Sweden - Crypto and the International Vibe - part 1

Anders Norlin is the genial and well-connected Fintech advisor and former CEO of the Swedish Fintech member organization Findec, and he reports that a Swedish Fintech scene that’s ‘booming like crazy.’ That’s in terms of VC capital deployed, as well as in growth and recruitment, with Stockholm being the hot spot for something like 80% of all businesses. Fintech overall is growing at around 20% year on year, and has been doing so for 20 years in a row, with Anders adding, “Klarna of course takes the lead, but also what's happening with our central bank and the E-Krona project - which is getting close to reality - means that Fintech is high profile.”

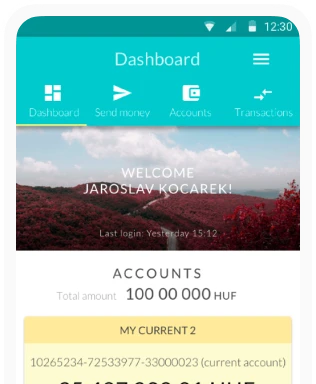

So do the Swedish population at large know what Fintech is? Sure, Anders says that ‘everyone’ uses Swish, the mobile payment system launched in 2012 by six large Swedish banks. With 98% of the adult population having Swish installed on their phones and around 95% using the app on a regular basis, the concept of Fintech is therefore widely understood. As Anders says, “If someone asks, ‘Fintech, what’s Fintech?’ And you answer, well, it’s like Swish… Then they say, ‘Oh, OK, I get it!’ And everyone also knows about Klarna. It's almost impossible not to know about Klarna! Of course, cybersecurity and some areas are quite complex subjects, but if you show people the end applications, then they understand.” Anders Norlin

Anders Norlin

Sweden certainly appears to be one of the Fintech giants in terms of superstar operations such as Klarna, and Tink, which have spread far beyond their native country. So is there a Fintech gene among Swedes, helping them forge ahead into new areas? Anders says that great design and trust are two qualities which have always underpinned the Nordic countries. “Good design is built in. User experience is no mystery to us. UX from day one is always very important. So design in general is very good, and across the whole of the Nordics we share the same legacy of clean and simple design. People expect things to work easily, otherwise they get furious!”Trust is also widespread across the Nordic countries, although Anders points out that sometimes people have perhaps too much trust in their governments: “You have the government here, and then you have tax authority on top of that.” Nevertheless, reporting to the tax authorities, or registering a company online has become streamlined and easy, taking just minutes. That requires faith in the system, and we’ll be returning to these issues of trust, and Fintech regulation later. Anders at the World Fintech Festival

Anders at the World Fintech Festival

There’s another characteristic of Swedes, which has helped the growth of the Fintech scene, according to Anders. “I would say we are very early to adopt new stuff. Just as an example, you had electric scooters popping up in California, and then you had VOI picking that up and launching the idea here, super fast. We're very keen to check in on new stuff and grasp it, and move fast.” An international, outgoing mindset is also important for Swedish companies, and “Even if you build a Fintech in Sweden, you can export it, because somehow it's built into our thinking that it should be International.”

From the Swedish point of view, Anders says - slightly apologetically - that Norway and Finland tend to be treated as test markets for new products and services, before expansion to the UK, Germany, or further afield. Interestingly he points to two other countries with a similar built-in international mentality: Estonia and Iceland, where the local market is so small that Fintechs simply haveto be built to operate in other territories.

Sweden has ‘The international vibe’, by which Anders means that around a third of the population is first, second or third generation immigrants. “And if you check the employees of Fintechs here, even in founder teams, okay, they’re Swedes, but from day one they’re focussed internationally - more or less everything is in English, and internally many speak English. Their websites are in English, and it’s been like that for a long time.”

So we have internationalism, a nation of early-adopters, insistence on user-friendly design, and a high degree of public trust in the mechanism of government. What’s not to like?

Erika then moved on to working with Evli, the Finnish investment bank, before joining the Norwegian financial services company Lindorff (now Intrum), as she wanted to learn more about the credit side. However new ideas and areas were calling her, and in 2015 she was feeling the pull of the Fintech sector. “I didn't want to be someone that protects old business models, I wanted to be a part of a challenge,” Erika explains about her need for change. “I was raised in the traditional finance sector, but I don't think that you have to be for or against. We need to work together.”

However an important moment came when she was being potentially headhunted for one of the top investment banking firms in Sweden. This involved being given an impressive lunch, in an equally impressive office. At the time, Erika recalls thinking, ‘But this is not what customers want to pay for. As a customer I don't want to pay for expensive lunches from my banking partner. I would rather have good services and good products, and pay lower fees. Then I can buy expensive dinners myself and have them with my friends, rather than with a banking person!’ Needless to say, Erika didn’t follow up that particular job prospect. Erika Eliasson

Erika Eliasson

She did however come into contact with the founders of Lendify, a P2P platform founded in 2014, that grew into a challenger bank, ‘Catering to Swedish households with high credit ratings who often already have loans from one of the traditional banks, but can and want to get better terms. Lendify’s goal is to give borrowers fair conditions with lower interest rates, and savers higher returns.’

In 2021 Lendify was acquired by Lunar Bank, for over SEK 1 billion. “Being a part of the team that built Lendify was extremely interesting, challenging and fun,” Erika says.

