Financial Scene of Ukraine

What makes Ukraine exceptional among other countries in Europe? There are thousands of reasons for that, among them - a unique financial scene which we are about to uncover together.

Let’s face the truth: Fintech advancement’s pace in Ukraine has been quite moderate, which mostly contributes to outdated regulations on the governmental level,lack of capital and investment, slow acceptance of innovation and low personal incomeamong the population.National Bank of Ukraine (NBU) itself among the current problems of the financial sector names:

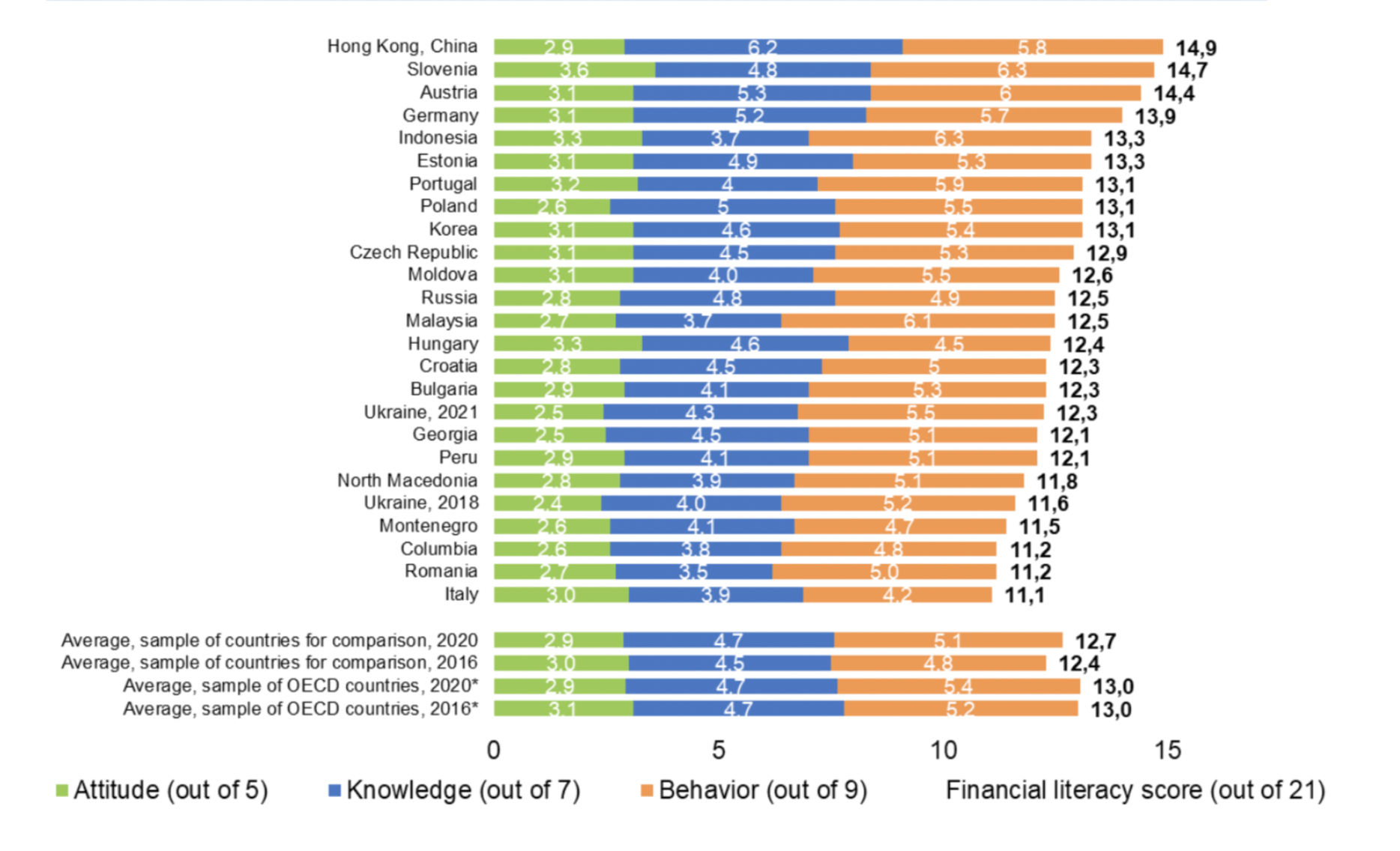

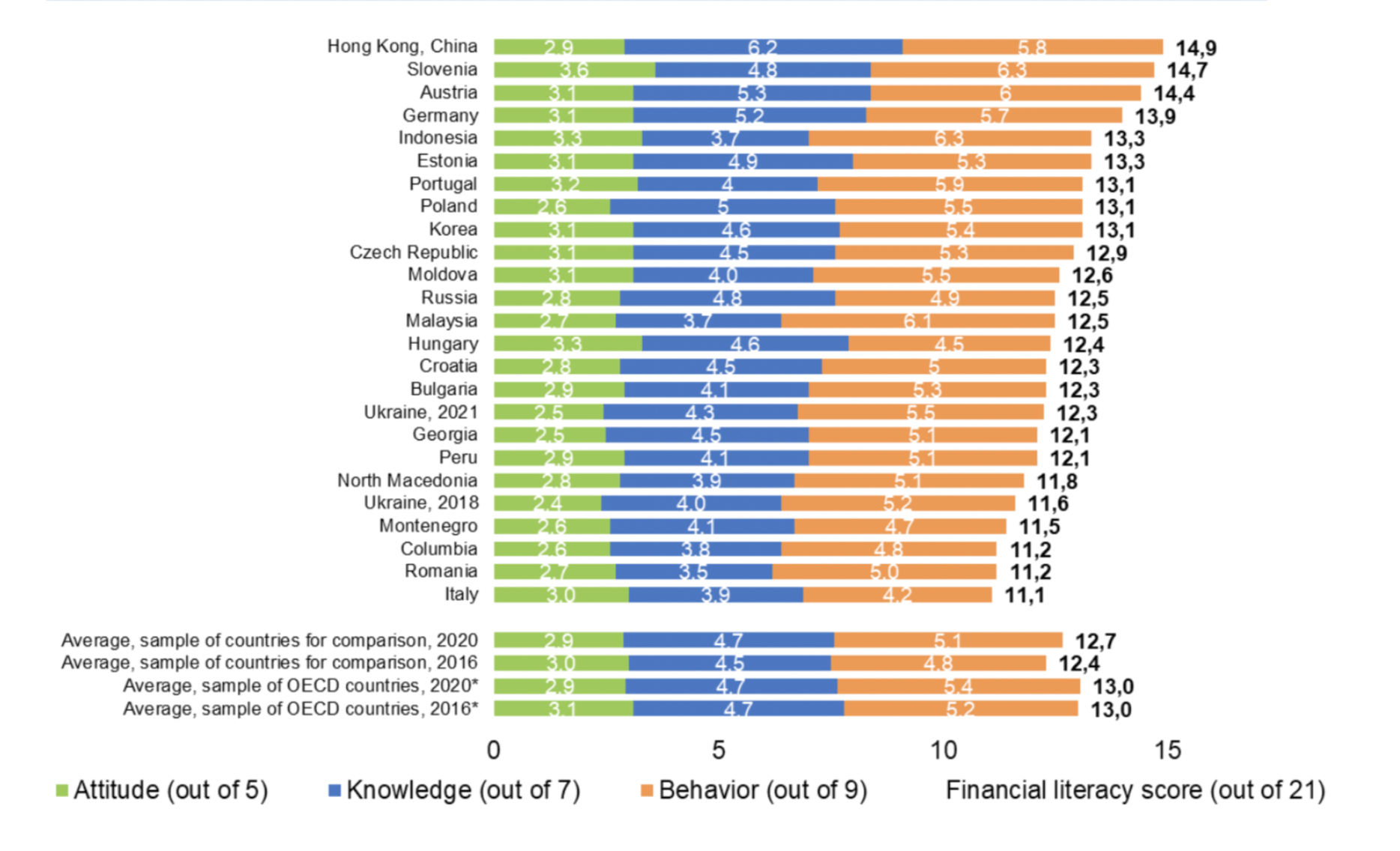

Another important factor that influences the development is a relatively low level offinancial literacy, especially in rural areas, underlined in the study conducted in 2021 by NBU. Despite an overall financial literacy score growing by 6% to 12.3 vs 11.6 in 2018, it still has room for improvement. According to the research, Ukrainians focus on short-term plans and spending money rather than saving it. It also brings to our attention a phenomenon of cultural stigma connected to discussing money matters and a visibly low priority among people for long-term financial planning. Financial literacy score of Ukraine (2018 and 2021) in comparison with other countries

Financial literacy score of Ukraine (2018 and 2021) in comparison with other countries

Sounds tough, but despite all of the above mentioned limitations and obstacles, a Fintech ecosystem in Ukraine is far from being stagnant and experiencing steady growth. It currently consists of more than 100 companies at different stages of maturity.

Most Fintechs are in the domain of money transfers and payments. Second place belongs to the technology companies providing infrastructure for financial solutions. Another bigger segment is digital lending.

There are few (and one specifically successful) neobanks that have risen high over the last few years and shaked a ground under the traditional banks. That is just a teaser for now, we will absolutely dig into this soon. Neobanks challenging traditional banks

Neobanks challenging traditional banks

Ukraine has followed the worldwide trend of establishing a fruitful cooperation between Fintech companies and banks, instead of constant competition. This approach benefits all parties: both business and society (through advanced financial inclusion), and the state as a whole.Cryptocurrency is just making its first steps and yet to be fully discovered. One of the most important break-trough was a Binance (World's #1 cryptocurrency platform) opening for the first time in history an account in a Ukrainian bank (IBOX BANK) in 2020. It was done with the assistance of the Ministry of Digital Transformation of Ukraine. The Ministry predicts that by 2024 almost half of Ukrainians will use virtual assets, and the country will be in the TOP-10 crypto countries in the world. Great goal, can’t wait to see what time will bring us! Binance in Ukraine

Binance in Ukraine

