The future of online mortgage application

For many, owning a home would remain a dream forever if mortgages didn’t exist. For millions of people, one of the first steps to home ownership is taking out a mortgage loan – but it’s often a bumpy road to getting there.

The coronavirus pandemic has profoundly disrupted the lives of everyone in the world, and the digitisation of services have moved at breakneck speed. Opening an account? Taking out a personal loan? Now it can all be done online and ‘in moments’.

Yet, in the case of mortgages, an online calculator is often still the ‘state of the art’, even though the knowledge and technology are all there. It is hardly surprising that an increasing number of Fintech, i.e., financial technology, start-ups are entering the market.

In this article, we’ll show you the latest and best solutions (especially from a UX perspective) and how they also make borrowing more convenient and efficient. In this article, we also look ahead to how this service can be automatic, immediate and end-to-end.

And if it becomes end-to-end, it will also make it easier for banks to acquire new clients while maintaining meaningful competition between them.

After digitisation, the multiplatform approach is finally transforming mortgage services

Starting from the basics: a mortgage loan is a loan that the borrower uses to buy or maintain a home or other property and agrees to repay the loan and all its interest and other charges over time, typically in a series of regular payments.

In principle, mortgage loans are mutually beneficial: people can get a property without having to pay the full purchase price, and banks can make a lasting profit over many years.

Despite the fact that mortgage loans are the most common form of home lending, despite significant changes in the personal finance market, they are still subject to very strict regulation and overburdened bureaucracy – in an era of full digitisation and simplification of processes!

Taking out a mortgage loan is therefore a huge challenge for the average financially literate clients. Fintech start-ups on the other hand, are currently transforming the path to home ownership with new financing models.

The need for this is greater than ever, as the average young adult now has more debt than their parents did at the same age, making it increasingly difficult for them to get a home loan.

Think about it, what previous generation could have ‘enjoyed’ the dubious glory of starting their working years with a whole string of debts? Hundreds of thousands of people in almost every country are repaying student loans and various types of commodity loans, and there are many who have bought their first (or perhaps first decent) car with a loan.

The housing sector remains heavily dependent on the traditional mortgage loan market, while access to mortgage-based home loans is often a long and complicated process for those who want to become homeowners.

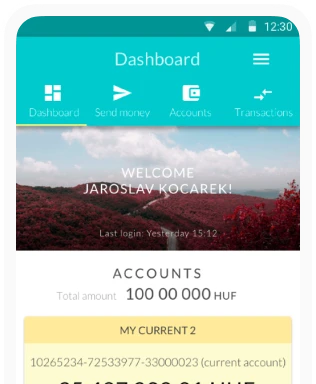

Digitisation, various web-based tools (e.g. calculators, fee comparison sites) have started to spread to mortgage loan brokerage in recent years, and now automation and multi-platform approaches are the most popular.

Banking is going digital – why is mortgage only just starting?

So it’s fair to ask: if virtually everything else can be digitised, why are banks still sticking to decades-old methods when it comes to mortgages?

Because anyone who has experienced the traditional processes around home ownership can tell you that they are non-transparent and stressful for the average person. Fees are varied, there can be a lot of hidden costs, moreover, the traditional commission structure of financial institutions is designed to encourage sales rather than support consumers.

Moreover, everyone has a mobile phone. Why shouldn’t banks take advantage of this in the mortgage sector?

A new generation of consumers and Fintech companies emerged recently

A new generation of businesses is now looking to turn the sector upside down and make buying a home a simple and digital process using data and new technologies.

A generation has grown up that takes computers for granted and is averse to paper-based administration – and they are being followed by those who were born with broadband internet, unlimited mobile internet and, of course, a whole digital ecosystem of smart devices.

Online shopping, financial services, investments, insurance and much more is being automated, and mortgage loans s are no exception. Not because there is an absolute obligation to digitise – but because there is no good reason not to.

Young adults and middle-aged people also want mortgage loan borrowing to be fully online

There is no point in using an online platform if they still have to email photocopied documents or visit a bank branch in person to get their statement stamped.

The main problem or challenge is that the assessment of mortgage application process follows a rather complex scenario, and some issues can only be evaluated by human intervention for the time being.

