The Polish Fintech scene - ‘I can actually see it!’

If Piotr Jan Pietrzak ever decides to move on from his work as Director of Product at web browser Opera, I’m pretty sure there’d be a perfect new slot for him: Polish Ambassador, roving the world to sing the praises of his native land.

Once upon a time he was champion of Polish electronic music, rockin’ the beats as a DJ. These days it’s something he does only for friends, but Piotr says, “There are so many undervalued Polish artists on the scene who make tremendous music, but they’re not really in the spotlight of the global music scene. The same with tech and with business.” He pauses and reflects on this, “Those things have something in common, right? Even if they’re totally different industries: music, business and tech, and both are from Poland. We are really good at this.” The challenge, he feels, is to promote those skills and even promote them outside of the country.

“There’s a huge opportunity for Poland in upcoming years to really talk about the talent, know-how, and what we are doing here. And it’s something that I will participate in as much as I can, because it’s what I call ‘positive nationalism.’ Nationalism now has very negative connotations, but historically it’s a positive thing.” Piotr sees a problem in Central and Eastern Europe being that a lot of companies try to achieve success initially on the domestic market. Only when they feel strong enough do they look to go outside. He compares this with U.S. companies that, “Don’t even have a product yet, but are already in Europe.” The pattern they follow is ‘fake it until you make it’, which he observes Americans sometimes doing to extremes. “I even wrote an article called Eastern Europe Sucks, because we like to complain so much… And forget how good we are.”

It’s a theme we will return to during our interview.

As a footnote to the process of interviewing Fintech players, I’m amused by the fact that shortly after I send this piece out for review, Piotr comes back to tell me he’s changed jobs. Despite my reckoning of the perfect placement for him as Ambassador, he has instead joined payments company BLIK, as Director for International Development. It seems that life outpaces reporting, and we must now add Director of Product at Opera to Piotr’s past CV. And wish him well in his new international role, of course.

Pushing digital channels

Despite his ‘positive nationalism’, Piotr is very far from having a limited viewpoint of how things are done in other countries. He was already involved in digital channels during his university years, making websites and ecommerce. After that came a job in Moscow, which was an unusual move, because everyone from Poland was heading West. Around 2012 mobile and online banking were already quite well developed in Russia, and just ahead of the curve, Piotr’s employer was building an insurance platform for selling online policies.

Later, on his return to Poland he started working for Dutch bank ING which had a strong focus on digitalization, with a business model to launch bank branches without physical presence in other countries (formerly known as ING Direct).

Well before Revolut or N26 came along, Piotr was working for ING in Poland, Germany, the Netherlands, the UK, and for a short period in the Philippines. “There was a really strong strategy on pushing mobile and online banking channels, and I think the pandemic situation has proved that they were right. All the other banks had to catch up very quickly with online and mobile banking, while ING in different countries already had it. So it was much easier to push users to digital channels.”

Piotr notes that from the beginning ING was very open to collaboration with startups and didn’t didn’t see them as competitors – cooperation being another recurring theme of our interview.

And then he moved to his now-previous job at Opera, on the wave of Big Techs which were entering financial services. “Companies such as Apple, Facebook, or Google are entering this area of finance, because they have the data, they have the users, they have a totally different relationship between the company and the user, right?”

‘You own my money!’

Piotr continues, “The banks in general have a kind of ultimate negative connotation: ‘You own my money!’ So it’s not a friendly relationship. Of course, banks are working to change that, but if you think about it, the big techs are already part of our lives. So it’s much easier for them to enter financial services, than for the banks to go beyond banking things. They try of course, but their relationship with users is different. I joined Opera because they had a very ambitious plan of building financial services for end users, by creating their own Fintech company. And they were looking for people with experience from the banking sector to help them deliver.”

He was attracted by Opera’s ambition to go to a totally different vertical, and says the company is good at trying new things and not giving up. “If you enter a totally new product line, even gathering those people who know how to do it, you still need to create the right kind of atmosphere and comfort zone. This is what Opera is doing right now.” Piotr says the company was already good at making an alternative browser for virtually every possible platform, and now is building and experimenting with financial products for retail customers.