Business areas of Ukrainian Fintech are also expanding. They gradually go beyond the financial sector and begin to work in related fields. The business stream of consulting services and analytical systems(U-TECH, HUBBER, Smart Data) has become quite popular over the last few years and even outpaced the popularity of mobile wallets (Payforce, Wallet Factory).Insurtech (Ewa, Sureberry, Spokk) and Regtech (YouControl, Ring) in particular are promising areas for application of innovative technology in the insurance and open public data sector.

Let’s take a look at the traditional bank players. Who are they?

According to Statista business data platform, the leading role currently belongs to the state bank of CB Privatbank that with more than double in total assets (by September 2021) overcame it’s main competitor - Oschadbank. Almost 466 billion hryvnia and 186 billion hryvnia in total assets respectively. CB Privatbank

CB Privatbank

Right after comes the Ukreximbank (130 billion Ukrainian hryvnia).

The leading bank among non-state ones is Raiffeisen bank that had total assets of 88.4 billion Ukrainian hryvnia, and kept the 4th place in the national rating.

Local population historically has high trusttowards the traditional banks and is loyal to the established institutions that they have been using for decades. Nevertheless there are some pain pointsthat can not be ignored anymore and makes more and more Ukrainians to reconsider their bank provider.

One of the biggest issues is lack of transparency in regards to bank fees and commissions. Some banks allow themselves to change rates and conditions even after the contracts are signed. Or omit / make it impossible to find a few important details in the agreement that come up later as an unpleasant surprise. Such speculations bring a lot of frustration and make customers feel insecure and unprotected.

Very slowly banks started to realize the importance of speaking the user's language: for a long time traditional banks surrounded themselves with obscure terms for ordinary people. Attempting to correlate the interaction with real life situations is one of the key components for a user experience where a customer’s interests are considered. For example, when a person wants to open a deposit, the bank must explain to him simply and clearly how much money this person will receive in the end. To gain users' trust one shouldn't disguise : “the amount of XXX excluding taxes”, “the amount without VAT”, but explicitly provide all the details.

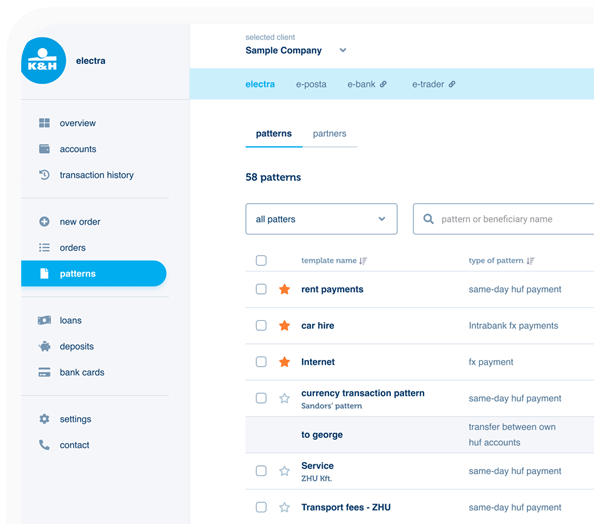

Another thing that makes Ukrainians to turn their heads towards neobanks is theoutdated services of traditional banks. Such procedures as getting online bank access, opening an account are already expected to happen without the necessity of a personal visit to the bank branch. Or usage of virtual payment cards- only very few Ukrainian banks can offer such a service nowadays.

No doubt, the ever-lasting competition between traditional banks and neobanks has its benefits - besides the variety of options, transaction fees in general have been decreasing, while the speed of financial transfers significantly improved.

