The Fintech Scene in Belgium

Belgium: a safe, secure country, where commerce has flourished for centuries. A country at the center of European activity, home of the European Commission and the Council of the European Union, and bordered by Germany, France, Luxembourg and the Netherlands. General Electric, IBM, Toyota, Microsoft, Monsanto, Pfizer and Levi Strauss & Co have their European or regional headquarters in Belgium, partly because of its central location in Europe. The capital, Brussels is a major base for Fintech companies, but Antwerp, Ghent and Leuven are also hotspots.

Belgium is a country somewhat divided between the Dutch-speaking community of the northern Flemish region, and the French-speaking Walloon region in the south. Add in a minority of German speakers, then top it off with a very widespread command of English, and it’s possible to see why Belgium is so well-placed at one of the crossroads of Europe, and why this benefits the growth of the Fintech market there.

At the same time these linguistic and cultural advantages to some extent work against smooth Fintech growth, as we shall see. With around 11.5 million inhabitants, Belgium is densely packed, but doesn’t have endless growth potential in the domestic Fintech market. Belgian Fintechs have tended to rely on organic internal growth focused on the local market, often being slow to cross the Belgian border. So a mixed bag of potential, and challenges, in a marketplace which is nevertheless very vibrant.

The Fintech Belgium network

Fintech Belgium is an association of around 100 Fintech companies and organizations in the country, dedicated to improving dialogue within the industry, creating partnerships and pursuing opportunities. The association’s Digital Finance Summit has become a must-attend event, which despite the restrictions of the Covid-19 pandemic, returned for its 5th annual outing in November 2020, in a hybrid form – hosting live ‘studio’ stages with attendees online. But they were not merely mute witnesses of the themed topic discussions – online attendees had many options to interface with all the activity. It’s a measure of the momentum that is a noteworthy part of the Belgium Fintech scene.

So, first call to one of the leading lights of the organization, Director Xavier Corman, also founder of Fintech companies Edebex.com and My-stand.com. What’s the mission of Fintech Belgium? “It started 5 years ago as a grass-roots movement, over pizzas and beer,” says Xavier. “We began with meetups and now we’ve grown to the unique position of being the largest collection of Fintech operators in the country, and the best source of information for customers, regulators, and the general public.” The aims of Fintech Belgium are twofold: To explain the Fintech ecosystem to the finance industry in general, and to lawmakers in particular, as well as educating citizens at large. Here the organization has to some extent been pushing at an open door as there is already a well-established acceptance of initiatives such as contactless payments and e-invoicing.

The second aim of Fintech Belgium is to support and encourage interaction between members, and to connect with other similar associations, both within and outside Belgium. Since the start of the pandemic, the association has flexed and thrived, with over 2,000 attendees coming to 13 webinars, plus the Digital Finance Summit. Here the concept of ‘studios’ where a TV-like experience was created with keynote speakers and panels, was the new way of dealing with the restrictions imposed because of Covid-19. The Studio 1 experience had four tracks: Banking, Technology, Insurance, with – significantly – the fourth track being titled ‘The world after Covid.’

Studio 2 offered an exciting Fintech pitch contest with around 15 companies competing for the honors, and support. While Studio 3 activities covered workshops, where concrete explanations of technical topics are broached.

Dealing with the pandemic

So in the face of difficulties it sounds like Fintech in Belgium is still managing to be active and forward-looking? “Yes, I am cautiously optimistic,” says Xavier. “Of course some companies are suffering because of the pandemic, but I see the opportunities as larger than the threats. For example, a lot of the more traditional companies in the country, and certainly the policy-makers, were very separated from technology in the past. Now for the first time they’re having Zoom meetings, and the government is using communications technology like never before. So these people are being brought into touch with technology, and because they’re often financial people, it’s all becoming more normal for them. Consumers too are getting very familiar with living in a virtual world. So the barriers to using apps to achieve financial activities are coming down. And anyway, in Belgium we have been big on payments for a long time. SWIFT, Eurocard and Mastercard have their European headquarters in Belgium, so the ecosystem is very strong here.”

