NORWAY – Small but sustainable

“It’s a long country, with only 5 million people, and big distances from everywhere to everywhere,” Niklas Sandqvist sets the scene for the place he’s called home since 1999 – Norway. “I’m actually Swedish,” he explains. “Sweden is a more industrialized country, more structured, more Germanic, and Norway has a shorter history of industrialization. But here there’s been tremendous development in the last 30-40 years, impacted by the wealth coming from the oil industry. We are now one of the world’s richest countries, per citizen.”

“We have high taxes, which enables us to fund our community really well. But the market across Europe is so different from the Norwegian one, and so many services developed here don’t fit in Europe.” This is a theme that we’ll be returning to.

As one of the founding members of Fintech Norway Niklas has always been keen to reach out to other organizations across Europe. An early contact was with Maria Staszkiewicz, then heading up the Czech Fintech Association, who was instrumental in giving advice to the new organization. Fintech Norway got up and running at the end of 2020, prior to which there were a number of associations for different financial areas, such as a separate crypto group. When we speak in 2021, Niklas says membership of Fintech Norway stands at 35, but he adds that caveat of population size, “Norway is like a village compared to most countries, so we are a small community and we are aware that we are small, but we are trying to cover the entire Fintech industry.”

Kind of standardized

So, is Norway a follower of trends elsewhere? Not so, says Niklas. “Norway as a country, and especially as a Scandinavian country, has been at the forefront of digitization. We have a lot of innovation and new technology driving standardization. And we are kind of standardized in Northern Europe.” OK, so all good.

There’s a but however. “But the weakness of the Scandinavian standardization is that it’s built for Scandinavia. So when you then compare that to Southern Europe or other countries not in the front line of digitization, we now see that it’s becoming more and more of a struggle to get Europe-wide standardization.”

“Fintech is a growing industry built on innovation, but it lacks standards. And so in Norway, and in Scandinavia, we have a lot of proprietary standards in a smaller ecosystem. This prevents Fintech companies from Northern Europe actually scaling to the rest of Europe, because there are sometimes no common standards.”

So Norway is technologically advanced and innovative, but is hampered by solutions that are too ‘local’. Niklas nods in agreement, “My drive is to reach out to other European Associations to make connections, and talk about how we can use the same routines, to benefit from more standardized processes.”

Standardization is something of a speciality subject for Niklas, since he spent over 10 years working in the field of ISO standardization before coming to his present activities.

But before we dive deeper, let’s drop into Bergen, on Norway’s southwestern coast. It’s surrounded by mountains and fjords, including Sognefjord, the country’s longest and deepest.

Stirring the pot

“It is a really beautiful city. It’s called the city of the seven mountains … because there are seven mountain tops,” enthuses Nicolai Hope Møller. “It’s a little bit like Seattle with a lot of fog and rain; it just gathers here and pours down in large quantities. In fact it rains eight times as much here as where I’m from in Denmark, so it was a kind of cultural weather shock for me! But there are great skiing possibilities here as well.” Nicolai’s wife is from Bergen, which was the impetus he needed to move there. He applied for a banking job, got it, and then later changed jobs again when some of his colleagues moved to the newly created Bulder Bank, where he is now UX lead.

Despite working for a bank however, Nicolai is keen to point out that, “I don’t see myself as a banker. Being in the UX environment, it’s not so much about the business that you’re in. It’s about solving user issues within the business, for the users. I could just as well be in ERP systems, or grocery online shops, or whatever. But I found a niche here, at least in Norway, working in two banks so far.”

Having made the case for his non-banking credentials, Nicolai then reconsiders, “But I’m also a banker, because I need to put myself in the position of the bank, to see the kinds of problems we need to solve from a bank perspective. And then I need to bring the user’s perspective into that too and stir the pot around, and find ways to communicate some of the strategic things that we want to do as a bank. As a designer, you’re always in between, and I like being in that spot, because it makes you creative about developing new solutions.”