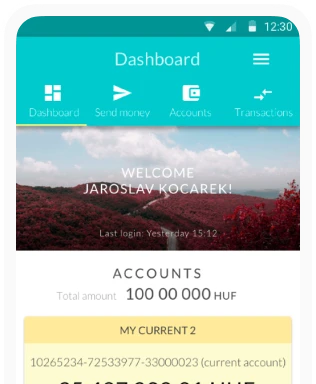

It’s visible that most Ukrainian banks move towards implementation and constant development of internet banking services. Both in the global market and in Ukraine in general, COVID19 had a significant impact on the acceleration of the growth of internet banking. Director of the Financial Stability Department of the NBU - Pervin Dadashova - confirmed that “thequarantine restrictions have had their positive consequences for the transformation of the Ukrainian financial sector. The pace of transferring customers online in a year is equal to that of many years under different conditions.” Pervin Dadashova

Pervin Dadashova

Despite some improvements, traditional banks are still quite far from what neobanks in Ukraine have already achieved.Neobank revolution initiators choose the following strong weapons towards market dominance:

Add to this an ease and speed and you would have a significant competitor to the good old-school warriors.

Naturally, nothing is perfect. The lack of physical branches and personal real life assistance can be an issue if the system/platform goes wrong. Also traditional banks have certain advantages related to risk diversification and betterbalance of the assets and liabilities structure.

Important to know that In Ukraine, at the moment, all neobanks work through cooperation with the existing banks. So far it’s the only viable option, since it would be almost impossible for neobanks to fulfill all official banking requirements.

Today, there are at least seven serious players on the market. Most of them imitate Monobank - mobile-only Ukraine’s first neobank founded in 2017. Monobank

Monobank

If we would need to pick only two important numbers about Monobank, that would be:

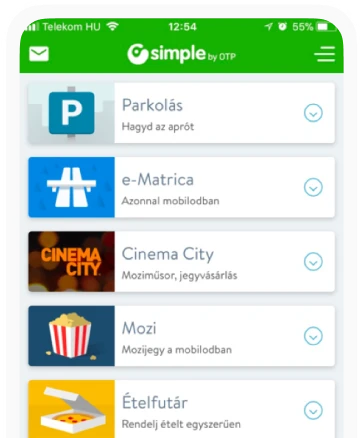

You can make apeer to peer payment, split your restaurant bill and many other useful manipulations in just a one click. Meanwhile there is an opportunity to receive up to 20% cashback on monthly expenses. Also due to its gamification, it has a very strong support among the younger generation.User experience design of vital peer to peer payments is determined by simplicity and convenience. With multiple options to send payments - to the user's email address, phone number or account handle - it gives maximum freedom and speeds up an otherwise long payment procedure. In a nutshell we talk about the ability to transfer money to other people anywhere in the world within seconds and moreover to build financial connections with low costs and no middleman. Izibank

Izibank

Another strong player is Izibank. Established in 2020, it also targets young users. Within a little bit more than a year it reached 100.000 active users in July 2021.

Izibank also provides 1% cashback on all purchases and 2% cashback on cafes, clubs and restaurants every Friday. The users have free money transfers, cash withdrawals and deposits from the City24 ATMs. Bank also helps to set financial goals and motivate users to plan their budgets, Sportbank

Sportbank

Founded in 2019 Sportbank is ideal for sport-lovers: it provides a cashback of up to 10% of monthly expenses on fitness centers and sport equipment.

Currently it has over 300.000 active users.

Sportbank, like other neobanks, allows users to register a credit card online by adding photos of their documents to the app. The bank has only essential financial services: it offers to transfer money, top up a card or mobile phone. Todobank

Todobank

Founded in 2019 Todobank, besides the expected traditional neobank features, focuses on convenient utility payments and offers 1% cashback on them.

Smaller Ukrainian neobank players worth mentioning are Neobank, O.Bank, Vlasny Rakhunok.

In order to learn more on the interconnection between traditional and neobanks in Ukraine, Ergomania addressed The Banking 50 as the largest professional community of financial market participants in Ukraine. The events organised by the Banking 50 are held monthly on the most relevant topics for the national financial market, including direct dialogue between market players, regulators and government members. The banking 50 professional communityIs there enough space for everyone on the market currently?Serhiy Tigipko, owner of 3 neobanks, including Monobank, stated his opinion on it during The Banking 50 ? Ukrainian Banking Forum that recently took place in Kyiv.

The banking 50 professional communityIs there enough space for everyone on the market currently?Serhiy Tigipko, owner of 3 neobanks, including Monobank, stated his opinion on it during The Banking 50 ? Ukrainian Banking Forum that recently took place in Kyiv. Serhiy Tigipko

Serhiy Tigipko

“I still see a place for neobanks, but these are projects with a break-even point of 3 years, actually 3.5-4, with a payback period of 5-6 years. And this is tens of millions of dollars of investment. There is a place on the market, I am sure something new will appear. But 500 thousand active clients with active limits - this will give you a small profit. If you pull it out, it’s great, if you don’t pull it out, bankruptcy will happen and you will have to sell your clients.”Alexander Pisaruk, Head of the Management Board, Raiffeisenbank Ukraine. “Theapocalyptic scenarios for the development of the banking sector, which were much talked about, did not materialize- there is and will be a place for both traditional and neobanks on the market. True, not all traditional banks will remain in the future, just like not all neobanks. In traditional banks, there are two things that inhibit rapid change - outdated technology and mentality. And the second is more difficult to replace than the first.” Alexander Pisaruk

Alexander Pisaruk

It’s important as never that traditional banks make steps towards Fintech, and even if they fail, are openly sharing their experience.

Volodymyr Mudryi, Chairman of the Board of a Ukrainian OTP Bank:“We also had a project in Ukraine, 2-3 years ago we tried to launch our own neobank for entrepreneurs - OTP Evolute. But we made decisions quickly, we calculated the payback period, the amount of investment and realized that this project was untenable and closed it in a year. So we have lessons on which to build our strategy and business model.” Volodymyr Mudryi

Volodymyr Mudryi

Yet what makes Ukraine different in financial aspects from other countries in the region?

One such thing is undoubtedly an integration of Diia (e-governance portal) into the financial field. The Diia app, used by 6 million Ukrainians, is not just a convenient platform to arrange civil matters, but also a successful Fintech solution and a remarkable example of fruitful cooperation between the state and financial service providers. Diia

Diia

As for today, digital documents in Diia are accepted by 3 insurers, 7 bankswhen receiving services in branches and another 4 bankswhen opening an account online. In addition, Diia was successfully integrated into 3 payment systems, 3 mobile operators and 2 internet providers.

One can also useidentification through Diia on online lending services. It also works in the opposite direction - a user can log in to the application through the BankID system, to which 36 Ukrainian banks and 66 commercial subscribers (financial companies, credit organisations and investment projects) are already connected.

