Is there a future for banking interfaces? Here's why not.

The title of this blog post may sound a bit strange at first, because it is meant to be “bombastic”. Of course, an experienced reader will know that there will be some twist to make it out that, although there isn’t one, there is one. Well, this time I am bound to disappoint. That is really not my intention.

I’ve had Brett King’s Bank 4.0: Banking Everywhere, Never at the Bank sitting on the edge of my bathtub for a long time. I remember back in 2013 when Stefan Dieffenbacher (head of our UX project at BNP Paribas Fortis in Belgium and conceptual wizard) was waving Bank 2.0 in front of us as the ultimate source of truth. This is how I first heard about Brett King. Then I heard a lot of good things about him, then some bad. Since our company specializes in banking and Fintech, I thought it was only right to read what Brett King thinks is hip in the world of banking. Even though I go to financial conferences non-stop and talk to bankers from IT and business, there are times when you look at a trend and you don’t see it.

The book was published 3 years ago, not now. One of the reasons I was reluctant to read it was that Bank 2.0 did not give me the positive shock I expected. It just gave me an “aha, aha I know this too” feeling with lots and lots of showing off. In contrast, when I picked up Bank 4.0 two days ago, it immediately inspired me with thoughts that I feel are worth sharing.

Brett King talks about the need not to tweak the current financial model, but to radically overhaul it. He also cites Ford’s horses vs. cars parable that perhaps we are getting a little tired of – all the innovation metaphors either come down to this one example or to praising Elon Musk. I think the example is lame because it focuses on one stage. True, Ford did make a leap in transportation by not bringing faster horses. However, if I had to choose between having a car or horses that graze on their own and take me where I want to go while I’m playing cards or just lounging in the carriage, I wouldn’t have hesitated much. I would have asked for the self-driving horses rather than the fast car. Hopefully in our lifetimes we will even have an intersection of the two.

The future of digital banking

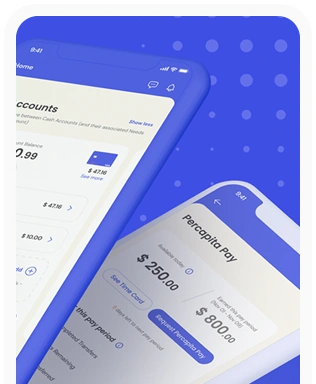

After this long introduction, let’s get down to business. In this context, I pondered how we in Ergomania could innovate banking. What would be the real big step forward? Let us be honest. Revolut is not a quantum leap. It is craftmanship at its best, based on the patterns that have been laid at our feet for ten years. I pulled out a mobile bank design from 2011 that I had designed for a large Central European bank back when I was a revolutionary freelancer. I compared the two transaction stories. Of course, Revolut is much better, nicer, more thoughtful, whatever. There are many differences, but the core idea is the same. There is a series of items in chronological order that you can filter as you like.

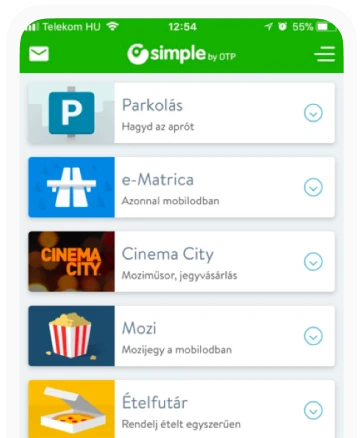

So, the all-encompassing, otherwise improving mobile banks don’t really embody the colossal advance. Perhaps voice control then? Voice control is indeed a bigger leap than just tinkering with existing mobile concepts. But it basically takes what we already know to a new modality for the time being. You can transfer money, just by voice, you can request a transaction history, just by someone reading it to you. That’s an evolution. It is necessary. In fact, I think it’s an inevitable step in the evolution of banking interfaces, but it’s not yet what we should aspire to.

I think the real step forward would be to eliminate the banking platforms. If customers and users didn’t realize they were working with money or who was behind it. That’s good news for banks, or even systems that perform banking functions (e.g. blockchain), but bad news for neo-banks, who for the time being are all about the interface (of course there are good services, I don’t disagree). Why is that? Because banking is not a pleasure. We’ve all seen the marketing photo of the pretty girl in the trendy knitted cap banking on a mountain top in the sunshine on some banking site. But banking is not like that in real life. Banking is a burden. Banking is a necessary evil. Perhaps the only exception to this is investing. But investing is only fun for people who like roulette, lotteries and sports betting.