Product muscle

The Bulder Bank Product team numbers ‘three and a half people’ in a development group of 35. None of the UI-UX is outsourced, which Nicolai had some experience of when he worked in Denmark. Teams in Poland and India provided UX services, which he says proved ‘counterproductive’ and slowed down progress. “Being in the same room in the same building definitely brings advantages,” he says, although of course this has largely been displaced by the pandemic.

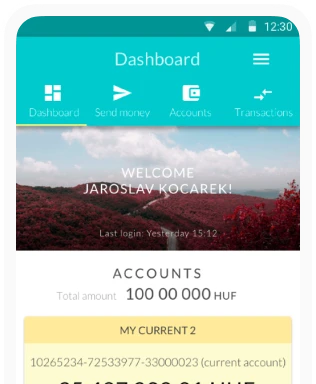

But what is Bulder Bank? Nicolai begins with his own backstory, starting with his time with S.banken, the purely digital bank launched in 2000. “We have a lot of users in Norway that are used to just having a bank in the pocket, and they don’t need an advisor or anything like that. So that’s the reason for Bulder Bank’s foundation, and we are actually a startup within one of the oldest banks in Norway.” That bank is the 200-year-old SparebankenVest. “We run on the same bank license, but as a completely detached unit, just using some of the common banking systems. It’s different from some of the Challenger banks, because we have a good foundation of products, and a bit of muscle within the product and IT area. But we also have very strict demands for developing Return On Equity.”

Fun mortgages?

So, it’s like say Lunar in Denmark? I ask. “No,” replies Nicolai, “We’re not built on funding from different series, as Lunar are. That means we have to make money so that we can spend money, and that’s why we’ve taken a bit of a different approach from Lunar, or some of the other digital banks. Our primary goal is to support mortgages in Norway, and to do that with completely digital onboarding, and for moving mortgages digitally. After one and a half years, we were already making a Return On Investment. We were cash positive and that’s a really privileged place to be.”

Every month the Bulder Bank app’s AI calculates the estimated value of a customer’s house, and based on that, gives a lower interest rate. “A lot of customers really love that, because they don’t need to focus on their mortgage anymore. It’s kind of a fun way to surprise some users, and we get really good feedback on it.”

Right, fun mortgages. There’s a new concept.

By the way, Nicolai has a connection to Kasper Mathias Svendsen Head of Design at Lunar Bank, as they both studied the Human Computer Interaction (HCI) Wave, which was contributed to massively by research at Aarhus University in the ’80s and ’90s. While there, he started up a ‘negative business’ (one where he and his partners always blew any profits on buying new tech). The project was to develop an educational app about the work of Danish novelist and poet Jeppe Aakjær (1866 – 1930). “We did a lot of crazy, maybe not so relevant stuff on that project … But it was really fun.”

Love and hate

“It’s kind of strange,” says Ørjan Bagn, Head of Service Design at DNB, Norway’s largest financial services group. “It’s something businesses have been doing for a long time that suddenly has a name and is a profession. But of course, one of the challenges then is to really explain what Service Design is.”

OK then, I challenge Ørjan, please explain. He’s sitting in a bright office space in Oslo, with the constant to-and-fro of colleagues visible through the glass wall behind him. The explanation comes swiftly and smoothly: “We have been designing services for years, of course. Service design is the result of something missing in between business development and tech. And for us, the designers always represent the customer and the customer perspective in any kind of project or initiative. The ‘customer’ could be the end customer, the customer of the customer, a user, or an internal employee. Whoever they are, we ensure that business needs and tech possibilities meet the needs of users. Today a service designer is a professional at a Master’s degree level. And we often have an annoying habit of asking ‘W-questions’ like why, who, where and when, whenever a new challenge is placed before us. Our questions are always intended to drill down to the what and how, and make certain that the solution solves the right problem and gives real value to the customers and business.”

So solutions come quickly? Ørjan continues, “When you have a challenge in front of you, it’s very human to immediately think of a solution. You quickly set your focus on what and how. But if you take a little time to take a small step back and ask a few simple questions, you often find a different and better solution. And that of course can be hurtful. It takes a little more time initially, but saves a lot of time later on. As a service designer you have different tools making sure the process takes as little time as possible, and gives the insights needed to come up with the right answers. A designer needs to be able to represent the customer through a professional and commercial mindset, with a sense of diplomacy.”