Initiatives from Fintech Belgium include the promotion of inclusivity. Alessandra Gambrill-Guion is General Manager at FinTech Belgium, and describes herself as ‘Ambassador for Fintech Ladies in Belgium’, where ‘Our network is for women working in fintech startups, banks, law firms, financial services and consulting. Together, we want to learn and grow, we want to inspire and empower each other. We want to shape the future of finance.’

Another shaper of the future is Johannes Vermeire, co-founder and CEO of POM.be is also a board member of Fintech Belgium and endorses Xavier Corman’s views. POM has been up and running since August 2014 as an invoice payment system, and Johannes says that while initially the pandemic hit sales, overall the shift to new ways of working is encouraging. “We’re breaking through,” he says. “And sales are picking up faster and faster.” Why? – “Because the virus means people want remote access to financial applications. For us, QR codes are becoming more and more known – and of course that’s a contactless solution, which is what we all need in these times.” Other examples of this include Digiteal and Payconiq.

Partnering with banks

Johannes says that Fintech Belgium got off to a good start partly because financial services have always been well regarded in the country, when often some of the nearby states were still getting up to speed. Meanwhile, thanks to Fintech Belgium, the industry and the regulators have got to know each other through regular contact. Banks in Belgium also soon joined the party, with two of the main four banks rapidly taking up innovative approaches. For example KBC Bank has won praise and awards for its mobile app, named Kate.

So if Belgium Fintech companies got a head start on some of their colleagues in other countries, does this mean that it’s an advantage which can be leveraged outside the domestic market? “We’re a complicated country,” Johannes observes. “We have three languages, and regulation differs from country to country, so you can’t just transplant a business model into another market. This isn’t just a consumer product like sports shoes which can be sold almost anywhere! Some offerings – such as data visualization – can easily cross national borders, but it’s far more difficult for financial products. Literally every country is different.” POM (which is an acronym for ‘Peace of Mind’) does currently operate at a small scale in France and the Netherlands, but for now Johannes will concentrate on the domestic market. The Belgium market for payments is also in effect protected from larger foreign players entering, because of the ‘nearly free’ payments model which can be ten times less than in other European countries. Belgian payments charged at 5 cents could be up to 50 cents in Spain, with countries where checks are still processed having charges measured in whole euro. So for foreign entrants the cost ratio can be too high, coupled with a relatively small population, and the three language issue. It doesn’t exactly mean that Belgium is sealed off from the rest of the world, but there is a sense that differing regulations limit Belgian Fintech’s expansion outside the national borders, and discourage inward enterprise. Then there’s the alleged ‘modesty’ of Belgians that Rik Coeckelbergs talks about.

American attitude

Founder of The Banking Scene, Rik was in banking full time, until deciding to give banks a voice in the financial technology space through The Banking Scene. He says that Belgium’s long history of involvement in financial tech has led to rapid growth and relatively easy adoption. The country was one of the first to have ATMs, and with the multi-bank Isabel Group system, customers can now access their accounts at more than 25 banks. So what’s there to be modest about? Rik explains, “Let’s say that Belgians are very skilled at building a beautiful car, but then they’re not so good at opening the garage doors and showing it to the world!”

Rik cites a new breed of young entrepreneurs as now shaking up that cautious image, notably Davy Kestens, founder and CEO of ‘The Profitable Banking App’, Cake. Having cut his teeth with a seven year success as founder of Sparkcentral in the USA, Kestens returned to his native Belgium, bringing with him a load of American-learned attitude – according to Rik – and hasn’t been at all modest in ‘opening the garage doors’. It’s that sort of willingness to be entrepreneurial in every aspect of getting a Fintech startup rolling that is showing the way forwards for other Belgian businesspeople.