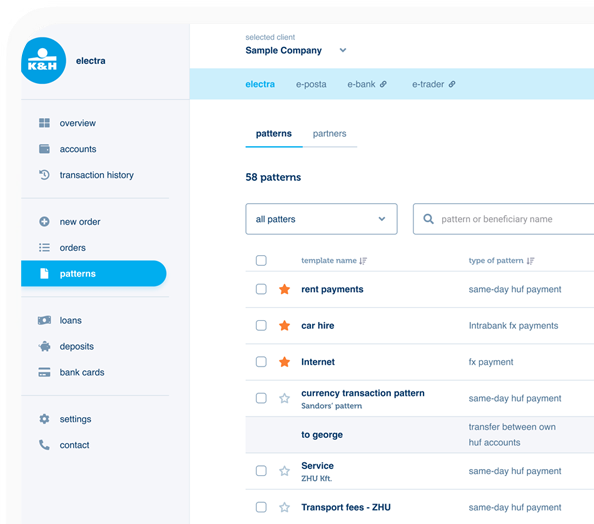

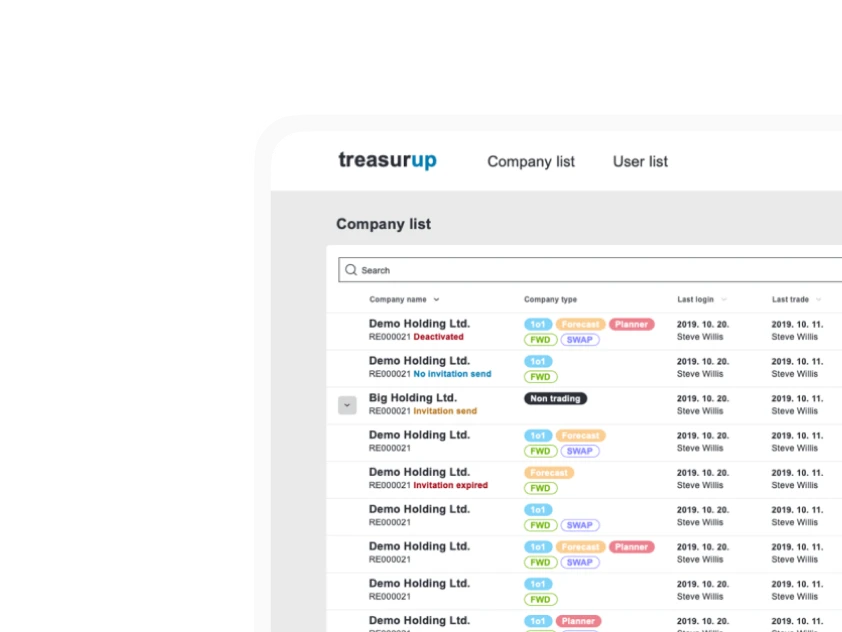

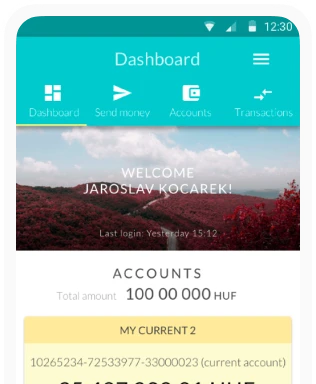

But the question is how can we eliminate interfaces with decades of persistent work and make ourselves partially or completely redundant in banking? Let’s look at a concrete example. As every UX designer knows, if you have to reduce a banking application to the minimum, you are left with four functions. Identification (i.e. login), transfer, balance inquiry and transaction history. The first three would be very difficult to knock out, and the role of the fourth has been kind of cornerstone-like for decades. Particularly given that we know the account history to be the reincarnation, or at least the child, of the account statement.

To innovate radically in a given environment, you first have to admit that if you reduce the number of functions without compromising efficiency and customer experience, you will have achieved results. To get rid of the transactional story, we need to see that the transactional story has not existed forever. And therefore, we need to ask the question, why does the transaction story exist at all?

Let’s stop the transaction history!