Teamwork

OK, Service Design is UX in DNB, right? Well, wrong… or right… it depends. In DNB the Service Design team works hand in hand with a UX team, where the UXers are vital to the usability, commercial effects and UI of service. This is based on insights which come from a collaboration between the Service Designers and the UXers. Both UX and Service Design work closely with Tech and Business, which together create the user experiences… or UX. “We want to make services that are so good that our customers consciously choose DNB as their bank. The only way to succeed with that is to make sure business, tech and design find the solutions together,” Ørjan says.

DNB has a total of 40 designers onboard, and counting. The design team includes colleagues from New Zealand, Germany, Iran, Portugal, Switzerland, Sweden and Denmark. This fits perfectly with the profile of DNB as a diverse Norwegian bank with an international reach. DNB serves all segments, from private to SME, and large international corporations. The bank is specialized in Norwegian-related industries, such as offshore, energy, fishing and shipping. The strategy for DNB is to adapt and deliver on the evolving needs of their customers, with a presence in markets from the USA to South America, from Singapore to Australia, and European countries. That internationalism is primarily to service corporate clients, while private customers are mainly from within the Norwegian home market.

“The diversity in our team is a good reminder to us of the diversity in our customer needs, both domestic and international. Acknowledging and understanding that people are different and have different needs is vital. And your best friend in that situation is having, getting and, most important of all, using insights,” says Ørjan.

Evolving at pace

Ørjan has a background in marketing, development and management, and has been part of tech and service development for many years. As such, he has lived through some very interesting times: “I’ve seen the way and the pace of how DNB has evolved, and that has always impressed me. There’s always a sense of urgency in the company – but balanced between long-term initiatives and more acute deliveries. As a financial institution you operate in a highly regulated and complex industry. As a bank you have to ensure you are compliant – that’s your license to operate. Being able to rush in a controlled phase is a skill in itself. Understanding when to mobilize and be at the forefront with a service, and when to wait-and-see, that’s one of the really big strengths of DNB.”

Competing on products, not infrastructure

In the bigger picture, Ørjan describes how the banks in Norway did something early on that has affected the way Fintech in Norway has developed faster than in many other countries. They realized that by acting together to create a common infrastructure for payments, it would be beneficial for all. Banks could compete on the services on top of the infrastructure, instead of competing on the infrastructure itself. This feat was achieved as far back as the 1980s, and soon most banks in Norway had implemented the infrastructure. With the possibility to use your bank card in any store in Norway, everyone wanted the bank card. “So implementing the bank card in Norway happened extremely quickly compared to a lot of other countries that have struggled with checks and cash. We turned digital early, and when people were used to ‘not seeing their money’, it was then easier to implement an Internet bank. Compared to other countries, Norway is quite small, with a population of a little over five million. Being a small fish in an international pond, you need to think differently and maybe collaboration is then easier. Card payments through BankAxept, log on services through BankID, common KYC services such as Invidem, and easy payment services through Vipps are all examples of collaboration at an infrastructure level.” Competition on products, but cooperation on infrastructure seems to be the Norwegian watchword.

For the development of Fintechs in Norway, there’s also been something of a butterfly effect, according to Ørjan. It’s a country with high trust towards banks and the banking system. “This is something we value highly, and continuously work on to ensure that we retain that trust.”

Connections and collaboration

We left Niklas Sandqvist about to talk about standardization, and how some services developed for the home market don’t fit into the rest of Europe. He says there should be great potential for exporting Norwegian Fintech, but then Norway is not an EU member, although it is associated through EFTA, the European Free Trade Association. “We have a small market, and it’s sustainable – kind of – but I think we can contribute to the rest of Europe to a greater extent. Norway should have good collaboration with Sweden, but it’s not there really.” Niklas says that Norway and Denmark are closer, and perhaps surprisingly says that there are good connections with Belgium.

