The UK Fintech Scene - Will the crown slip?

In speaking with people around Europe about all things Fintech and UX-UI, a common theme I’ve heard is, ‘But here we’re not as advanced / innovative / mature as the UK.’ So when I call in to Andy Samu in London, I’m keen to hear his take on this. Is the United Kingdom really leading the Fintech charge?

Andy is a great touchpoint as Features Editor at DisruptionBanking, the go-to source for everything Investment Banking and Fintech, based out of the Level39 technology hub in London. His overview and knowledge seems remarkably comprehensive, but he’s far from blindly supportive of this idea of UK excellence. The dominance of Monzo, Revolut and Starling in the neobank area have however helped the uptake of Fintech, with corresponding growth in surrounding ecosystems. “In Germany there’s N26, in Holland there’s Bunq, but these are the only major players,” Andy says. “The legislation in the UK has also been encouraging for Fintech startups, and the British public have got behind this, in part encouraged by government. For example, if you go to the pub, people are talking about Fintech. They don’t necessarily know it’s called Fintech, but they’re aware of the idea of Fintech, and these days everyone touches aspects of Fintech, and they’re all participants in markets. Now is the time of the Retail Investor, and it’s very encouraging to see the way people are taking their financial future into their own hands.”

Selling Fintech

Andy even identifies the start of this uptake coming from consumers, who set out to ‘cheat the system’ when airlines began charging extra around 2016 for payment of flights with credit cards. The way around this was to use debit cards which looked like credit cards, but which avoided the charges. From this small beginning, Andy traces the current evolution of non-numbered cards. “If you lose your card it’s a big hassle for the card issuer to create a new one with all the numbers on the card. It costs them money. Now cards have fewer details on them, so apps are pushed even harder.” It’s an example of the push-pull of Fintech development.

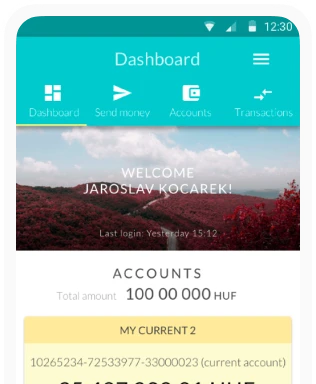

UX has played an important part in making things simpler and more approachable for users. “It would take 15 clicks to open an HSBC account, or even 35 clicks for an American Express gold card. Compare that to say 5 clicks for Revolut or Starling. And from the moment you start there’s so much information,” Andy says. “And then came wallets, and Blockchain…” So it’s not such a surprise that Fintechs have seen widespread uptake in the UK.

Is it simply a more pragmatic approach that apparently distinguishes the UK from its continental neighbors? “We’re probably better at selling Fintech,” Andy says. “We don’t just look to the home market, or even to Europe. Fintechs in the UK are more focussed on Israel, the USA, Canada and Singapore than on Europe.” Switzerland also features in a UK government sponsored Fintech ‘mission’ to the country, which includes reaching out to Austria. “We’re good at telling the world about Fintech, and the current UK government has worked out how to support this. The Chancellor, Rishi Sunak has said that he considers Fintech to be an export industry that should be nurtured. Fintech export is about to commence.”

I really want to ask about Brexit and its impact, but let’s defer that question for the moment and instead travel – virtually – some 600 kilometers to the north, and the Scottish capital city of Edinburgh.

Scotland – a different type of Fintech?

Mickael Paris is Marketing Director of Fintech Scotland, having co-founded the organization in 2018 with Stephen Ingledew, following on from a career with Skyscanner and Oracle Maxymiser, among others. But why a separate Fintech set-up for Scotland? (And here it must be pointed out that if you ask most people living in the British Isles to explain the intricate political and statutory arrangements between Scotland, Wales, Northern Ireland and England, you will probably get confused pretty quickly!)

Mickael says the case for Scotland as a Fintech cluster is because it has its own USPs. London and Edinburgh are well served by rail and air connections, so it’s easy to travel between centers, but he points to several important differences. “There’s a big Fintech connection with the universities in Scotland,” he says. The first MSc in Fintech in the UK was launched at the University of Strathclyde in Glasgow, the largest city in Scotland, and there is, “Great talent coming out of the Scottish universities, especially in the areas of Blockchain, AI, RegTech and Wealth Management.” He also points to one of the world’s most powerful supercomputers located at the Edinburgh Parallel Computing Centre as an indication of the vibrant atmosphere for financially-related developments in Scotland. The EPCC’s mission is, ‘To accelerate the effective exploitation of novel computing throughout industry, academia and commerce.’