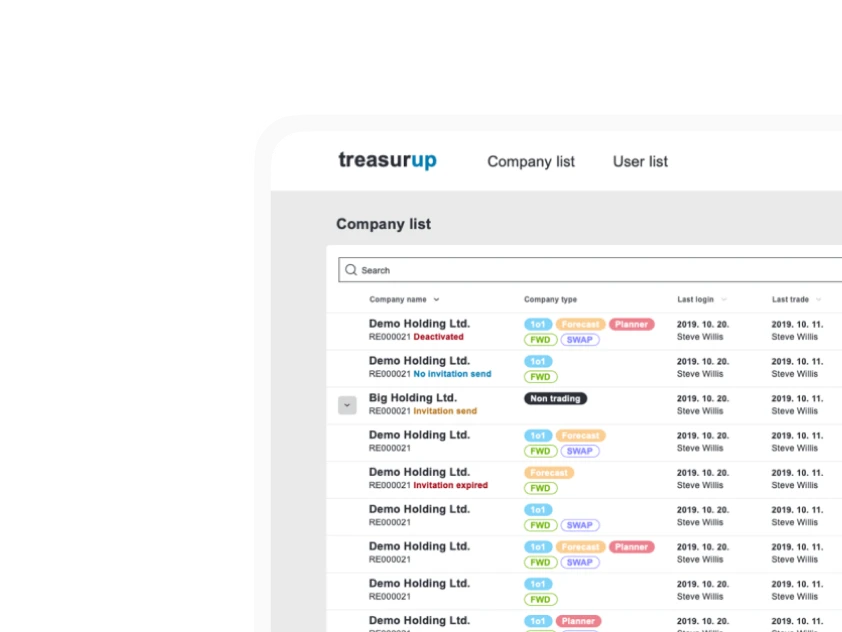

Rik points to the success of UnifiedPost – perhaps the first Belgian unicorn, founded in 2000 which, when it came to its IPO was six times oversubscribed. The company says its mission is, ‘To help customers structure complex financial ecosystems by delivering convenient, smart, digital solutions.’ Adding, ‘Throughout the world, businesses are digitizing their financial value chain: from contract or order, to invoice, payment and financing. For this evolution to succeed, there must be a trusted network connecting this diverse ecosystem.’ And that, in this case, is the success story which is UnifiedPost, now active in 15 countries, with a reach of over 5 million digital users, 400,000 SMEs and over 250 Corporate and Government clients.

UnifiedPost began life by offering a route to digitalization, turning unstructured documents into structured ones, which as Xavier Corman points out, is at the core of all digital offerings. What exactly does ‘unstructured’ mean then? – It’s documentation which remains stored in its native format, be that on paper, photographs, plans, or video and other media. Processing and understanding unstructured documents is hard, and time intensive. In comparison, structured documents are easy to store and search. “There are a lot of Belgian Fintechs which have become very successful on the basis of developing structured solutions,” Xavier notes. Such as?