His background is from the financial industry’s banking association, where one of the objectives was to keep the financial market Norwegian, and therefore to some extent sealed off from cross border influences … and opportunities. Around 2017 Niklas “changed sides of the table”, crossing over to join forces with grocery stores to build a Fintech, Aera Payment and Identification, ‘created and dedicated to merchants’. This is where he can still be found in his ‘day job’ as VP of Stakeholder Relations. Here he helps shape the retail transformation from the merchant perspective to embrace the opportunities the Fintech industry brings: “How can we actually drive development and have a hand on the steering wheel?”

Using tech to meet challenges

Describing the scope of Aera, Niklas starts with the geographic challenges, “Our clients have stores from the Russian border by the Arctic sea down to southern Norway, which is the distance from Oslo to Rome. You can imagine that there are huge distances where there isn’t a grocery store, and when there is, there are just a few local people living nearby. So customers have to travel a lot, and retailers are struggling because people don’t live there, and are all moving to the towns.” The solution is digital transformation, and is becoming available at selected stores across the country.

“Today you are able to go to some stores, anytime of the day, check in with your app, and pick up your milk or bread or whatever, then pay for it from your cellphone and walk away. And in these particular stores there are no shop assistants.”

The company is also looking for ways to allow liquor or beer sales, where younger people need to be screened for age. Here Aera is using biometrics integrated with the company’s loyalty app, which in turn connects to eID providers. This will be through the European Digital Identity project, although this part is as yet more of a vision than a reality. Distribution of medicines in rural areas is another benefit, allowing customers to get their digital prescriptions fulfilled at the grocery stores. “That part is not exactly Fintech,” Niklas says. “But it’s really important if we are to have a Europe where people can live anywhere. We need to use technology to meet these kinds of challenges.” Niklas adds that there have been no job losses, despite the process of digital transformation.

This leads our conversation naturally towards social issues and whether Fintech is making any impact there. Niklas says that there are members of Fintech Norway assisting people to handle credit card debt, but says that this is an individual initiative, rather than one created by the association. He then makes what is to me a somewhat surprising statement – that Norway doesn’t have any unbanked citizens. Like, none? No, not one, because apparently everybody has a bank account. I think of other countries – for example, my own homeland of Hungary – where there are many homeless people, and try to imagine every one of them having a bank account, as a right. That’s some stretch of the imagination.

Niklas is clearly not a person for sweeping statements however, because he later gets back to me, having accessed government figures for 2018, which reveal that at that time 0.25% of Norwegians were still unbanked. As he notes, ‘Close to none’ is a better description.

Asking interesting questions

Social responsibility is a high priority for DNB, says Ørjan Bagn. The Norwegian state is the biggest owner of DNB, so there is a strong connection to sustainability and other social issues. This includes, perhaps surprisingly, a product for people without an internet connection. This isn’t necessarily because they can’t get connected, but that they choose not to be. DNB is also very open to helping non-Norwegians get a toehold in the country, with information presented in a wide variety of languages, much of it on paper and available through branch offices. There’s also the Lærepenger project, which roughly translates as ‘Learn about money’, launched a few years ago. It’s a package for families and schools to help children learn about financial literacy. The ‘She invests’ initiative focuses on balancing the financial gap between men and women, and has attracted international attention. Taking responsibility is about understanding needs on many levels, as well as actual user behavior.

Ørjan describes the shifting user behavior of financial markets as very interesting. “We follow many trends closely, and right now there is a lot going on. The pandemic has boosted our digital behavior, making participating in digital meetings a common skill. We see people and businesses wanting integrated services such as car parking payment through an in-car smart device, or an automated credit line based on a company’s inventory. There are new mortgage models based on new ways of living and sharing, and home office needs. And what about car ownership? For instance when you no longer own a car but subscribe to a car. How and where will you finance that? Who provides the insurance? Cryptocurrency and web 3.0!” Ørjan is enthusiastic, “These sorts of insights are really interesting to us, because if you combine the knowledge of trends and changes with the questions why, who, where, when, you come closer to understanding the what and the how – what services people need, and how we can offer them.” And that’s exciting? Ørjan nods in agreement – a man in the right place at the right time.