Fintech is not fringe

I ask Mickael if this means his own Fintech Crusade is made easier. “We have a mission, but it’s not a Crusade! Fintech is not a fringe movement – it’s now throughout the financial sector. You can’t be in finance and not be in Fintech – it empowers everything.” He points to two recent reviews which acknowledge the embeddedness of Fintech in the UK: The Kalifa Review and the Logan Report. The first, covering the whole of the UK and published in February 2021 begins its executive summary with the following words:

‘Fintech is not a niche within financial services. Nor is it a sub-sector. It is a permanent, technological revolution that is changing the way we do finance. Its essence is in both fast-growing fintech companies, and the investment and use of technology by our incumbent financial institutions. It’s in the way we regulate previously unknown technology and set new standards. But most importantly, it’s about delivering better financial outcomes for customers, especially consumers and SMEs. We want to deliver these outcomes across the UK and export them to the world.’

Government support

The specifically Scottish viewpoint of the Logan Report predated Kalifa by some ten months, and was commissioned by the Scottish government to suggest a route map out of the pandemic, with the overview that, ‘The review’s recommendations are primarily concerned with stimulating and accelerating the maturity of Scotland’s Technology Ecosystem. By this we mean the system, in its widest sense, that supports and nurtures technology businesses in Scotland, from the early start-up phase through to fully scaled maturity.

The output of this ecosystem should be a stream of technology start-ups that reach sustained profitability, including a significant proportion that do so at scale; with consequent benefits in opportunity for our people, in job creation and in tax revenues. The review’s recommendations are intended to significantly improve upon current outcomes against this goal; that is to say, our recommendations are intended to increase the creation rate of profitable, scaled tech businesses and to reduce the time taken for viable individual start-ups to reach scale.’

Fintech Scotland were involved in both the Logan and Kalifa reports and Mickael commends them as, “Essential pieces of work that should inform our actions and initiatives across the UK.”

The UK out of Europe

From England to Scotland, there would certainly appear to be healthy encouragement for Fintech, but let’s check in on that question of Brexit. In case anyone is unfamiliar with the term, it refers to the UK’s departure from the European Union, officially on January 1, 2020.

Mickael, a native-born Frenchman who has lived in Scotland since 2005 believes that, “Fintechs will thrive either way. Fintechs are resilient. From the start of the Brexit process, we had the attitude, ‘If we stay in the EU, OK. If we leave the EU, OK. Either way we will make it work.’ Some Fintechs have had to open European offices, but we haven’t seen any Scottish Fintechs closing down because of Brexit. While some financial companies have moved some assets out of the UK, the innovation is still here, and a lot of that is down to the Regulator. Our culture of innovation is here, and it’s not going anywhere. That’s recognized internationally. Fintech isn’t new – it emerged from the 2008 financial crash and the emergence of Bitcoin. It was born out of a crisis, and now there are new crises. When a new crisis hits, we accelerate.”

Andy Samu of DisruptionBanking is also untroubled by the departure of the UK from Europe. Yes, some jobs have gone to other centers, most notably Amsterdam, with Dublin and ‘Bankfurt’ also being beneficiaries of London’s somewhat lessening importance in the Eurozone. But, he points out, the margin in Euro exchanges is so relatively small it’s not a major factor in markets. He brings in his colleague Harry Clynch to comment. “Until recently I was working in Foreign Exchange in London,” says Harry. “Now if my previous firm is making a call to a client in Europe, they are required to have a European colleague also on the call, but that’s about all. UK companies still have a presence in Europe and where necessary they are adapting.”

Andy Samu adds that European Fintechs will increasingly find it possible to emulate the UK’s Fintech progress, irrespective of the relatively small fallout of Brexit (at least in the Fintech area). “We have been a gateway for innovation in the UK, rather than necessarily a pioneer. But look at other countries – France doesn’t look outwards to any specific large market, nor Germany. Germany looks to its smaller neighbors Austria and Switzerland, with the three countries together forming the DACH Region: Germany – D, Austria – A, and Switzerland – CH, united by language and geography.

Andy continues, “Spain for instance has its natural market in South America, but the UK’s natural market is much larger. In time our European – especially Eastern European colleagues – will gain the knowledge of how to apply innovation, especially by learning from the USA and the UK, where London has been the hub for innovation.”

UK UX?

Underpinning and enabling all Fintech offerings is UX-UI, so let’s turn to Managing Partner of The UX Agency, Edward Croft-Baker. The company was founded in 2008 and does ground-breaking work in helping organisations identify and solve real problems to innovate and grow.

“For me innovation is not just the latest shiny smartphone,” Edward begins. “It can be as simple as changing the copy in an email to make it more understandable. By understanding needs and challenges we can solve problems.” He cites the mass manufacture of Ford cars in the early 1900s. “If you’d asked people before that how they’d like to move around better, they would have said, ‘Faster horses!’ So with UX we are always trying to understand customer needs and then adding the technology to make that work.”