Since fraud needs to be filtered out, banks are using human intervention to perform loan adjudication – even though Fintech has long been widely using ML (machine learning and blockchain technologies to enhance protection against fraud.

Mortgages are one of the most sensitive forms of lending

Mortgage lending remains one of the most complex, regulated and bureaucratic banking services, as lenders must ensure that all loans meet strict requirements to minimise potential risks.

Contrary to popular perception, banks also have no interest in collapsing mortgage loans and putting people on the street, as the mortgage loan is secured by the property and if the debtor becomes permanently unable to repay the loan, there are serious consequences.

The role of technology in the mortgage market

As digital transformation involves a number of risks, it is important that the company undertaking the automation has strong banking expertise (financial knowledge and a detailed understanding of the mortgage lending process) and is familiar with the full legal framework.

In addition, they need a technological knowledge base that enables their application to pre-qualify mortgage loan applications, at least in part.

All this is not insurmountable, as more and more start-ups appear on the market that are revolutionising the traditional ways of buying a home, and helping people to become homeowners more easily and through a partially or entirely online process.

There are 5 reasons why people want to bank online

For the technology to be used, it is important to understand the clients themselves. The majority of people would avoid being present in person not because of fraud or the pandemic!

The top 5 reasons why people would prefer online mortgage loans are:

- Accessibility, as an online application is always at hand Consumers do not have to adjust their schedule to the bank’s opening hours or take time off work.

- Convenience, as they simply fill in an online form and don’t have to fill in dozens of paper forms.

- No human factor, because Fintech start-ups’ applications analyse the data submitted by the user without human intervention.

- Speed, as consumers who apply for mortgage loans online have their applications processed by algorithms far faster than if mortgage loan application is done by an administrator. Of course, the final decision is always made by the bank after human review.

- Lower fees, because online mortgage software can also allow smaller banks to improve diversification between regions, boosting competition in the market, one effect of which is that individual financial institutions will attract new clients with lower fees.

The mortgage lending market is not only becoming more digital, but also more AI. Image source: rawpixel.com

The mortgage lending market is not only becoming more digital, but also more AI. Image source: rawpixel.com

Overall, we can say that mortgage lending has been digital for a long time, it’s just that the opportunities offered by the platforms/tools have not been fully exploited. The mobile platform has also emerged for solutions where it was previously unheard of due to the small screen/small data loading problem.

Fintech start-ups and the mortgage

Fintech companies are approaching the mortgage market from two directions. One is the digitalisation of the process itself, and the other is a recognition that for many, the hardest part of getting a mortgage loan is raising the down payment.

To solve the second problem, some start-ups have developed alternative investment-lending models, opening up entirely new opportunities for consumers. One example is Crowdproperty, which offers an investment option for those who want to realise a higher interest rate on their money than a bank deposit or long-term portfolio – or who want to buy property with community finance.

We do not focus on them in this article, however, because their development is more likely to be seen as a common fund creation solution.

Mortgage Fintech companies in the press

In July 2021, Forbes (also) dedicated a special article to online mortgage Fintech companies. As Forbes noted, more people are now offering some kind of loan product online than at any time in history.

Because borrowers have different needs, financial profiles and credit goals, Forbes Advisor has compiled a list of online lenders that excel in different areas. Of these, only those dealing with mortgage are of interest to us, but there are a fair number of them:

12 mortgage lenders that do business online and in person in the United States were surveyed. The lenders surveyed by Forbes experts are among the largest volume mortgage lenders, including banks, credit unions and online lenders.

As these are US companies, we’ll look at just the top three to see what the European market can learn from them.

Better: Pre-qualification in 20 minutes

Better is available in most of the states of the US. It is a fully digital service, so those interested can log in from anywhere in the world. The pre-approval time is fairly quick – applicants receive a quote and pre-approval in around 20 minutes.

In addition, it automatically searches for discounts available to clients without any extra effort or cost to the borrower.

Guaranteed Rate: bank comparison site

With the use of Guaranteed Rate, consumers preparing to take out a mortgage loan can expect average fees and competitive interest rates that are below the US national average. Borrowers can receive a pre-approval letter within 24-48 hours, but can get an online pre-qualification in as little as 15 minutes.