Competition not hostility

We’ve already heard about that original impetus to keep the Norwegian financial market Norwegian, and how to some extent that has siloed the country’s emerging Fintechs, cutting them off from connections to the wider European scene. The driving force behind the creation of Fintech Norway was PSD2, where every Fintech was experiencing the same difficulties and struggling with the grip of the banks. Niklas says that the banks regarded Fintech as threats, and although the situation is improving, there is still a way to go in the regulatory space. “Now we have members comparing loans. We have members who will challenge banking services with new offerings to replace the legacy services. We have members with crypto currencies or crypto assets, so there’s a wide spectrum of new challenges for the banks.” Despite this competitive environment, Niklas says the association strives to bond with the banks and not be in a hostile relationship. “We have to look at the opportunities to learn from each other.”

Fintechs are constantly knocking on the doors of banks … but the doors don’t get opened very often. “And then you go to the Regulator and talk about the new technology, and the complex European regulations that are coming in.” It’s a paradoxical situation, where the financial industry has been pushing digital evolution since the arrival of digital banking in the ’90s. There is now almost zero cash usage in Norway, and card payments are free. Paper is barely used in the financial industry, and as for taxes … Well, your pre-filled form arrives digitally, with a checkbox saying, ‘This is what we know about you, is it correct?’ All you need to do is click ‘Yes’. So there’s a super-savvy digital population, and a switched-on government, standing alongside a banking system that is protective, and suspicious of Fintech initiatives.

No paper solutions

That connection to government is one that Niklas values, giving an example of a project where the benefits for society were framed as a business case to be presented to Norwegian citizens. “When you apply for a loan for a house, you have to provide salary papers, some documentation about the house itself, and you will have to supply your tax details for the previous three years. And so on. So you have a bunch of paperwork that you have to physically take to people, or mail to the bank. And then you wait for a couple of weeks at which point they may say, ‘Oh, this house is too expensive for you, blah, blah, blah.’”

“Our project with BITS AS (the financial infrastructure company of the bank and finance industry in Norway) set out to do this all in real time. We wanted to make it so that you can apply for the loan, the bank gets all the data from the government about pay, taxes, and can look at the account and offer a loan.”

Great, so it worked? Niklas indicates with a sort of ‘Yes and No’ nod of the head. “You could then manage to do this in several banks when you are physically there, in real time.” Well, at least that was better than waiting weeks for an answer. “But it required a standard, and cooperation with the authorities to actually give the data to the bank.” It was about getting the tax authorities to share their data, and having the IT infrastructure to enable that. And that goal has been achieved in the long term?

Niklas nods more decisively, “Today, when you apply for loans in Norway, in every bank, or when you apply for a credit card, it’s fully integrated with, and uses government data. It’s a complete no-paper solution.”

Seamless mortgages

Nicolai Hope Møller is also enthusiastic about no-paper operation and Bulder Bank’s approach to this. With just one proviso: Customers must either have a finger, or a head! “Bulder Bank is built on the idea that you don’t need anything other than an app. We are mobile only, and don’t provide any web interfaces. So you have to log in with some kind of biometric login.” Hence the need for at least one finger, or a head. That second criterion seems pretty inclusive for likely customers. “It’s our choice to preserve security for users. We could also provide PIN codes and stuff like that, but we think that going forward in banking, during the next 5-10 years, biometric login is the only thing, and we feel it’s the right way to go.”

So, let’s say in the case of a mortgage application – is the home evaluation physical or digital, and is signing the contract all digital too? “Yes, it’s 100% digital,” Nicolai confirms. “You sign in with your bank ID, which is now used across Norway for personal use, then we get all of your data from the different places. We get data from the Skatteetaten, the tax department. And we get info about the house from another source, and we get your last six salary slips as well. So when you log in and approve us getting that information for you, we have a really good picture of whether we are able to give you a loan or not.”