Opera already has a Fintech in Spain, where the company is experimenting and learning how it works. The plan is to expand to other countries while developing new products and leveraging the browser, along with financial services. A first up Proof of Concept is the Opera browser beta version of its Fintech, launched in Spain in February, bringing a cashback service, digital wallet, and Mastercard debit card, and also enabling online payments, as well as in physical stores with Google Pay.

What makes Poland different?

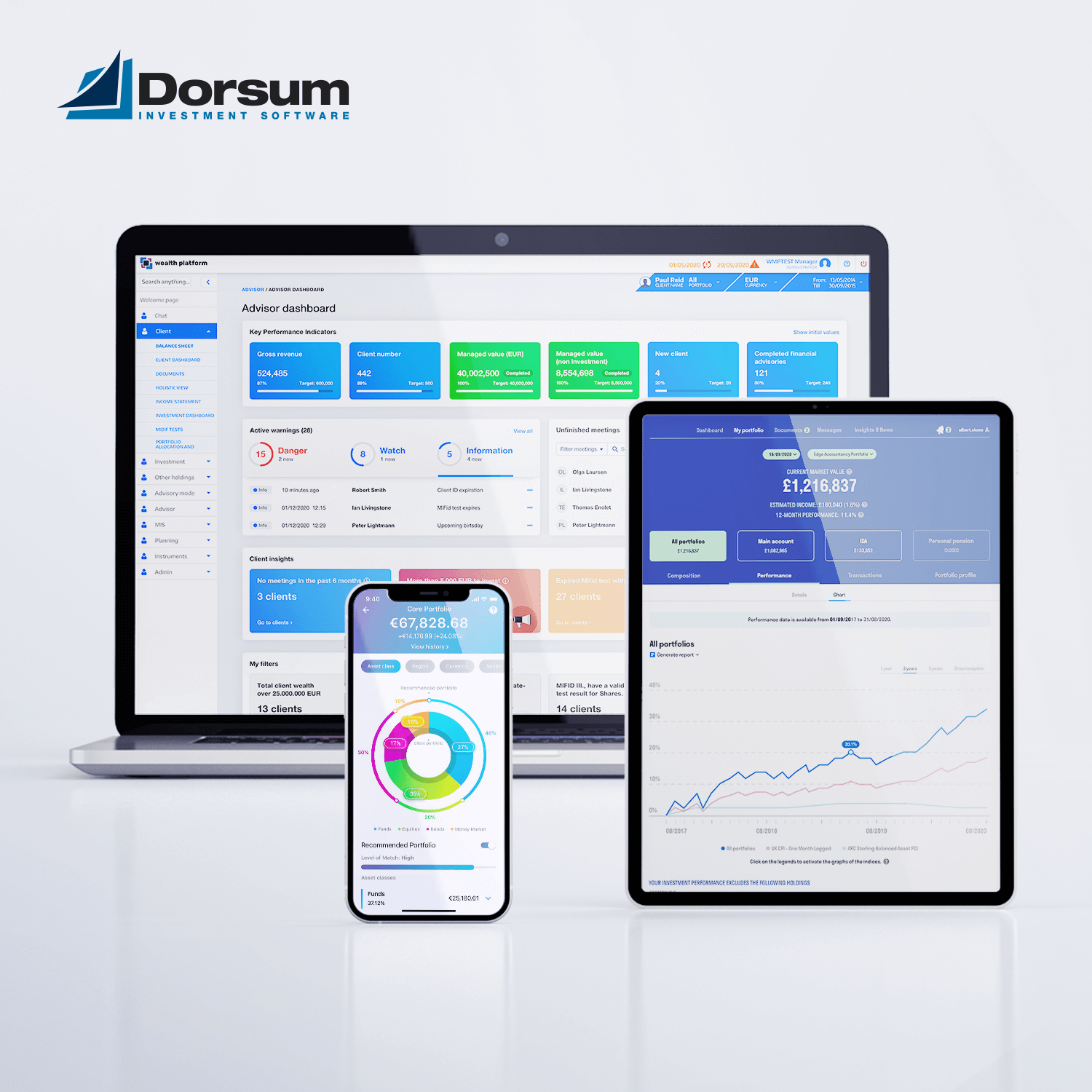

Too much to do and too little time to do it might also be the mantra of Maciej Swiderek, Country Head for Dorsum, a well-established Hungarian Fintech and Wealth Management company, now spreading its wings in other CEE territories. I’m imagining a well-staffed, buzzing Warsaw office, but Maciej says that for the moment the only person he is managing is himself. In the near future there will be local Business Analysts and support staff onboard, but right now it’s just him – with of course a lot of guidance from the head office in Budapest. So why is Dorsum looking to Poland, and what makes the market there interesting or different?

He says that the economy is basically on the right course given the population size of almost 40 million, making Poland one of the biggest countries in the CEE region, with a large internal market, including for financial services. “Back in 2007, when I was starting in the industry,” Maciej reflects, “There were 40 to 50 banks operating, whereas nowadays, it’s basically 10 banks. Of course there are maybe 30 banks registered, but if you look at the market, there are around only 10 major players. At some point, most realized that the market is becoming so competitive, that