It’s a fact that greateradoption of digital service delivery can produce significant economic returns. Yet it’s important to remember that lack of attention to User Experience gaps can hinder the adoption of digital channels by both citizens, businesses, and bureaucrats. If by now user research should be a prerequisite for the design of any services, this is even more true for digital products that have integration with governmental services.

Another concept that reinforces the unique characteristics of the Ukrainian Fintech sector is kiosks. As part of a Payment providers cluster it competes with such classical payment network providers as MasterCard and Visa, and internet payment providers / bill aggregators, such as UAPay.

What makes the kiosk concept special - is that such companies (EasyPayas the most popular with 17.500 terminals nationwide) rely on a network of kiosks that require customers to insert cash and then perform a range of functions including bill payment, purchases, transfers and card top-up. These financial activities are typically performed via the internet in other developed markets. Payment kiosks

Payment kiosks

Who else could have significant power in the financial world of Ukraine? Notably, it is the mobile operators. There are three of them nowadays: Vodafone, KyivStar and LifeCell. And thanks to a sufficient subscriber base, good coverage and solid assets, they have shown interest in entering the financial market and aim to gain the ability to issue e-money to offer or host mobile wallets. How this will work out mostly depends on the governmental regulations.

The next aspect is strongly connected to thelabour emigrationthat has been a prevalent phenomenon in Ukraine since the country's independence in 1991. The number of Ukrainian workers now living abroad is estimated at between 2.2 and 2.7 million, equivalent to 13-16% of total employment in Ukraine.

One of the solutions besides classic Western Union and SWIFT international payments is an account deposit service. The first such service was launched by Industrialbank together with MoneyGram(international money transfer system). From almost anywhere an individual can send a money transfer to Ukraine to a current account or a bank card. The receiver does not need to go to the branch, he just needs to have an account or card that will allow him to receive a money transfer and immediately use his money.

Last but not least is the rapidlygrowing micro-lending tendency. It’s noted that in the first half of 2021 more than 7 million quick loans were issued for a total of 31.6 billion hryvnia, which is 43% more than in the first half of 2020. If in 2016-2017 there were 20-25 active microfinance organisations on the market, now there are about 60, say Moneyveo, a microcredit company that has the largest income in Ukraine this year (1.6 billion). Moneyveo

Moneyveo

What explains such rapid growth? Unfortunately most people in Ukraine live from paycheck to paycheck. Only a small percentage of Ukrainians have money put aside. In case of delayed wages (common for state institutions) and job cuts there are not so many options to improve a difficult situation. If a close circle of friends and family is out of question, credit card or credit could be a solution. But if the credit conditions are unfortunate due to credit history or low income and could make the financial situation even harder, microloans come into the picture.

What is the danger of microloans? A high interest rate. Banks set an annual interest rate for a loan, while microfinance organisations take interest daily. However, as a rule, customers pay attention only to the size of the interest rate, not paying attention to the fact that this interest is calculated every day.

Usually it is 2-3% per day, seemingly almost nothing, especially in comparison with the banking 13-20%. But given that this is a day, not a year, it turns out that the average annual percentage in a microfinance organisation can approach 750%, if an unfortunate borrower gets penalties and fines due to payment delay or wasn’t attentive enough to notice that 2% interest would last only for the first 5 days. One can get into a realdebt hole. Despite all of the facts, it’s flourishing in Ukraine as a short-term comfortable solution.

Market prospects are optimistic and players don’t see any restrictions limiting them to act and bring the bravest ideas to life. The players we took a sneak peek at above believe the Market will decide on new tendencies, while the National Bank of Ukraine will take care of the risks.

Svetlana Chirva, President, Regional Manager of Visa in Ukraine, Moldova and Belarus listed the following tendencies awaiting Ukraine: Svetlana Chirva

Svetlana Chirva

New leaps of development of the biometric identificationare going to take place - prognoses Inga Andreeva, General Director of Mastercard in Ukraine. Confirmation of NFC transactions using TouchID or FaceID, as well as the transition of these solutions to the internet instead of the usual SMS verification message with a password.

Moreover she expects Voice commerce to be a new trend - technology based on artificial intelligence which helps shopping just with your voice and a smart device.

As Kurt Elster, host of the Unofficial Shopify Podcast, said, “The magic of voice shopping is convenience, with the ideal use case being re-orders of consumable goods, especially since smart speakers are often in or near the kitchen. Imagine this: you’re in your kitchen, you take the last of your multivitamin, and say aloud, ‘Alexa, re-order multivitamins,’ and you’re done. They’re on their way to you. That’s literally thefastest, most convenient way possible to purchaseanything. Voice search is here to stay, and we fully expect adoption to steadily increase over time.”

Having expertise in the field of Voice User Experience, Ergomania confirms the incredible speed with which Voice technology has been developing in the last years. Read more about Conversational Design in our blog.

Oleksii Yudin, Head of the National Depository of Ukraine, notes that “in 2022, many companies plan to offer the development of mobile applications for securities transactions, which implies further development of depository services. We are now actively working on API, which will allow clients to build new depository services.” National Depository of Ukraine