Is Bulder Bank’s main offering mortgages? Apparently provided seamlessly … as long as you have a head on your shoulders. Nicolai points out that Bulder also has a standard package of normal accounts, and the bank suggests saving goals, and has credit and debit cards, along with normal transfer services. “But it’s the mortgage stuff we benefit from in terms of economic survival. That’s where we make the money, and then we spend it on building a better app for the future.” There are other apps upcoming, such as mikro sparing (micro saving) initiatives specifically based on the way people live their lives, but for now they’re under wraps.

Making a mobile bank

Call me simplistic, but I’m still thinking about the use of biometrics, and the implications. Can Nicolai expand on the subject? He sure can. “If you want to make a complete mobile bank, one of the big advantages is that you get a lot of things out of the different platforms. You have both Apple and Android devices. And when you use biometrics, it’s on the phone. So it’s not us who are taking the biometrics, it’s the phone that’s actually locking you in and out, based on your biometric data. And that encrypts the unlocking in the bank to say, This is the authenticated user: We know who you are, we know which bank you should be with.”

He admits that there are customers who say, ‘Oh, I don’t want to give you my fingerprint, because you’re going to use it against me, or you’re going to send it to some secret database.’ Nicolai underscores the fact that the bank never holds the biometric information – it’s always on the phone.

He believes that Bulder may be the only bank in the world to be entirely cloud-based, using Google Cloud, and adds that the team are in-demand guests on conference stages to talk about the experience of building a bank on the Google platform. A few observations are not always so congratulatory, as Nicolai observes, “Just yesterday there was a Google outage, so we had an outage as well. But that’s a little unusual, and at least we can say it was Google’s fault! That’s a little bit cooler than saying it’s just some third party doing something wrong in their servers, somewhere deep in the mountains. So we build upon that, and we build on Firebase, which is a Google framework to accelerate development and performance for mobile development.”

He expands on the reasons for going with Google, “When we set out to build this bank on the side of an existing bank, we were asked, ‘If you have one year to build it, what compromises will there be?’ At that time, we said it needs to be all native, and built in the cloud, not some kind of cloud ready bank. It needs to be built up there, so we can scale whenever we need to buy more server space, or whatever.”

So, no compromises.

The triangular matrix

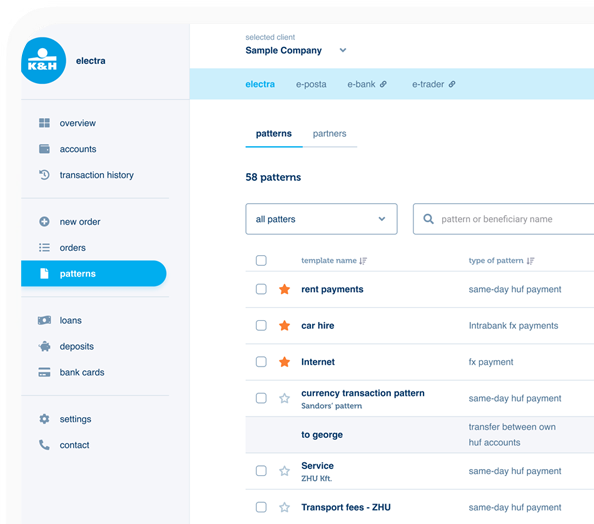

No compromises within DNB either, as Ørjan Bagn explains the process of bringing new products to market, and the part design plays in that. “We always have a triangle where you have business, tech and design represented and working together. That triangle is vital for our success. You need good people in clear roles in a collaborative environment.”

That sounds logical and structured, and I ask if smooth running is therefore guaranteed. Ørjan smiles as he responds, “Both yes, and no. We have a ‘family structure’ for some of our initiatives, so everything that is confined to let’s say our Mobile bank, is smooth running. And then we have other channels and services where it’s also smooth running. The next step for us is to ensure we are able to maintain the same good experiences we provide in each channel and service, in the customer journeys going across them.” And then Ørjan sums up with a wonderful metaphor, describing the complexity of having multi-product, multi-channel and multi-platform offerings, “The really big challenge comes when a lot of the matrix is in the matrix. We have to solve how we are going to work in the matrix in the matrix.” He ends his metaphor by adding, “Luckily we have tools to navigate the complexity, following our user journeys!”