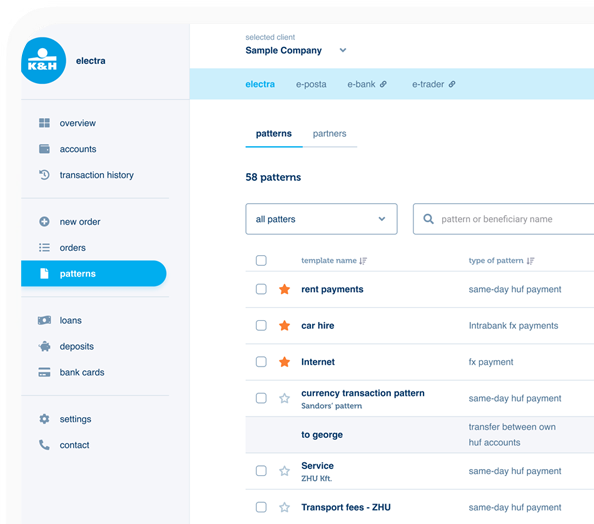

He cites the Isabel Group, founded in 1995 as a financial aggregator, and now recognized as Belgium’s biggest Fintech, offering a comprehensive range of financial solutions, authorized by the National Bank of Belgium. The Isabel Group has a number of financial offerings, including Isabel 6, codabox, zoomit and clearfacts. The Isabel 6 multi-banking platform provides access to accounts at 27 Belgian banks, including Belfius, BNP Paribas Fortis, ING and KBC, and currently numbers nearly 71,000 business users, making around 460 million transactions a year. Bancontact and itsme (‘A smarter way to be you’) also merit mention by Xavier.

ING Bank led the way with the payment system Payconiq, founded in Belgium in 2015 and later joined by KBC and Belfius banks. It is now operational in Belgium, Luxembourg and The Netherlands and enables online, in-store and peer-to-peer payment, where ‘paying is secure, and surprisingly simple.’ Payconiq currently has 60,000 merchants connected across the 3 countries of operation. It’s worth noting that 69% of Belgians use online banking and e-commerce services, some 15% more than the European average.

KBC Bank’s startit enterprise incubator and accelerator has been influential in helping many new businesses get off the ground, both in Belgium, and now also the Czech Republic and Hungary. To date in excess of 200 million euro has been raised for startups, at a rate of around 120 per year. A proven process is used by startit to identify and validate ideas, then build, market and scale them.

Bonsai is another payment app, which majors on an ecological approach. For every ten payments a user makes, the company pledges to plant a tree, under the slogan, ‘Pay back the planet, plant a tree,’ with to date 2,964 trees having been planted through the Eden Reforestation projects, active in 8 countries. As with Payconiq, Bonsai starts from a consumer level, where even buying a coffee is within the scope of the app. Fintech in Belgium isn’t always about high finance!

An AI-driven app, 33reasons aims to take away the burden of financial paperwork from entrepreneurs, by providing a ‘virtual buddy’ that helps prepare financial administration for a company’s account. Based in Kerksken, between Ghent and Brussels, 33reasons is currently launching its OkiOki digital assistant in free beta format.

Another specialized platform, this one directed to banks, is to be found with blanco – the banking platform for wealth and asset managers, where client onboard monitoring, or KYC (Know Your Customer) is so important. Or as the company claims, ‘At Blanco, we don’t believe in tech only. We believe in the symbiosis between man and machine.’

Based in Ghent, docbyte has been operating since 2006 and provides RegTech services for banks, insurers and other organizations needing regulatory services, using intelligent technologies to digitize and automate what may originally be a paper trail. As a result, processes are speeded up, and ‘compliance can be turned into a competitive advantage.’

AnyTech

Xavier Corman jokes that, “Anything can be Fintech now, you just add the word ‘Tech’ and you’ve got a new sector!” As well as RegTech, the so-called InsureTech arena is another growing Fintech in Belgium. He cites Qover as an example of the new breed of InsureTechs springing up, with – in the case of Qover – supplying ‘Insurance for the digital revolution.’ Having started in Brussels, the company is already active in eleven countries, and rolls out products for specific clients in different territories. A good example of Qover’s creative approach to insurance comes with the support for Deliveroo courier cyclists, who often work in heavy traffic, making their job dangerous, and therefore unattractive to traditional insurers. The Qover solution – initially trialed only in Belgium – was to create an app specifically for the riders, which would cover their insurance needs when they were actually delivering, and which when they logged off from work, logged off from the insurance package as well. This part-time insurance helped reduce costs and has provided a highly suitable process for Deliveroo employees, and the company itself. To date there are some 40,000 individual riders insured under the scheme, across 7 European countries. Put another way, that can be expressed as 3.5 million insured hours.