By the time she left Lendify in April 2021 she’d risen to become Deputy CEO. During the same period her Fintech profile was greatly expanded, as she became a Board Member of the Swedish FinTech Association in February 2019, and now Chairwoman since 2020. She’s also Chairwoman of the Wellstreet Fintech Board, and Senior Advisor with Kreab Worldwide, - a well known public relations and public affairs firm. Erika also holds down a place on the Board of Kameo Sweden - a digital marketplace for crowdfunded loans in real estate - as well as being on the Board of Advisors for Realtid. Oh, and then there’s the small matter of her ‘day job’ as CEO of Goobit. It’s a case of right place, right time: “What’s happening in the Fintech space now is a lot of crypto and blockchain. So I think in Fintech terms this is the most interesting space to be in right now.”

Erika says that there’s much debate in the Swedish media about the pros and cons of blockchain and crypto, but summarizes, “It's here and it's here to stay. I think it's wrong to focus on whether it's good or bad. We need to do the absolute best with it. And we need to work with the establishment, so they know the business models. The blockchain and crypto companies also need to understand how the financial industry operates, so we can work together with it.”

From this point of view she welcomes increased regulation, if it’s the right regulation. She cites the new European-wide MiCA (Markets in Crypto Assets) proposed framework as being an example of the way forward. MiCA includes the aim of ensuring that, ‘The EU embraces the digital revolution and drives it with innovative European firms in the lead, making the benefits of digital finance available to European consumers and businesses.’ Erika stresses the importance of decision makers understanding digital business models, but also points out how the crypto industry has a responsibility to explain, educate, and address the challenges. One of those challenges comes directly from the background that Erika originally came from - banking. “It’s difficult to challenge the banks in an infrastructure built and controlled by them. That’s why we need to educate the regulators.” Swapping to her Chairwoman hat and speaking for the Swedish FinTech Association, she reports that 68% of members think that the understanding of new business models from decision makers and authorities is too low.

The Association has good dialogue with the Swedish Financial Supervisory Authority but at the same time the FSA in some ways lacks the brief to encourage innovation, as compared to the UK where that is a clear part of the mission. On the upside, there’s the ongoing E-Krona project, spearheaded by the Swedish Central Bank. It’s still in development, but Erika sees it as a good sign that the authorities are taking a positive lead, and that in time the infrastructure will become more open to different actors. As to the longterm effects of that initiative - it’s as yet too early to predict. Specifically on the crypto and blockchain front however, the CEO of Goobit speaks of the long and deep experience the firm has in the crypto area. Founded by Christian Ander, now Chairman of the Goobit Board and majority owner, Goobit has been in the crypto space for over 10 years, and Erika says that in that time crypto has become ever more mainstream. There are currently around 200,000 Goobit customers in Sweden, but when I ask if the company has its eye on expansion into other markets, Erika refers to her recently published forward to the company’s Q2 report: Goobit is currently taking a strategic step back to reassess the home market and evaluate, ‘What are we doing? How can we do that in more cost effective, efficient ways, and how can we improve the product for our customers?’ Goobit Group

Goobit Group

I’m reminded of Erika’s story of being given lunch by her prospective employers, only to question if that was an appropriate way of spending customers’ money. Of Goobit, Erika says, “We’ve been around for a long time, we have high knowledge of crypto and blockchain, and we will continue from there. Of course the market evolves, and we will evolve with it.”

So evolution, not revolution?

It’s also been a case of evolution for the ‘ever curious’ Anders Norlin (as he describes himself on LinkedIn), and Findec, which started up in 2019, gaining early partnership support from Nordea and PwC. There are now close to 200 member companies, “But the members are all Fintechs, period.” However, incumbent banks and other partners can have access to the ecosystem. Of the current membership, about 20 companies are international Fintechs with a Swedish presence, Revolut being one prominent example. Although no longer actively involved in the Association, Anders sees Findec primarily as a bridge between Fintechs, as well as a connector to relevant organisations, both national and international. “Findec’s aim is to improve the flow of information across the ecosystem,” he says. That includes an accelerator program called ‘The Bonfire’, run jointly with PwC and now heading for its third year, to encourage and support startups within Fintech and InsureTech. Anders Norlin at a FinBar Estonia meeting

Anders Norlin at a FinBar Estonia meeting

I mention something I picked up from interviews in Denmark and Bulgaria and wonder about the gender balance in Swedish Fintech. It’s something that the industry is aware of, and Anders says that while he is tracking all the female founders, as yet there are clearly way too few. In fact only 6%-7% of all Swedish Fintechs have female founders or co-founders. One way to contribute to a better solution is to identify and highlight women who are role models as future leaders, and while the gender balance of the total number of employees, and within management positions, is improving, there’s still a way to go when it comes to female Fintech founders. But is a change in awareness coming? Yes, says Anders, definitely.

The question of gender balance is also one which naturally I’m interested in hearing about from Erika Eliasson, who must be exactly the sort of role model that Anders is talking about. Perhaps surprisingly she sees the more traditional organizations as being more advanced in enabling women to break through the ‘glass ceiling’: “I've been working quite a long time in the financial industry. And they're more aware of the challenges and the problems in big companies. They have time to put more effort into those types of questions. A lot of Fintechs are a group of friends starting a company, and then they recruit others around them.” So it’s perhaps immediate (male) friends and acquaintances who get recruited, rather than necessarily the best candidates for a job, irrespective of gender? Because of the need for speed when you're building a company you need to recruit fast and so you look to your own network.