PSD2 and TTPs

Back with Niklas Sandkvist, the subject is PSD2 and the part Fintech Norway is playing. “In Europe, we have around 4,500 banks. So if you’re a Third Party Provider and create an app, to get one bank to send money to another bank, you have a lot of integration to do. And that points to the need for a common infrastructure. But the banks don’t like this because interoperability will actually increase customer churn. So they have no drivers for building these APIs.”

The Regulatory Technical Standard – PSD2 RTS – is “pretty detailed,” says Niklas, but then also, “Not detailed enough. Brussels doesn’t want to build the infrastructure or provide the technical standard because it’s a continuous improvement in technology. So the problem is the struggle of getting a relationship between the bank and the TPP working technically, and there will be operational issues where there is no contract between the TPP and the bank. You can’t call your key account manager, and say ‘I don’t like your service’, because there aren’t any contact people.”

Looking for clues

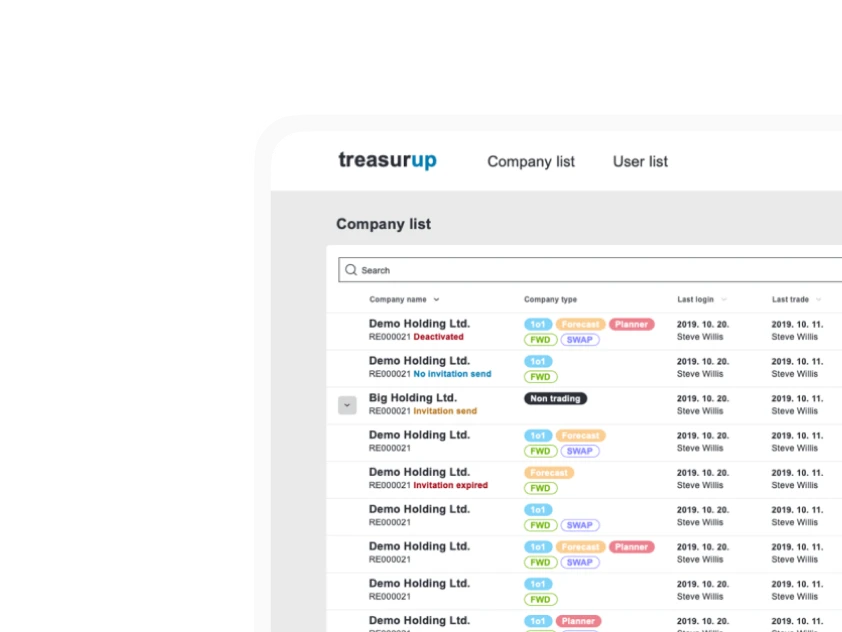

The answer was a collaborative platform built by Fintech Norway members, with Niklas co-founding 33report to ‘Report compliance with dedicated interfaces according to PSD2. A simple and efficient tool to facilitate dialogue between TPPs and ASPSPs (Account Servicing Payment Service Providers).’

The company name comes from article 33 of the Regulatory Technical Standard, mandating all players in PSD2 to report on potential noncompliance. However, the problem is that no one was doing this, because there were no tools in place to facilitate efficient dispute resolution. “So we said, ‘We are missing a piece.’ The TPPs said that they can build the measures. And the banks said they are building this developer portal, but if you build the app, I’m sure you are not going to visit 4,500 developer portals every morning, right?”

So 33report is talking to the industry and has close to 20 banks signed up (in 2022), with a few TTPs trying out the service. It’s like a ticket engine that documents observations of deficiencies or service level gaps, or other obstacles to PSD2. In fact, anything preventing a user experience as regulated for. The resulting data is compiled in an ‘envelope’ and sent to the bank in question, which can then respond … or not. The TPPs can also post their tickets to a Ledger, and all 33report participants can access this, looking for common issues or best practices: For example, is this ticket about a technical or functional error preventing the objectives of PSD2 being delivered?