National Depository of Ukraine

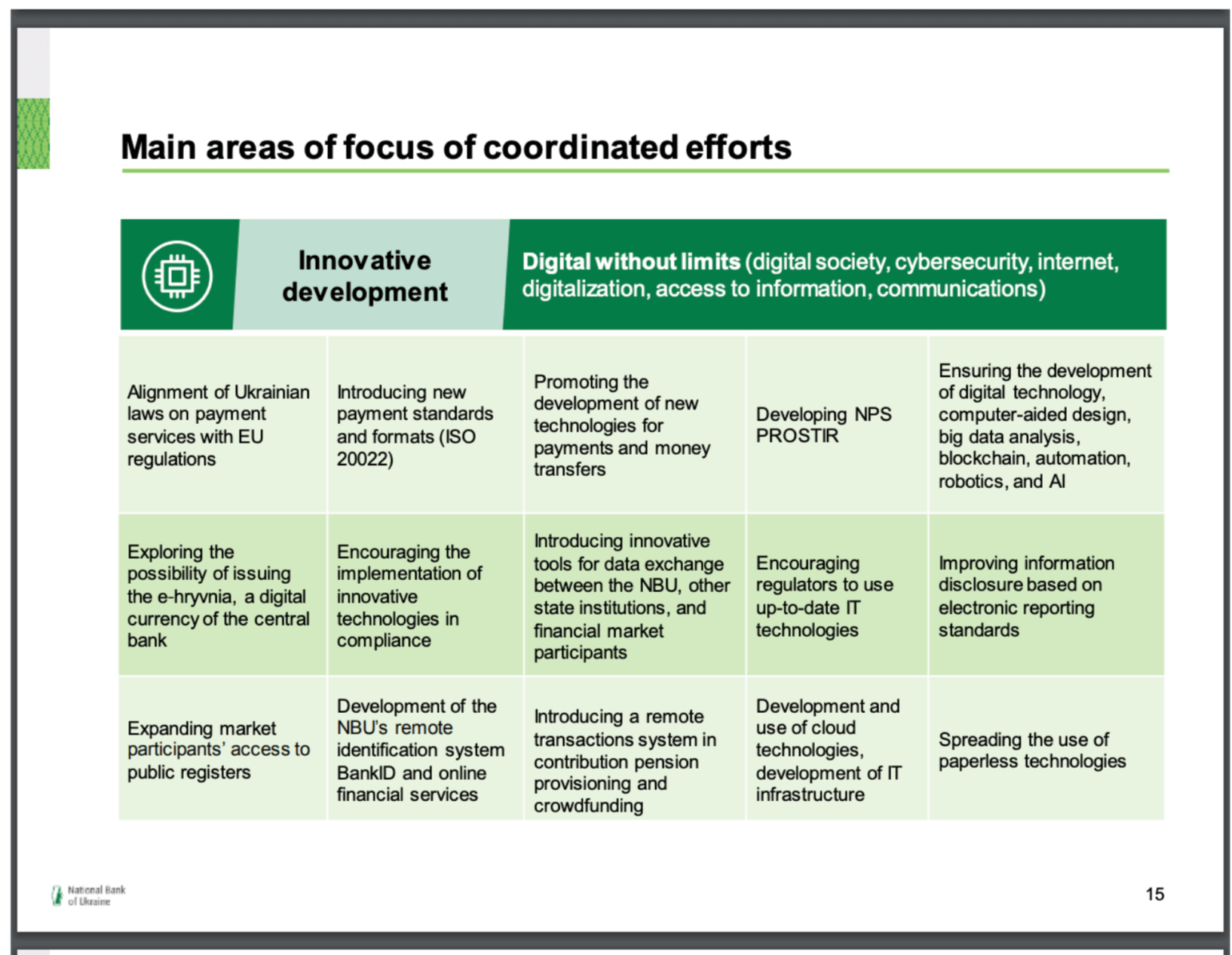

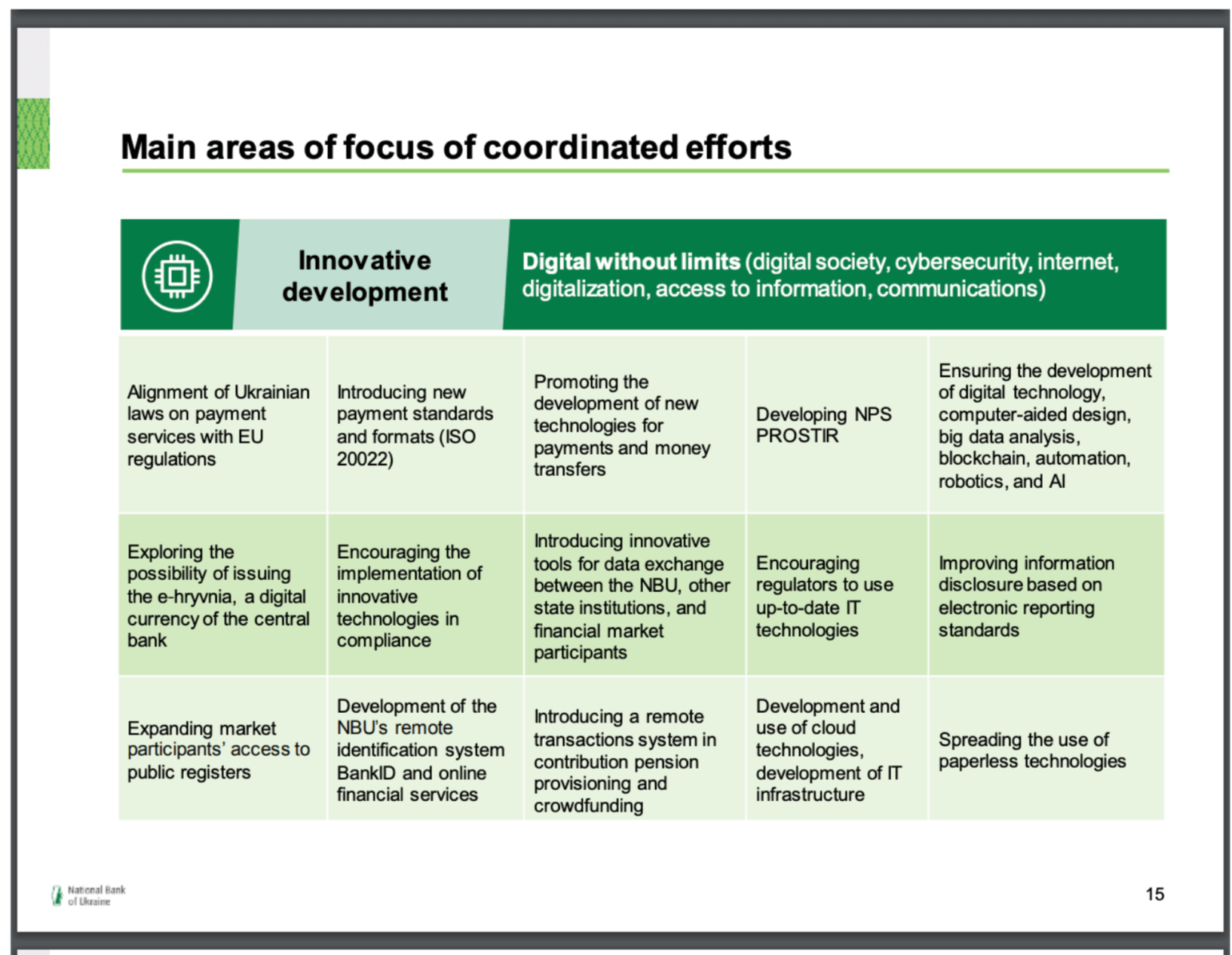

NBU also aims to put maximum efforts into the financial sector digitalisation, paying special attention to legal regulations and payment standards alignment, exploring the opportunity to issue e-hryvniaand introducing a remote transactions system in contribution pension provisioning. A slide of a “Presentation of the Strategy of Ukrainian Financial Sector Development until 2025” in regards of Digital development

A slide of a “Presentation of the Strategy of Ukrainian Financial Sector Development until 2025” in regards of Digital development

New leap of growth is expected for Cryptocurrencies. The Verkhovna Rada adopted the law "On virtual assets" in September 2021. The norms of this Law will begin to work only after amendments are made to the Tax Code of Ukraine, which will regulate taxation procedure for transactions with virtual assets. After that one should expect bothjoint projects of banks and Fintech startups in the field of the crypto industry, as well as their own cryptocurrency products from banks. Transparent market rules will stimulate investment and innovation.Private investment is going to become another development trend. There is practically no market for financial instruments in Ukraine. Only now there is an attempt to form it, so in the upcoming year there will be a demand to ensure simple and safe access for Ukrainians to the world market of financial instruments. Financial instrumentsIT for compliance has recently gained proper attention. Ukrainian banks will continue to test and implement solutions for remote identification and verificationof a client, develop software algorithms for assessing the risk of transactions and clients.