“I'm impressed by people starting companies,” says Erika. “And that's what more women need to do. We need to own more - investing and starting companies - because if you are on the owner side, you can make the decisions.” You can check out a seminar hosted by the Polish Embassy in Sweden titled ‘Women in Fintech’ from May 2021 which features Erika in a panel discussion. Swedish FinTech Association

Swedish FinTech Association

In her role as Chairwoman of the Swedish FinTech Association Erika points out that the Secretary General, Louise Grabo has also made her mark in the organization. While Erika to some extent is a figurehead of the Association, Louise does the day-to-day ‘heavy lifting’ and takes part in the ongoing debate about Swedish Fintech. So in terms of gender balance, at least the FinTech Association is heading the right way, even if companies in general still have a long way to go.

Anders Norlin says, “We know that there's a pool of female founders who are happy to contribute with their networks, and give a hand to others. It’s helping eliminate potential resistance to moving into Fintechs, which for sure are male dominated. It’s not super bad male dominated, but it's far from being acceptable. So we need to continue the work of gradually lowering the barriers to more women being in Fintech, and being leaders of Fintechs.”

Incidentally, the question of correcting the gender balance in the financial arena actually goes back quite some way, with the venerable Stockholms Enskilda Bank (SEB) claiming to be the first to employ women… way back in 1857.

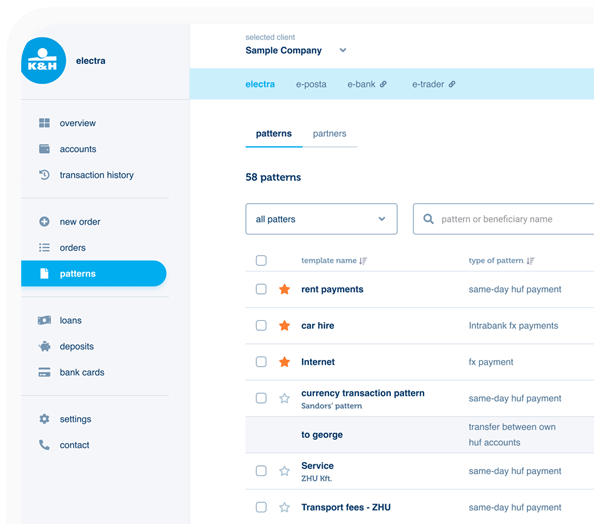

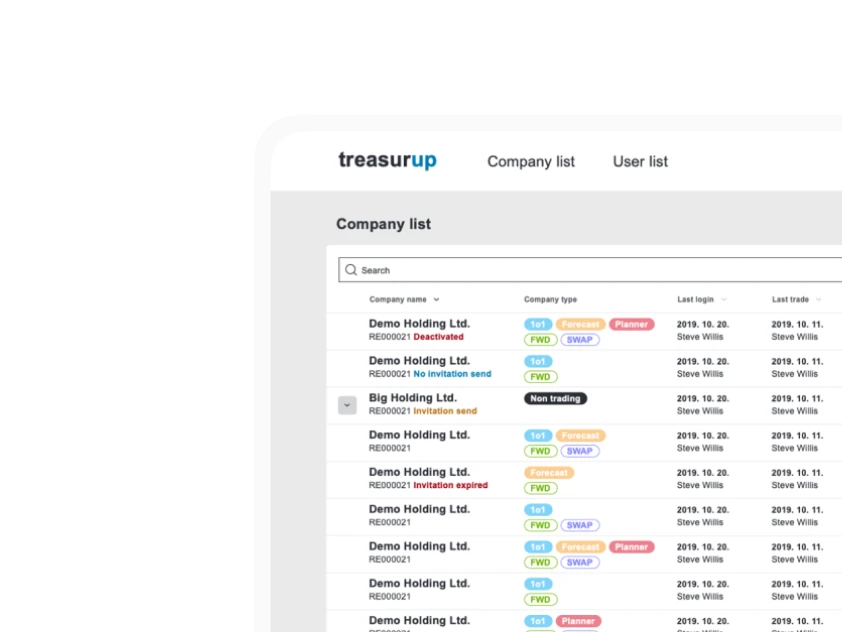

Turning to another common theme of many pan-European interviews, the subject of UX-UI design, I’m interested in Anders’ comments about good design being inbuilt in the Nordic countries. Using a very British expression, he says that the philosophy is to always have ‘Easy-Peasy’ - or if you prefer, frictionless operation. “Check out Klarna - smooth payment is completely part of the offering. In other cases, especially in the US, it can still be quite complex. The result is probably the same, but the user experience here (in Sweden) is muchbetter. And it's built in as a core business model that the user experience is not only for the end consumer, but also how you engage, how you implement, and how you install an app.” He points to the original success of Ericsson mobile phones which while the products fulfilled a need, at the same time were ‘a nightmare to use.’ Ericsson was a premier-league Swedish company, however at that time with poor end user experience, being a b2b-player. As soon as the Finnish company Nokia appeared in the market with much better UX and easier to use products, Swedish consumers rapidly deserted their own national brand in favor of practicality. And then the iPhone entered the market, and the next fast change occurred, again in favor for even better UX.

Because of her various roles and positions, Erika Eliasson is wary about suggesting noteworthy new Fintechs, but Anders Norlin is more willing to throw a few names my way. He starts with Juni, founded in Gothenburg in 2020 and positioned as ‘the financial companion for ecommerce entrepreneurs’. Juni reached Series A funding very quickly from inception, a good example of the record VC funding levels of 2021.