PNC Bank: even real property agents can get involved

PNC Bank operates throughout the US and offers a wide range of mortgage loan products, including special loans for low-income and moderate-income borrowers.

Called Home Insight, it offers an innovative online service called, which allows clients to determine their affordable mortgage loan payment and get started on their home purchase with real-time interest rate quotes and loan products.

Furthermore, it allows them to track the approval process and upload the certification documents. In addition, the client can invite a real property agent to monitor the progress of the process.

Following the US examples, here are some European Fintech start-ups!

4 mortgage Fintech start-ups from Europe

Molo: the first fully digital solution

Molo is an all-digital mortgage loan lending platform that promises its users outstanding speed, free of paper. It is the first of its kind in the UK.

They use machine learning-based technology to make real-time lending decisions in a digital, seamless and transparent way, so that clients get faster responses and a better client experience – meaning their system is designed with a UX approach from the outset.

LendInvest: complex asset manager

LendInvestis also a UK-based, but much more complex asset management platform: it provides bridging loans, development finance and home mortgage loans to brokers, lessors and developers alike.

LendInvest is independent of banks and the UX approach was also the basis for the design of its system. They built an asset management platform designed to simplify the mortgage lending process.

LoanLink: the German solution

LoanLink is a Germany-based start-up that uses advanced algorithms to compare and track mortgage products from over 400 lenders. This enables advisors and their clients to make informed and unbiased decisions.

They simplify the traditional process and help their clients save time and money, while making buying property in Germany transparent and problem-free.

Hypomo: the Hungarian-backed Slovak start-up

Hypomo is a Bratislava-based but global online mortgage loan broker that aims to make mortgage transactions completely online and free of charge, making them faster and simpler.

Hypomo is licensed and regulated by the National Bank of Slovakia and is listed in the register of financial service providers in Slovakia, Hungary, Poland and Malta. Hungarian start-ups may be guided by the fact that MKB Fintechlab has supported the start-up with an undisclosed amount of pre-seed funding.

Will online mortgages spread or fail?

At the moment, Fintech start-ups and their investors, including national central banks, believe in the future and present of online mortgage lending. That is, if serious banking and financial analysts believe it will be successful, we also can expect it to be successful.

In addition, there are two trends that reinforce the above for the future – or at least for a situation where online application becomes established alongside physical presence:

- a whole range of banking services can now be managed partly or entirely online,

- there is a growing clientele that requires and expects online transactions.

For all these reasons, mortgage Fintech start-ups have come up with 5 types of solutions in no time.

- The classic process support software

- Direct online mortgage lending

- Data analytics applications

- Market lending platforms

- Digital mortgage loan brokers

There is nothing much to show on the classic support, they speed up and simplify the process, e.g. by managing documents online so they don’t have to be filled in manually, filed, entered into a computer, recorded in a database, etc. In addition, they require human presence to continue.

In direct lending, the mortgage registration and loan recording is virtually done online, and data analytics applications mainly support the investor side. They work in a similar way to stock market analytics software, only here they analyse loan schemes.

Market lending platforms are more like aggregators, where the system itself selects the ideal mortgage loan scheme from all the available mortgage products based on the data provided and even helps you to apply for it.

Digital mortgage loan brokers work in a similar way to stock exchange brokers, because they search for the best mortgage loan offers available on the market according to the needs of the clients and then establish the link between the client and the financial institution.

What impact will online mortgages have on traditional mortgages?

Now that we have reviewed the current situation and the way forward, let’s ask: how will this change the mortgage market?

The answer in brief is that AI (artificial intelligence) and ML (machine learning) will almost certainly improve the client experience even further, as they already have. Machine intelligence specifically speeds up processes to a great extent, so if a financial institution can digitise its mortgage lending system just that much, it stands to gain a lot.

The use of various algorithms can therefore save resources and time while enhancing the client experience, and can also be used to, for example, verify the authenticity of the documentation requested for a mortgage loan application.

Process automation is becoming more common

It is easy to see the benefits of automating routine, repetitive tasks. It simultaneously speeds up the mortgage loan application process, frees up resources to allow bank staff to focus on higher value-added tasks such as checking documents, filling in forms, photocopying, filing, etc.