Financial instrumentsIT for compliance has recently gained proper attention. Ukrainian banks will continue to test and implement solutions for remote identification and verificationof a client, develop software algorithms for assessing the risk of transactions and clients.

Next to it a whole boom of services that analyze customer behaviorand give personalized financial advice is expected to happen.

Despite all the existing limitations, the financial scene of Ukraine has a big potential and a rapid development pace. Governmental legislative support, mutually beneficial cooperation of traditional and neobanks, next to openness to new challenges is a solid foundation for a steady growth and fruitful results in future.

The sky is the limit for all the young and not so young Fintech players of Ukraine.

The time has passed when users’ account and payment related problems must have been solved at the bank register window. Knowledge about the audience’s habits, desires and pain pointscan help to create such outstanding user experience solutions that would help Fintech companies to stand out.

Having a low conversion rate for payment by card in the app or on the website? User Experience Research might simply find unwillingness of users to enter credit card data. Give it a thought about the Masterpass or GooglePay / ApplePay solution.

Interested in attracting a young audience to your products? Learn what they use on a daily basis and get in there - integrate money transfers and payments into a chatbotfor Telegram or FB Messenger.

For those having an offline business - it's time to implement QR paymentsso that the user’s camera shoots not only stories on Instagram, but also serves as a tool for paying for goods or services.

Many more great insights an Ergomania team is happy to share to bring products and services to the next level. Having a vast experience in user experience design in the finance fieldmakes us great allies in winning over the market!

Overview of a Ukrainian Fintech ecosystem

Let’s face the truth: Fintech advancement’s pace in Ukraine has been quite moderate, which mostly contributes to outdated regulations on the governmental level,lack of capital and investment, slow acceptance of innovation and low personal incomeamong the population.National Bank of Ukraine (NBU) itself among the current problems of the financial sector names:

- Restrained competition due to a large market share of state-owned banks,

- The need to bring the Nonbank financial Institutions (NFI) markets closer tointernational standards of operation

- Insufficient protection of creditor rights

- Inefficient and underdevelopedinfrastructure of capital markets and organized commodity markets, with low transaction volumes

- Fragmented and underperforming state support for lending to the real economy (including small and medium-sized banks (SMBs))

- Low contribution of NFIsto economic growth.

Another important factor that influences the development is a relatively low level offinancial literacy, especially in rural areas, underlined in the study conducted in 2021 by NBU. Despite an overall financial literacy score growing by 6% to 12.3 vs 11.6 in 2018, it still has room for improvement. According to the research, Ukrainians focus on short-term plans and spending money rather than saving it. It also brings to our attention a phenomenon of cultural stigma connected to discussing money matters and a visibly low priority among people for long-term financial planning.

Financial literacy score of Ukraine (2018 and 2021) in comparison with other countries

Financial literacy score of Ukraine (2018 and 2021) in comparison with other countriesSounds tough, but despite all of the above mentioned limitations and obstacles, a Fintech ecosystem in Ukraine is far from being stagnant and experiencing steady growth. It currently consists of more than 100 companies at different stages of maturity.

Most Fintechs are in the domain of money transfers and payments. Second place belongs to the technology companies providing infrastructure for financial solutions. Another bigger segment is digital lending.

There are few (and one specifically successful) neobanks that have risen high over the last few years and shaked a ground under the traditional banks. That is just a teaser for now, we will absolutely dig into this soon.

Neobanks challenging traditional banks

Neobanks challenging traditional banksUkraine has followed the worldwide trend of establishing a fruitful cooperation between Fintech companies and banks, instead of constant competition. This approach benefits all parties: both business and society (through advanced financial inclusion), and the state as a whole.Cryptocurrency is just making its first steps and yet to be fully discovered. One of the most important break-trough was a Binance (World's #1 cryptocurrency platform) opening for the first time in history an account in a Ukrainian bank (IBOX BANK) in 2020. It was done with the assistance of the Ministry of Digital Transformation of Ukraine. The Ministry predicts that by 2024 almost half of Ukrainians will use virtual assets, and the country will be in the TOP-10 crypto countries in the world. Great goal, can’t wait to see what time will bring us!

Binance in Ukraine

Binance in UkraineBusiness areas of Ukrainian Fintech are also expanding. They gradually go beyond the financial sector and begin to work in related fields. The business stream of consulting services and analytical systems(U-TECH, HUBBER, Smart Data) has become quite popular over the last few years and even outpaced the popularity of mobile wallets (Payforce, Wallet Factory).Insurtech (Ewa, Sureberry, Spokk) and Regtech (YouControl, Ring) in particular are promising areas for application of innovative technology in the insurance and open public data sector.

Traditional banking vs internet banking in Ukraine

Let’s take a look at the traditional bank players. Who are they?

According to Statista business data platform, the leading role currently belongs to the state bank of CB Privatbank that with more than double in total assets (by September 2021) overcame it’s main competitor - Oschadbank. Almost 466 billion hryvnia and 186 billion hryvnia in total assets respectively.

CB Privatbank

CB PrivatbankRight after comes the Ukreximbank (130 billion Ukrainian hryvnia).

The leading bank among non-state ones is Raiffeisen bank that had total assets of 88.4 billion Ukrainian hryvnia, and kept the 4th place in the national rating.

Local population historically has high trusttowards the traditional banks and is loyal to the established institutions that they have been using for decades. Nevertheless there are some pain pointsthat can not be ignored anymore and makes more and more Ukrainians to reconsider their bank provider.

One of the biggest issues is lack of transparency in regards to bank fees and commissions. Some banks allow themselves to change rates and conditions even after the contracts are signed. Or omit / make it impossible to find a few important details in the agreement that come up later as an unpleasant surprise. Such speculations bring a lot of frustration and make customers feel insecure and unprotected.

Very slowly banks started to realize the importance of speaking the user's language: for a long time traditional banks surrounded themselves with obscure terms for ordinary people. Attempting to correlate the interaction with real life situations is one of the key components for a user experience where a customer’s interests are considered. For example, when a person wants to open a deposit, the bank must explain to him simply and clearly how much money this person will receive in the end. To gain users' trust one shouldn't disguise : “the amount of XXX excluding taxes”, “the amount without VAT”, but explicitly provide all the details.