Another Gothenburg Fintech, Minna Technologies, came through an ING accelerator program in 2019, and is already reaching out at a European level. Minna is aiming to be ‘the World's leading subscription management solution, integrated with retail banks.’ To date those banks include ING, Danske Bank, Swedbank and SpareBank. tinkTink, as previously mentioned by Anders, barely needs introduction, with its Open Banking platform connecting in excess of 3,400 European banks and financial institutions. The growth has been little short of spectacular, from a standing start in 2012 to the current claim that Tink ‘powers the new world of finance.’ A Swedish mega-success story if ever there was one, and June 2021 saw the announcement of VISA acquiring Tink for €2 billion: another US giant acquiring a Swedish Fintech success (PayPal acquired iZettle - now Zettle - in 2018).

tinkTink, as previously mentioned by Anders, barely needs introduction, with its Open Banking platform connecting in excess of 3,400 European banks and financial institutions. The growth has been little short of spectacular, from a standing start in 2012 to the current claim that Tink ‘powers the new world of finance.’ A Swedish mega-success story if ever there was one, and June 2021 saw the announcement of VISA acquiring Tink for €2 billion: another US giant acquiring a Swedish Fintech success (PayPal acquired iZettle - now Zettle - in 2018).

A brand that Anders points to as a great Swedish success story is Spotify, founded back in 2006. Being a music streaming service it’s clearly not a Fintech, and yet Anders says the way the company raised money, and expanded rapidly using world class UX, has contributed many lessons to Fintechs which have followed. One key message comes from the sense of confidence that it’s possible to start in Sweden and then quickly ‘Go Global’, a pattern Klarna followed.Bambora is another eye-catcher as far as Anders is concerned, working in the secure retail payments space, with a rapidly developing global footprint following acquisition by Ingenico - itself now part of Worldline. - Wheels within wheels, and success on top of success!

As for Anders’ own business activities, he is partner and co-founder of the Coach and Capital VC fund, established in 2008 with 13 investments made in the portfolio, mainly in ICT and CleanTech startups. Coach & Capital

Coach & Capital

His final tip of an ‘area to watch’ is Green Fintech, which is working to accelerate green finance and investments, provide tools for improving companies’ sustainability work (ESG), and change consumer behavior through Fintech solutions and innovation. He adds that as we were discussing female representation in Fintech, this area has more female founders, such as Cecilia Repinski, with her startup Green Assets Wallet. Swedish Fintechs to watch in the Green Fintech area are Doconomy, Worldfavor, and Normative – all growing superfast with international attention.

So it sounds like there’s a lot happening, and that, to return to Anders’ original observation of a ‘booming’ Fintech scene, there is much to look forward to. “I am fortunate to work with some of the Fintechs that have top notch knowledge and insights. And that's the core of the growing Fintech industry - to have great entrepreneurs paving the way as role models for others to follow.”