either they had to invest a lot of money, or they simply wouldn’t get into the top 5 or even top 10. So because of that competitiveness, and falling interest rates, a lot of institutions decided to focus somewhere else. In a nutshell, it’s about the evolution of a competitive market, the size of the market, and the demanding expectations and habits of Polish financial institution customers.”

Demanding customers? – What are they looking for? Maciej says that people are very keen on anything new that is happening in financial services, and are quick to absorb fresh technologies and solutions that banks and financial institutions provide.

Innovation is treated as normal, so that – for example – consumers in Poland now can’t imagine living without touchless payments, something that’s not even all that popular across Western Europe. In fact Poland is in the top 5 countries in the world for using contactless payment, phone payment, and even using wearables for payments. So for Fintechs planning to develop a business in Poland, there is a great audience from both clients of banks, and the banks themselves, which are very open to integrating solutions and new services. However, “You’re not going to blow people’s minds with the fact that you offer contactless payments, or anything else which a lot of banks already offer. You have to think of something new to be able to surprise the customer.”

Cooperation, cooperation

Maciej notes that cooperation between Fintechs and financial institutions, banks in particular, is very good in Poland, with almost all of the top 10 banks having a dedicated department to work with outside vendors and Fintechs to develop solutions. There’s a constant search for innovation that can be brought into the banks’ offerings.