In addition, it is also important that client experience improves and increases loyalty towards the financial institution.

Enhancing the client experience is becoming more and more fundamental to modern administrative processes.

For the ‘millennial generation’, i.e. those in their twenties and thirties, digital transactions are important, and the next generation will naturally want to do things online.

A financial institution that does not make the transition to semi-digital processes will soon find that young adult clients will choose a competitor as their first bank. In fact, it is often enough for a bank to automate everything that does not require human decision-making and can be done by an algorithm.

The end of traditional banks?

No, not at all! Process automation and digital support will free up employees from robotic work and give them more time and opportunities for personal contact, individual financial advice, etc.

This means that clients can actually receive a higher quality of service. And experience shows that people prefer to go to a live person with more complex (for them) questions rather than trying to get the answer from a machine.

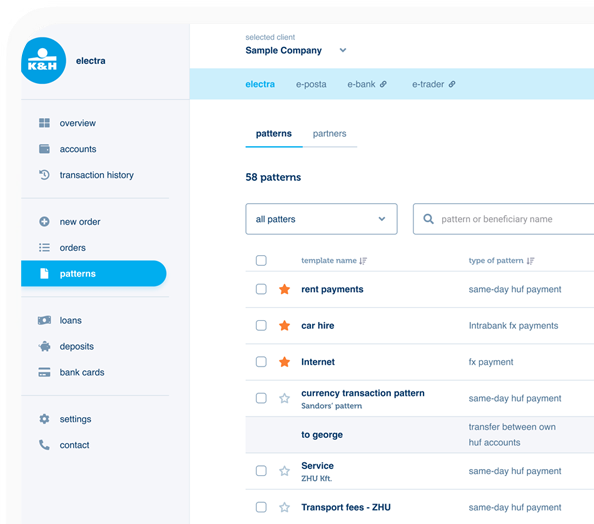

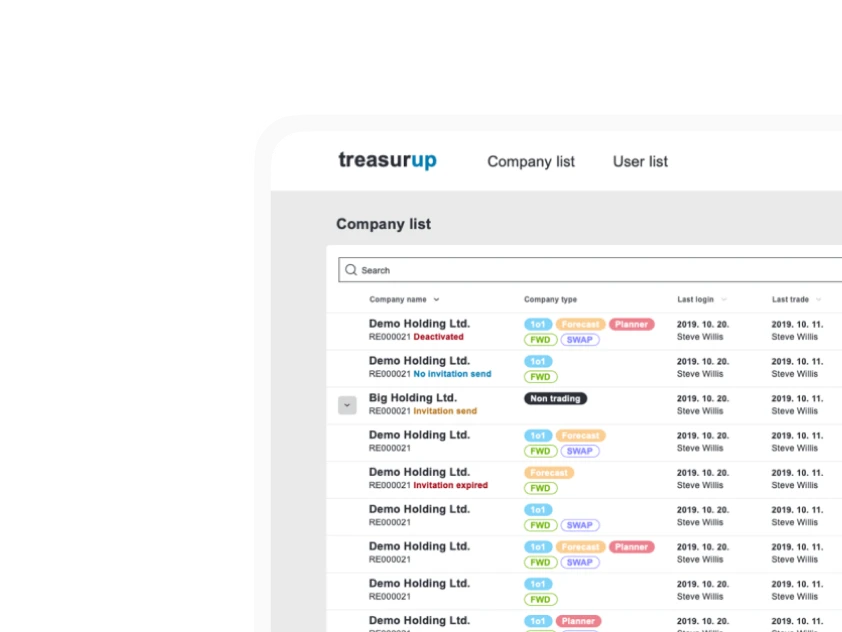

Ergomania at the forefront of Fintech development in Hungary

Ergomania can be a partner for banks, financial companies and Fintech start-ups alike, because we are a financial design company with significant design experience in mortgage lending through more than fifty successfull Fintech projects in the European region.

As an innovative financial design firm, we believe we can make a major breakthroughin this area. We know how challenging it can be to create a mortgage loan application from nothing or to digitise financial services.

We are confident that even the very cumbersome mortgage lending process will be digitised in Europe, just as it was in the US a few years ago. And we will provide our partners with professional support on this challenging but successful journey.