack and the right people and you can build anything, then all we have to do is start running! But of course we have to continuously measure if what we are doing is right. There is always a window of opportunity, and it is currently open.”

That window of opportunity in the Netherlands certainly seems available, with the relative openness of the Legacy banks to change and innovation, and the strength of the Fintech network. Although the landscape of the Netherlands is noticeably flat, Fintech is on a steady rise.