Xavier is also keen that we don’t forget to take into account his own enterprise, Edebex, providing what used to be called factoring services, in pre-digital days. Your company has performed the work, invoices the client, and then what..? Too often, then you wait, and wait some more for payment to be made. It’s a problem for all businesses, but for SMEs especially it can be a killer. With Edebex, an invoice is listed for sale, an investor buys it, and within 72 hours, the money is in your bank. No more nail-biting waiting for weeks, and then more weeks. To date, Edebex have pre-financed for a total in excess of 547 million euro, which is a lot of help for companies where cashflow is their lifeblood.

Digiteal, backed by the National Bank of Belgium, and Belfius Bank also offers a system for faster, more regular payment to businesses and partners companies in their invoicing and payments processes. A consumer division also helps the public to make payments, and securely buy and sell.

All of these are examples of different approaches, all creative, all Fintech. So anything is Fintech? “Fintech is not everything,” says Xavier. “But it is everywhere.”

Challenges and opportunities

Rik Coeckelbergs sees some stratification occurring in the Belgian Fintech scene, in part related to the pandemic. “Banks are less likely to be looking to partner with startups now. They want scale-ups rather than startups.” He also points to the regional government structure of Belgium as sometimes a little difficult for younger companies to engage with. Not only has the country three official languages, but variations in regional regulation can in some cases limit innovation and growth. “Yes,” he says, “There are, and will remain, great opportunities for Fintech, but with a more limited number of organizations involved. Big organizations want to see business continuity, not just a couple of year’s track record. There has to be project support and the ability to deal with changing circumstances, and it’s going to get harder for a five-person company to survive, compared to a fifty-person company.” He contrasts this sobering view with brighter news however, “Banks do want to partner Fintechs, because they recognize that this has to be the way forward. So there is still room for innovation.”

Rik also points to SmartFin, the Venture Capital company founded by CEO Jürgen Ingels with a specific brief to support European tech startups, whose mission is expressed as, ‘We believe in building and growing successful companies rather than setting up financially engineered transactions. We also look for opportunities where other investors hesitate to go, refusing pigeonholing that would limit our flexibility.’ You can find a TEDxBrussels talk by Jürgen Ingels, titled ‘From spaghetti to lasagna: Untangling the banking system’ which seems an apt metaphor for both the disruptive and supportive approach of his company.

In talking of the Belgian Fintech scene, you can’t go far without finding the involvement of Jürgen Ingels, whose Financial Services platform building initiative The Glue was founded in 2015, to ‘strategize, conceptualize, create and run your digital solutions.’ The vision is to create a future where there is seamless interaction of banks, consumers, and insurers. In Belgium it seems that vision is well on the way to reaching critical mass.

An unusual feature of the Belgian Fintech scene is that to date around three quarters of companies are focused on B2B offerings, so let’s go from a big, muscly Venture Capital Fintech, to one founded to answer a common consumer issue: You’re dining out with friends (remember that, pre-pandemic?) and the bill comes at the end of a pleasant evening. Everyone decides to split the bill, but then one person had wine, another no starter, and so on – we’ve all been there! Tricount is an app specifically designed to split bills between friends and family, and is extending into other areas of expense-sharing. Tricount does the math for users too, so that at the end of a long meal, the brainwork about sharing the bill is handled by the app. Miguel, a user quoted on the Tricount website says, “Awesome for managing shared expenses with friends or family. I use it for shared expenses with my partner. This application is essential for me.”

The place of UX-UI design

All of this intense Fintech activity suggests that there must be a lot of design and development going on around user experience and user interfaces. As Johannes Vermeire comments of his company POM, “UX-UI design is really important. Our company is called ‘Peace of Mind’ for a reason! The user interface and experience has to be simple, easy to use, and straightforward. We have put a lot of effort into UX-UI.” It’s an effort which doesn’t stop, as Johannes says their UX is always evolving. “We are constantly working to meet customer needs, and our innovations of four years ago are now being copied, so we have to stay ahead.” While he is ‘quite proud’ that the POM solution is regarded as so good it’s worth copying by competitors, Johannes sees one of the ways to keep the edge sharp is through continuing advances in UX-UI design.