Another thing that makes Ukrainians to turn their heads towards neobanks is theoutdated services of traditional banks. Such procedures as getting online bank access, opening an account are already expected to happen without the necessity of a personal visit to the bank branch. Or usage of virtual payment cards- only very few Ukrainian banks can offer such a service nowadays.

No doubt, the ever-lasting competition between traditional banks and neobanks has its benefits - besides the variety of options, transaction fees in general have been decreasing, while the speed of financial transfers significantly improved.

It’s visible that most Ukrainian banks move towards implementation and constant development of internet banking services. Both in the global market and in Ukraine in general, COVID19 had a significant impact on the acceleration of the growth of internet banking. Director of the Financial Stability Department of the NBU - Pervin Dadashova - confirmed that “thequarantine restrictions have had their positive consequences for the transformation of the Ukrainian financial sector. The pace of transferring customers online in a year is equal to that of many years under different conditions.”

Pervin Dadashova

Pervin DadashovaDespite some improvements, traditional banks are still quite far from what neobanks in Ukraine have already achieved.Neobank revolution initiators choose the following strong weapons towards market dominance:

- high interest rates on deposits

- a simplified way to get loans

- low rates

- new solutions for financial analytics.

Add to this an ease and speed and you would have a significant competitor to the good old-school warriors.

Naturally, nothing is perfect. The lack of physical branches and personal real life assistance can be an issue if the system/platform goes wrong. Also traditional banks have certain advantages related to risk diversification and betterbalance of the assets and liabilities structure.

Important to know that In Ukraine, at the moment, all neobanks work through cooperation with the existing banks. So far it’s the only viable option, since it would be almost impossible for neobanks to fulfill all official banking requirements.

Today, there are at least seven serious players on the market. Most of them imitate Monobank - mobile-only Ukraine’s first neobank founded in 2017.

Monobank

MonobankIf we would need to pick only two important numbers about Monobank, that would be:

- over 4,4 million clients

- valued at over $1 billion.

You can make apeer to peer payment, split your restaurant bill and many other useful manipulations in just a one click. Meanwhile there is an opportunity to receive up to 20% cashback on monthly expenses. Also due to its gamification, it has a very strong support among the younger generation.User experience design of vital peer to peer payments is determined by simplicity and convenience. With multiple options to send payments - to the user's email address, phone number or account handle - it gives maximum freedom and speeds up an otherwise long payment procedure. In a nutshell we talk about the ability to transfer money to other people anywhere in the world within seconds and moreover to build financial connections with low costs and no middleman.

Izibank

IzibankAnother strong player is Izibank. Established in 2020, it also targets young users. Within a little bit more than a year it reached 100.000 active users in July 2021.

Izibank also provides 1% cashback on all purchases and 2% cashback on cafes, clubs and restaurants every Friday. The users have free money transfers, cash withdrawals and deposits from the City24 ATMs. Bank also helps to set financial goals and motivate users to plan their budgets,

Sportbank

SportbankFounded in 2019 Sportbank is ideal for sport-lovers: it provides a cashback of up to 10% of monthly expenses on fitness centers and sport equipment.

Currently it has over 300.000 active users.

Sportbank, like other neobanks, allows users to register a credit card online by adding photos of their documents to the app. The bank has only essential financial services: it offers to transfer money, top up a card or mobile phone.

Todobank

TodobankFounded in 2019 Todobank, besides the expected traditional neobank features, focuses on convenient utility payments and offers 1% cashback on them.

Smaller Ukrainian neobank players worth mentioning are Neobank, O.Bank, Vlasny Rakhunok.

In order to learn more on the interconnection between traditional and neobanks in Ukraine, Ergomania addressed The Banking 50 as the largest professional community of financial market participants in Ukraine. The events organised by the Banking 50 are held monthly on the most relevant topics for the national financial market, including direct dialogue between market players, regulators and government members.

The banking 50 professional community

The banking 50 professional community Serhiy Tigipko

Serhiy Tigipko“I still see a place for neobanks, but these are projects with a break-even point of 3 years, actually 3.5-4, with a payback period of 5-6 years. And this is tens of millions of dollars of investment. There is a place on the market, I am sure something new will appear. But 500 thousand active clients with active limits - this will give you a small profit. If you pull it out, it’s great, if you don’t pull it out, bankruptcy will happen and you will have to sell your clients.”Alexander Pisaruk, Head of the Management Board, Raiffeisenbank Ukraine. “Theapocalyptic scenarios for the development of the banking sector, which were much talked about, did not materialize- there is and will be a place for both traditional and neobanks on the market. True, not all traditional banks will remain in the future, just like not all neobanks. In traditional banks, there are two things that inhibit rapid change - outdated technology and mentality. And the second is more difficult to replace than the first.”

Alexander Pisaruk

Alexander PisarukIt’s important as never that traditional banks make steps towards Fintech, and even if they fail, are openly sharing their experience.

Volodymyr Mudryi, Chairman of the Board of a Ukrainian OTP Bank:“We also had a project in Ukraine, 2-3 years ago we tried to launch our own neobank for entrepreneurs - OTP Evolute. But we made decisions quickly, we calculated the payback period, the amount of investment and realized that this project was untenable and closed it in a year. So we have lessons on which to build our strategy and business model.”

Volodymyr Mudryi

Volodymyr MudryiUnique characteristics of the Ukrainian financial market

Yet what makes Ukraine different in financial aspects from other countries in the region?

One such thing is undoubtedly an integration of Diia (e-governance portal) into the financial field. The Diia app, used by 6 million Ukrainians, is not just a convenient platform to arrange civil matters, but also a successful Fintech solution and a remarkable example of fruitful cooperation between the state and financial service providers.

Diia

DiiaAs for today, digital documents in Diia are accepted by 3 insurers, 7 bankswhen receiving services in branches and another 4 bankswhen opening an account online. In addition, Diia was successfully integrated into 3 payment systems, 3 mobile operators and 2 internet providers.

One can also useidentification through Diia on online lending services. It also works in the opposite direction - a user can log in to the application through the BankID system, to which 36 Ukrainian banks and 66 commercial subscribers (financial companies, credit organisations and investment projects) are already connected.

It’s a fact that greateradoption of digital service delivery can produce significant economic returns. Yet it’s important to remember that lack of attention to User Experience gaps can hinder the adoption of digital channels by both citizens, businesses, and bureaucrats. If by now user research should be a prerequisite for the design of any services, this is even more true for digital products that have integration with governmental services.

Another concept that reinforces the unique characteristics of the Ukrainian Fintech sector is kiosks. As part of a Payment providers cluster it competes with such classical payment network providers as MasterCard and Visa, and internet payment providers / bill aggregators, such as UAPay.

What makes the kiosk concept special - is that such companies (EasyPayas the most popular with 17.500 terminals nationwide) rely on a network of kiosks that require customers to insert cash and then perform a range of functions including bill payment, purchases, transfers and card top-up. These financial activities are typically performed via the internet in other developed markets.