First of all, we have to see that the transaction history is still not unique, because we have one or more accounts that have no history. This account is called a cash account. The cash that is in our pockets, in our wallets, in our coat pockets, in our safes, has no history. Of course, there are extreme cases, especially with a lot of cash, where someone keeps a paper trail of its changes, but this is very rare (or you have to be a company to do it) and usually sounds sickening. Which one of us has been writing down for years how the amount of cash in his wallet has changed and by what items? And could we live like that? Did we feel the urge to change that immediately, even if it was on the model of our digital bank account? I doubt it. And of course, we don’t really know of any start-ups working on automatically tracking and logging the cash flow around us, even though it could be theoretically possible.

Of course, there are situations where this would be useful. We can have dilemmas like, why the hell did I spend 140 euros on last night’s party? As if I had money in my jacket pocket, but now I can’t find it. Did I lend my friend 50 or 100 euros last weekend? But none of these things are so overwhelming, regular or important that they make the average person start to manage their spending, which is a huge burden.

The other aspect to consider is why does/can the transaction history exist? What could have created it? If we go through these aspects thoroughly (I’m just trying to illustrate the thinking here), then we do have a chance to reform the function, and I believe, to eliminate it.

The transaction history satisfies two needs. I am looking for one or more transactions, or I want to review my transaction history for some reason.

Looking for a transaction request

Our standard tool for searching transactions is to filter the transaction list in this way. However, the nature and content of these filters are still shaped by tradition rather than by a perfect knowledge of users’ habits. In an average banking project, no more than a dozen interviews are conducted to find out about user habits, and these are also mostly aimed at exploring non-standard functions. To the best of my knowledge, no one has ever done exhaustive research to understand exactly what users are looking for in a transaction history and to categorise these cases, be they 8 or even 670, appropriately and provide exhaustive solutions for each case. And until that happens, we’re left to fiddle with filters or desperately spinning a transaction history in the hope of finding what we’re looking for.

I want to review my transactions claim

The other strong need for a transaction history to exist is the desire to see what has happened to my account. There are several known motivations for this. The main one is the fear of being scammed, but we can also mention the desire to increase awareness (this is partly what PFM, Personal Finance Management, is for). I am sure there are other aspects beyond these, but these are probably the most important.

The transactions that we are most afraid of are those that do not take place immediately on the spot. If I make a transfer now in the internet bank, I am likely to believe that it happened and that I made it. Of course, there are exceptions here too. I may not believe that my transaction has taken place, even though I asked my bank to. The equivalent of this in the cash world is that if I give someone €50, I don’t want to analyse in depth whether the money has gone out of my wallet or whether it has stayed there. I could see with my own eyes that I was handing it over and that was my intention.

However, there are cases where there is more uncertainty. I have entered a standing order, I pay my utility bill automatically, I pay by credit card, etc. There are of course the cash analogies. If I lazily give my moderately reliable friend my wallet to pay for lunch, I might check the contents of my wallet in the toilet to see if he has accidentally taken out a bit more money than he should have. That is, of course, if I remember how much money, or at least what kind of denominations, were in it.

But there must be more effective ways to deal with fear than scrolling through the transaction list and wondering if I saw a transaction and if I did, if it was the right amount. Or, in parallel, can I ponder whether the transactions I have made elsewhere or at another time are really there?

So what about the other functions?

As we can go through the process of eliminating the transaction history, we can also bring out the other features to make them imperceptible little by little. Do we need a split bill if the system knows our habits? Probably not. The system can learn from my behaviour that if I am with a friend, I will invite him or her, he or she will invite me, or I will split the bill, or I will do this with some friends and that with others. It can all be learned. If I were an aristocrat and had a lackey who was always with me, he would certainly learn to handle it. He wouldn’t always be asking me what to do. And, if a lackey can learn to do that, so can the AI one day. It’s easier than arguing about Kant and Heidegger.

Where to go next on the UX revolution

What is the solution? Should the nearly 10-year-old No UI movement be revived, inspired by Brett King? Even I don’t see that immediately, but if we understand the context, we can move forward. If I had an assistant to review the transaction history for me and I trusted him, I wouldn’t have to look at these. If, God forbid, that assistant was a robot, then I wouldn’t need the transaction history interface anymore. Of course, AI is not the solution to everything (at least not yet), but if it works well, we don’t need an interface. Of course, you need a UX person at the beginning to understand the user and fine tune the system, but once you have that, you can take your hat and look for a new challenge, or if you’ve run out of challenges, you can go and relax at last.

I dedicate this writing to my parents, from whom I learned that the right solution is the best solution.