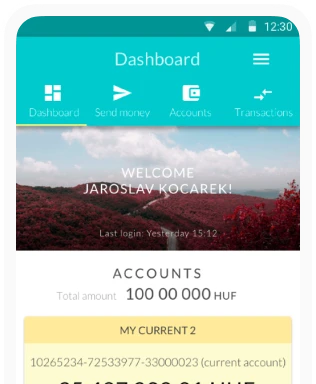

Mobile app use is becoming increasingly important in the Belgian Fintech and Banking scene, replacing web use, and this is likely to continue. Historically, between 2016 and 2017 mobile banking apps usage increased by 69% in the country. And a brief look at the current top Finance Apps in Belgium in the IOS store confirms the breadth and variety of offerings. And every application, every platform needs great UX-UI design to function seamlessly.

Xavier Corman endorses the view, and specifically mentions Budapest UX-UI design agency, Ergomania, which has been active with BNP Paribas, and with Fintech Belgium. “Good user experience is essential when you go digital,” says Xavier. “A company like Ergomania is the link between the technology and the user. Even if you have a Rolls Royce or a Ferrari, you don’t sell cars if people don’t know about them.” Ah, we’re back to that ‘Belgian modesty’ of not opening the garage doors! “Remember that UX design is not just about the end user,” Xavier continues. “A company executive is a user too, and for example a bank has to be comfortable with its UX design.” Good point: we are all users of apps and Fintech products, and it is indeed a two-way thing. We tend to think only of the end-user, but when targeting companies, they too are ‘users’. “Ergomania helps digital finance players in Belgium…” (and elsewhere) “…To increase their sales. They bring the tech part together with the user part,” Xavier concludes.

As well as being a Fintech Belgium partner, Ergomania has other in-depth experience of Fintech applications for Belgium. This includes working jointly with Digital Leadership from Munich, and Steve Deplacie’s team at Belgian banking giant BNP Paribas Fortis on UX strategy. Since 2019 Steve has been Chief Digital Officer at MediaFin in the Brussels area, but prior to this was Head of the BNP Paribas Customer Experience Center, guiding more than 30 designers to support BNP Paribas Fortis in creating excellent digital customer experience. This also meant bringing in outside agencies, and Ergomania’s ‘nearshoring’ capabilities were valuable here. While many agencies are now being forced to adapt to remote working because of Covid-19, it has always been part of the ethos of Ergomania to use a wide range of online tools, in order to provide the most efficient and cost effective services to clients.

Fintech and banking knowledge, knowing and understanding the local market and users – anywhere in the world – as well as favorable pricing and quick deployment are the watchwords for Ergomania, and all of these qualities have been brought to bear within the Belgian Fintech market.

Opening the garage doors?

So in the country that gave us ‘The Muscles from Brussels’, Jean-Claude van Damme, Adolphe Sax, inventor of the saxophone, surrealist painter René Magritte, and actor Audrey Hepburn – among many other notables – Belgium has made its mark in the world. The same can be said for the Fintech market which is vibrant in the country, with a strong support network, and many examples of innovative companies and offerings. Will they all translate across borders? Some perhaps only slowly. Others have already reached ‘escape velocity’ and are operating outside of their home country.

What’s for sure is that cooperative initiatives such as Fintech Belgium, with the Digital Finance Summits, and operations such as The Banking Scene, promote a sense of cohesion and mutual support which helps build on the successes already achieved. Times are not easy, and some companies are finding it difficult to get or keep traction, and yet the general mood is optimistic. As Johannes Vermeire remarks, “You know, Fintechs in Belgium so far aren’t too affected by the virus.” Rik Coeckelbergs calls the pandemic, “A challenge, but a blessing,” and says that because of the meetups he has been organizing, “In the last six months I’ve learned a lot about banking!” Or, to repeat Xavier Corman’s observation, “Fintech is not everything, but it is everywhere.”

Maybe time to open the garage doors?