Payment kiosks

Payment kiosksWho else could have significant power in the financial world of Ukraine? Notably, it is the mobile operators. There are three of them nowadays: Vodafone, KyivStar and LifeCell. And thanks to a sufficient subscriber base, good coverage and solid assets, they have shown interest in entering the financial market and aim to gain the ability to issue e-money to offer or host mobile wallets. How this will work out mostly depends on the governmental regulations.

The next aspect is strongly connected to thelabour emigrationthat has been a prevalent phenomenon in Ukraine since the country's independence in 1991. The number of Ukrainian workers now living abroad is estimated at between 2.2 and 2.7 million, equivalent to 13-16% of total employment in Ukraine.

One of the solutions besides classic Western Union and SWIFT international payments is an account deposit service. The first such service was launched by Industrialbank together with MoneyGram(international money transfer system). From almost anywhere an individual can send a money transfer to Ukraine to a current account or a bank card. The receiver does not need to go to the branch, he just needs to have an account or card that will allow him to receive a money transfer and immediately use his money.

Last but not least is the rapidlygrowing micro-lending tendency. It’s noted that in the first half of 2021 more than 7 million quick loans were issued for a total of 31.6 billion hryvnia, which is 43% more than in the first half of 2020. If in 2016-2017 there were 20-25 active microfinance organisations on the market, now there are about 60, say Moneyveo, a microcredit company that has the largest income in Ukraine this year (1.6 billion).

Moneyveo

MoneyveoWhat explains such rapid growth? Unfortunately most people in Ukraine live from paycheck to paycheck. Only a small percentage of Ukrainians have money put aside. In case of delayed wages (common for state institutions) and job cuts there are not so many options to improve a difficult situation. If a close circle of friends and family is out of question, credit card or credit could be a solution. But if the credit conditions are unfortunate due to credit history or low income and could make the financial situation even harder, microloans come into the picture.

What is the danger of microloans? A high interest rate. Banks set an annual interest rate for a loan, while microfinance organisations take interest daily. However, as a rule, customers pay attention only to the size of the interest rate, not paying attention to the fact that this interest is calculated every day.

Usually it is 2-3% per day, seemingly almost nothing, especially in comparison with the banking 13-20%. But given that this is a day, not a year, it turns out that the average annual percentage in a microfinance organisation can approach 750%, if an unfortunate borrower gets penalties and fines due to payment delay or wasn’t attentive enough to notice that 2% interest would last only for the first 5 days. One can get into a realdebt hole. Despite all of the facts, it’s flourishing in Ukraine as a short-term comfortable solution.

New trends on financial market in upcoming future

Market prospects are optimistic and players don’t see any restrictions limiting them to act and bring the bravest ideas to life. The players we took a sneak peek at above believe the Market will decide on new tendencies, while the National Bank of Ukraine will take care of the risks.

Svetlana Chirva, President, Regional Manager of Visa in Ukraine, Moldova and Belarus listed the following tendencies awaiting Ukraine:

- Tap-to-phone

- Real time e-commerce

- “Buy now, pay later”

Svetlana Chirva

Svetlana ChirvaNew leaps of development of the biometric identificationare going to take place - prognoses Inga Andreeva, General Director of Mastercard in Ukraine. Confirmation of NFC transactions using TouchID or FaceID, as well as the transition of these solutions to the internet instead of the usual SMS verification message with a password.

Moreover she expects Voice commerce to be a new trend - technology based on artificial intelligence which helps shopping just with your voice and a smart device.

As Kurt Elster, host of the Unofficial Shopify Podcast, said, “The magic of voice shopping is convenience, with the ideal use case being re-orders of consumable goods, especially since smart speakers are often in or near the kitchen. Imagine this: you’re in your kitchen, you take the last of your multivitamin, and say aloud, ‘Alexa, re-order multivitamins,’ and you’re done. They’re on their way to you. That’s literally thefastest, most convenient way possible to purchaseanything. Voice search is here to stay, and we fully expect adoption to steadily increase over time.”

Having expertise in the field of Voice User Experience, Ergomania confirms the incredible speed with which Voice technology has been developing in the last years. Read more about Conversational Design in our blog.

Oleksii Yudin, Head of the National Depository of Ukraine, notes that “in 2022, many companies plan to offer the development of mobile applications for securities transactions, which implies further development of depository services. We are now actively working on API, which will allow clients to build new depository services.”

National Depository of Ukraine

National Depository of UkraineNBU also aims to put maximum efforts into the financial sector digitalisation, paying special attention to legal regulations and payment standards alignment, exploring the opportunity to issue e-hryvniaand introducing a remote transactions system in contribution pension provisioning.

A slide of a “Presentation of the Strategy of Ukrainian Financial Sector Development until 2025” in regards of Digital development

A slide of a “Presentation of the Strategy of Ukrainian Financial Sector Development until 2025” in regards of Digital developmentNew leap of growth is expected for Cryptocurrencies. The Verkhovna Rada adopted the law "On virtual assets" in September 2021. The norms of this Law will begin to work only after amendments are made to the Tax Code of Ukraine, which will regulate taxation procedure for transactions with virtual assets. After that one should expect bothjoint projects of banks and Fintech startups in the field of the crypto industry, as well as their own cryptocurrency products from banks. Transparent market rules will stimulate investment and innovation.Private investment is going to become another development trend. There is practically no market for financial instruments in Ukraine. Only now there is an attempt to form it, so in the upcoming year there will be a demand to ensure simple and safe access for Ukrainians to the world market of financial instruments.

Financial instruments

Financial instrumentsNext to it a whole boom of services that analyze customer behaviorand give personalized financial advice is expected to happen.

Conclusions

Despite all the existing limitations, the financial scene of Ukraine has a big potential and a rapid development pace. Governmental legislative support, mutually beneficial cooperation of traditional and neobanks, next to openness to new challenges is a solid foundation for a steady growth and fruitful results in future.

The sky is the limit for all the young and not so young Fintech players of Ukraine.

The time has passed when users’ account and payment related problems must have been solved at the bank register window. Knowledge about the audience’s habits, desires and pain pointscan help to create such outstanding user experience solutions that would help Fintech companies to stand out.

Having a low conversion rate for payment by card in the app or on the website? User Experience Research might simply find unwillingness of users to enter credit card data. Give it a thought about the Masterpass or GooglePay / ApplePay solution.

Interested in attracting a young audience to your products? Learn what they use on a daily basis and get in there - integrate money transfers and payments into a chatbotfor Telegram or FB Messenger.

For those having an offline business - it's time to implement QR paymentsso that the user’s camera shoots not only stories on Instagram, but also serves as a tool for paying for goods or services.

Many more great insights an Ergomania team is happy to share to bring products and services to the next level. Having a vast experience in user experience design in the finance fieldmakes us great allies in winning over the market!