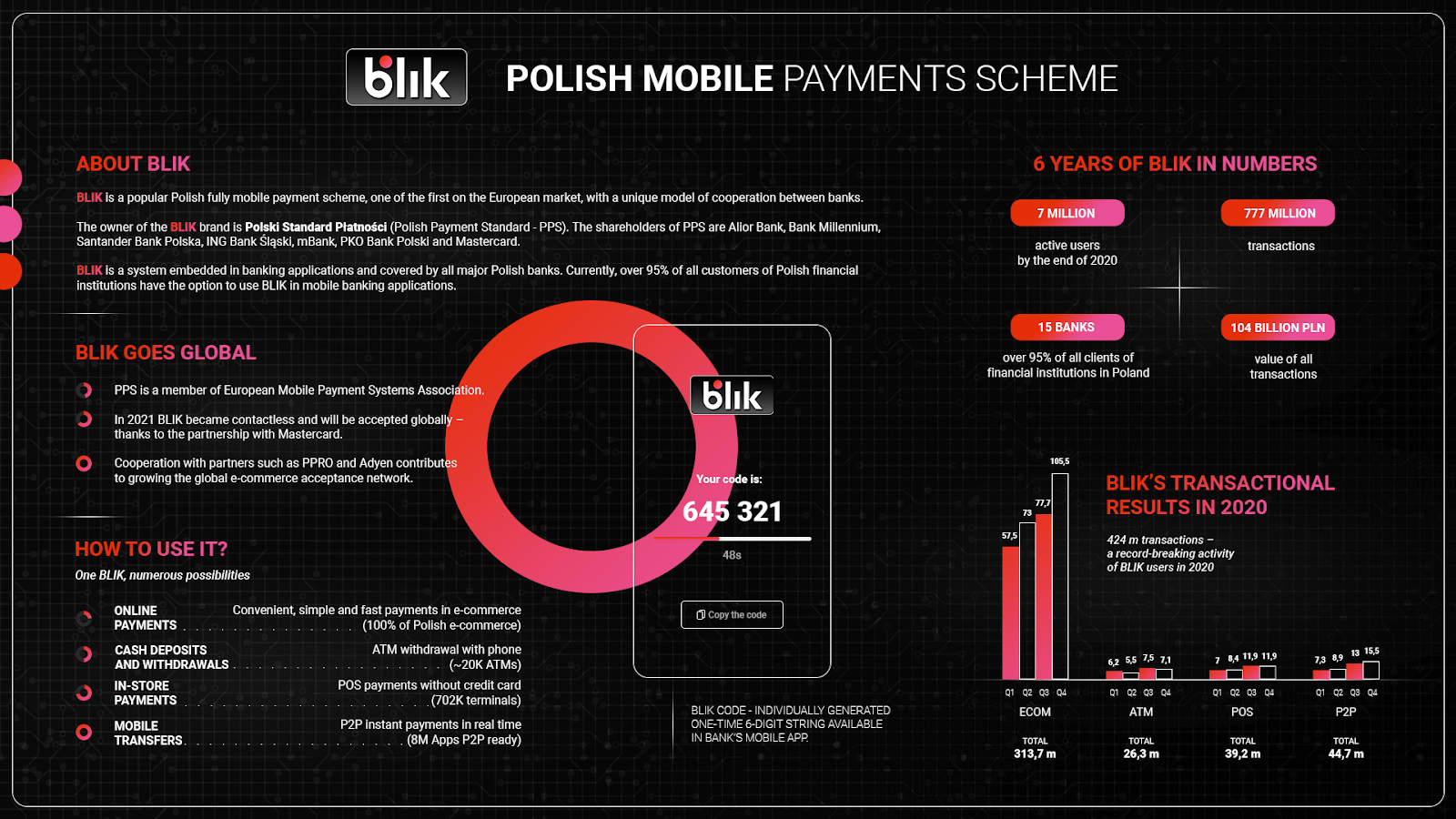

One significant step was the creation of the BLIK payments system, developed by a consortium of the big banks, and owned by PPS, the Polish Payment Standard. “With BLIK you can send money to another person using just their phone number – you don’t even need their account number, it’s only necessary that you’re set up with your bank. If you are, you can search and find any other BLIK user.” From January to March 2021, Polish BLIK users performed over 153 million transactions worth €4 billion, with more than 74% of transactions in Q1 2021 being made online. “I’m very proud of BLIK,” says Maciej. “It’s doing really well, and is expanding outside Poland.” He also gives kudos to Kokos, the oldest and biggest Polish social finance platform for P2P social lending and currency exchange, in which area it is market leader.

BLIK also featured on Piotr Pietrzak’s radar even before he took up his new job, and in fact he comes to my rescue to explain Maciej’s reference to 74% of transactions being made online. So what constitutes the rest then? – P2P payments, ATM withdrawals and POS transactions, Piotr flashes back. He adds that according to the official quarterly report from the Polish National Bank, coverage of Point Of Sales terminals is now 100% contactless across the whole country, meaning that Poland has probably achieved a world first.

He also mentions a Boston Consulting Group report identifying around 250 challenger banks in the world, of which only 14 have so far broken even. “You can see that the game of creating a really good business model in this environment is super hard. The startups like to brag about how much money they have raised. But it’s not the money that they earned, it’s not the money that they generated. So BLIK is a wonderful example, where old, boring legacy banks did something great. Now BLIK is accepted in virtually 100% of e-commerce in Poland – there’s no website that doesn’t accept BLIK, and it’s spreading outside Poland – an amazing example of a successful Fintech.”