Although he co-founded 33report, Niklas says he’d be glad to place the platform in any ‘neutral entity’ anywhere in Europe, but says there is slow progress on this. That said, a joint Governance Board is about to be set up as a first step in achieving this.

Hearts and minds

Speaking on the subject of research, Ørjan Bagn at DNB says that this is of course vital, and a Service Designer will often be used to understand what sources need to be tapped into, to really understand if something is a good idea or not. And then based on the stage of development, the sort of insights needed will be considered. So in the early stages there is one type of need, and then the closer you get, there is a different type of need. The heart and mind of a customer are important to understand too, Ørjan insists. Appreciating pain points is also essential, where things can sometimes get irrational and extremely emotional. Understanding what sort of mindset the user is in when you deliver a service is crucial, and Ørjan gives as an example a customer who has just had a death in their family and almost immediately has to deal with complex financial and legal issues. “It’s not only about solving a problem, it’s really about understanding what sort of mindset you would be in when you had to talk to a bank the day after you have just lost someone. It’s not only about the mind. It’s about the heart in that situation.”

This human-centric approach underscores the need to explain how the mindset affects people, and what that could mean for a service. “As Service Designers we have to understand the emotional part if we are to implement something. That is such an important part of succeeding. It can look good on paper, but it doesn’t always work in reality. Understanding different mindsets before a product or service reaches the market is important.”

Telling stories

As UX lead, Nicolai Hope Møller is conscious of also having to bring his business head to the party, because balance and perspective is needed to create “UI-UX which narrates the story for users. UX is a lot about storytelling, and you can tell a story in 100 different ways, but it has to be compelling and transparent.” OK, no argument with that. And what about testing, that favorite activity of any good UX-er?

“Testing,” he laughs. “My first response is that there is never enough. But I think every designer would say that; you always want to do more. But one thing I do like is that we get so much qualitative feedback, that we are kind of able to tell the story without doing that much testing. We still do a lot of quantitative tests, click tests, and 5-second tests, and stuff like that. We usually do it in a tool called Useberry (‘Your one-stop solution for quick remote testing and rich, actionable insights’). It’s a Greek company and they’re pretty skilled at developing really fast, new products – very cool. And then we combine it with sketches from Figma, which is our primary design tool. We send it out to both customers and non-customers – we try to design in public with the users.”

It’s sustainable, kind of

This sense of openness runs through most of what I’ve learned about the Norwegian approach … or at least the desire for openness, and the promise of it to come. Is it something to do with those amazing mountains and fjords, the relative lack of humanity in vast tracts of land? Niklas Sandqvist loves hiking and exploring in the mountains, and the harsher the weather, the better, “You can walk for days and not see anyone,” he says.

Ørjan Bagn is also an outdoorsman, who loves climbing mountains and then snowboarding down again. He is also, “Always curious and wondering about why people do as they do.”

From the cold clean mountains to the pits of hell, as Nicolai Hope Møller reflects that banks are still mistrusted. Not in themselves, because in fact Norwegians actually do trust banks as institutions, but they are suspicious of interest rates, mortgage rates, and the ways in which these are manipulated. “It’s like Dante’s circles of hell,” he smiles. “Dante placed the loan sharks in the seventh circle of hell among the murderers, as a group together. So, what every bank is doing today, Dante condemned as being at the same scale as murder.” Nicolai tries another analogy, “So I would just say, why not remove the carpet-seller bargaining from the equation when you need to go to your bank. Don’t use threats, just do it all digitally. That will mean more loyal customers for the banks, and they won’t need a person actually answering the phone.”

“But talking about Fintech and banks, I think this is just the start of the digital journey, right? Banking on a mobile phone is only 5-10 years old – banking in the pocket is a very new thing. So banks need to scale and do it fast, and they need to have a digital platform to do it all on. Otherwise, it’s not possible.”

And that earlier thought from Niklas is worth repeating: “We have a small market, and it’s sustainable, kind of, but I think we can contribute to the rest of Europe to a greater extent.”