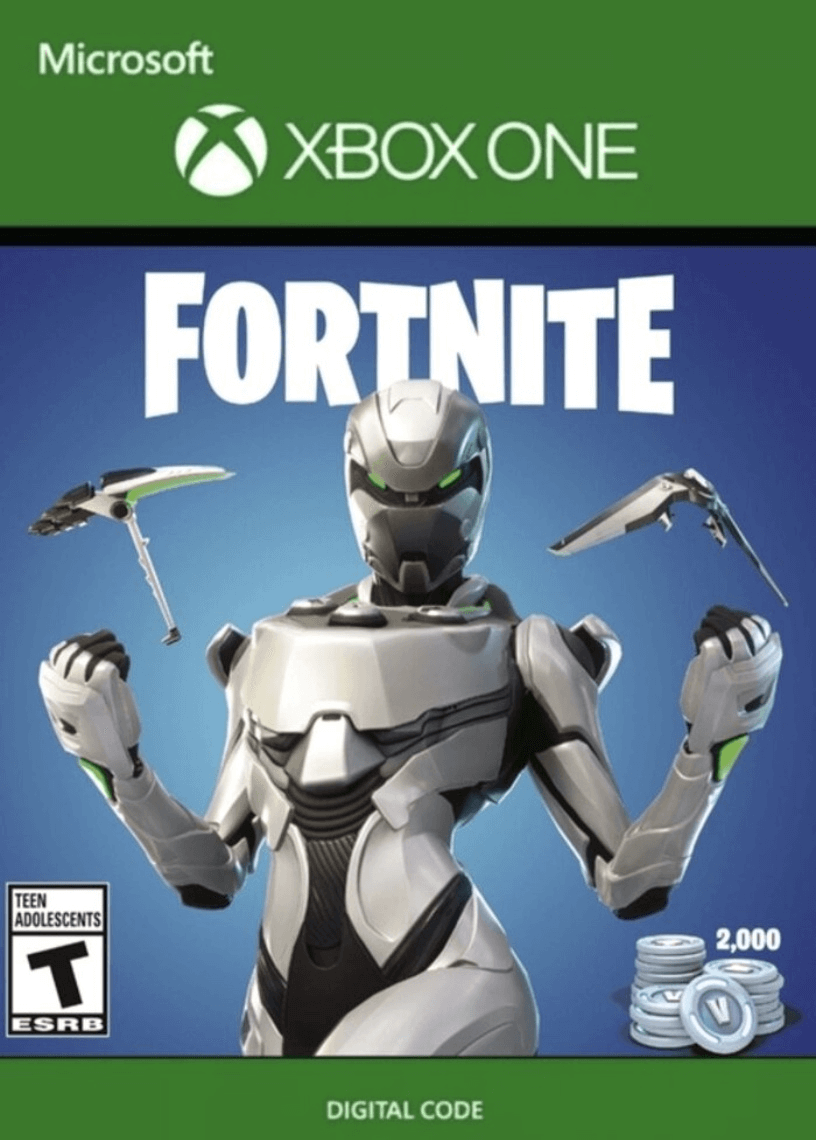

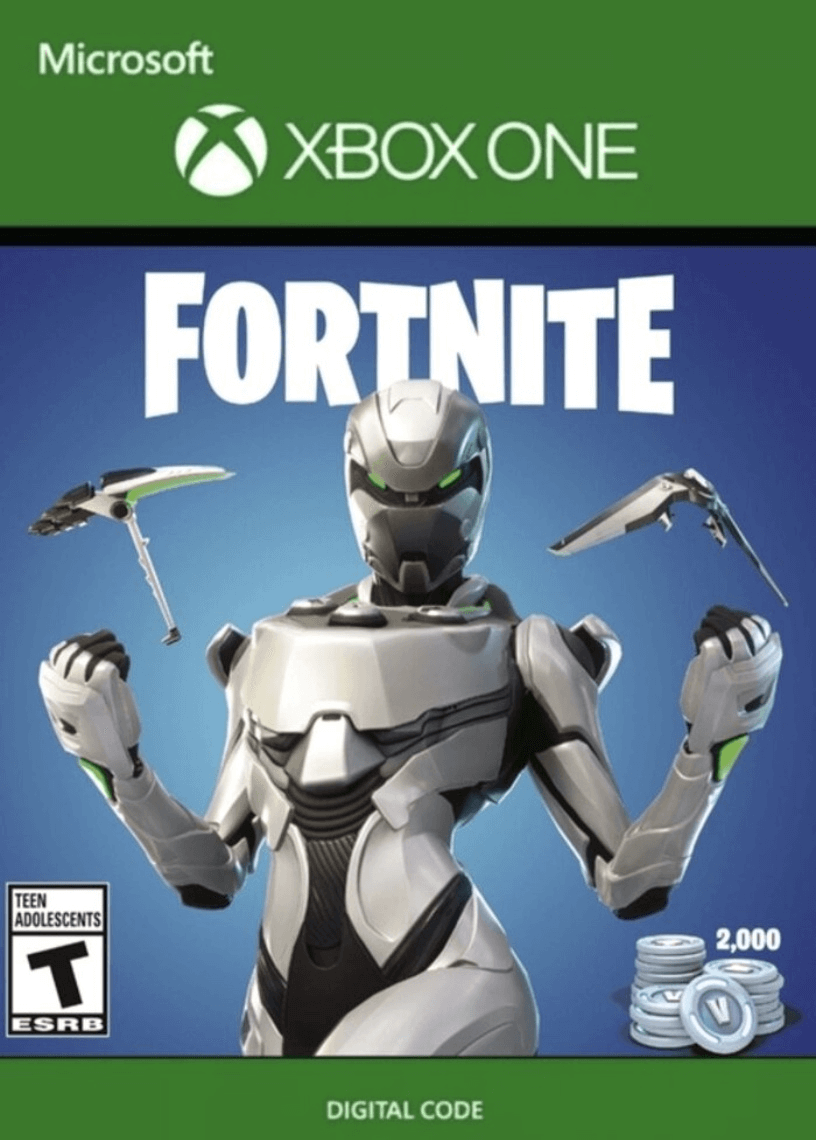

And a summary from Erika Eliasson at Goobit? “The key message is that we need to work together: the Fintech sector, the established banks, the authorities, and the decision makers. Crypto is here, so we don't need to argue if it's bad or good or bad, we just need to find a way to regulate, and work together, because it can be used by society in a really good way. I also think it can be a problem that the banks control the infrastructure, so it’s important to look into that if we want to have a thriving Fintech sector going forward. So yes, I'm optimistic - otherwise I wouldn't be in this space. It's challenging, but I'm optimistic.” A Fortnite skin - yours for just 2,000 V-Bucks

A Fortnite skin - yours for just 2,000 V-Bucks

And as a final word from me,I have to thank Erika for a little bit of extra education right at the end of our conversation. You may be much more up to speed about the world of online gaming than I am. Indeed, it would be hard not to be more up to speed than I am. As we’re chatting, I ask Erika if any of her children understand what her work involves, and she says that her son does have an appreciation of - in effect - the cryptoworld. It seems that he doesn’t desire actualclothes, of the sort we wear, but virtual suits for the characters in the games he plays, such as Fortnite. This requires trading using V-bucks, a virtual currency exchangeable for electronic garments, or skins.As Erika says, “This new generation growing up are more into digital assets. And I think that's where the crypto industry will grow as well, because digital assets will become more and more important in society. My son prefers digital clothes instead of real clothes, and I think that says quite a lot.”

It does indeed.

Or as Anders Norlin observes, Sweden seems to be a nation of early-adopters… with that International Vibe.