Upskilling

So is it the youthfulness of the Polish market that makes the adoption of Fintechs so relatively easy? As with other CEE countries, the Communist heritage of Poland means that there was heady change to be undergone in a very short timespan. As Maciej Swiderek comments, “We all know that countries from our region had a lot to skill up on after 1989. Our parents’ generation was the first to operate in a free market, and they did great. Then there’s my generation who entered the market in the 2000s. We were well educated, and had been surrounded since the 90s by technology. I also think that the banks tried to be innovative and to really prove something to the market.” He says it led to a general drive for the idea expressed by ‘Poles Can’ – a phrase a bit like Obama’s ‘Yes we can’.

For another take on pride in being Polish, I call in to Konrad Olejarczyk, Head of Project Delivery at UX Agency Mobee Dick, based in Katowice & Warsaw. “In Poland, the market for Fintech and banking is surprisingly evolved,” he says. “I think we are at the top in terms of innovation and adoption by users. The challenger banks have it really hard here, although Revolut is maybe second or third on a customer basis, and in terms of scale. But it’s mostly that people adopt things in finance easily because our market is so evolved.” As an example he says, “I have all these cards and accounts with maybe 10 euros in each of them, but I’m not going to switch completely because banks in Poland are pretty awesome.”

The idea of banks being described as ‘awesome’ by a relatively young and definitely hip UX Design Agency member is surprising in itself. While I’m absorbing that, I throw in a question about the name: Mobee Dick. I read the novel about the great white whale a long time ago, but don’t recall too much UX Design content. Konrad says the company founders simply liked the idea of an ‘open ocean theme’, and wanted to draw attention to the focus on mobile telephone – mobi – solutions, especially back around 2011 when they were putting together Mobee Dick. What’s the offering then?

Basing decisions on data

“We are a design and research studio, that’s the core of what we do,” Konrad doesn’t hesitate in delivering a rapid explanation. “So these two parts are interchangeable: sometimes we’re designing research, sometimes we’re researching design, and they have to work together. We have designers and researchers as needed, but also strategists to help set everything up and work with our customers tailoring products and projects. We take ideas that our customers come with, then we propose the way of working and conducting a project. That is so the business goals are met, the customer goals are met, and the project achieves its KPIs, or any other indicators we decide to focus on.”

The main markets for Mobee Dick are e-commerce businesses, banking, finance and insurance: “A whole, huge area that is constantly evolving, changing and improving.” Konrad says that the agency also likes to keep fresh with work for other interesting projects, because sometimes a change of perspective can be important.

He gives AILIS as an example of a health-related tool which Mobee has worked on, enabling women to use early breast cancer detection technology. Part of the design team’s brief was to ensure that the app was approachable and ‘less scary’. It’s something Konrad believes is, “Pretty amazing because it’s going to save lives.”

In principle, for financial clients Konrad says the same criteria should apply: Base your decisions on data, and on information from the business and its customers. “This is the core of every UX company there is. You want to design things, but that’s not the biggest part of what makes you a user experience company, it’s what you base your decisions on.”

In his previous work at Credit Agricole, Konrad hugely enjoyed creating and improving products for people who were often not tech savvy at all. And yet he believes that often banking processes and products are among the first to be encountered by people new to using a computer and the internet. “So we need to think about this whole broad spectrum of people. Of course, it depends on the project and the product, because finance is huge in terms of the different solutions that we work on.

Also coming from that, financial products are a necessity, they’re not for fun. Some people appreciate good design or a process that has been made much easier, but at the end of the day people just want to go there, make transfers, see how much money they have… And then get on with their lives. So you shouldn’t make big splashes everywhere, and maybe go too high on innovation or new design ideas.”

He says a banking service will be used by millions of people, which can be more challenging than working on something for a small and defined niche audience. Even though research and knowledge of banking gets the agency a long way, in the end it’s not possible to know everyone. “So making things simple is the way of approaching everything. And making things simple is very hard.”