Although The UX Agency is very well-versed in Fintech, Edward points out that they also have clients in online retail, music, pizza, and car finance. “Clients are realizing that UX is a process that involves the whole organisation. Innovation sometimes comes in small packages, and UX helps deliver that.”

So if Fintech is not the only area of expertise, how much is the London-based UX Agency focussed on the domestic UK scene? In fact its outlook is global, with a Saudi Arabian payments system being a recent brief. Mobile-based health insurance products & services have also been developed for Nigeria and Pakistan where, Edward explains, “The churn on pay as you go phones is high. People throw them away when they run out of money, so how to ensure that their health insurance remains secure? We can only apply a fix to that if we firstly understand the motivations, needs and challenges customers face. We do that by researching the problem.”

He adds that for specifically Fintech offerings, a lot of startups initially rely on in-house teams, or off-the shelf UX ‘solutions’. The UX Agency is then often recruited at the point when a Fintech is asking, ‘Why is it not working?’

Frustrating? Edward is measured in his answer: “It’s all about context, and there is no miracle process. We’re good at understanding the unique context of a business, its people, products and services. We then research to give action and direction to clients and help them design solutions and put in the UX processes to continue themselves in the future.”

I wonder if that’s a hallmark of the UK approach, but Edward isn’t overselling that, “It would be mildly arrogant of Brits to say that we are premium. We work with great UX-ers all over Europe. For example our Scandinavian partners are just as experienced as we are and we follow the same processes – you need to understand and communicate the insights from the research, and bring it down to solutions. It’s all basically about understanding customers – keep on testing, and never lose touch with the customer.”

It always starts with people

Based on this it would appear that Fintech is no different to any other activity requiring UX, but Edward points to one aspect that he feels is particularly important: helping users to a better understanding of profit and loss. In this he echoes Andy Samu’s observation that the average person in a pub now talks with greater knowledge about financial markets. “Understanding how financial markets work is increasingly important for people, rather than just borrowing money. For us it always starts with people. Then we turn towards the technology and how to solve a problem. With a business, we also have to discover how to monetize it, increasing the revenue stream and reducing operationals.”

András Rung of UX Agency and Fintech specialists Ergomania has joined us on the call and asks, “So based on your observations, is there no difference between UX for Fintech, and any other UX?”

Edward considers this, “Customers can be harder to access with some Fintechs. They tell us ‘You can’t talk to our clients’. We have ways around this!”

(As András Rung is on the call, it’s worth mentioning that Ergomania’s own experience of the UK Fintech market started in 2019 with a comprehensive UX review at the London office of a major international money transfer firm. The project involved analysis and benchmarking, and went very smoothly. It’s an example of how the best UX companies are able to work across national boundaries and can take on projects successfully – and competitively – by nearshoring).

Grass roots

Although The UX Agency’s health-related work in Pakistan and Nigeria should be noted, there’s an understandable focus on business problems and monetization. So in comparison it’s interesting to see some of the more ‘alternative’ projects Fintech Scotland has engaged with, which have a decidedly ‘grass roots’ flavor. One initiative is Women’s Coin, which offers, ‘A vision to redefine charitable giving through tokens, blockchain and smart contracts. Every time you send a charitable donation, no intermediary fee is deducted. – Undiluted financial support to those in need to live a better life.’ Based in Edinburgh but reaching out to the world, this charitable foundation has found a natural ally in Fintech Scotland.

Ecological projects also feature among the organizations partnering with Fintech Scotland. The country is blessed with strong offshore winds (something of an understatement!) and a new Fintech is looking at using cryptocurrencies to finance a wind project. Mickael Paris also points to Striver, situated in the border country between Scotland and England, which is creating a bridge between small businesses, – especially those badly hit by the pandemic – and low-income consumers. This startup Fintech helps companies raise much-needed income by offering coupons for goods and services. There’s a strong community element too, ‘Enabling and incentivising members to share ideas, challenges and opportunities.’

Inbest is a benefits app which Fintech Scotland had a direct hand in helping develop. It’s an online calculator which assists low-income and marginalized members of society claim the social benefits they are entitled to. It’s a much needed and timely initiative, with the number of Scottish claimants having almost doubled in one year – to 207,180 – mainly caused by the impact of the pandemic.

It seems a long way from the ‘cutting edge entrepreneur’ image often associated with Fintech. And there’s more: Not quite at the social program end of things, but still very much to do with ‘normal life’, there’s Pour – an app designed for the hospitality sector, enabling customer ordering of food and drinks, and venue ordering from suppliers. That may not seem so unusual, and indeed is something available to all large pubs and food chains. The difference is that this is tailor-made and customizable for one-venue businesses, giving them the same flexibility and operational muscle as much larger organizations.