So do the Swedish population at large know what Fintech is? Sure, Anders says that ‘everyone’ uses Swish, the mobile payment system launched in 2012 by six large Swedish banks. With 98% of the adult population having Swish installed on their phones and around 95% using the app on a regular basis, the concept of Fintech is therefore widely understood. As Anders says, “If someone asks, ‘Fintech, what’s Fintech?’ And you answer, well, it’s like Swish… Then they say, ‘Oh, OK, I get it!’ And everyone also knows about Klarna. It's almost impossible not to know about Klarna! Of course, cybersecurity and some areas are quite complex subjects, but if you show people the end applications, then they understand.”

Anders Norlin

Anders NorlinSweden certainly appears to be one of the Fintech giants in terms of superstar operations such as Klarna, and Tink, which have spread far beyond their native country. So is there a Fintech gene among Swedes, helping them forge ahead into new areas? Anders says that great design and trust are two qualities which have always underpinned the Nordic countries. “Good design is built in. User experience is no mystery to us. UX from day one is always very important. So design in general is very good, and across the whole of the Nordics we share the same legacy of clean and simple design. People expect things to work easily, otherwise they get furious!”Trust is also widespread across the Nordic countries, although Anders points out that sometimes people have perhaps too much trust in their governments: “You have the government here, and then you have tax authority on top of that.” Nevertheless, reporting to the tax authorities, or registering a company online has become streamlined and easy, taking just minutes. That requires faith in the system, and we’ll be returning to these issues of trust, and Fintech regulation later.

Anders at the World Fintech Festival

Anders at the World Fintech FestivalThe early adopters

There’s another characteristic of Swedes, which has helped the growth of the Fintech scene, according to Anders. “I would say we are very early to adopt new stuff. Just as an example, you had electric scooters popping up in California, and then you had VOI picking that up and launching the idea here, super fast. We're very keen to check in on new stuff and grasp it, and move fast.” An international, outgoing mindset is also important for Swedish companies, and “Even if you build a Fintech in Sweden, you can export it, because somehow it's built into our thinking that it should be International.”

From the Swedish point of view, Anders says - slightly apologetically - that Norway and Finland tend to be treated as test markets for new products and services, before expansion to the UK, Germany, or further afield. Interestingly he points to two other countries with a similar built-in international mentality: Estonia and Iceland, where the local market is so small that Fintechs simply haveto be built to operate in other territories.

Sweden has ‘The international vibe’, by which Anders means that around a third of the population is first, second or third generation immigrants. “And if you check the employees of Fintechs here, even in founder teams, okay, they’re Swedes, but from day one they’re focussed internationally - more or less everything is in English, and internally many speak English. Their websites are in English, and it’s been like that for a long time.”

So we have internationalism, a nation of early-adopters, insistence on user-friendly design, and a high degree of public trust in the mechanism of government. What’s not to like?

The pull of Fintech

Erika Eliasson, the CEO of blockchain and crypto firm Goobit from November 2021 onwards, came originally from a traditional financial background, starting off at Erik Penser Bank (a privately owned bank with high net worth customers).Erika then moved on to working with Evli, the Finnish investment bank, before joining the Norwegian financial services company Lindorff (now Intrum), as she wanted to learn more about the credit side. However new ideas and areas were calling her, and in 2015 she was feeling the pull of the Fintech sector. “I didn't want to be someone that protects old business models, I wanted to be a part of a challenge,” Erika explains about her need for change. “I was raised in the traditional finance sector, but I don't think that you have to be for or against. We need to work together.”

However an important moment came when she was being potentially headhunted for one of the top investment banking firms in Sweden. This involved being given an impressive lunch, in an equally impressive office. At the time, Erika recalls thinking, ‘But this is not what customers want to pay for. As a customer I don't want to pay for expensive lunches from my banking partner. I would rather have good services and good products, and pay lower fees. Then I can buy expensive dinners myself and have them with my friends, rather than with a banking person!’ Needless to say, Erika didn’t follow up that particular job prospect.

Erika Eliasson

Erika EliassonRight place, right time

She did however come into contact with the founders of Lendify, a P2P platform founded in 2014, that grew into a challenger bank, ‘Catering to Swedish households with high credit ratings who often already have loans from one of the traditional banks, but can and want to get better terms. Lendify’s goal is to give borrowers fair conditions with lower interest rates, and savers higher returns.’

In 2021 Lendify was acquired by Lunar Bank, for over SEK 1 billion. “Being a part of the team that built Lendify was extremely interesting, challenging and fun,” Erika says.

By the time she left Lendify in April 2021 she’d risen to become Deputy CEO. During the same period her Fintech profile was greatly expanded, as she became a Board Member of the Swedish FinTech Association in February 2019, and now Chairwoman since 2020. She’s also Chairwoman of the Wellstreet Fintech Board, and Senior Advisor with Kreab Worldwide, - a well known public relations and public affairs firm. Erika also holds down a place on the Board of Kameo Sweden - a digital marketplace for crowdfunded loans in real estate - as well as being on the Board of Advisors for Realtid. Oh, and then there’s the small matter of her ‘day job’ as CEO of Goobit. It’s a case of right place, right time: “What’s happening in the Fintech space now is a lot of crypto and blockchain. So I think in Fintech terms this is the most interesting space to be in right now.”