Keeping things simple

Part of that simplicity comes from working on small incremental changes that do not affect customers in a negative way. “You need to work everywhere at once on little changes, constantly changing, constantly shifting these little blocks, so that they fit together better.” Mobee Dick engaged in a two-year collaboration (and ongoing projects) with BNP Paribas where the bank wanted to spread UX mindsets, design knowledge, and research knowledge across the whole company. If that sounds like asking the agency to cut off the branch they were sitting on, Konrad doesn’t see it that way. Cooperation is a frequent watchword of all three Polish interviewees, and he outlines the result of these discussions: A ‘UX Academy’ where Mobee Dick provides BNP Paribas with designers and researchers, to create and service what is basically an internal agency.

Anyone from the whole of BNP Paribas can go to the Academy and ask for help with specific projects. “It’s a brilliant way of working towards the goal of having one single mindset for user experience design, and stressing the importance of research.” The concept is working well, and currently Mobee has 8 employees in place at BNP Paribas, which for a company of around 40 is significant. “So we focus on projects and customers, and having cool things with good quality.” That seems like a good enough summary!

Coming trends

While Konrad Olejarczyk is clear about the way in which Mobee Dick keeps its feet on the ground (or should we refer to its flippers?), Maciej Swiderek is interested in looking at coming trends and tech. I’m tempted to wonder if this is connected to his high regard for technical guitar master John Petrucci, and Maciej’s own adventures as a metal guitarist. Whatever, he sees AI as an increasingly happening thing, with biometrics in general gaining ground. He underlines the fact that touchless payments are already very well established in Poland, and when he logs into one of his own accounts, he uses facial recognition. Other methods are, “A little outdated. Typing in passwords is tedious, biometrics are better.”

He says there are now Take& GO Stores in western Poland where there are no shop assistants or cashiers. A system of sensors on the shelves, plus cameras located throughout the shop monitor shopping activity. At the shop entrance, customers are verified using a mobile application, after which they can freely choose what they want, while the intelligent shelves and cameras identify the goods in the shopper’s basket. Then when leaving the store, the app automatically charges the customer’s card. This is a trend which Maciej sees as going over very big during the next couple of years.

And as to voice usage? Hmm, not quite so Fast and Furious, Maciej suspects. While a population of nearly 40 million puts Poland in the giant category for the CEE Region, like many of the neighboring countries, there isn’t a wide uptake of the language across the globe. Polish is spoken by about 0.6% of the world’s population, or around 50 million people, compared to the dominance of English at 1.35 billion speakers (the majority being second and third language speakers). So for the moment voice use in Polish is too niche, and “Too risky,” Maciej thinks. Which brings the discussion on to UX-UI design, which he sees as crucial because of the high expectations in the Polish population in general. People demand that apps work, and work well. Revolut showed the way for innovation in UX, and since then UX design has become ever more important in the market. Maciej draws attention to mBank as being one of the most innovative banks, with a “Great, user-friendly app.” The mBank Group’s strategy is, ‘To help. Not to annoy. To delight… Anywhere.’ mBank is Poland’s fourth largest bank in terms of total assets and has 2.2 million active mobile banking users, 5.6 million retail clients, and is also present in the Czech and Slovakian markets.

Language and clarity

Of voice, Konrad Olejarczyk says that of course the Polish language is a barrier. “I love voice technology. I have Google speakers and I play with the technology, but it’s not evolved yet to actually help people in a meaningful way. Banking is not for fun, it’s a tool for most people, and you don’t log in to get something cool. You do banking to solve your problem. So it needs to be much easier for the customer to use voice than to do anything else. And it’s not that way yet, especially with the Polish language, which is a little bit difficult!

So I think that the key part right now is working on language.”