Mickael also draws attention to Zumo, a Scottish crypto wallet offering launched in 2020, which he says is democratizing cryptocurrency use, and making it ever more ‘normal’ with the promise that, ‘Our non-custodial smart wallet gives people full ownership and control of their money.’ As a startup Zumo raised ‘a few millions’ – mainly from wealthy individual investors – and is now growing at pace. Mickael points out that for Zumo, UX-UI design is, “Everything – it’s the most important part.”

Clustering

Scotland Fintech is therefore active in a lot of areas, and what about the mixing and mingling side of things? “We don’t just look after Fintech firms in Scotland, we have established relationships with other UK hubs to form the FinTech National Network and we’re also connected to other international clusters. We have worked to develop around thirty large strategic partners, and so we have the means to connect them with already existing Fintechs. It’s demand-led so there are more likely to be meaningful connections. We manage a very innovative cluster here in Scotland, including universities, students, regulators, governments, and hubs around the world.”

In fact, ‘clusters’ is not a casual description. There is a European Secretariat for Cluster Analysis and to date Fintech Scotland has been awarded the Bronze ESCA Quality Label – the first fintech cluster management organisation to gain this in the whole of the UK.

Meanwhile Fintech Scotland, “Helps others to organize events” and is preparing its 4th annual Fintech Festival in September 2021 – a hybrid virtual/onsite nature, and likely involving most of its 170-ish Fintech member companies.

Out on the horizon

With some of those examples of socially-oriented Fintech helped by Fintech Scotland, I ask Andy Samu of DisruptionBanking if anything similar has caught his eye. He mentions Singapore-based TADA, a blockchain-enabled Fintech for ride-hailing of taxis and tuk tuks. (Tuk tuks are those three-wheeler taxis used all over Asia, so-named because of their distinctive ‘popping’ engine noise). Then there’s a Mumbai-based Fintech enabling street vendors and Dabbawalas to find cash to buy ingredients in the morning, in order to sell their wares every afternoon. It’s hedging, but not in the way most traditional banks would understand, or want to risk. Two fascinating examples, and it’s indicative of the far horizons Andy Samu’s attention is focused on. Yes, he’s headquartered in the Level39 technology hub in London’s Canary Wharf, but his is not a UK-centric view (although in fact the view from Level39 is rather spectacular). Nevertheless, I press him for some trends in the UK.

“Fintechs are elastic and flexible,” he says. “They know how to take a package and uptailor it. What this is enabling is increasingly Banking as a Service. Let’s say a big bank decides it wants to get into the Orkney Islands.” (A picturesque group of islands off the northernmost tip of Scotland, with a population of around 22,000). “It’s not a worthwhile thing for the bank to develop all the necessary infrastructure, but another party, such as Wonga may be willing to consider the risks and open up the market.” (That’s a just for-instance, of course). And that says Andy, is BaaS.

He also remarks that NFTs are ‘bubbling along’ as a trend, but isn’t drawn on his feelings about this. “And Decentralized Finance is getting higher on the radar,” he says.

And what is getting higher on the radar from a UX perspective? Edward Croft-Baker remains grounded but optimistic, “the result of the pandemic is businesses know their customers even less and are rushing to understand the new needs, challenges & opportunities. UX and digital are the solution. Reflecting on the place of UX, he observes, “We are increasingly seeing that UX process delivers innovation and that to do this it needs to be integrated with the whole of the organisation. We see a continued respect for UK UX work and I think the future looks good.

Comprehensive, coordinated and focussed

Is the UK the one to watch for other Fintech countries? It seems from the understated approach of Edward Croft Baker and Mickael Paris that what they are doing is quite normal, and they’ll leave it to others to decide if their ‘normal’ is someone else’s exceptional. And for Andy Samu, the geographic location of the UK – whether attached or detached from Europe – seems almost irrelevant. He’s an enthusiast for all things Fintech, wherever they are launched.

From my brief visit to the British Isles, I take away a sense of quiet confidence, and a strong sense of Fintech maturity. For a final word let’s return to the Kalifa Review (chaired by entrepreneur Ron Kalifa) – the UK government sponsored report on the future direction for Fintech:

‘Set out in this Review, is a strategy and a delivery model for us to provide leadership in Fintech. If we are to succeed then it must be comprehensive, coordinated and focussed. That is why I have put forward recommendations to support Fintech scaleups with the capital and skills they need to succeed. But these measures must be combined with world-leading policy and regulation. The UK has a hard-won reputation of trust when it comes to regulation and the rule of law. We must ensure that we build trust in this new wave of tech-enabled products and services. Above all, it is about building markets for this innovation to grow into. A great product will not succeed without a strong customer base, adequate regulation, access to data, skills and capital. It is this holistic approach that I have striven for in this Review. And it must be done now. Others are waiting for our crown to slip.’