Crypto and the right regulation

Erika says that there’s much debate in the Swedish media about the pros and cons of blockchain and crypto, but summarizes, “It's here and it's here to stay. I think it's wrong to focus on whether it's good or bad. We need to do the absolute best with it. And we need to work with the establishment, so they know the business models. The blockchain and crypto companies also need to understand how the financial industry operates, so we can work together with it.”

From this point of view she welcomes increased regulation, if it’s the right regulation. She cites the new European-wide MiCA (Markets in Crypto Assets) proposed framework as being an example of the way forward. MiCA includes the aim of ensuring that, ‘The EU embraces the digital revolution and drives it with innovative European firms in the lead, making the benefits of digital finance available to European consumers and businesses.’ Erika stresses the importance of decision makers understanding digital business models, but also points out how the crypto industry has a responsibility to explain, educate, and address the challenges. One of those challenges comes directly from the background that Erika originally came from - banking. “It’s difficult to challenge the banks in an infrastructure built and controlled by them. That’s why we need to educate the regulators.” Swapping to her Chairwoman hat and speaking for the Swedish FinTech Association, she reports that 68% of members think that the understanding of new business models from decision makers and authorities is too low.

The Association has good dialogue with the Swedish Financial Supervisory Authority but at the same time the FSA in some ways lacks the brief to encourage innovation, as compared to the UK where that is a clear part of the mission. On the upside, there’s the ongoing E-Krona project, spearheaded by the Swedish Central Bank. It’s still in development, but Erika sees it as a good sign that the authorities are taking a positive lead, and that in time the infrastructure will become more open to different actors. As to the longterm effects of that initiative - it’s as yet too early to predict. Specifically on the crypto and blockchain front however, the CEO of Goobit speaks of the long and deep experience the firm has in the crypto area. Founded by Christian Ander, now Chairman of the Goobit Board and majority owner, Goobit has been in the crypto space for over 10 years, and Erika says that in that time crypto has become ever more mainstream. There are currently around 200,000 Goobit customers in Sweden, but when I ask if the company has its eye on expansion into other markets, Erika refers to her recently published forward to the company’s Q2 report: Goobit is currently taking a strategic step back to reassess the home market and evaluate, ‘What are we doing? How can we do that in more cost effective, efficient ways, and how can we improve the product for our customers?’

Goobit Group

Goobit GroupI’m reminded of Erika’s story of being given lunch by her prospective employers, only to question if that was an appropriate way of spending customers’ money. Of Goobit, Erika says, “We’ve been around for a long time, we have high knowledge of crypto and blockchain, and we will continue from there. Of course the market evolves, and we will evolve with it.”

So evolution, not revolution?

Evolution and balance

It’s also been a case of evolution for the ‘ever curious’ Anders Norlin (as he describes himself on LinkedIn), and Findec, which started up in 2019, gaining early partnership support from Nordea and PwC. There are now close to 200 member companies, “But the members are all Fintechs, period.” However, incumbent banks and other partners can have access to the ecosystem. Of the current membership, about 20 companies are international Fintechs with a Swedish presence, Revolut being one prominent example. Although no longer actively involved in the Association, Anders sees Findec primarily as a bridge between Fintechs, as well as a connector to relevant organisations, both national and international. “Findec’s aim is to improve the flow of information across the ecosystem,” he says. That includes an accelerator program called ‘The Bonfire’, run jointly with PwC and now heading for its third year, to encourage and support startups within Fintech and InsureTech.

Anders Norlin at a FinBar Estonia meeting

Anders Norlin at a FinBar Estonia meetingI mention something I picked up from interviews in Denmark and Bulgaria and wonder about the gender balance in Swedish Fintech. It’s something that the industry is aware of, and Anders says that while he is tracking all the female founders, as yet there are clearly way too few. In fact only 6%-7% of all Swedish Fintechs have female founders or co-founders. One way to contribute to a better solution is to identify and highlight women who are role models as future leaders, and while the gender balance of the total number of employees, and within management positions, is improving, there’s still a way to go when it comes to female Fintech founders. But is a change in awareness coming? Yes, says Anders, definitely.

The question of gender balance is also one which naturally I’m interested in hearing about from Erika Eliasson, who must be exactly the sort of role model that Anders is talking about. Perhaps surprisingly she sees the more traditional organizations as being more advanced in enabling women to break through the ‘glass ceiling’: “I've been working quite a long time in the financial industry. And they're more aware of the challenges and the problems in big companies. They have time to put more effort into those types of questions. A lot of Fintechs are a group of friends starting a company, and then they recruit others around them.” So it’s perhaps immediate (male) friends and acquaintances who get recruited, rather than necessarily the best candidates for a job, irrespective of gender? Because of the need for speed when you're building a company you need to recruit fast and so you look to your own network.

“I'm impressed by people starting companies,” says Erika. “And that's what more women need to do. We need to own more - investing and starting companies - because if you are on the owner side, you can make the decisions.” You can check out a seminar hosted by the Polish Embassy in Sweden titled ‘Women in Fintech’ from May 2021 which features Erika in a panel discussion.

Swedish FinTech Association

Swedish FinTech AssociationIn her role as Chairwoman of the Swedish FinTech Association Erika points out that the Secretary General, Louise Grabo has also made her mark in the organization. While Erika to some extent is a figurehead of the Association, Louise does the day-to-day ‘heavy lifting’ and takes part in the ongoing debate about Swedish Fintech. So in terms of gender balance, at least the FinTech Association is heading the right way, even if companies in general still have a long way to go.