That’s the written rather than the spoken word. “We have had a UX writing team for the past couple of years. I always say that UX writing is the lowest amount of investment with the highest amount of return, because you work with words, so you don’t need much development, or even any. The amount of clarity that you can generate by just working on the way you say things to people, how you write them in your tools, and in your guides – that’s what we’re focusing on right now, especially with the difficult language we have. It’s also not so simple to create short texts in Polish.” In addition, translating from English to Polish is always challenging for mobile apps, because everything is much longer, and ‘more serious sounding’ in Polish.

As well as the actual language used, banks are also working on new language guides to simplify how they talk about products and regulations, making everything more approachable. Kondrad traces this transparency to the advent of Fintechs and the informality associated with their approach: They said ‘Hi’ rather than any stiff greeting, and did things like sending a GIF that could be passed on to friends when making a transfer. Suddenly, dealing with money felt more relaxed, and no longer had that sense of ‘You own my money’ mentioned by Piotr Pietrzak.

So working on language is a key ingredient in UX for Mobee, but “It’s still not that obvious to some of the companies that we work for, “ says Konrad. “However every time we include UX writers into our project team, the results speak for themselves: Wow, this really changes things! So I would say this is something we do well right now. As for voice, it’s not going to evolve that fast, and the same thing with AI, but these ideas will continue because they’re cool and fun to think about.”

Piotr Pietrzak is cautious about Polish UX – whether cool or fun – because he feels there’s not enough exposure or acknowledgement of the skills available. “If people think about great tech companies and great financial services, Poland does not come to mind as a first choice. It’s a complex problem of not being able to promote yourself outside the country.” A lack of confidence, and that ability to ‘fake it till you make it’, mentioned earlier? Yes, perhaps, Piotr laughs.

The larger picture

The picture I’m getting of Poland is of an advanced, financially aware population, hungry for innovation and relaxed about taking up new ideas. Or at least that’s one side of the coin. The other side shows that there’s still a way to go. Piotr gives two examples from his own payments experience. One was where he wanted to tip the renovators of a new flat he was moving into. “I said, ‘Hey, guys, I can send you the money transfer,’ and they said ‘Yeh, but it takes time.’ I said, ‘No, it’s P2P, you get money right away.’ And you should have seen their faces when I set up their banking app, and said, ‘OK, check it now.’ They said, Oh, wow, it’s already here. It’s instant!”

“Here there are about 20 million active users of online banking. Of course, that includes people who are multi-banking, but it’s still quite a lot. Nearly 15 million have mobile banking and if you want to go deeper, there are 9 million mobile-only banking users. So they don’t even log onto internet banking through their laptop or desktop, but do it purely on their phones.” He adds that Covid helped the rate of adoption, especially among the older generation who were previously less aware of what can be achieved with mobile banking. Right now he defines general awareness of what can be achieved with mobile as ‘moderate’, but with a huge potential for growth.

Built in Poland

“If you talk about banking you have compliance, legal, and regulatory frameworks,” Piotr continues. Naturally Fintechs can therefore exploit opportunities because they’re not fully regulated. However, as soon as they want to get further – as in all European markets – they need to reach for a banking license. “And then they have to start to play by the same rules, like the banks, and then we can compare apples with apples.” Ever the enthusiast for Polish Fintech, he points to cloud banking as a new development led by Vodeno: ‘The most comprehensive ready to use solution for Retail & SME Banking enabled by advanced API technology.’ The Banking As A Service solution was built in cooperation with Google and is one of the first and leading examples of banking 100% in the cloud. The solution has now been rolled out to Aion, a new challenger bank in Belgium. “Live in Belgium, built in Poland,” Piotr says. “I think it’s a good example of how great our IT sector is, and together with the banking sector, we are starting to export this know-how.”

Poland was already a big shared service hub, with major corporations including Credit Suisse, HSBC, and JP Morgan having large offices in the country. “Now, we are moving to exporting our know-how – companies are not coming to us just because there is cheap labor and great service. Revolut has a really big office in Cracow, and it’s not an overstatement to say that some parts of Revolut were actually built in Poland. And it’s not only about development, because there are already structures in place with product owners, senior managers, and so on. It’s no longer just outsourcing, because we are starting slowly as Poles to export our ideas. And this has never happened before.” He says that as yet people outside of Poland don’t know about these successes because Fintechs are not promoting themselves well enough, for example by communicating their message in English. “So people are really surprised when they hear that something is from Poland, and I’m trying to strongly push this agenda privately: That we’re doing great things – Vodeno being one example.”

Talent on demand

“From our own perspective the banks are pushing everything,” says Mobee’s Konrad Olejarczyk. “And there are projects that require a completely new approach. If you’re building a startup, you want to hit the ground running and create something great, but maybe not within a corporate timetable. This is where we can come in and help.”

He also points to a shift in Mobee’s activity to what the company calls a Talent On Demand Service, for example in some of the work for BNP Paribas: “These companies need experts, and people with skills, but recruiting them is increasingly difficult. Not everyone wants to work for a large company, especially in the creative business. Many of these people are designers but are also artists at heart, so they don’t want to be in fixed structures for too long.”

I’m aware that this is something which has been done for quite some time by Ergomania, working from Budapest. The company offers banks and other financial organizations the opportunity to ‘Hire a Pro UX, UI and Service Designer’, on a short or long-term basis, with the option of even expanding to full teams. Instead of sometimes searching for months for the right person, clients get experienced, proactive professionals quickly, with far less danger of the burnout or just plain boredom that Konrad at Mobee Dick notes can sometimes overtake those creative and free spirited ‘artists at heart’.

As Konrad continues, “So this is where we come in, to build teams that actually integrate with a company and work with them. We can create a tailored team for half a year. We work in six month shifts, for example, so then there is another person coming in with a fresh perspective from another project. This is how we work with the bigger companies right now. There’s still room for big projects and new solutions, but when companies are trying something completely new, they don’t build a special department just for a short burst of workload. So they hire us, and the key thing is a close integration between UX professionals like us, and banking professionals. Scaling up huge teams is just unsustainable, so they need the flexibility that we can offer, especially with new projects that clients want to create for a limited time.”

Limits and Freedoms

Konrad continues by pointing out that every company has their own debriefing questions, one of his favorites being WHY? “Why do you want to do this? So let’s say you want to do an app for older people… Okay, so what are the reasons for this decision? Have you tried testing it with your current client base? Have you done some early testing of prototypes that are working better and improving your KPIs for this group? Of course the key thing you need to see is the whole landscape from technological, legal, and business perspectives. With banking, you need to understand what’s going on and what limits you have.”

Limits and freedoms, cooperation and individualism. Pride in Polish know-how and a ‘Poles Can’ mindset, offset by an apparent tendency to complain, and a lack of self belief. A nation of early adopters of technology, while at the same time one with many people still unaware of what can be achieved quite easily through mobile payments, for example. I take away the sense of a vibrantly innovative culture, with Fintechs being created and pushed by the incumbent banking industry. And I also have a sense of a somewhat sleepy giant, which when it wakes fully may become a mighty force, not just in the region, but globally.

Konrad Olejarczyk likes to ‘drive things’ – as in karts and cars. He’s also an astronomy fan and has his own telescope (currently stored at his parent’s home, as it happens). “When I looked at Saturn for the first time, it was game-changing for me. It was like, ‘Whoa, it’s really there!’ It’s not like in a movie or books or stuff… I can actually see it.” I decide to adopt this as something of a metaphor for the Polish Fintech scene, thank you Konrad!

Piotr Pietrzak is currently enrolled in an executive education programme at Stanford University, which features a lot of striking business case studies, the majority of them American of course. Interesting, but he likes being able to contribute the observation to his fellow students and teachers, “Hey guys, don’t you know that this solution also exists in Poland?”

And Maciej Swiderek praises the Polish openness to new solutions, “We use technology, we like it, and then there’s a spiral: We know solutions that are practical, which make life easier with ways to pay and transact faster, and simpler. And this is not just innovation for the sake of innovation.”

As and when that sense of innovation really gets traction, as with Konrad Olejarczyk’s view of the heavens, I suspect we may all be saying, ‘Whoa, it’s really there… I can actually see it!’