Anders Norlin says, “We know that there's a pool of female founders who are happy to contribute with their networks, and give a hand to others. It’s helping eliminate potential resistance to moving into Fintechs, which for sure are male dominated. It’s not super bad male dominated, but it's far from being acceptable. So we need to continue the work of gradually lowering the barriers to more women being in Fintech, and being leaders of Fintechs.”

Incidentally, the question of correcting the gender balance in the financial arena actually goes back quite some way, with the venerable Stockholms Enskilda Bank (SEB) claiming to be the first to employ women… way back in 1857.

‘Easy-peasy’

Turning to another common theme of many pan-European interviews, the subject of UX-UI design, I’m interested in Anders’ comments about good design being inbuilt in the Nordic countries. Using a very British expression, he says that the philosophy is to always have ‘Easy-Peasy’ - or if you prefer, frictionless operation. “Check out Klarna - smooth payment is completely part of the offering. In other cases, especially in the US, it can still be quite complex. The result is probably the same, but the user experience here (in Sweden) is muchbetter. And it's built in as a core business model that the user experience is not only for the end consumer, but also how you engage, how you implement, and how you install an app.” He points to the original success of Ericsson mobile phones which while the products fulfilled a need, at the same time were ‘a nightmare to use.’ Ericsson was a premier-league Swedish company, however at that time with poor end user experience, being a b2b-player. As soon as the Finnish company Nokia appeared in the market with much better UX and easier to use products, Swedish consumers rapidly deserted their own national brand in favor of practicality. And then the iPhone entered the market, and the next fast change occurred, again in favor for even better UX.

On the near horizon

Because of her various roles and positions, Erika Eliasson is wary about suggesting noteworthy new Fintechs, but Anders Norlin is more willing to throw a few names my way. He starts with Juni, founded in Gothenburg in 2020 and positioned as ‘the financial companion for ecommerce entrepreneurs’. Juni reached Series A funding very quickly from inception, a good example of the record VC funding levels of 2021.

Another Gothenburg Fintech, Minna Technologies, came through an ING accelerator program in 2019, and is already reaching out at a European level. Minna is aiming to be ‘the World's leading subscription management solution, integrated with retail banks.’ To date those banks include ING, Danske Bank, Swedbank and SpareBank.

tink

tinkA brand that Anders points to as a great Swedish success story is Spotify, founded back in 2006. Being a music streaming service it’s clearly not a Fintech, and yet Anders says the way the company raised money, and expanded rapidly using world class UX, has contributed many lessons to Fintechs which have followed. One key message comes from the sense of confidence that it’s possible to start in Sweden and then quickly ‘Go Global’, a pattern Klarna followed.Bambora is another eye-catcher as far as Anders is concerned, working in the secure retail payments space, with a rapidly developing global footprint following acquisition by Ingenico - itself now part of Worldline. - Wheels within wheels, and success on top of success!

As for Anders’ own business activities, he is partner and co-founder of the Coach and Capital VC fund, established in 2008 with 13 investments made in the portfolio, mainly in ICT and CleanTech startups.

Coach & Capital

Coach & CapitalHis final tip of an ‘area to watch’ is Green Fintech, which is working to accelerate green finance and investments, provide tools for improving companies’ sustainability work (ESG), and change consumer behavior through Fintech solutions and innovation. He adds that as we were discussing female representation in Fintech, this area has more female founders, such as Cecilia Repinski, with her startup Green Assets Wallet. Swedish Fintechs to watch in the Green Fintech area are Doconomy, Worldfavor, and Normative – all growing superfast with international attention.

So it sounds like there’s a lot happening, and that, to return to Anders’ original observation of a ‘booming’ Fintech scene, there is much to look forward to. “I am fortunate to work with some of the Fintechs that have top notch knowledge and insights. And that's the core of the growing Fintech industry - to have great entrepreneurs paving the way as role models for others to follow.”

Crypto is here, no argument

And a summary from Erika Eliasson at Goobit? “The key message is that we need to work together: the Fintech sector, the established banks, the authorities, and the decision makers. Crypto is here, so we don't need to argue if it's bad or good or bad, we just need to find a way to regulate, and work together, because it can be used by society in a really good way. I also think it can be a problem that the banks control the infrastructure, so it’s important to look into that if we want to have a thriving Fintech sector going forward. So yes, I'm optimistic - otherwise I wouldn't be in this space. It's challenging, but I'm optimistic.”

A Fortnite skin - yours for just 2,000 V-Bucks

A Fortnite skin - yours for just 2,000 V-BucksThe virtual suit

And as a final word from me,I have to thank Erika for a little bit of extra education right at the end of our conversation. You may be much more up to speed about the world of online gaming than I am. Indeed, it would be hard not to be more up to speed than I am. As we’re chatting, I ask Erika if any of her children understand what her work involves, and she says that her son does have an appreciation of - in effect - the cryptoworld. It seems that he doesn’t desire actualclothes, of the sort we wear, but virtual suits for the characters in the games he plays, such as Fortnite. This requires trading using V-bucks, a virtual currency exchangeable for electronic garments, or skins.As Erika says, “This new generation growing up are more into digital assets. And I think that's where the crypto industry will grow as well, because digital assets will become more and more important in society. My son prefers digital clothes instead of real clothes, and I think that says quite a lot.”

It does indeed.

Or as Anders Norlin observes, Sweden seems to be a nation of early-adopters… with that International Vibe.